-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 6

-

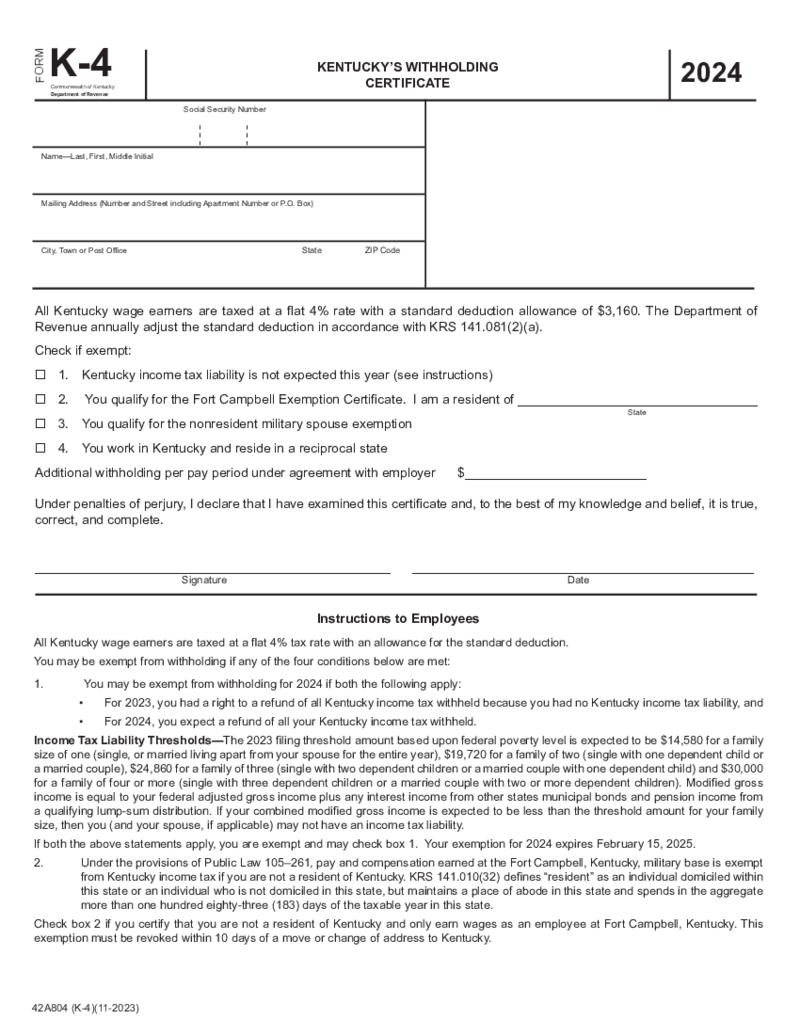

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

-

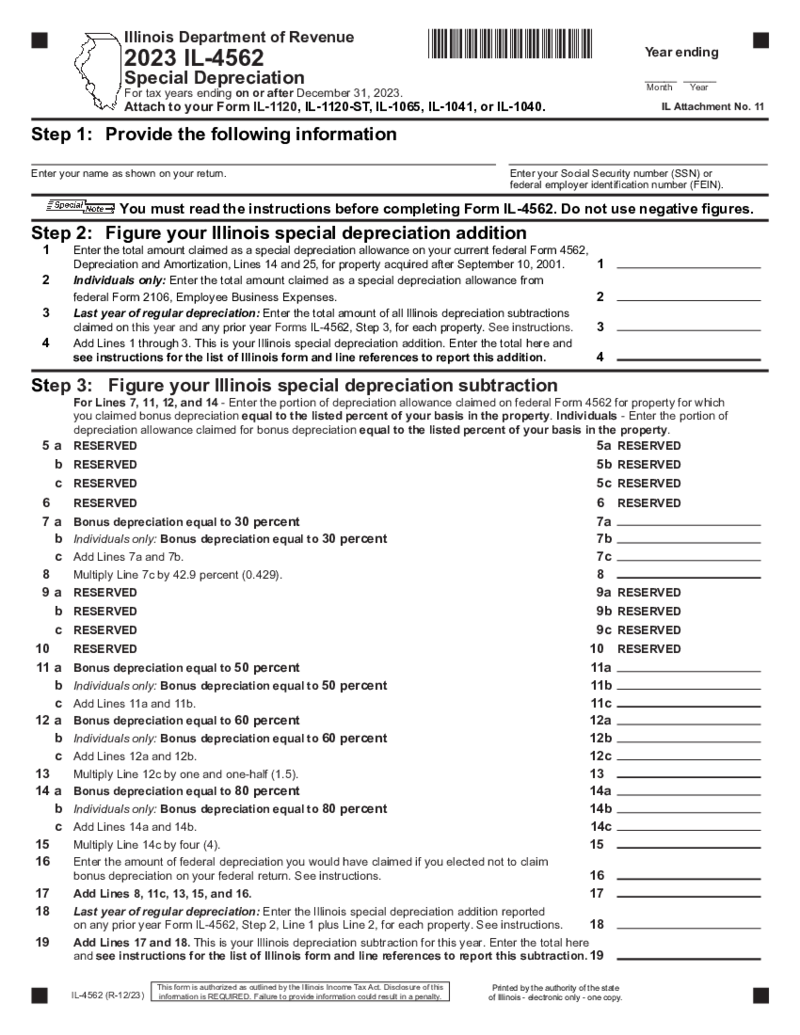

Form IL-4562

What Is Form IL-4562?

Form IL-4562, often referred to as the Special Depreciation, is a tax document used by Illinois taxpayers to claim additional depreciation for certain property. It provides the means to report the special depreciation allowance and I

Form IL-4562

What Is Form IL-4562?

Form IL-4562, often referred to as the Special Depreciation, is a tax document used by Illinois taxpayers to claim additional depreciation for certain property. It provides the means to report the special depreciation allowance and I

