-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 7

-

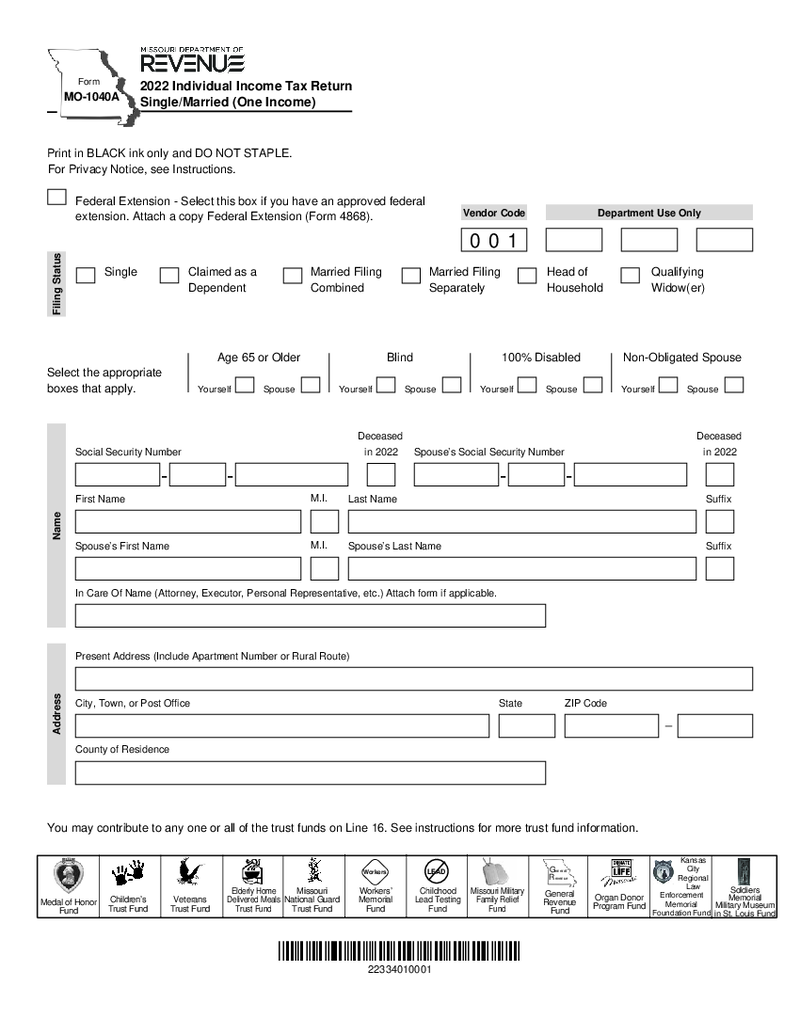

Form MO-1040A - Single Married with One Income Tax Return

Detailed Instructions on the MO 1040A Fillable Form

Form MO 1040A is a simplified version of the standard Form 1040 used for filing individual income tax returns in Missouri.

The MO 1040a printable form is designed with clarity in mind. It

Form MO-1040A - Single Married with One Income Tax Return

Detailed Instructions on the MO 1040A Fillable Form

Form MO 1040A is a simplified version of the standard Form 1040 used for filing individual income tax returns in Missouri.

