-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 12

-

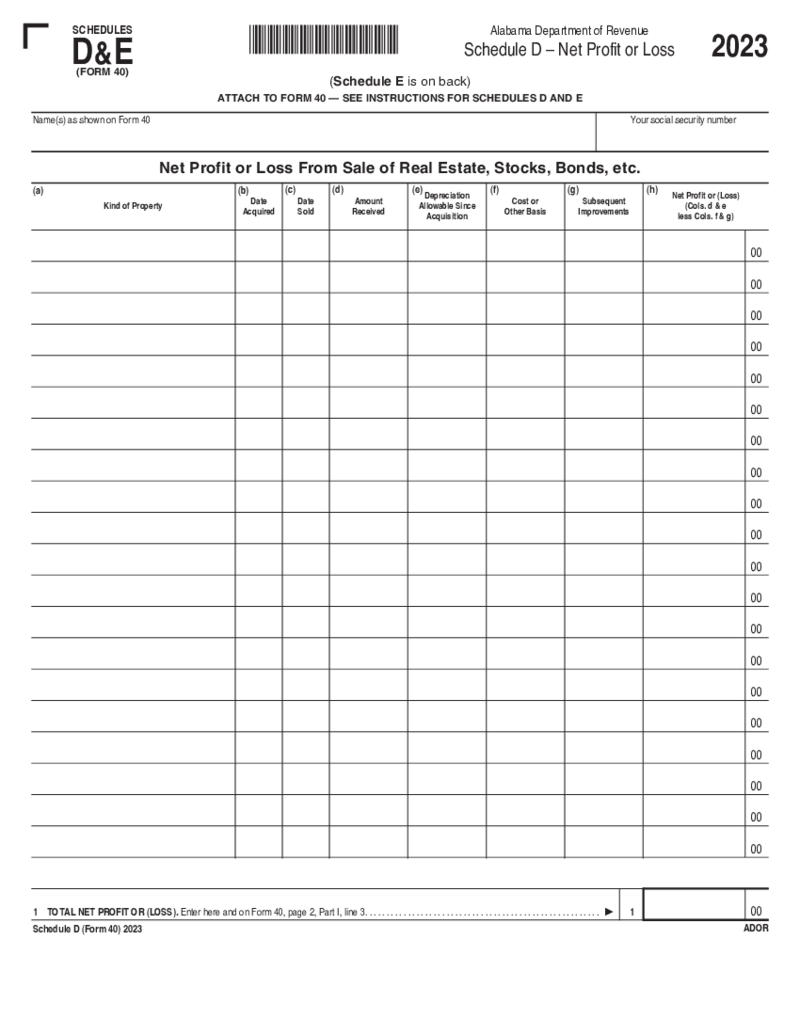

Schedule D - Net Profit or Loss

Understanding the Alabama Schedule D for Form 40

Form 40 is the standard individual income tax return form for residents of Alabama. One crucial component of this form is Schedule D. Schedule D is used to report net profit or loss from federal transaction

Schedule D - Net Profit or Loss

Understanding the Alabama Schedule D for Form 40

Form 40 is the standard individual income tax return form for residents of Alabama. One crucial component of this form is Schedule D. Schedule D is used to report net profit or loss from federal transaction