-

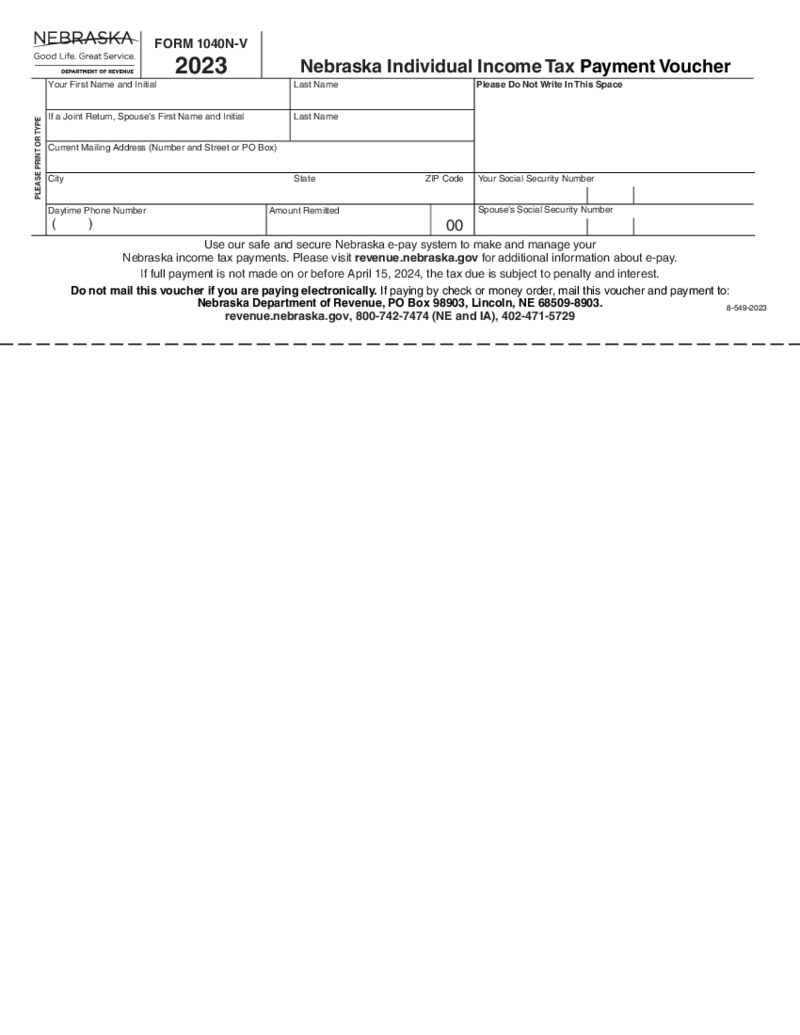

Nebraska Form 1040N-V

Understanding Nebraska Tax Form 1040N V

When it comes to tax season, understanding the specific forms required by your state is crucial. For Nebraska residents, the Nebraska tax form 1040N-V is an essential piece of the puzzle if you are making a payment

Nebraska Form 1040N-V

Understanding Nebraska Tax Form 1040N V

When it comes to tax season, understanding the specific forms required by your state is crucial. For Nebraska residents, the Nebraska tax form 1040N-V is an essential piece of the puzzle if you are making a payment