The MO 1040a printable form is designed with clarity in mind. It

-

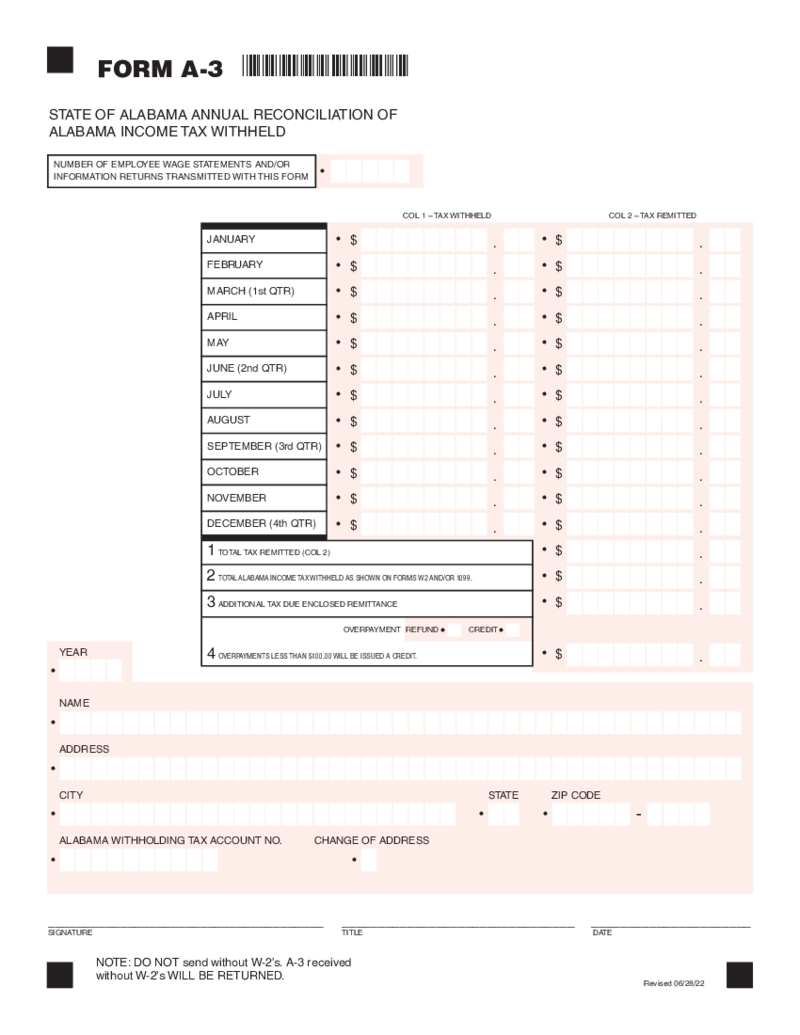

A-3 Annual Reconciliation of Alabama Income Tax Withheld

Understanding the Alabama A 3 Form

An A 3 form Alabama, also known as the Annual Reconciliation of Alabama Income Tax Withheld, is a document employers in Alabama must fill out. It details the total state income tax withheld from employees' earnings t

A-3 Annual Reconciliation of Alabama Income Tax Withheld

Understanding the Alabama A 3 Form

An A 3 form Alabama, also known as the Annual Reconciliation of Alabama Income Tax Withheld, is a document employers in Alabama must fill out. It details the total state income tax withheld from employees' earnings t

-

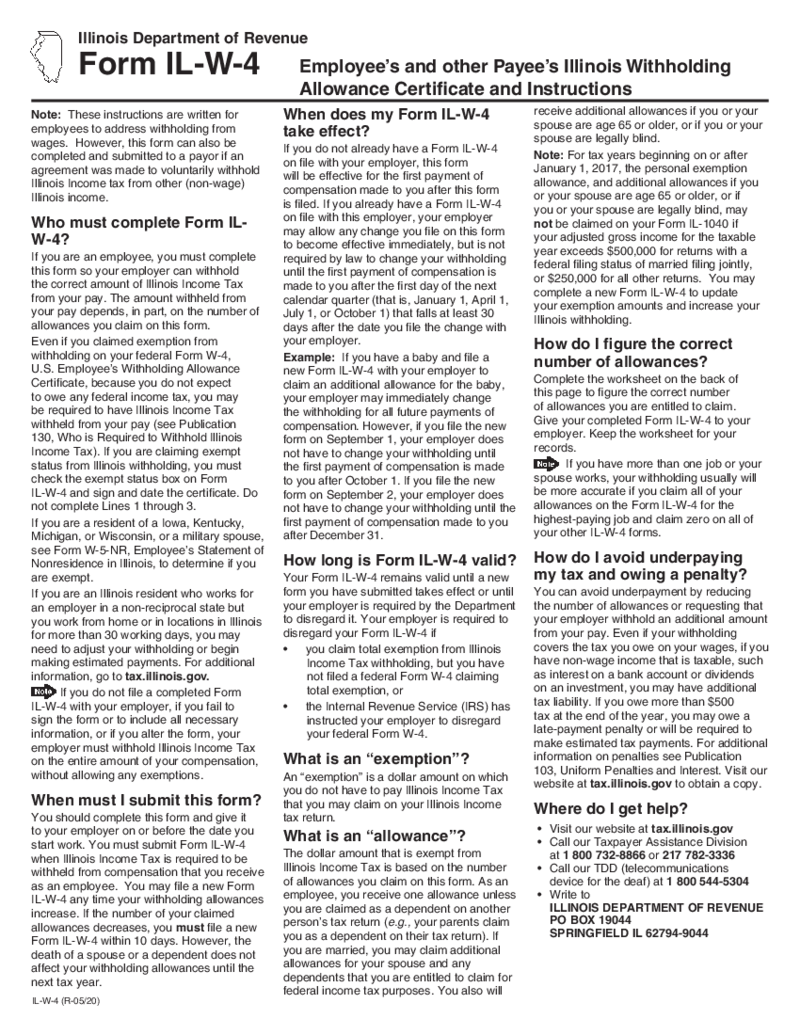

IL-W-4 - Illinois Employees and other Payees Withholding Allowance Certificate

What Is the IL W-4 Form 2023?