-

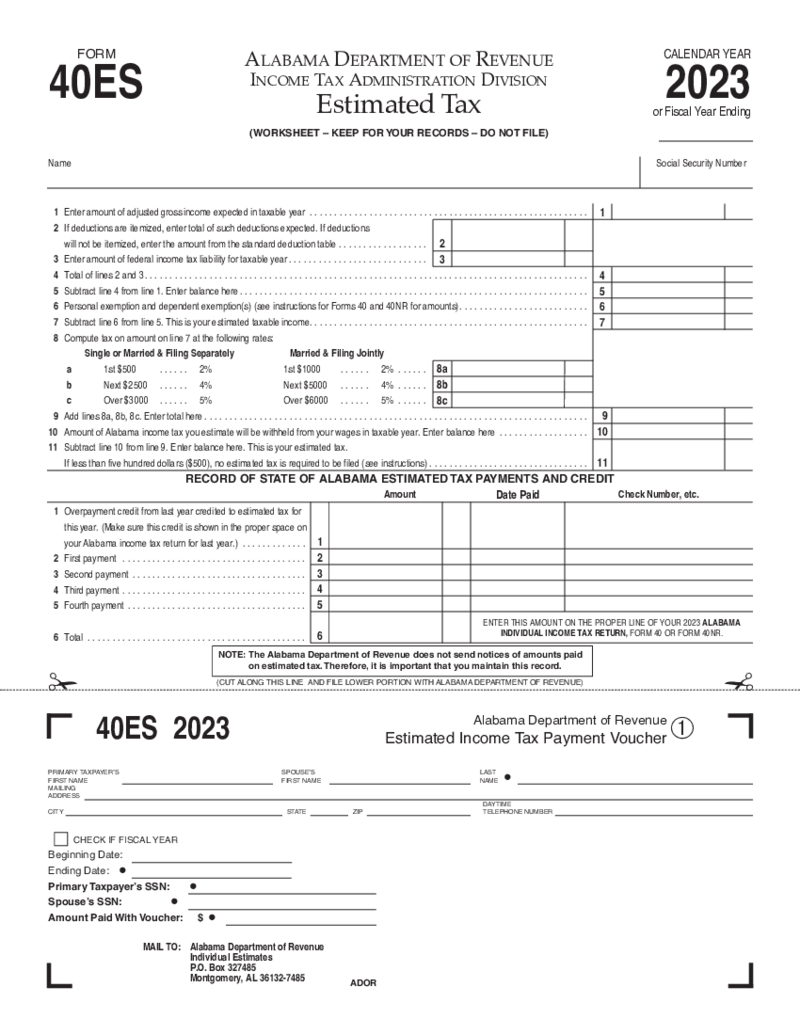

Alabama Tax Form 40ES

How Do I Acquire Fillable Alabama Tax Form 40ES?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Write &l

Alabama Tax Form 40ES

How Do I Acquire Fillable Alabama Tax Form 40ES?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Write &l