-

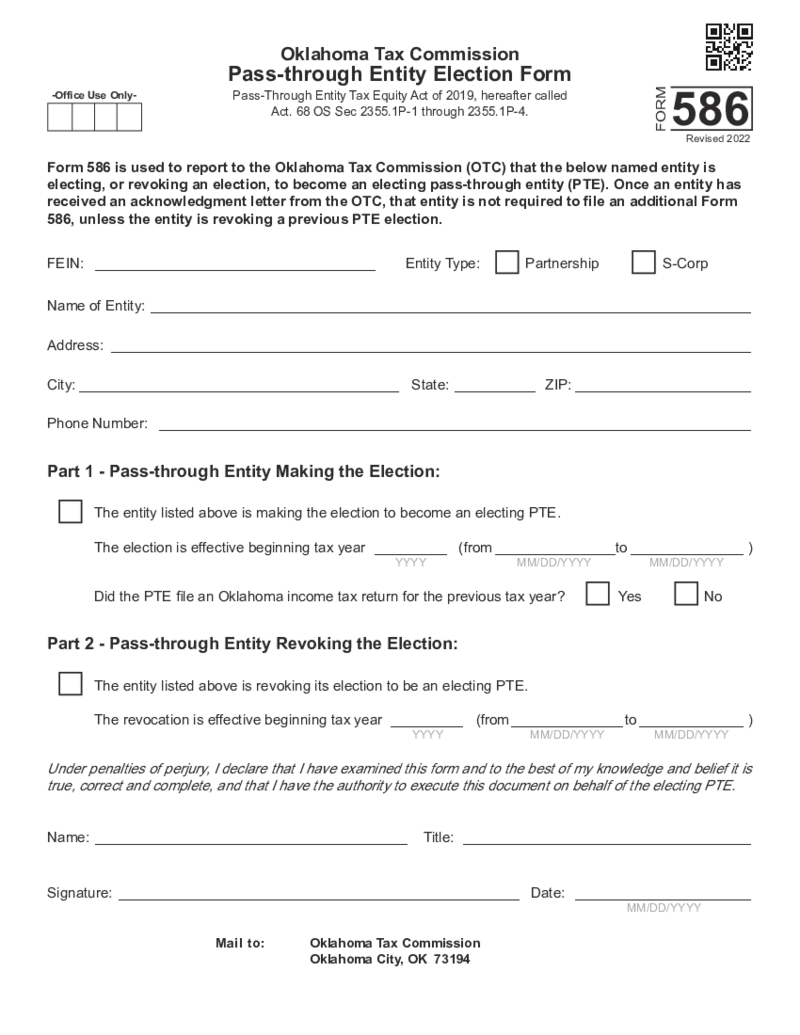

Form 586 Oklahoma Pass-through Entity Election Form (2022)

Oklahoma Form 586, also known as the Oklahoma Pass-Through Entity Tax Form, is a necessary document for certain business entities. This form allows businesses that function as pass-through entities, such as Limited Liability Companies (LLCs) and S Corporations, to de

Form 586 Oklahoma Pass-through Entity Election Form (2022)

Oklahoma Form 586, also known as the Oklahoma Pass-Through Entity Tax Form, is a necessary document for certain business entities. This form allows businesses that function as pass-through entities, such as Limited Liability Companies (LLCs) and S Corporations, to de

