-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 3

-

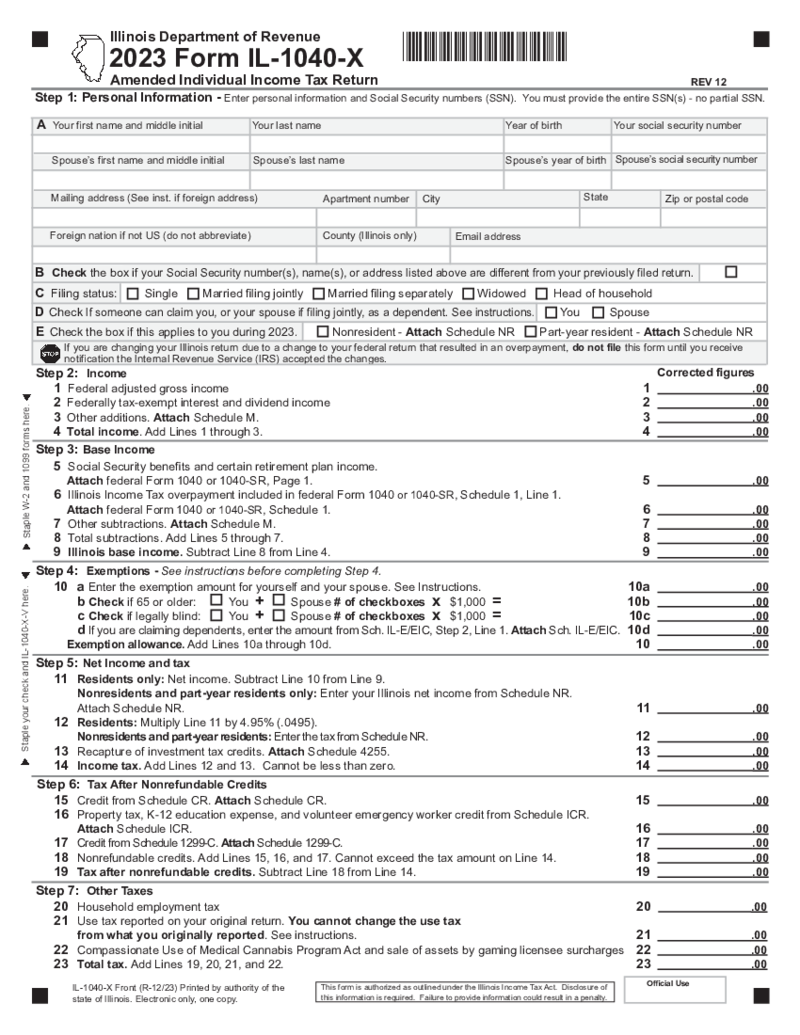

Form IL-1040-X

What Is Form IL 1040 X?

Fundamentally, form IL 1040 X is used to rectify any misinterpretations or inaccuracies made in the original tax filing process. This implies when an adjustment to your income, credit, or deduction must be made, this form springs i

Form IL-1040-X

What Is Form IL 1040 X?

Fundamentally, form IL 1040 X is used to rectify any misinterpretations or inaccuracies made in the original tax filing process. This implies when an adjustment to your income, credit, or deduction must be made, this form springs i