-

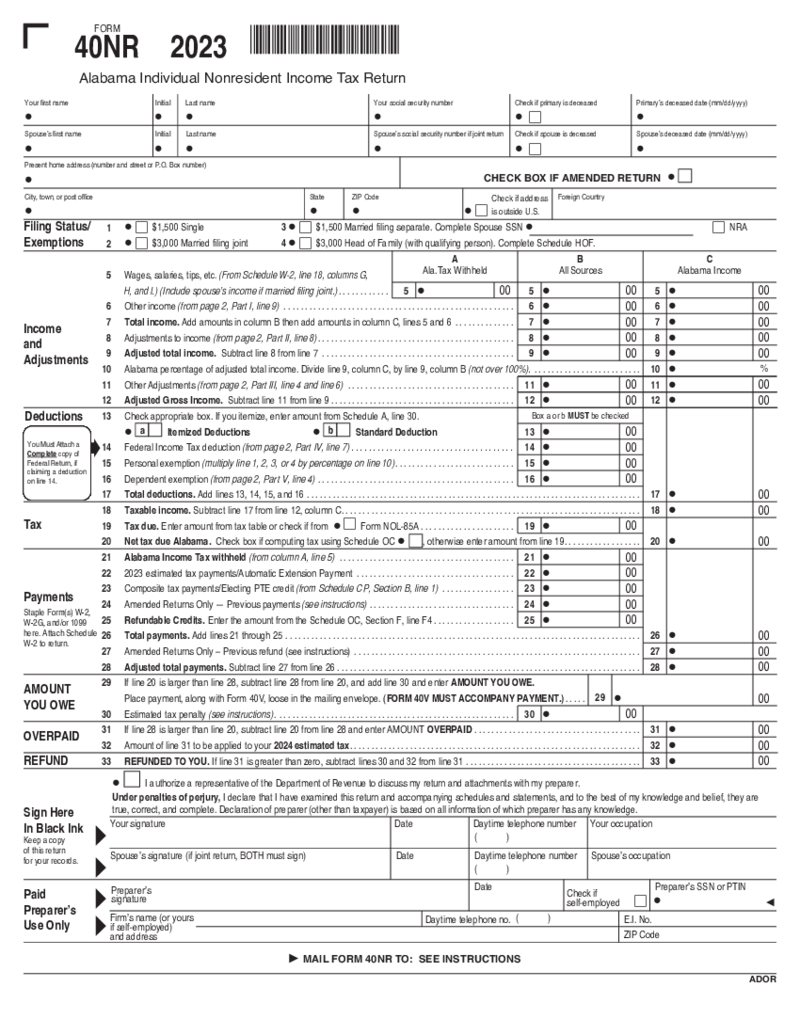

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

-

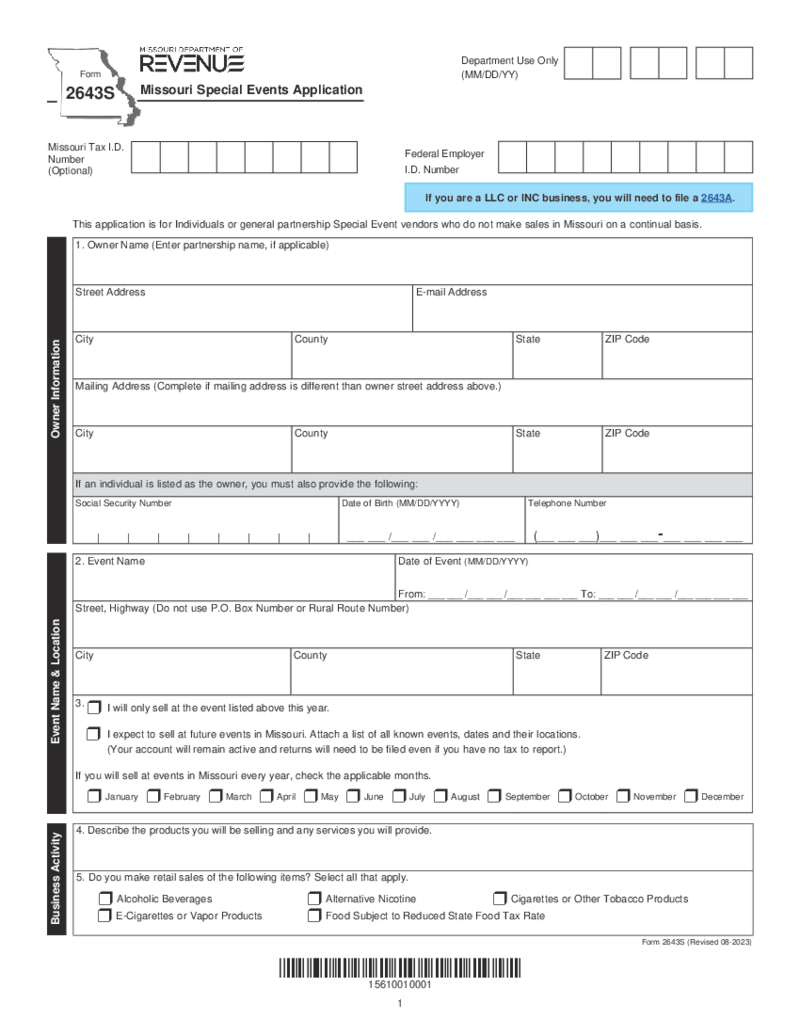

Missouri Special Events Application

What Is Missouri State Form 2643S?

The 2643S form Missouri is designed to permit vendors at temporary events such as craft fairs, festival

Missouri Special Events Application

What Is Missouri State Form 2643S?

The 2643S form Missouri is designed to permit vendors at temporary events such as craft fairs, festival

