-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 17

-

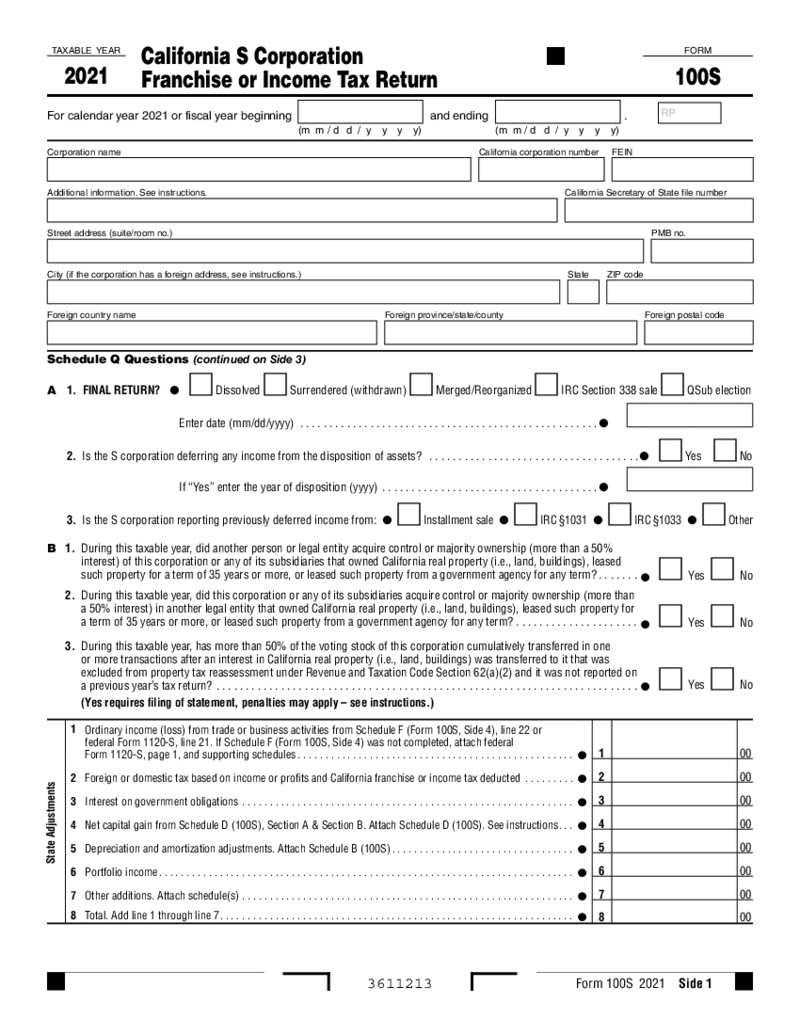

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

-

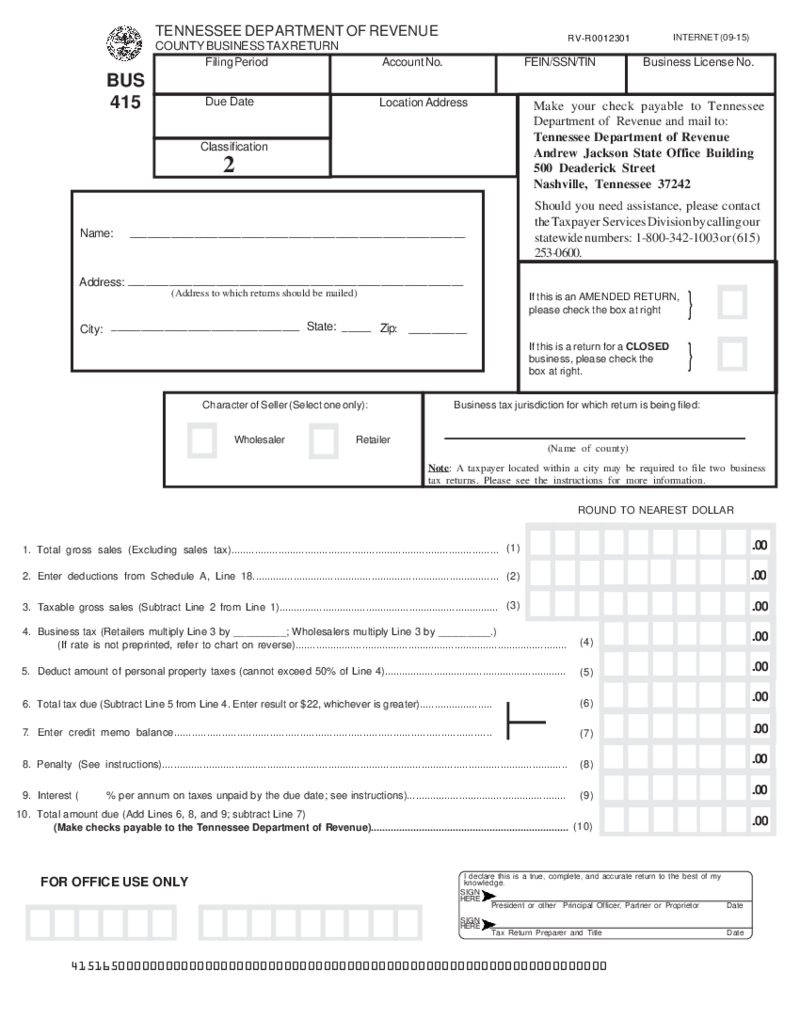

Business Tax Return (Form BUS-415)

Understanding the Business Tax Return Form

Known as Form BUS-415, this important document is the official business tax return form used by companies across the US. This form is undeniably integral to fulfilling tax obligations and ensuring all finances ar

Business Tax Return (Form BUS-415)

Understanding the Business Tax Return Form

Known as Form BUS-415, this important document is the official business tax return form used by companies across the US. This form is undeniably integral to fulfilling tax obligations and ensuring all finances ar