-

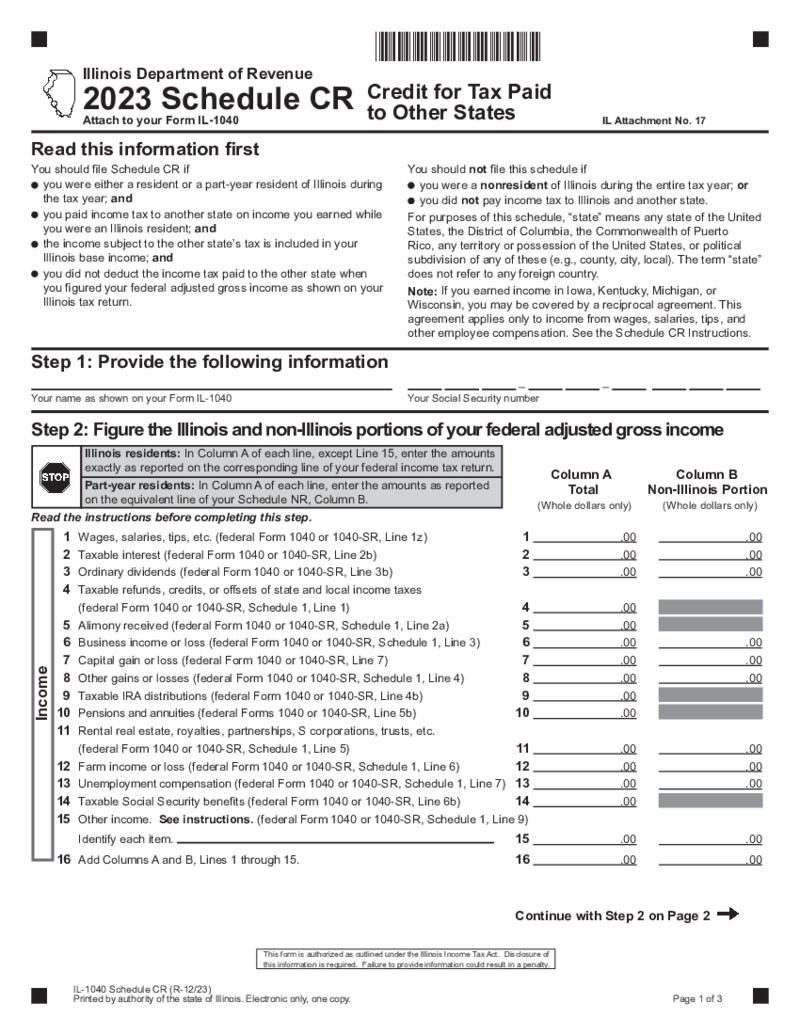

Illinois Tax Form 1040 Schedule CR

What Is Illinois Tax Form 1040 Schedule CR?

The Illinois Tax Form 1040 Schedule CR is a document designed for taxpayers in Illinois who need to claim a credit for income taxes paid to other states. This form works in conjunction with the main IL-1040 form

Illinois Tax Form 1040 Schedule CR

What Is Illinois Tax Form 1040 Schedule CR?

The Illinois Tax Form 1040 Schedule CR is a document designed for taxpayers in Illinois who need to claim a credit for income taxes paid to other states. This form works in conjunction with the main IL-1040 form