-

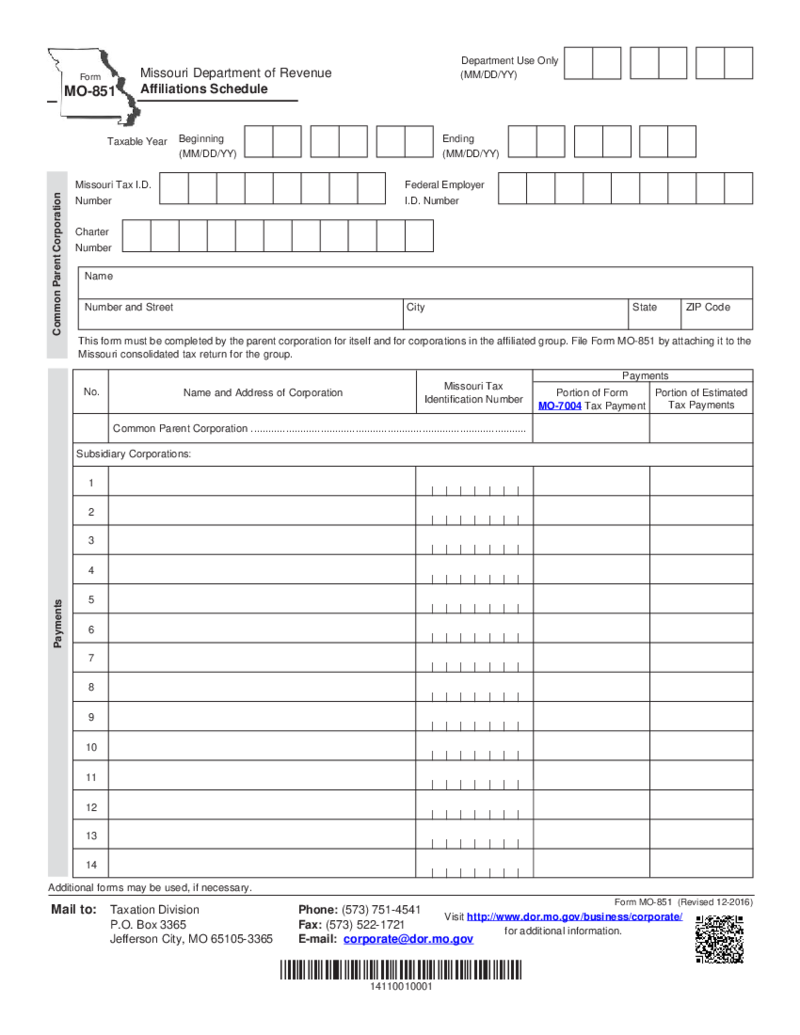

Form MO-851 - Affiliations Schedule

Complete Guide to Understanding and Filing Form MO-851

The MO Form 851 is a crucial document for corporations operating within an af

Form MO-851 - Affiliations Schedule

Complete Guide to Understanding and Filing Form MO-851

The MO Form 851 is a crucial document for corporations operating within an af

-

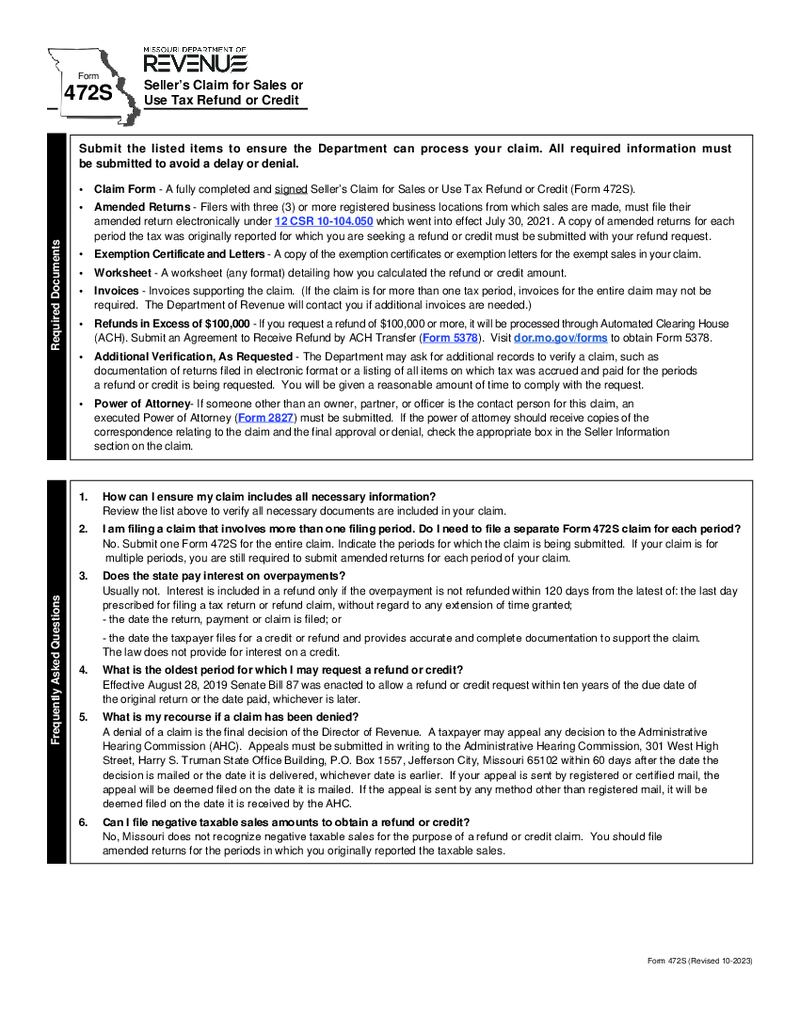

Missouri Form 472S - Sellers Claim for Sales or Use Tax Refund

Understanding Missouri Form 472S - The Essential Guide for Sellers

Missouri Form 472S, officially known as the Seller's Claim for Sales or Use Tax Refund, is a vital document for businesses and individuals seeking to claim a refund or credit for sales

Missouri Form 472S - Sellers Claim for Sales or Use Tax Refund

Understanding Missouri Form 472S - The Essential Guide for Sellers

Missouri Form 472S, officially known as the Seller's Claim for Sales or Use Tax Refund, is a vital document for businesses and individuals seeking to claim a refund or credit for sales