-

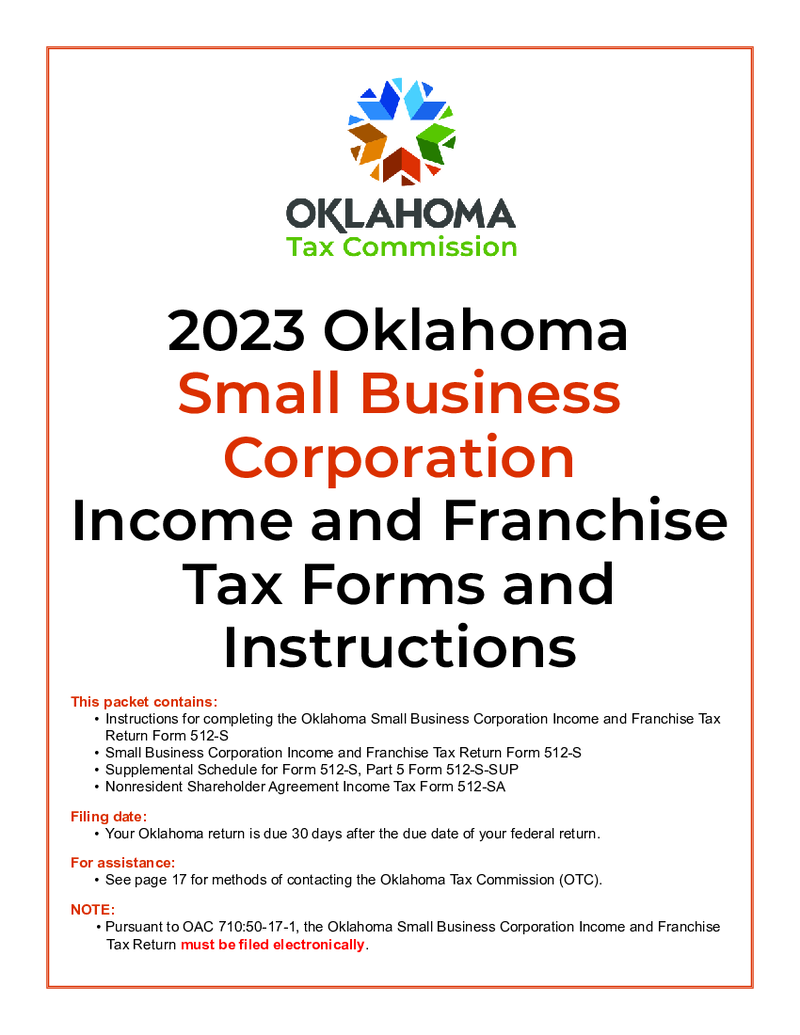

Oklahoma Form 512-S

Understanding the Oklahoma Form 512 S

Navigating state tax forms can be complex, but understanding the Oklahoma Form 512-S is essential for certain entities conducting business within the Sooner State. This specific Oklahoma form is a crucial document for

Oklahoma Form 512-S

Understanding the Oklahoma Form 512 S

Navigating state tax forms can be complex, but understanding the Oklahoma Form 512-S is essential for certain entities conducting business within the Sooner State. This specific Oklahoma form is a crucial document for

-

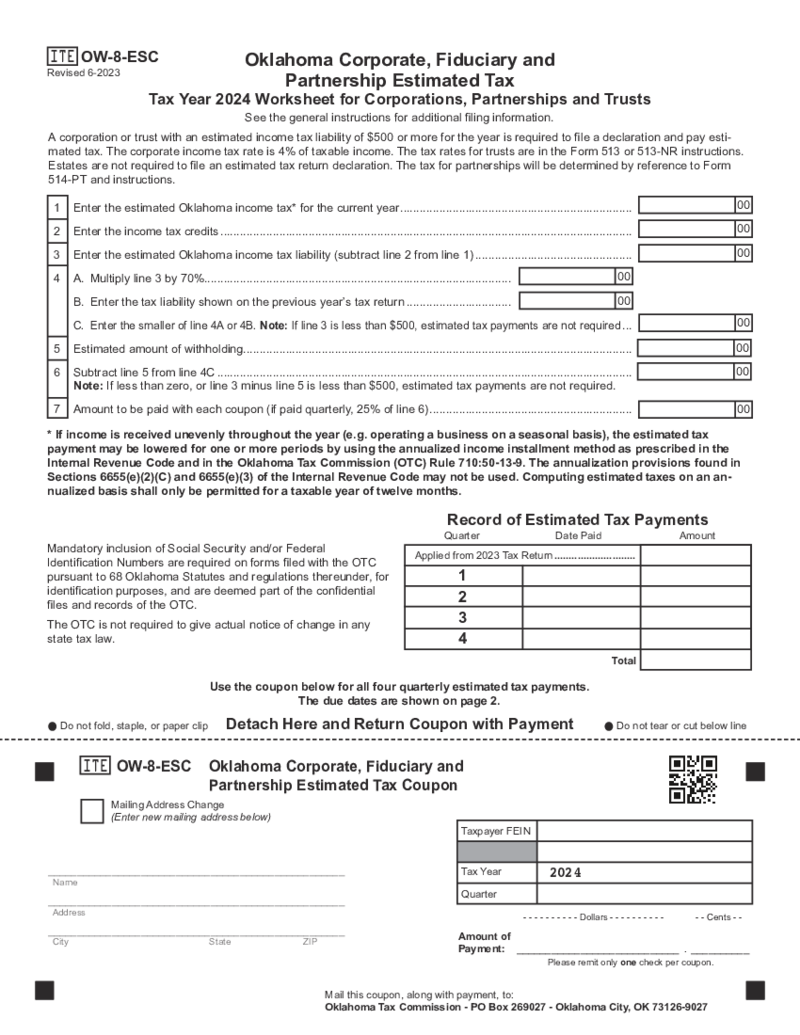

Form OW-8-ESC Oklahoma Corporate

What Is Form OW 8 ESC?