-

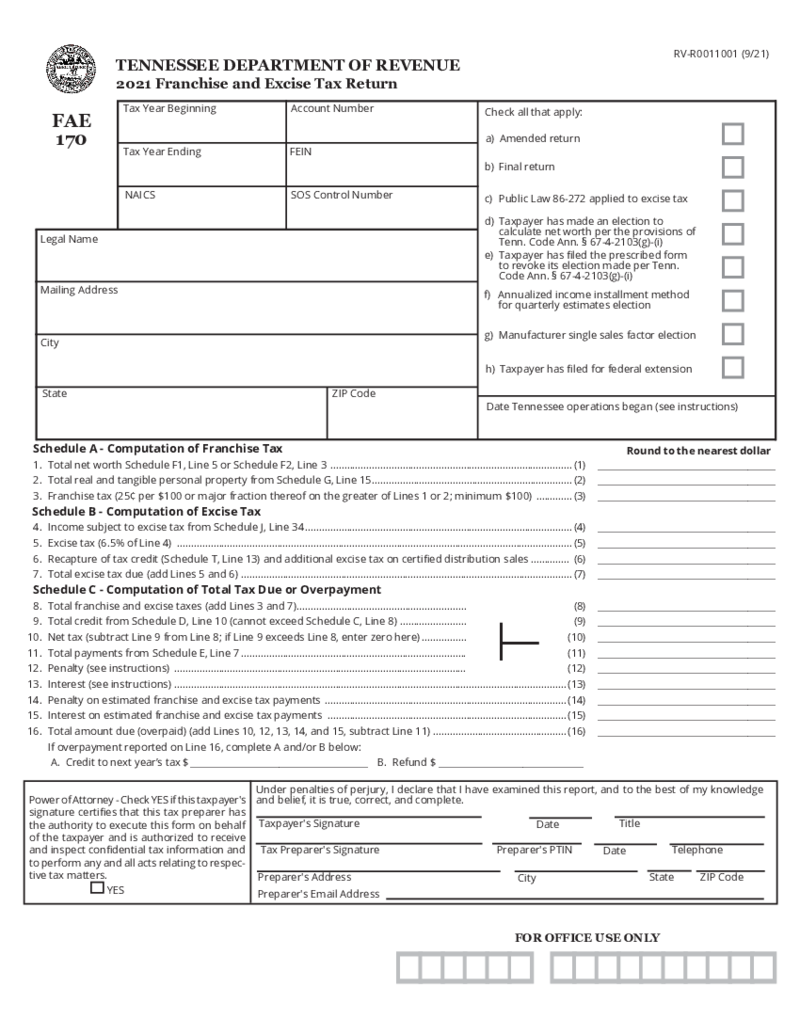

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

-

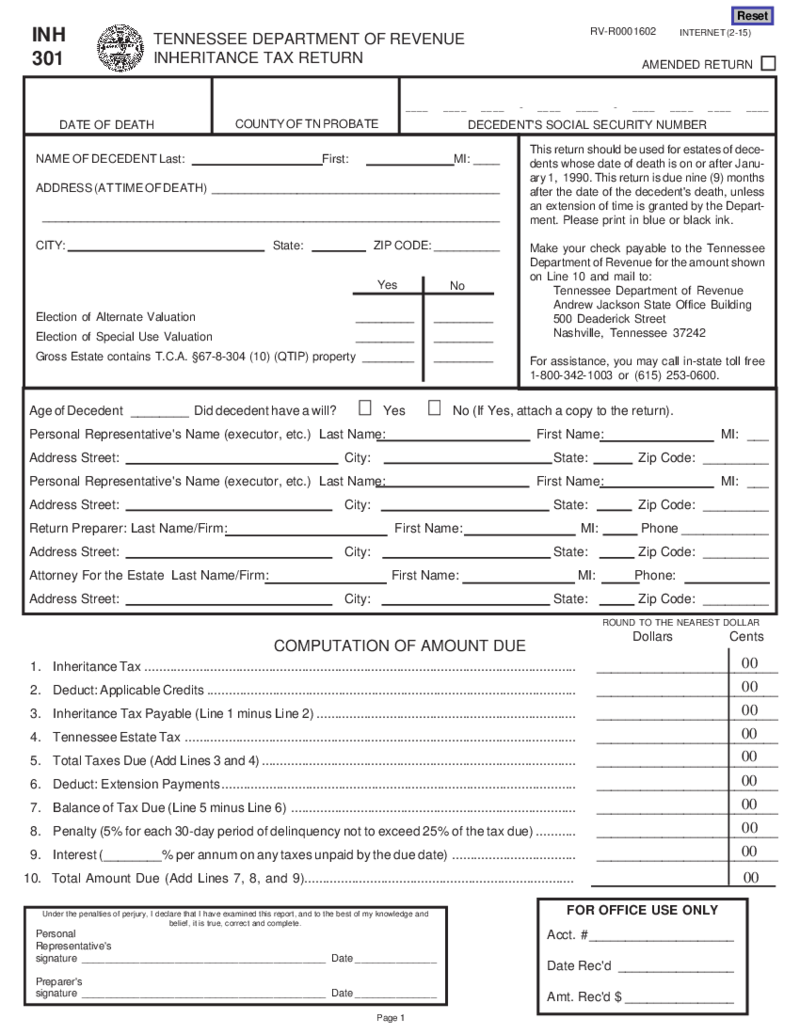

Tennessee Inheritance Tax Return (Form INH 301)

Understanding Your Tennessee Inheritance Tax Return

One essential document you'll likely encounter when settling an estate is the Tennessee Inheritance Tax Return. Traditionally known as Form INH 301, it is brought to you by the Tennessee Department o

Tennessee Inheritance Tax Return (Form INH 301)

Understanding Your Tennessee Inheritance Tax Return

One essential document you'll likely encounter when settling an estate is the Tennessee Inheritance Tax Return. Traditionally known as Form INH 301, it is brought to you by the Tennessee Department o