-

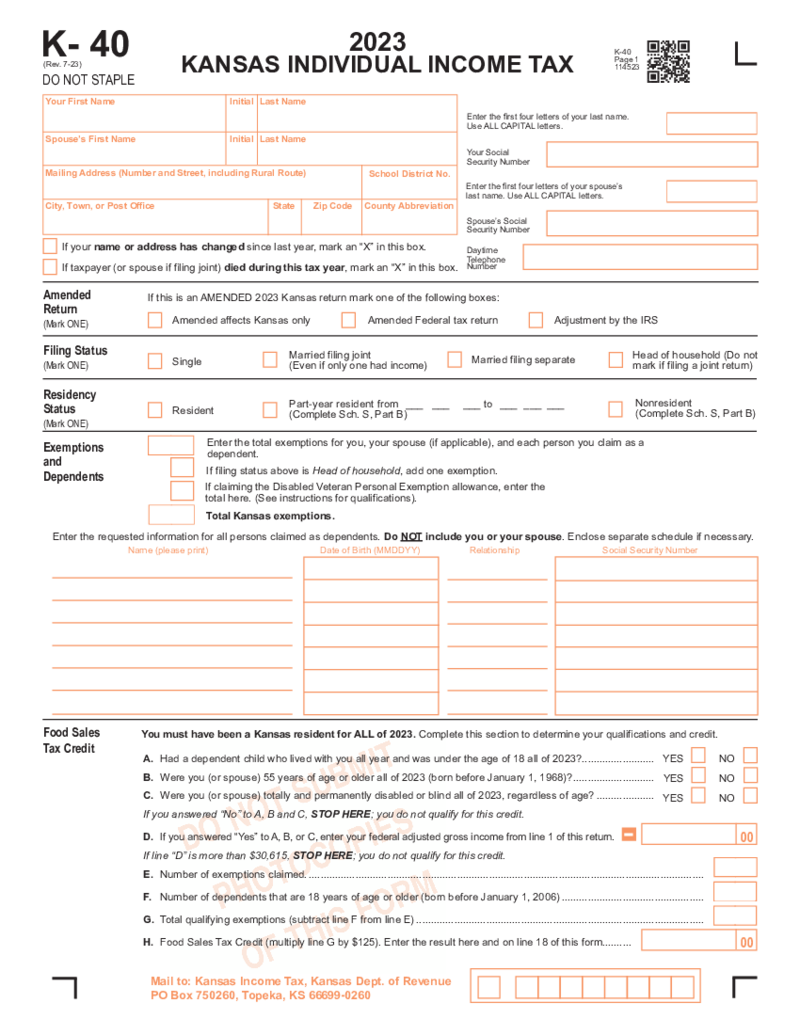

Kansas Form K-40

What Is Kansas Form K-40?

When tax season arrives, Kansas residents must prepare to submit their state income taxes using the Kansas Form K 40. It's designed for taxpayers to report their annual income, calculate their tax due, and claim any applicabl

Kansas Form K-40

What Is Kansas Form K-40?

When tax season arrives, Kansas residents must prepare to submit their state income taxes using the Kansas Form K 40. It's designed for taxpayers to report their annual income, calculate their tax due, and claim any applicabl