Form OW-8-ESC serves as a tool for Oklahoma corporations to calculate and pay their estimated income taxes quarterly. This form is primarily used by businesses that anticipate owing at least $500 in state income tax after subtractin

Form OW-8-ESC Oklahoma Corporate

What Is Form OW 8 ESC?

Form OW-8-ESC serves as a tool for Oklahoma corporations to calculate and pay their estimated income taxes quarterly. This form is primarily used by businesses that anticipate owing at least $500 in state income tax after subtractin

-

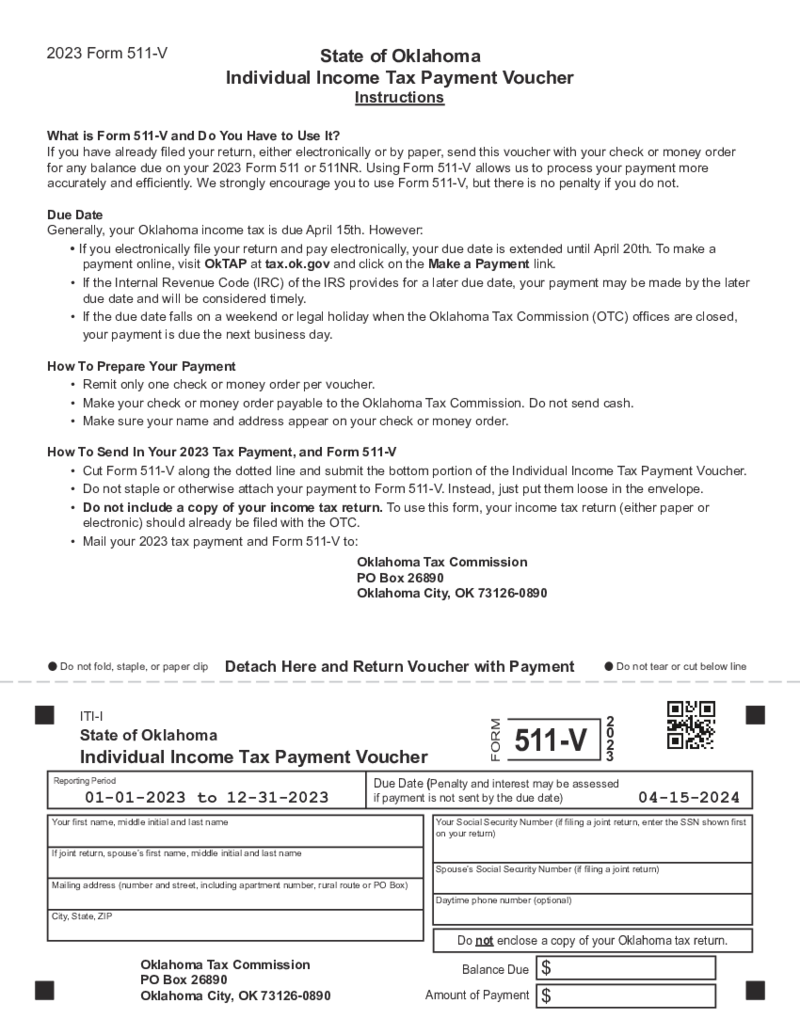

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

-

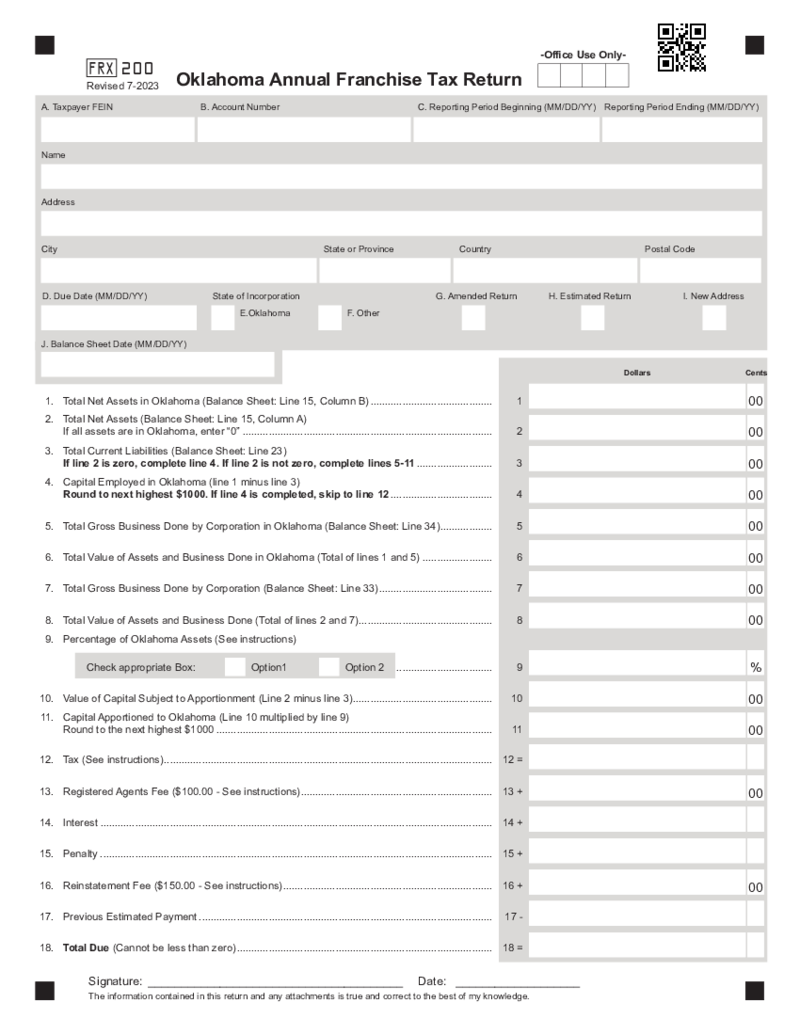

Form FRX-200 Oklahoma Annual Franchise Tax Return

Overview of the Oklahoma Annual Franchise Tax Return Form

The Oklahoma Annual Franchise Tax is levied on corporations operating within the state. It is calculated based on the company's capital invested or used in

Form FRX-200 Oklahoma Annual Franchise Tax Return

Overview of the Oklahoma Annual Franchise Tax Return Form

The Oklahoma Annual Franchise Tax is levied on corporations operating within the state. It is calculated based on the company's capital invested or used in