-

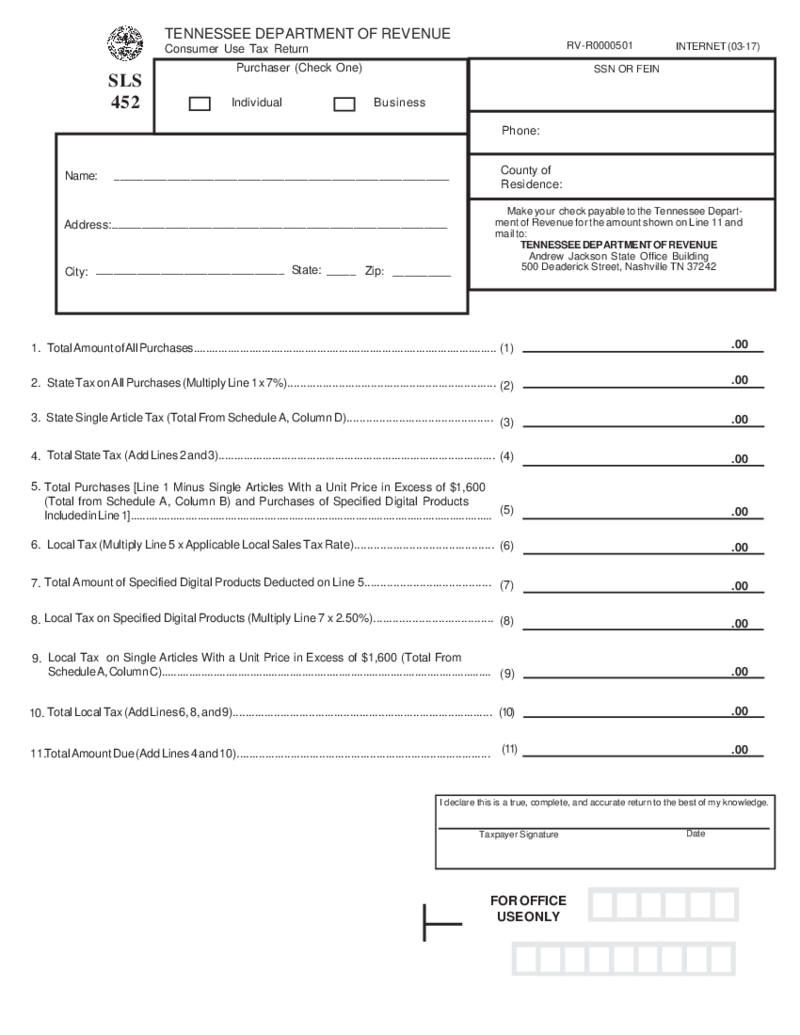

Consumer Use Tax Return SLS 452

Understanding the Consumer Use Tax Return Form

The consumer SLS 452 form provides a framework for consumers to report and pay the tax due on tangible personal property purchased outside their state but used within it. A good understanding of this form is

Consumer Use Tax Return SLS 452

Understanding the Consumer Use Tax Return Form

The consumer SLS 452 form provides a framework for consumers to report and pay the tax due on tangible personal property purchased outside their state but used within it. A good understanding of this form is