-

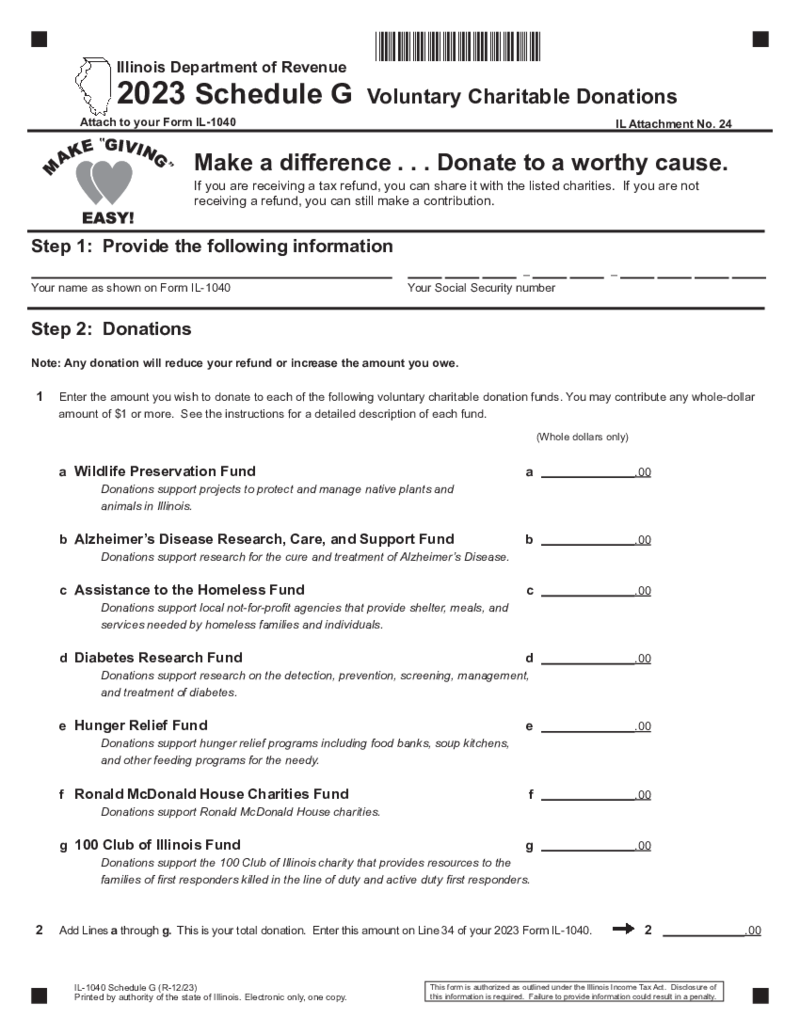

Illinois Tax Form 1040 Schedule G

Explaining Illinois Tax Form 1040 Schedule G: A Guide

Understanding tax forms can often be a daunting task. Illinois Tax Form Schedule G is one such form that may initially seem complex but serves a noble purpose. This article aims to demystify this speci

Illinois Tax Form 1040 Schedule G

Explaining Illinois Tax Form 1040 Schedule G: A Guide

Understanding tax forms can often be a daunting task. Illinois Tax Form Schedule G is one such form that may initially seem complex but serves a noble purpose. This article aims to demystify this speci

-

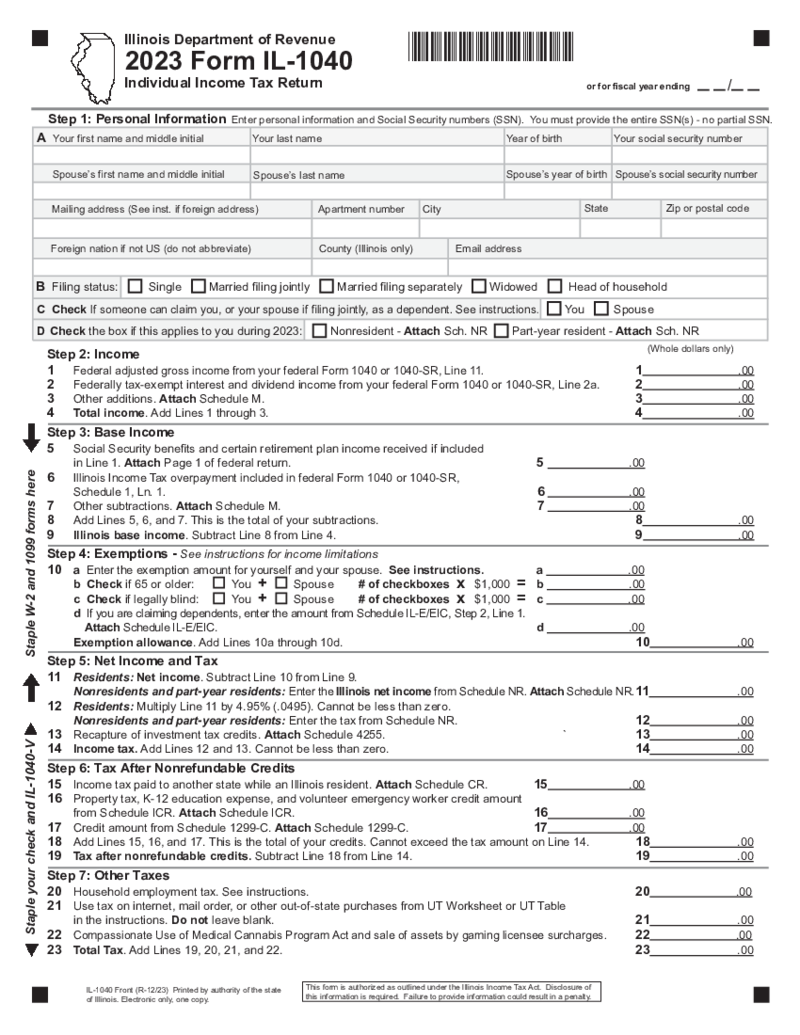

Form IL-1040

What Is a Form IL-1040?