-

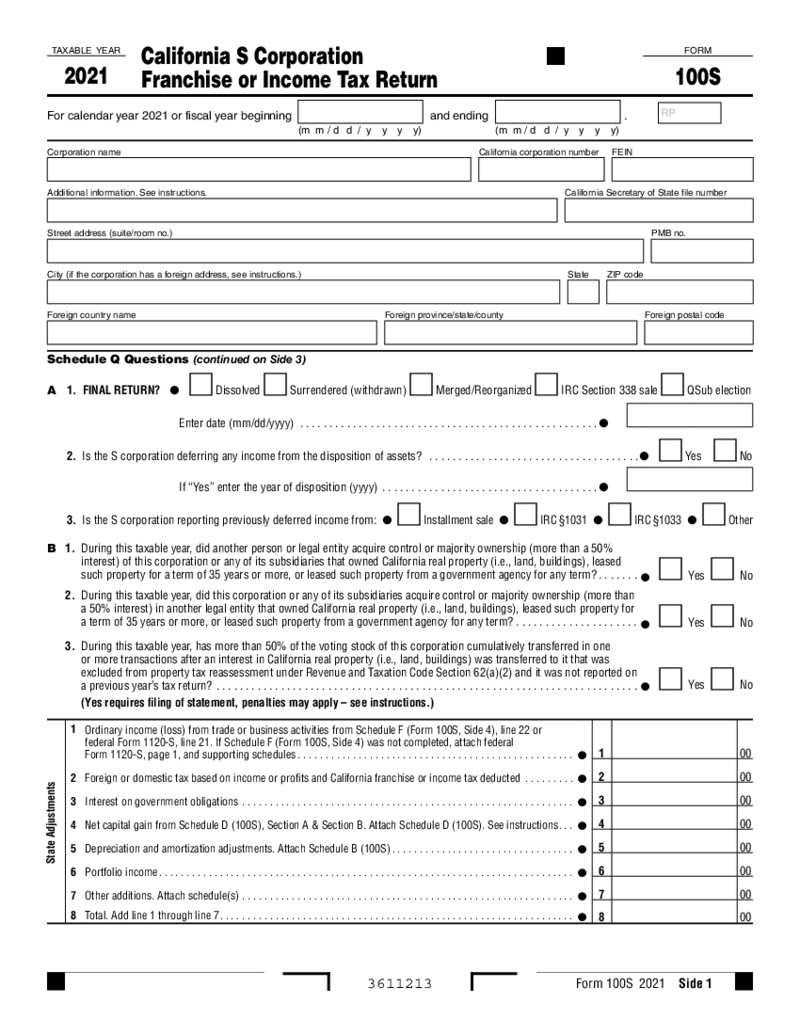

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

-

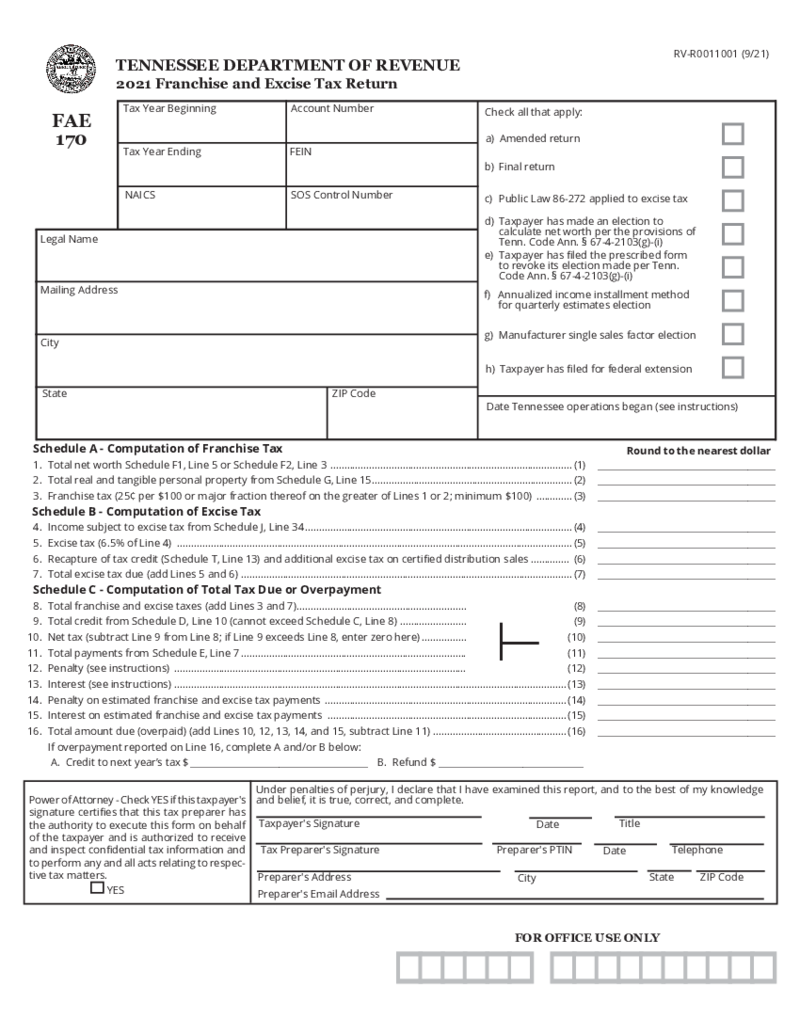

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

-

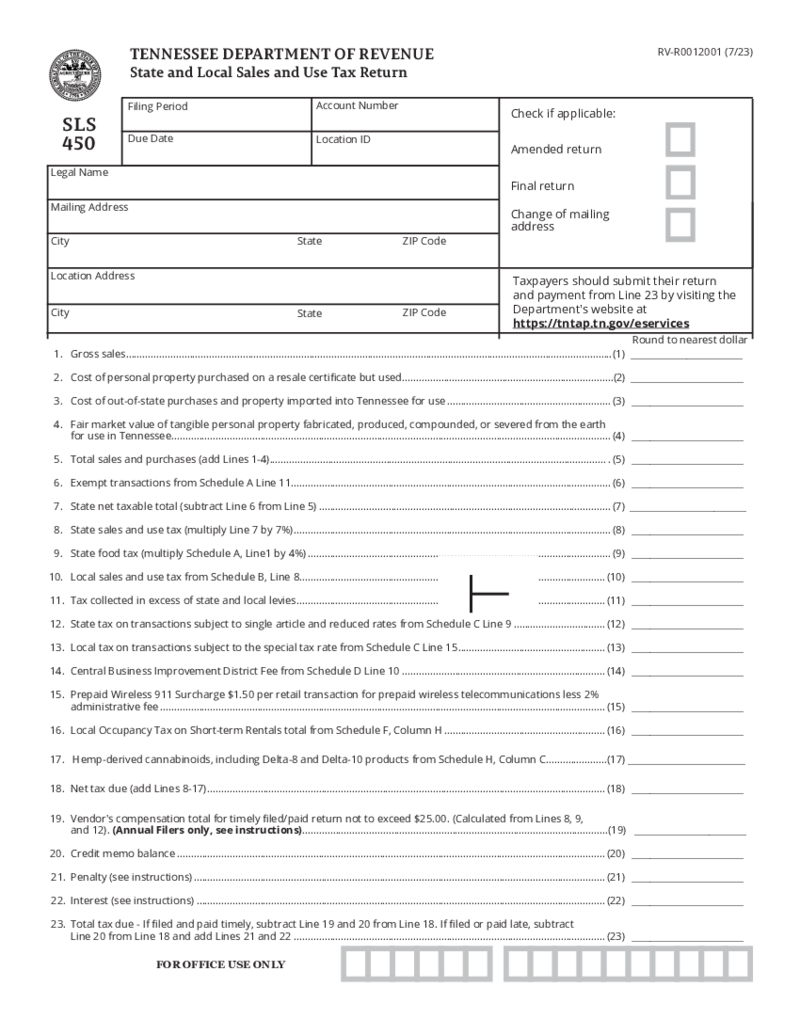