-

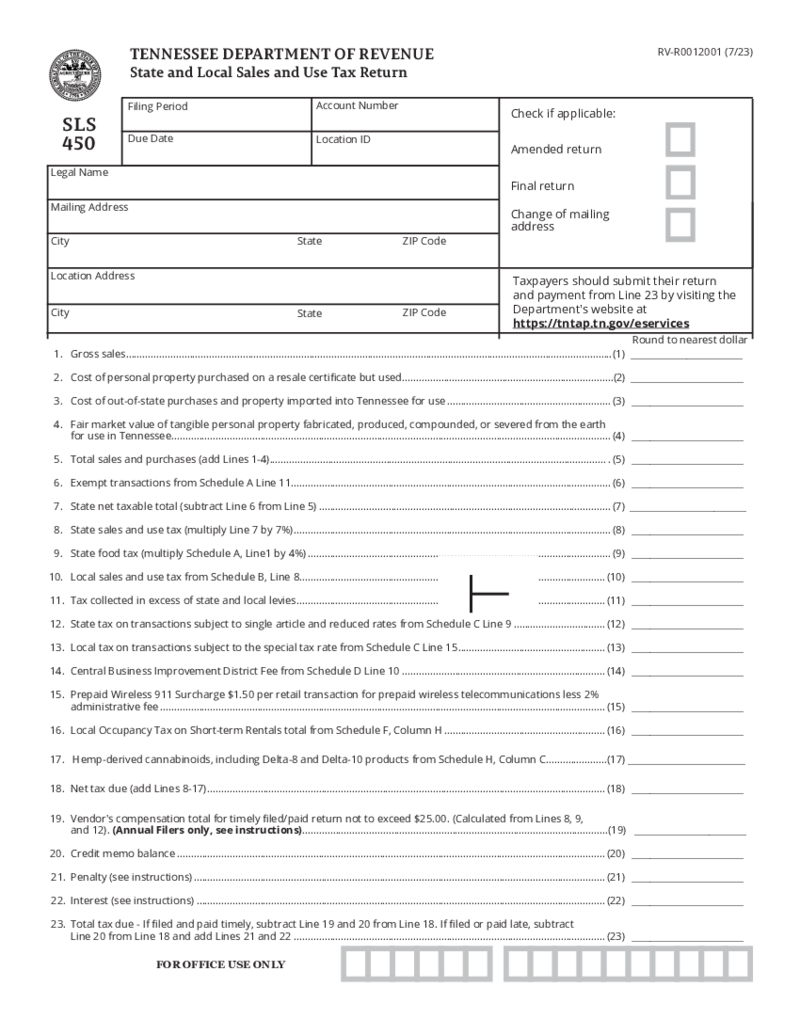

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

-

State of West Virginia Tax Form

Understanding the West Virginia State Tax Form

If you're a taxpayer in the state of West Virginia, you're no stranger to the anxiety of tax season. Yet, the process doesn't have to be an uphill battle. Typically, state tax forms can feel compl

State of West Virginia Tax Form

Understanding the West Virginia State Tax Form

