-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

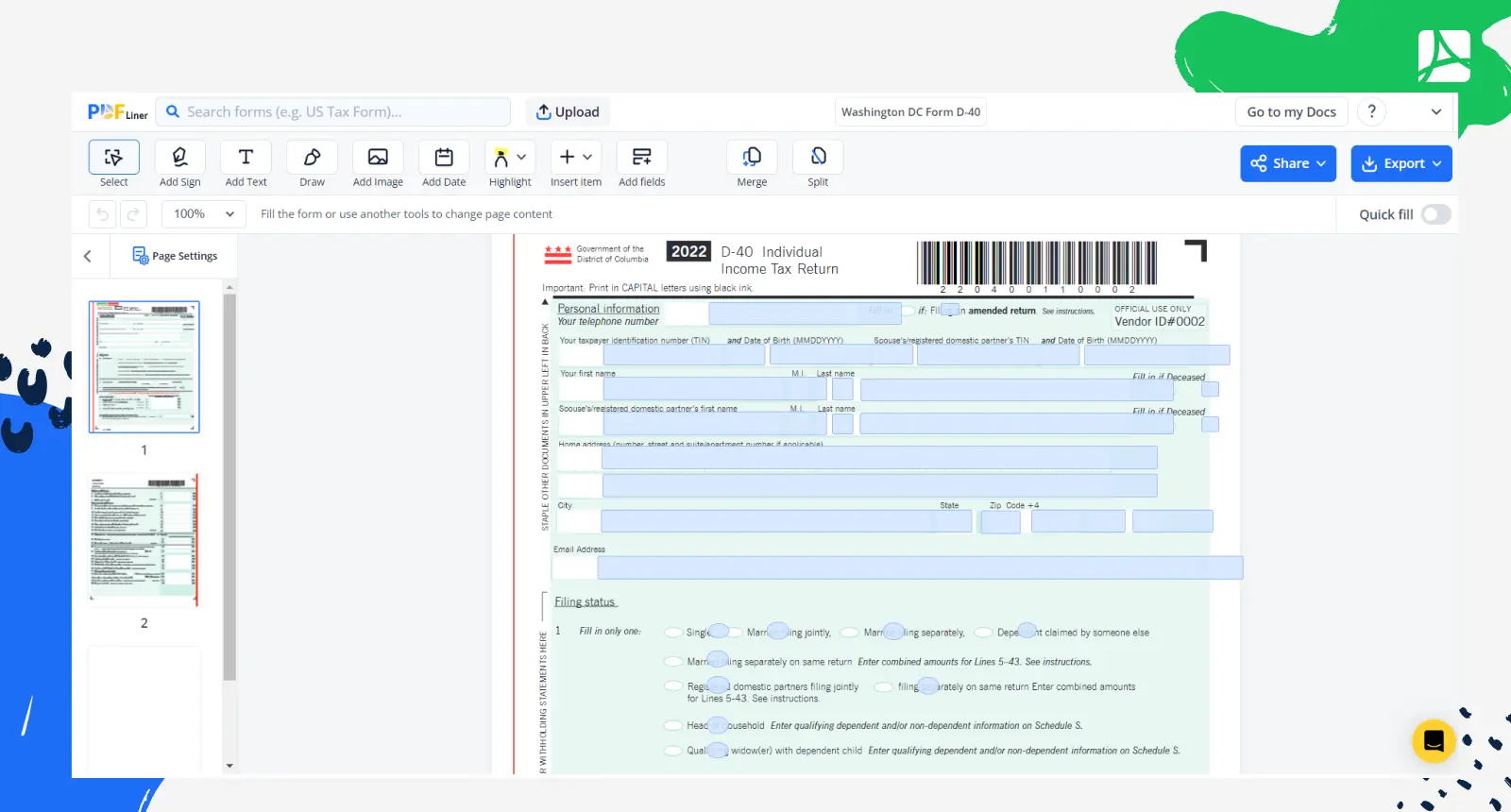

Washington DC Form D-40

Get your Washington DC Form D-40 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Washington DC Form D 40?

Washington DC Form D-40, also known as the Individual Income Tax Return form, is used by District of Columbia residents to report and file their annual income tax. Whether you are a full-time resident or a part-year resident, this form must be filed if your gross income meets the minimum filing thresholds.

Requirements for filing DC form D-40

Before diving into how to fill out Washington DC form D-40, it's crucial to determine if you're required to file this form. You must file this form if:

- You are a full-year resident of Washington DC, and have a gross income above the minimum filing threshold.

- You were a part-year resident and earned income during your residency in DC.

How to Fill Out Washington DC Tax Form D 40

Filling out the form D-40 may seem a bit daunting at first, but understanding the process and following these steps will simplify the task:

- First of all, review the displayed form to ensure it is the correct Form D-40 for the tax year you need to file.

- Start filling out the form by clicking on the editable fields and entering the required information.

- Click on the interactive fields and type in your First Name, Middle Initial, Last Name, Social Security Number, complete home address, etc in the designated spaces.

- Choose your filing status, such as Single, Married Filing Jointly, Married Filing Separately, or Head of Household, by clicking on the appropriate checkbox.

- Proceed to the Income Information section and list all sources of income. Enter the wages, interest, dividends, pensions, and other income amounts.

- Calculate your DC Gross Income by adding all your income amounts stated in the previous step. Input your Adjusted Gross Income by subtracting from your gross income any allowable deductions, such as IRA contributions, student loan interest, or moving expenses.

- List any income sources taxable in Washington DC but not included in your federal adjusted gross income. This may include non-DC bond interest and non-DC partnership income.

- In the Subtractions section, input amounts for any income not taxable by Washington DC but included in your federal adjusted gross income. This may include DC bond interest, partnership income, and government employee wages.

- Using the instructions on the D-40 form, calculate your total tax liability by applying the appropriate tax rates and brackets to your adjusted gross income.

- List any tax credits you are eligible for, such as the Earned Income Tax Credit or child tax credit, and subtract the total amount from your tax liability.

- Calculate the amount owed if your total tax liability exceeds your payments and credits. If the payments and credits exceed your tax liability, calculate your refund. Enter the appropriate figure in the designated area.

- Once you have completed the form, scroll down to the bottom of the form and sign electronically. Include your daytime phone number and date of signing.

Common mistakes and tips for avoiding them

When filling out the DC form D-40, taxpayers sometimes make mistakes that can lead to misconceptions, delays, or even penalties. To help you avoid these pitfalls, we have compiled a list of common errors and tips for preventing them.

- Filing with incorrect or incomplete personal information: Double-check your name, SSN, and address before submitting your form.

- Providing inaccurate income information: Ensure all amounts listed are accurate and that all sources of income are reported.

- Miscalculating deductions and adjustments: If itemizing deductions, use the correct forms and maintain proper documentation.

- Incorrectly calculating tax liability: Use the tax table provided in Form D-40 instructions for accurate tax liability calculations.

- Overlooking credits and payments: Review all applicable credits and include any estimated tax payments or withholdings made throughout the tax year.

Fillable online Washington DC Form D-40