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

-

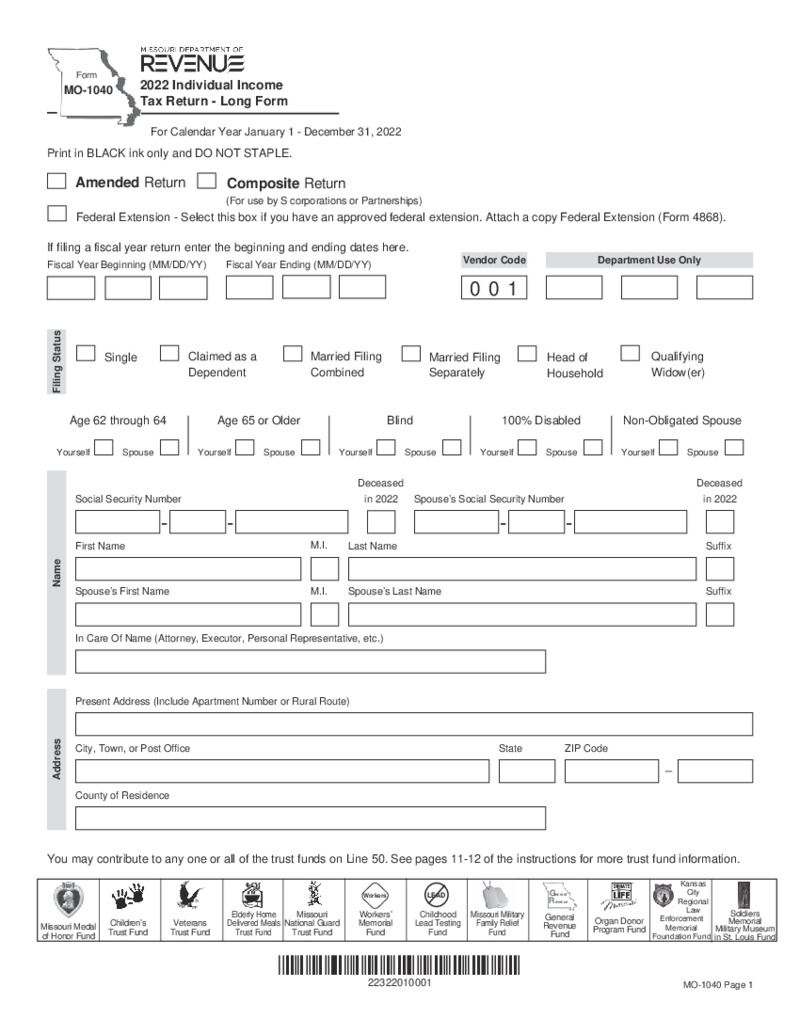

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

Form MO-1040 - Individual Income Tax Return

What Is MO 1040 Form

The MO 1040 form is the primary personal income tax form for residents of the state of Missouri. Similar to the federal 1040 form, this state-specific form is used to report income, calculate tax liability, and claim credits or deduct

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.