Form IL-1040 is the general income tax return form for the state of Illinois. The form is used to report an individual's annual income and calculate their tax liability. In most cases, taxpayers will use the form to file their

Form IL-1040

What Is a Form IL-1040?

Form IL-1040 is the general income tax return form for the state of Illinois. The form is used to report an individual's annual income and calculate their tax liability. In most cases, taxpayers will use the form to file their

-

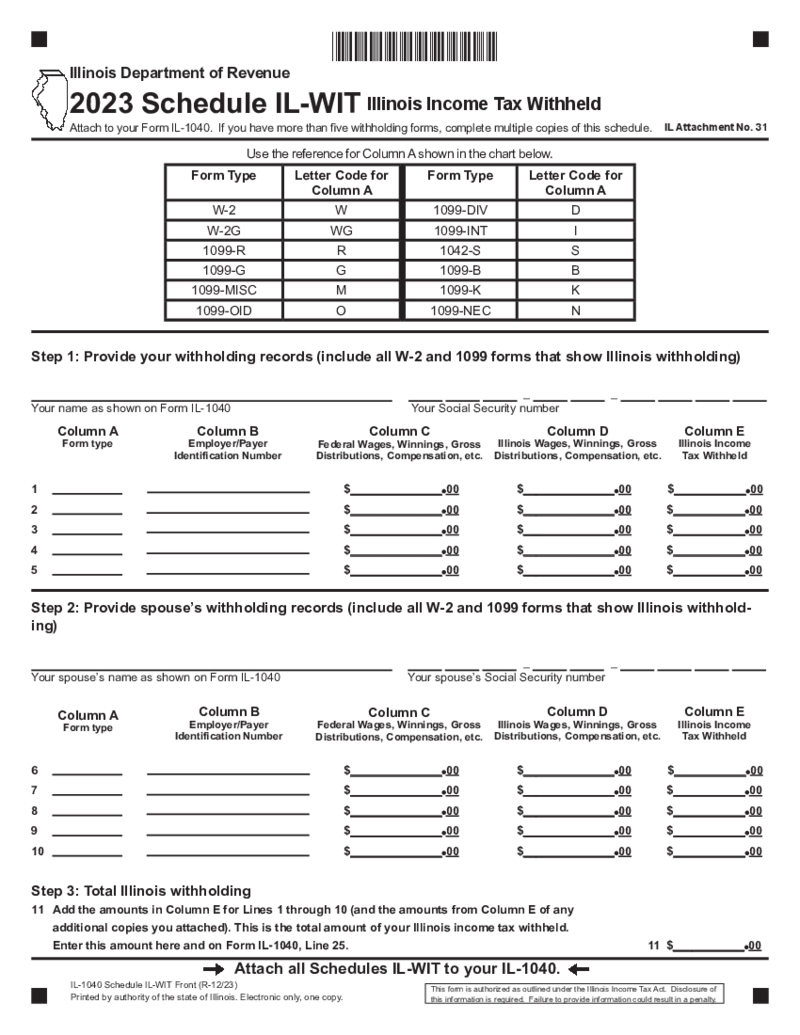

Illinois Tax Form 1040 Schedule IL-WIT

What Is Schedule IL-WIT Form?

Schedule IL-WIT is the Illinois Withholding Income Schedule. If any Illinois income tax has been withheld from you throughout the year, then you must complete and submit the form. This includes income tax withheld from salari

Illinois Tax Form 1040 Schedule IL-WIT

What Is Schedule IL-WIT Form?