The form IL W-4 is an essential document for employees and other payees across the state of Illinois. It's a withholding allowance certificate that informs employers of the amount of state income tax to withhold from a pa

IL-W-4 - Illinois Employees and other Payees Withholding Allowance Certificate

What Is the IL W-4 Form 2023?

The form IL W-4 is an essential document for employees and other payees across the state of Illinois. It's a withholding allowance certificate that informs employers of the amount of state income tax to withhold from a pa

-

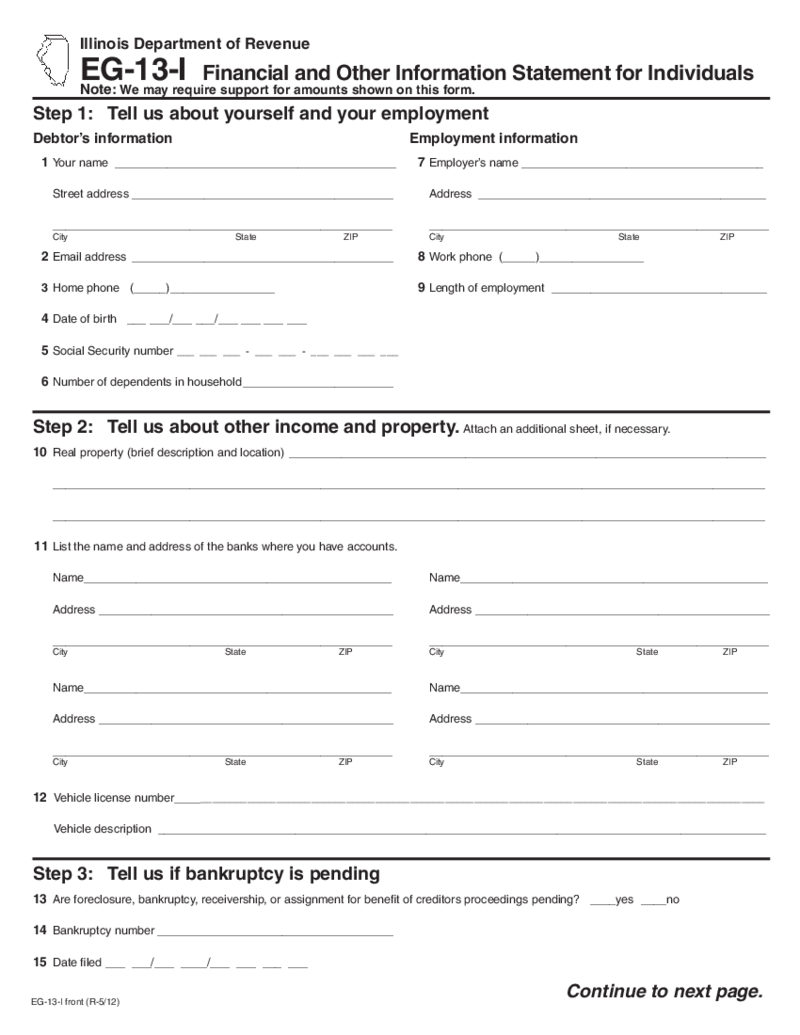

EG-13-I - Illinois Financial and Other Information Statement

Illinois Form EG 13 I Detailed Explanation

The EG-13-I form, specifically designated for Illinois state residents, plays a significant role in financial proceedings. The Illinois Department of Revenue Form EG-13-I efficiently collects a multiplicity of in

EG-13-I - Illinois Financial and Other Information Statement

Illinois Form EG 13 I Detailed Explanation

The EG-13-I form, specifically designated for Illinois state residents, plays a significant role in financial proceedings. The Illinois Department of Revenue Form EG-13-I efficiently collects a multiplicity of in