If you're a taxpayer in the state of West Virginia, you're no stranger to the anxiety of tax season. Yet, the process doesn't have to be an uphill battle. Typically, state tax forms can feel compl

-

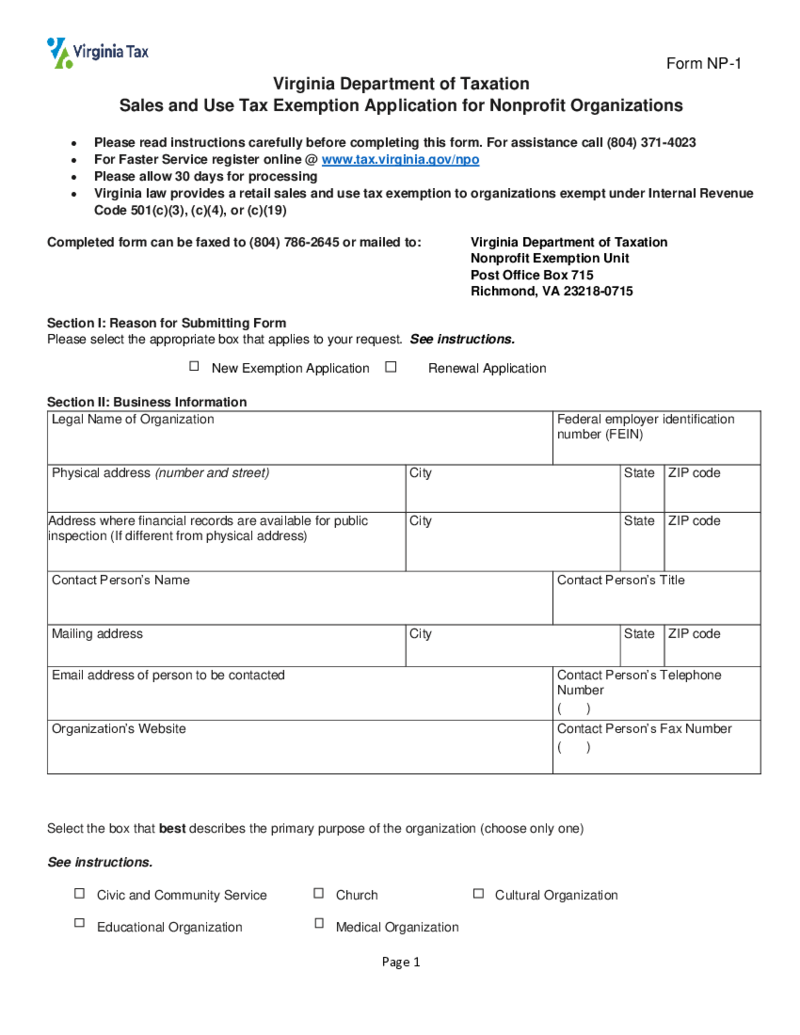

Virginia Tax Exemption Form

Understanding the Virginia Tax Exemption Form

It's crucial to first comprehend what a Virginia tax-exempt form entails. This document allows certain organizations, businesses, or individuals to be exempted from paying state taxes on their purchases. T