Schedule IL-WIT is the Illinois Withholding Income Schedule. If any Illinois income tax has been withheld from you throughout the year, then you must complete and submit the form. This includes income tax withheld from salari

-

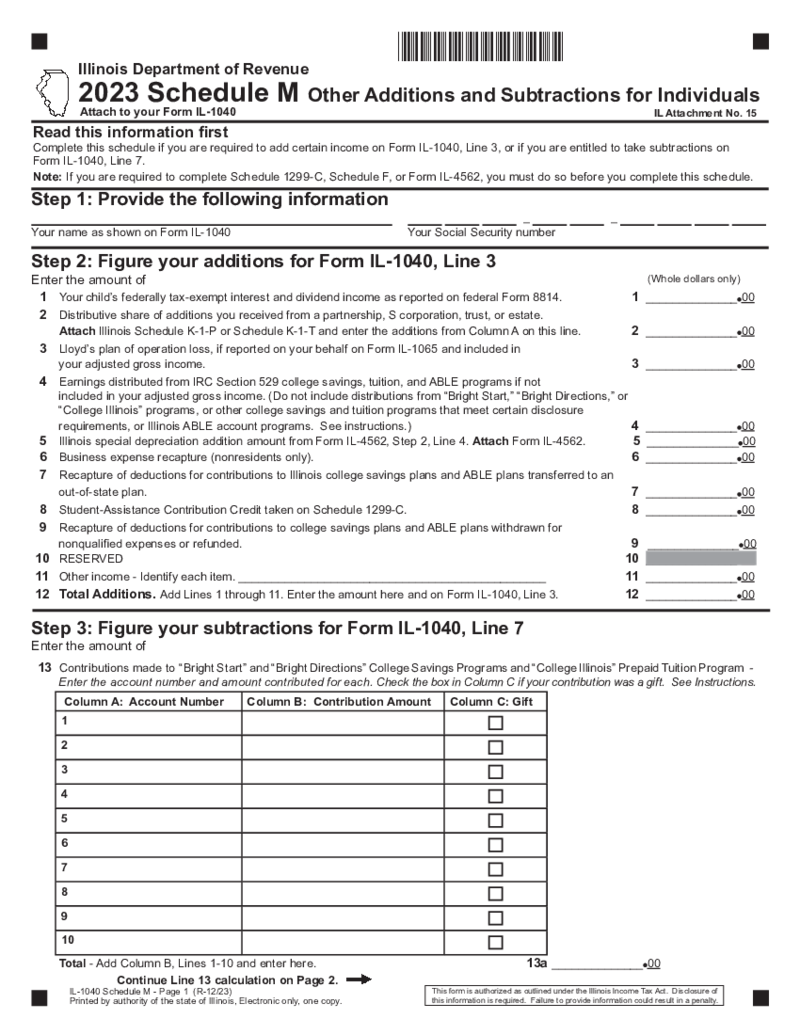

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

-

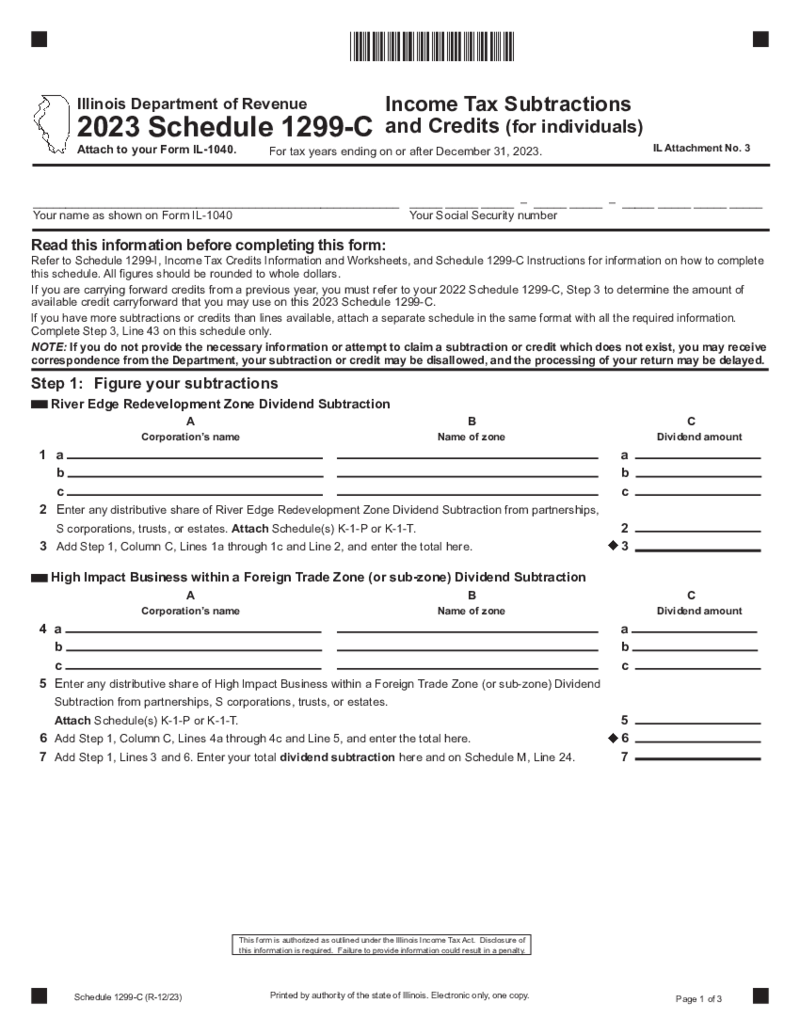

Illinois Tax Form Schedule 1299-C

What Is the Illinois Form 1299 C?

Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income cred

Illinois Tax Form Schedule 1299-C

What Is the Illinois Form 1299 C?

Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income cred

-

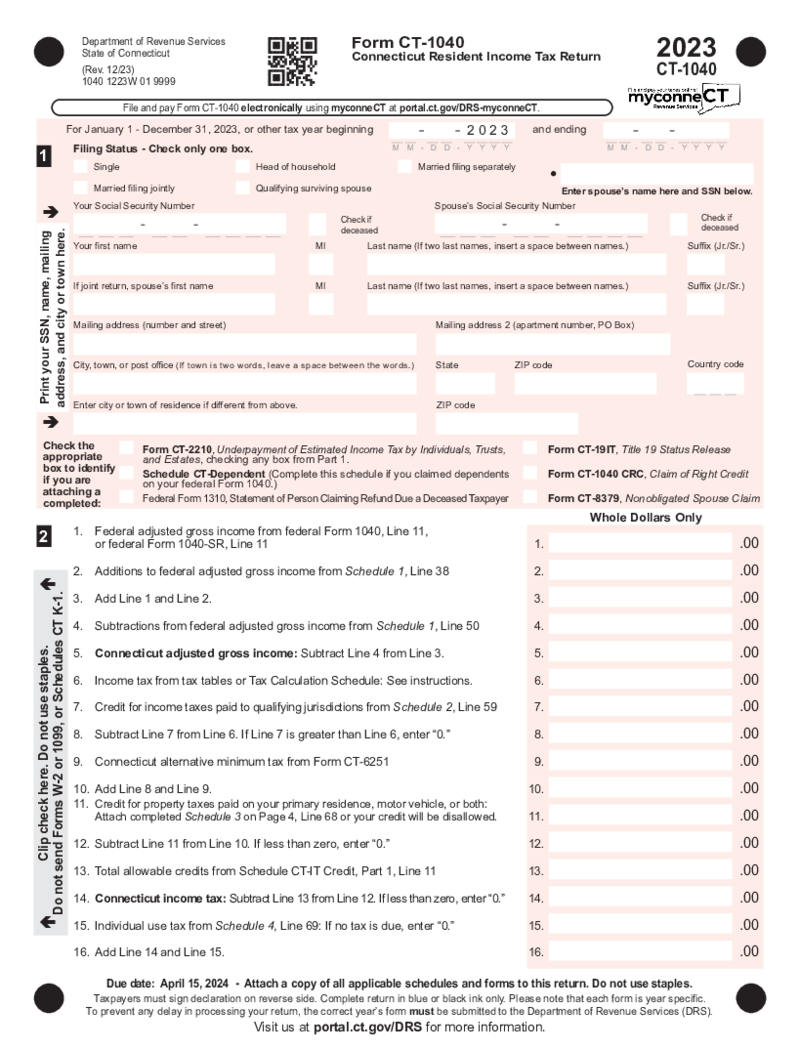

Connecticut Resident Income Tax Return - Form CT-1040

Understanding Form CT-1040

Connecticut form 1040 is the primary income tax return form used by Connecticut residents to report their annual income, claim deductions, calculate their tax liability, or request a refund. This document is specifically for ind

Connecticut Resident Income Tax Return - Form CT-1040