-

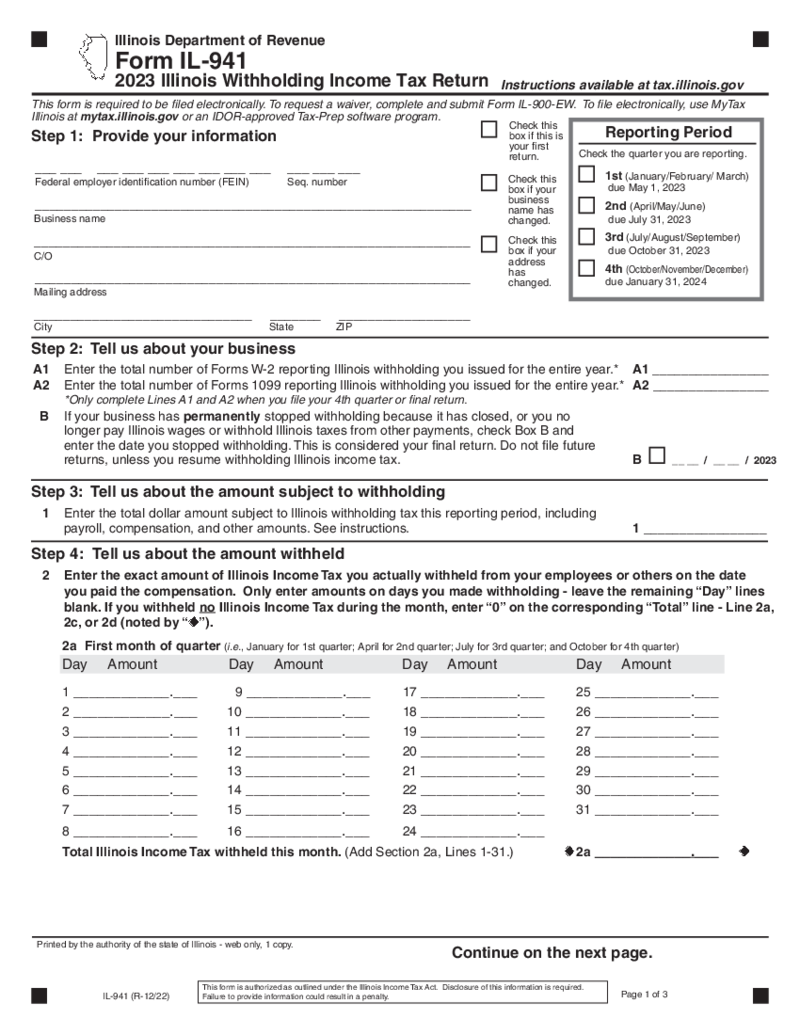

Illinois Form 941

Overview: State of Illinois Form 941

The Illinois 941 form is designed to report the amount of taxes withheld from employee wages. It includes federal income tax deductions, and social security and Medicare taxes. As a business owner or employer in Illino

Illinois Form 941

Overview: State of Illinois Form 941

The Illinois 941 form is designed to report the amount of taxes withheld from employee wages. It includes federal income tax deductions, and social security and Medicare taxes. As a business owner or employer in Illino

-

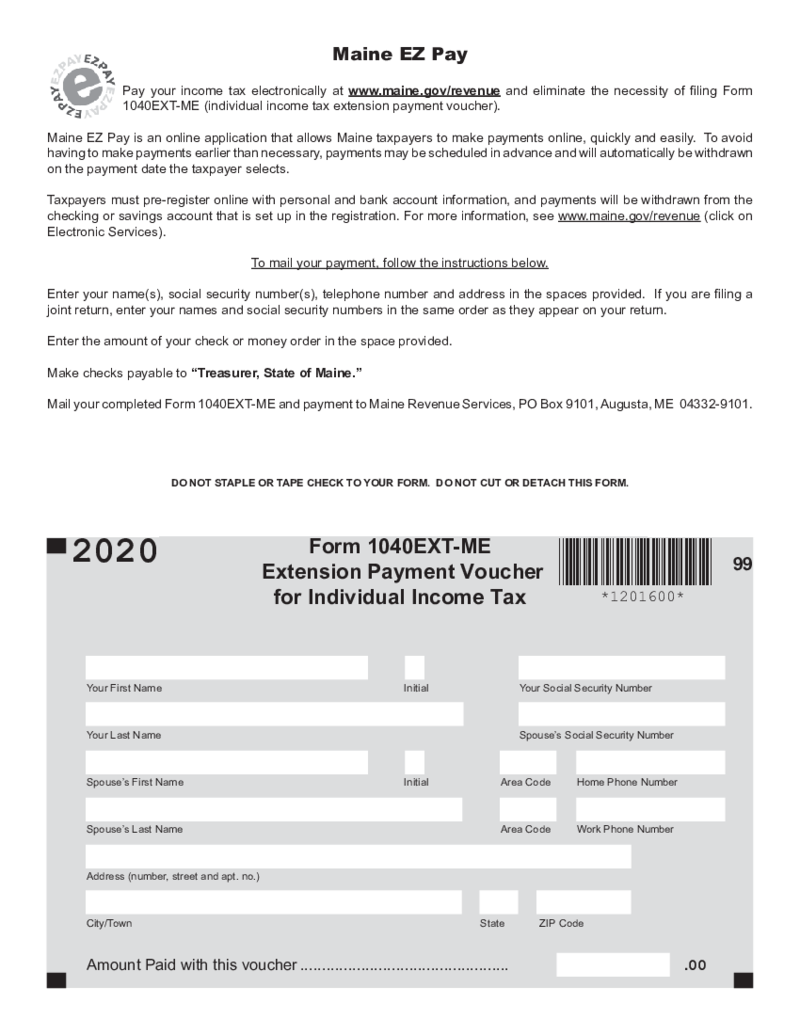

Maine EZ Pay

What is a Maine EZ Pay Form?