Virginia Tax Exemption Form

Understanding the Virginia Tax Exemption Form

It's crucial to first comprehend what a Virginia tax-exempt form entails. This document allows certain organizations, businesses, or individuals to be exempted from paying state taxes on their purchases. T

-

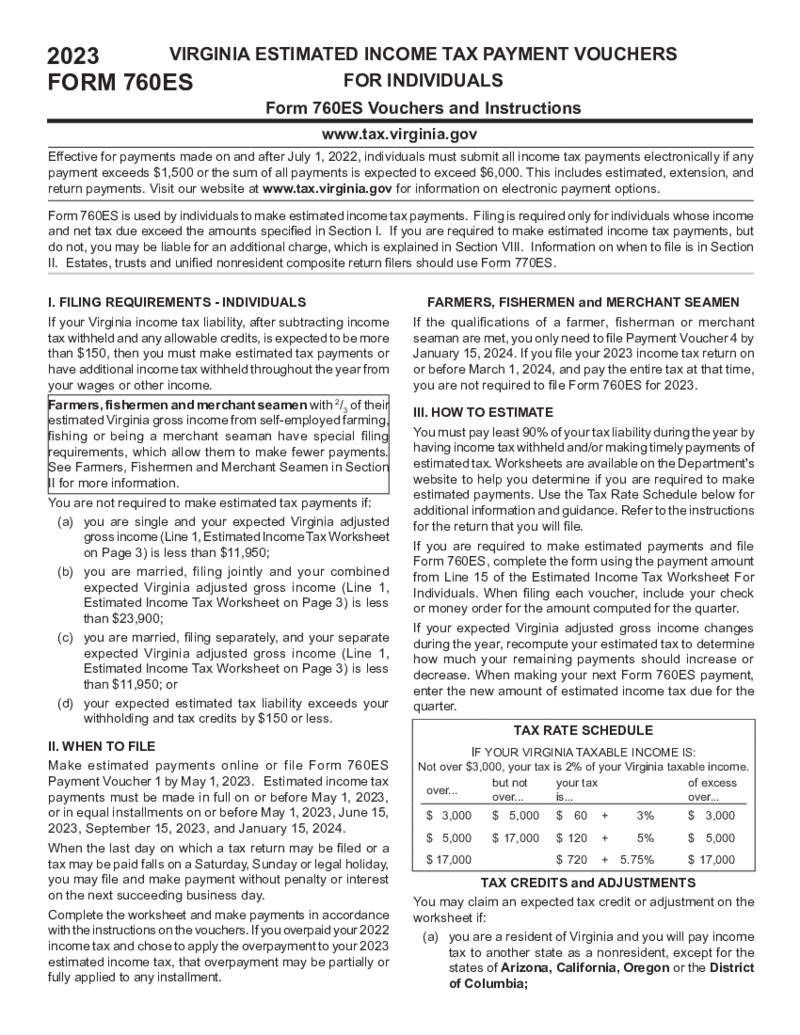

Form 760-ES

Understanding VA Form 760 ES

Form 760 ES, also known as the Virginia Estimated Income Tax Payment Vouchers for Individuals, is essential for taxpayers in the US. This highly specific state tax form is intended primarily for the residents of Virginia and i

Form 760-ES

Understanding VA Form 760 ES

Form 760 ES, also known as the Virginia Estimated Income Tax Payment Vouchers for Individuals, is essential for taxpayers in the US. This highly specific state tax form is intended primarily for the residents of Virginia and i