-

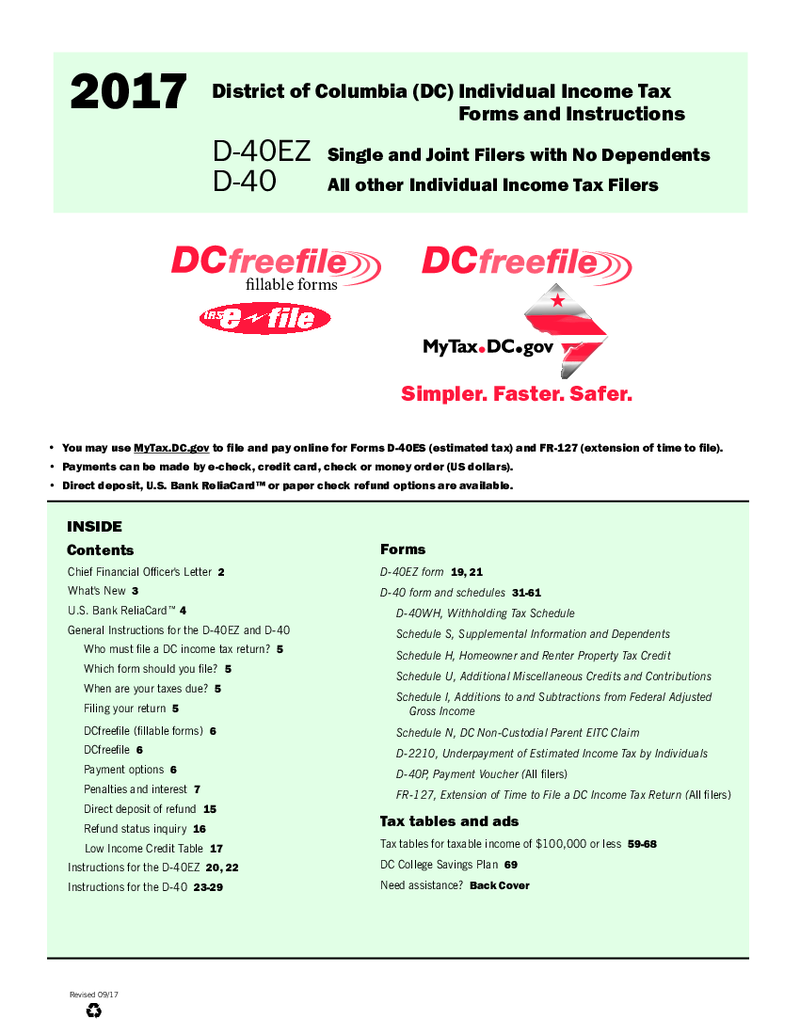

Washington DC Form D 40-EZ

Understanding the D 40 EZ Form

The D 40 EZ form is the shorter version of the more comprehensive D-40 tax form. It is specifically tailored for individuals with a more straightforward tax situatio

Washington DC Form D 40-EZ

Understanding the D 40 EZ Form

The D 40 EZ form is the shorter version of the more comprehensive D-40 tax form. It is specifically tailored for individuals with a more straightforward tax situatio

-

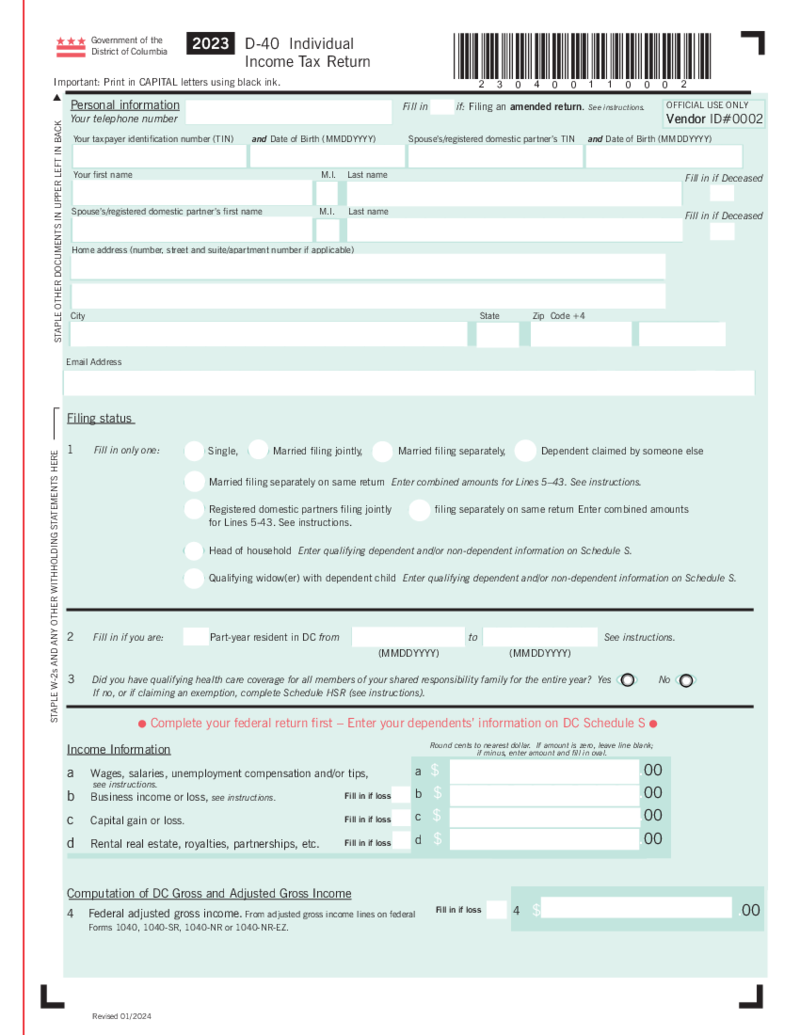

Washington DC Form D-40

What Is Washington DC Form D 40?

Washington DC Form D-40, also known as the Individual Income Tax Return form, is used by District of Columbia residents to report and file their annual income tax. Whether you are a full-time resident or a part-year reside

Washington DC Form D-40

What Is Washington DC Form D 40?