The fillable form Maine 1040EXT-ME is needed to make tax payments online. This form is specifically designed to simplify the process of making payments for various services and fees in the state of Maine. By utilizing this Mai

Maine EZ Pay

What is a Maine EZ Pay Form?

The fillable form Maine 1040EXT-ME is needed to make tax payments online. This form is specifically designed to simplify the process of making payments for various services and fees in the state of Maine. By utilizing this Mai

-

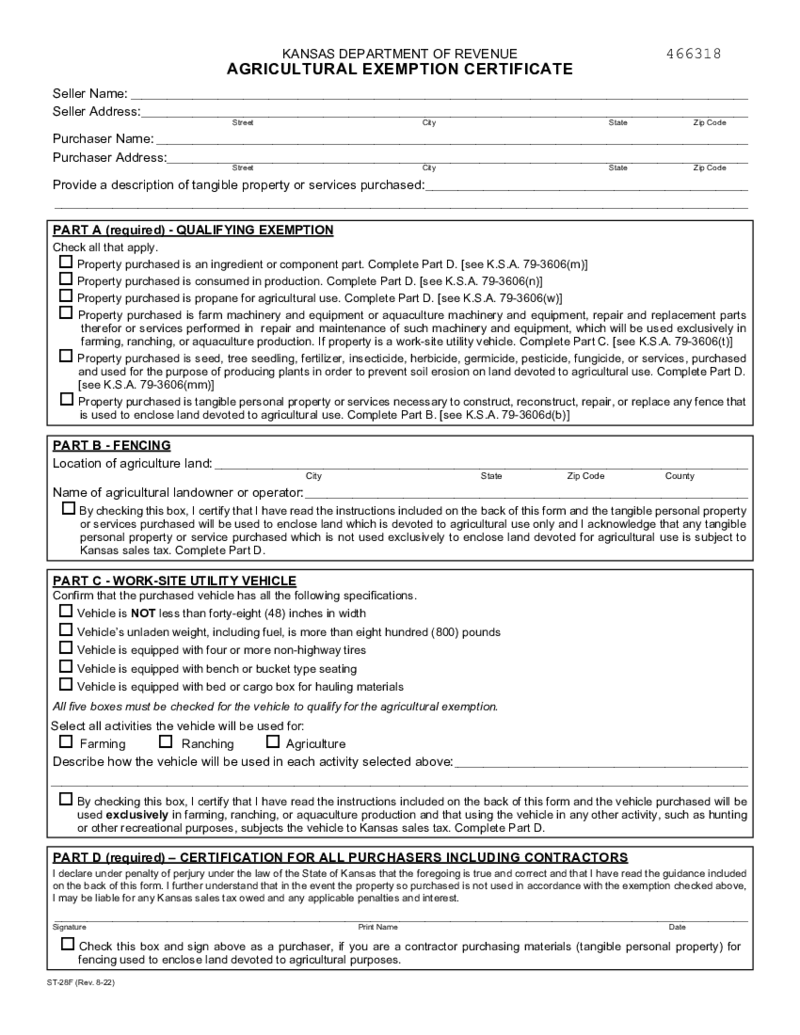

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

-

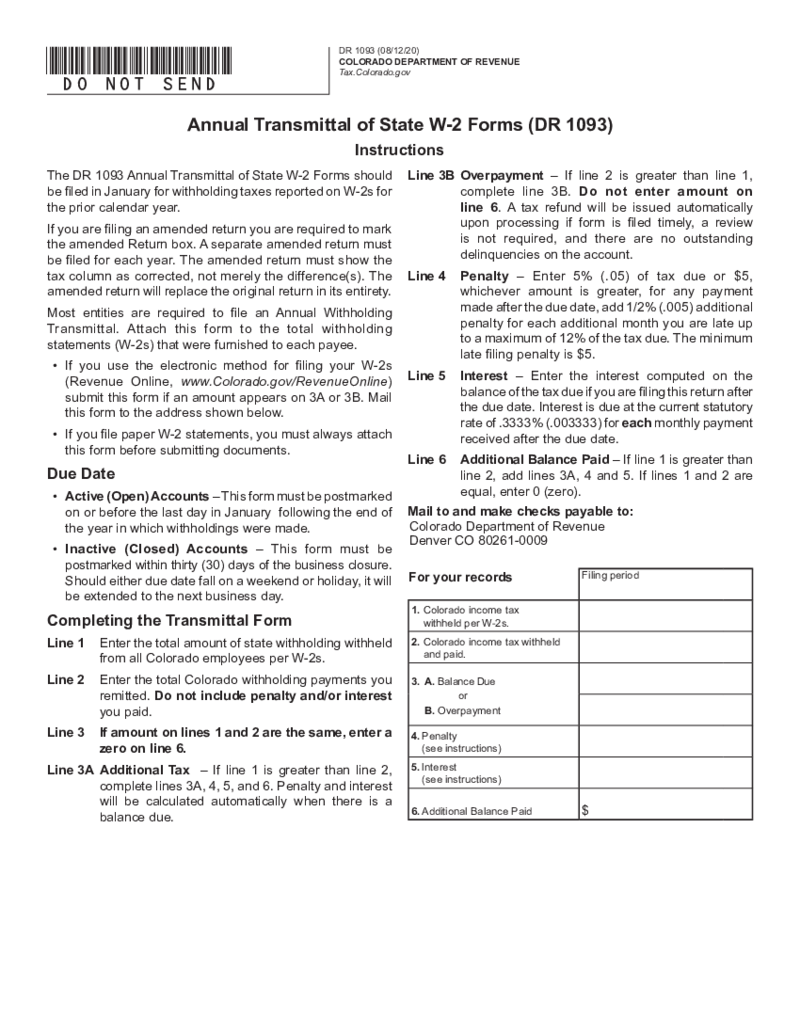

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

-

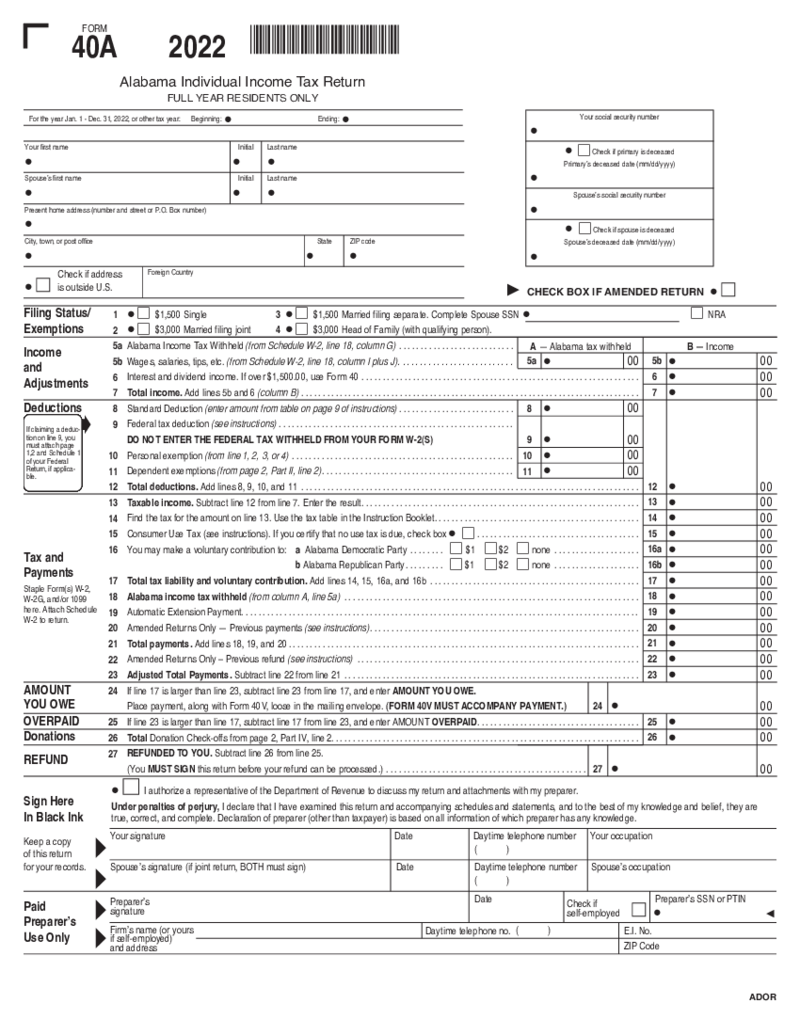

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

-

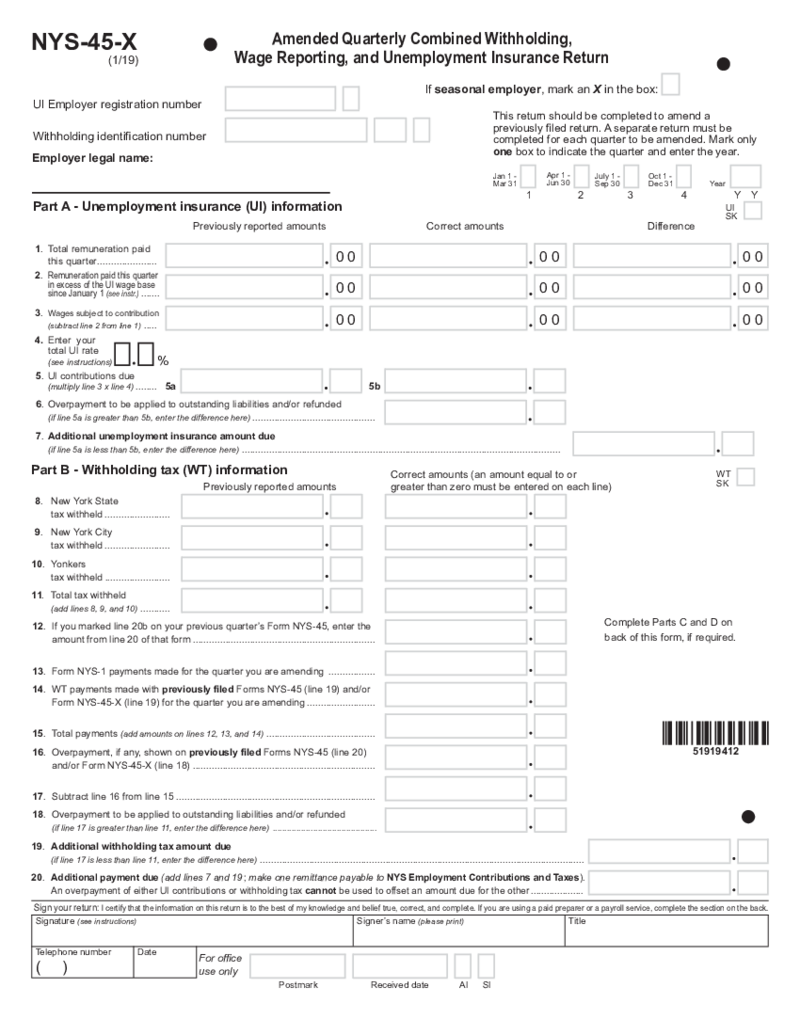

New York Form NYS-45-X

What Is New York Form NYS 45 X

New York Form NYS 45 X, also known as the Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves as a mechanism for employers in New York State to correct previousl

New York Form NYS-45-X

What Is New York Form NYS 45 X

New York Form NYS 45 X, also known as the Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves as a mechanism for employers in New York State to correct previousl