-

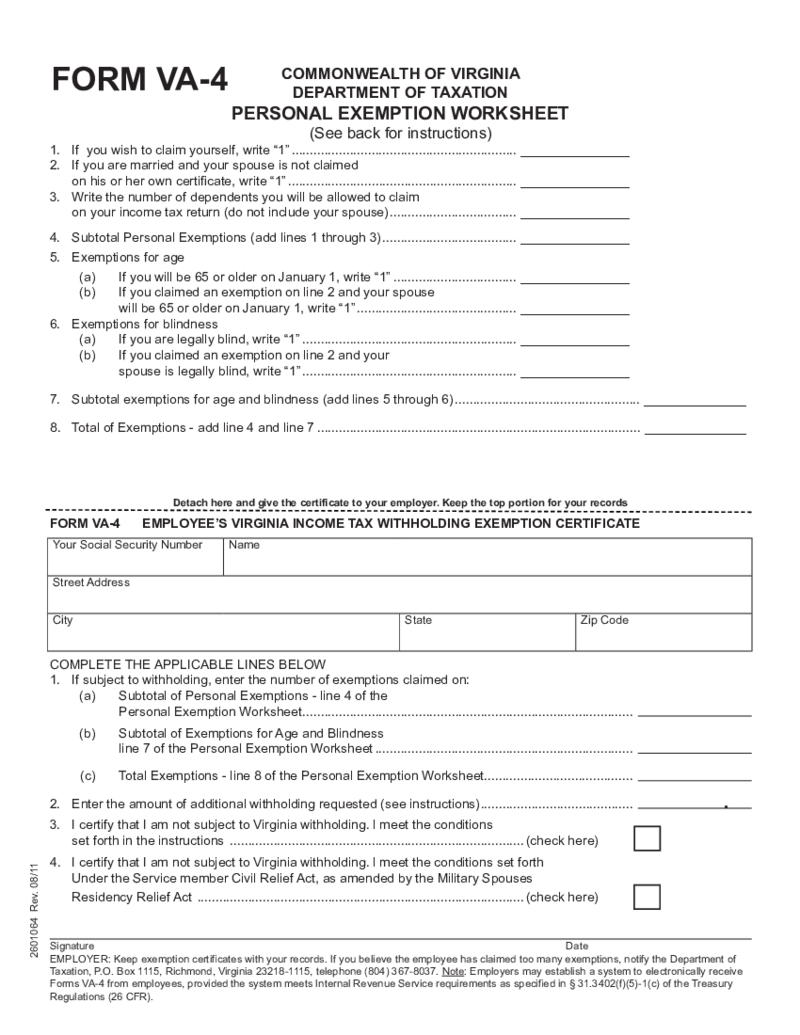

Form VA-4

What Is Virginia VA-4 Form?

Simply put, the VA Form VA-4 is the state of Virginia’s equivalent to the W-4 provided by the federal government. This form aids employees in determining the exact amount of state income tax that their employers should wi

Form VA-4

What Is Virginia VA-4 Form?

Simply put, the VA Form VA-4 is the state of Virginia’s equivalent to the W-4 provided by the federal government. This form aids employees in determining the exact amount of state income tax that their employers should wi