Washington DC Form D-40, also known as the Individual Income Tax Return form, is used by District of Columbia residents to report and file their annual income tax. Whether you are a full-time resident or a part-year reside

-

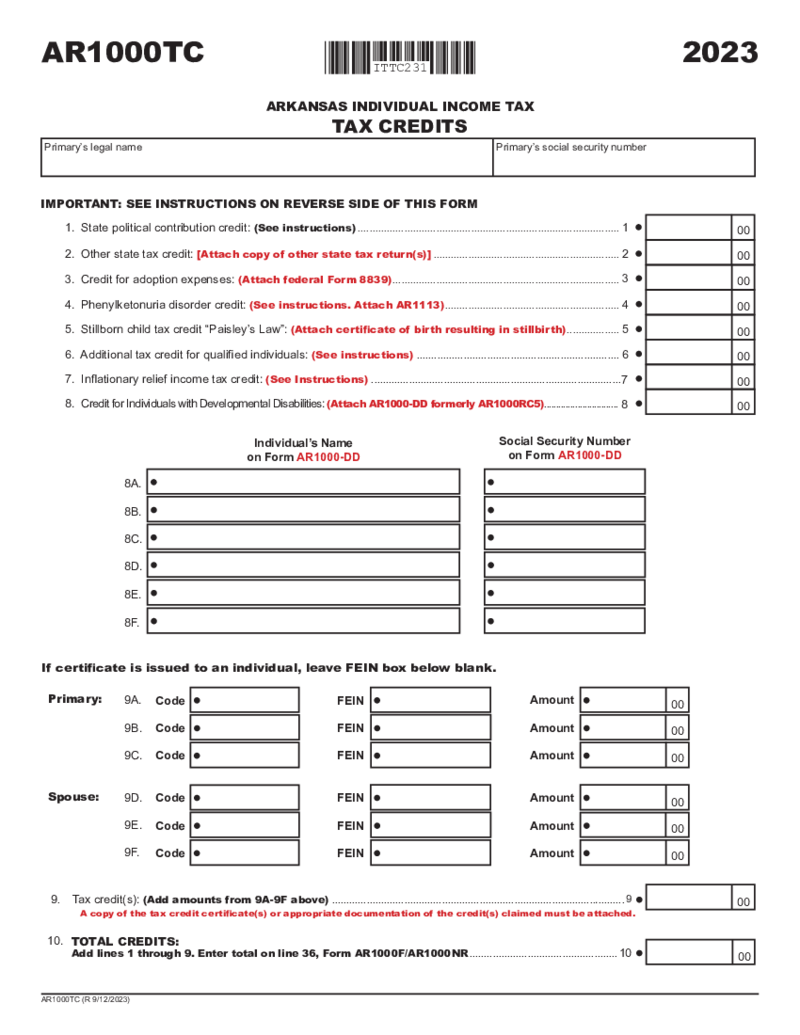

Arkansas Form AR1000TC Schedule of Tax Credits and Business Incentive Credits

The Ultimate Guide to Filing Form AR1000TC in Arkansas

Filing taxes can be a complex process, particularly when you're looking to take advantage of various tax credits for business in Arkansas. Among the forms that need special attention is AR1000TC,

Arkansas Form AR1000TC Schedule of Tax Credits and Business Incentive Credits

The Ultimate Guide to Filing Form AR1000TC in Arkansas

Filing taxes can be a complex process, particularly when you're looking to take advantage of various tax credits for business in Arkansas. Among the forms that need special attention is AR1000TC,