-

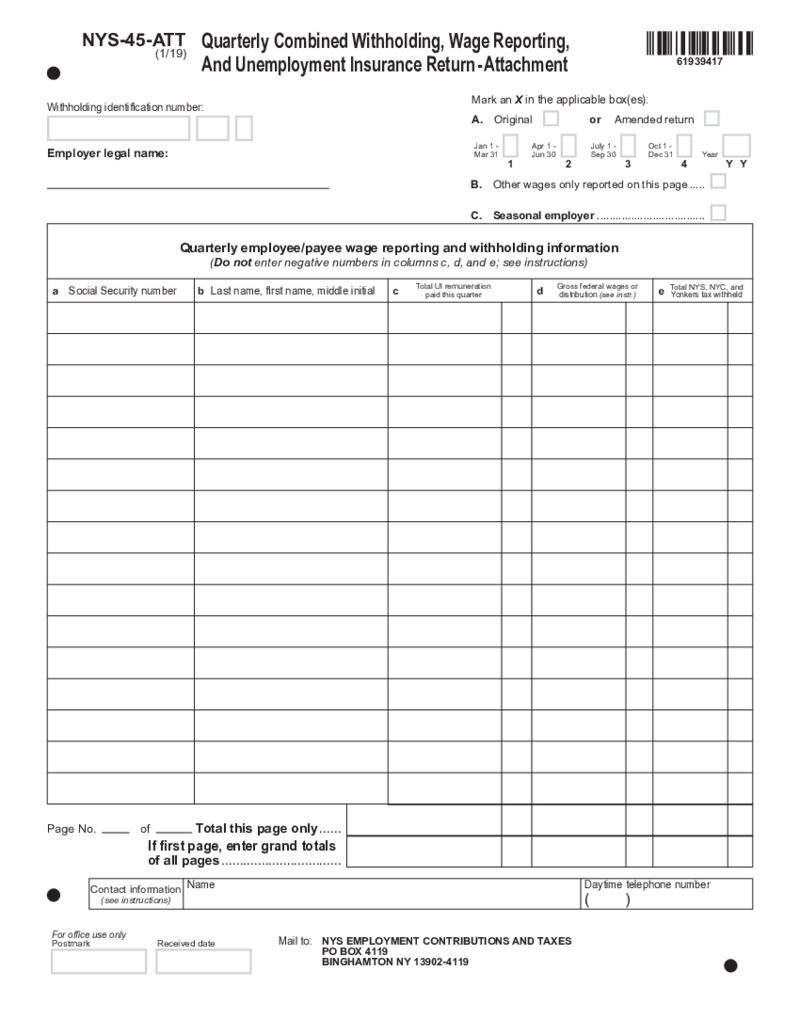

New York Form NYS-45-ATT

What Is A Form NYS-45-ATT

Form NYS-45-ATT, often called the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment, is a supplementary document associated with New York State's primary Form NYS-45

New York Form NYS-45-ATT

What Is A Form NYS-45-ATT

Form NYS-45-ATT, often called the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment, is a supplementary document associated with New York State's primary Form NYS-45

-

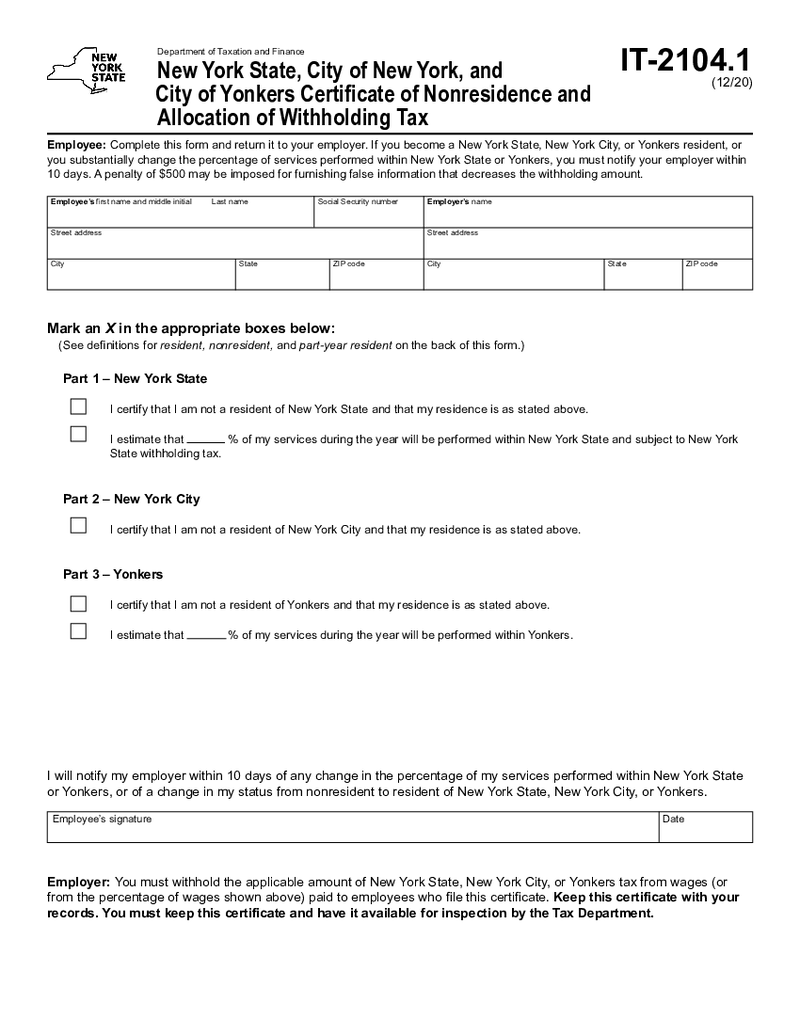

New York Form IT-2104.1

What Is Form IT 2104.1

New York form IT-2104.1 is essential for nonresidents and part-year residents who earn income in New York State but are not subject to typical state withholding rates. This form serves as a Nonresident and Part-Year

New York Form IT-2104.1

What Is Form IT 2104.1

New York form IT-2104.1 is essential for nonresidents and part-year residents who earn income in New York State but are not subject to typical state withholding rates. This form serves as a Nonresident and Part-Year

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.