-

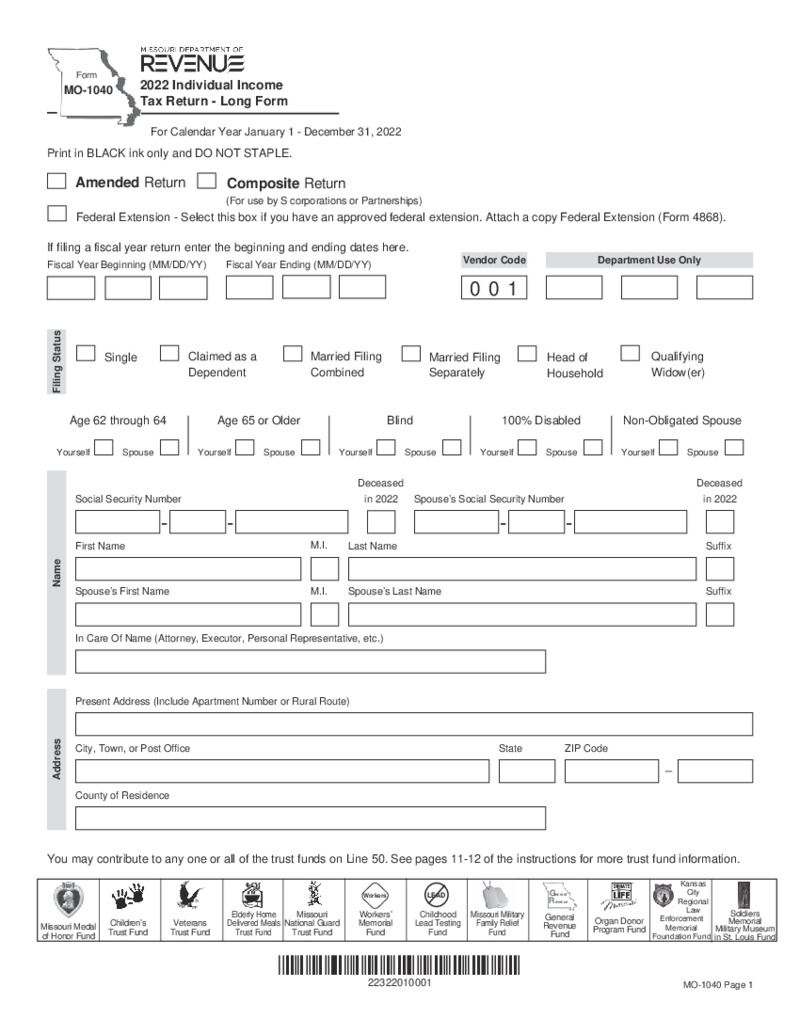

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

-

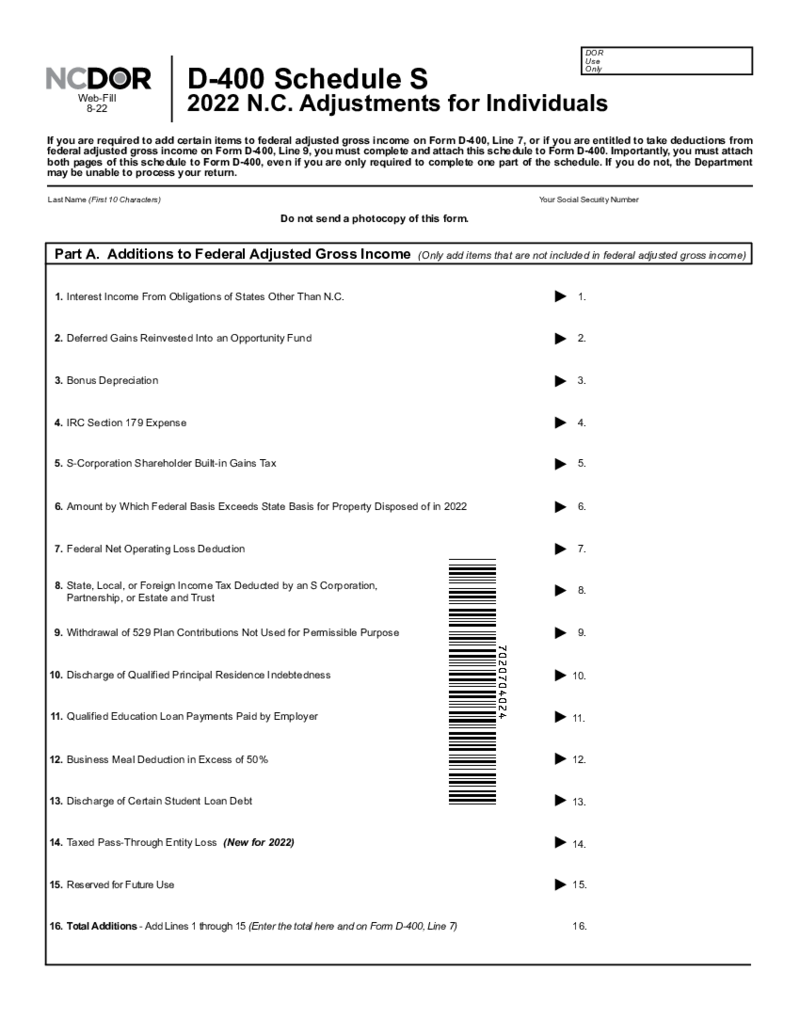

NC D-400 Schedule S

What is the NC D-400 Schedule S

The NC Form D-400 Schedule S is a supplemental form used in conjunction with the primary NC D-400 form. It's designed to help taxpayers in North Carolina claim specific tax credits and deductions that aren't necessa

NC D-400 Schedule S

What is the NC D-400 Schedule S

The NC Form D-400 Schedule S is a supplemental form used in conjunction with the primary NC D-400 form. It's designed to help taxpayers in North Carolina claim specific tax credits and deductions that aren't necessa

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.