-

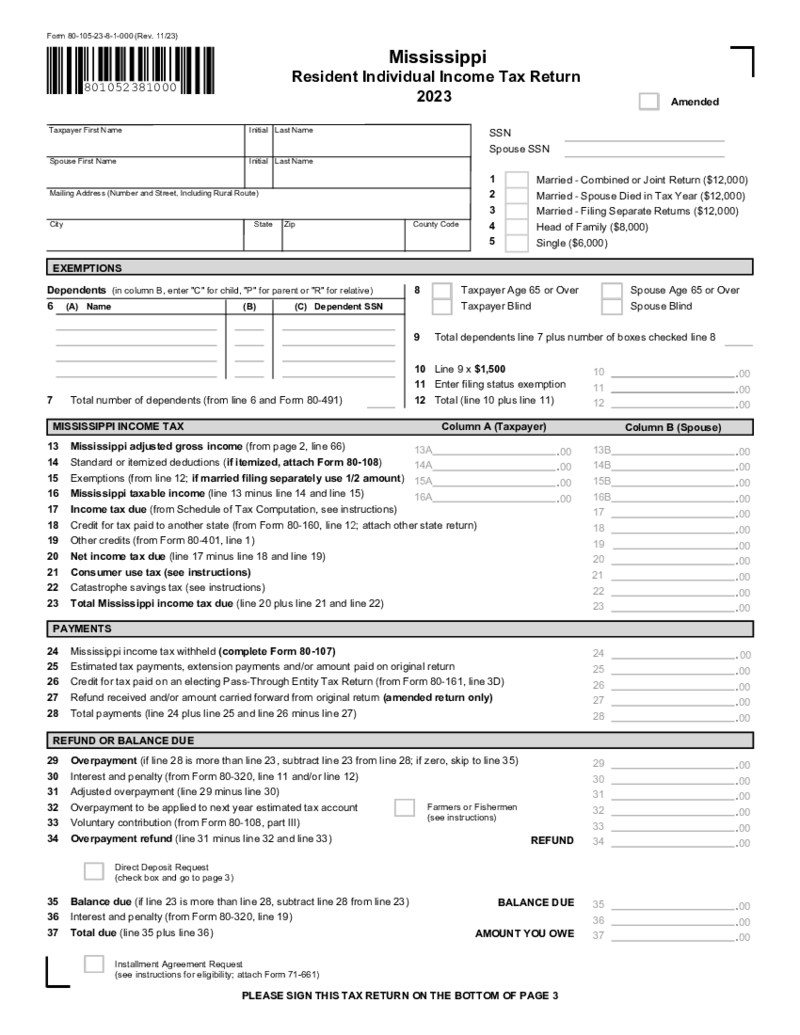

Mississippi Resident Individual Income Tax Return

What Is the Mississippi Resident Individual Income Tax Return?

The Mississippi resident individual income tax return is a form that all residents of the state must complete and submit if they meet certain income thresholds. Based on a resident's incom

Mississippi Resident Individual Income Tax Return

What Is the Mississippi Resident Individual Income Tax Return?

The Mississippi resident individual income tax return is a form that all residents of the state must complete and submit if they meet certain income thresholds. Based on a resident's incom

-

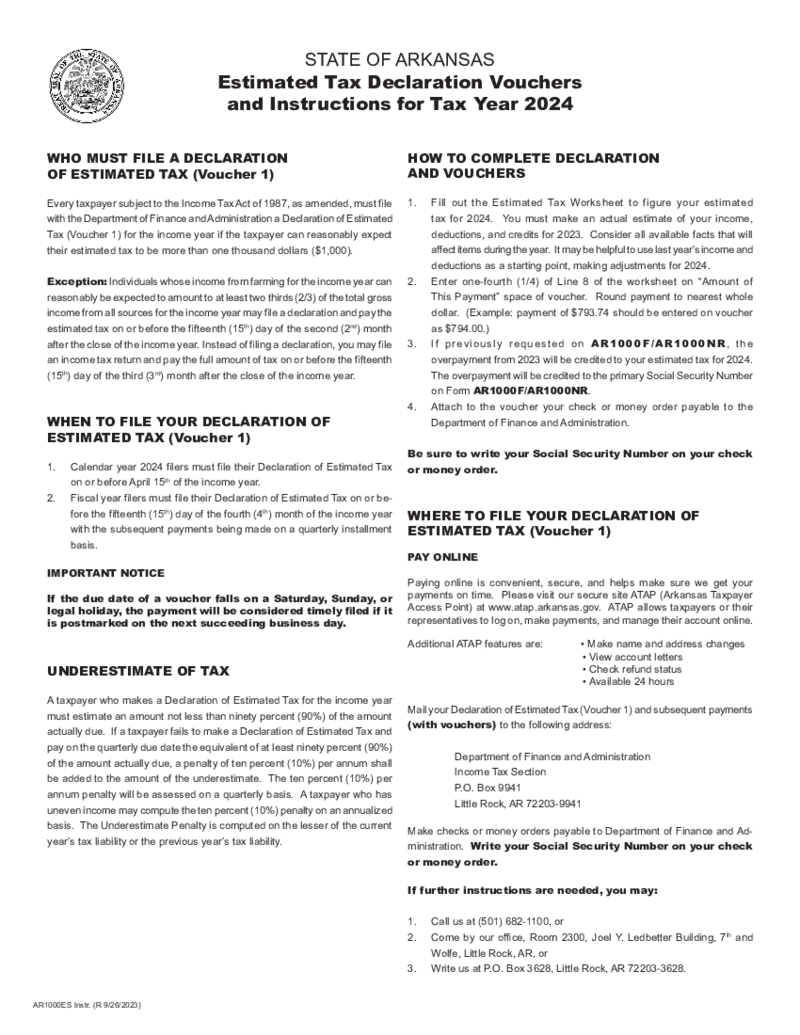

Arkansas Form AR1000ES Individual Estimated Tax Vouchers

The Complete Guide to Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Navigating tax payments can be challenging, especially for those new to making estimated tax payments. The Arkansas Form AR1000ES is designed to aid taxpayers in managing their

Arkansas Form AR1000ES Individual Estimated Tax Vouchers

The Complete Guide to Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Navigating tax payments can be challenging, especially for those new to making estimated tax payments. The Arkansas Form AR1000ES is designed to aid taxpayers in managing their

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.