Understanding Form CT-1040

Connecticut form 1040 is the primary income tax return form used by Connecticut residents to report their annual income, claim deductions, calculate their tax liability, or request a refund. This document is specifically for ind

-

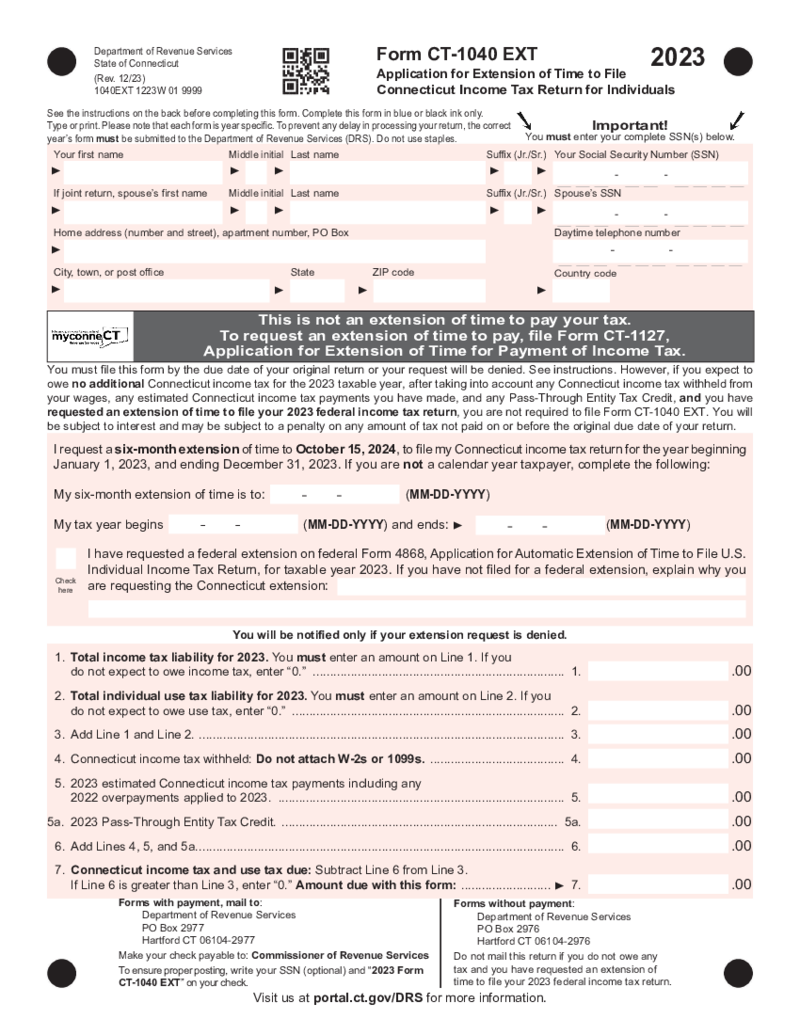

Connecticut Form CT-1040 EXT

Understanding CT Form 1040 EXT

Navigating tax documents can be challenging, and Connecticut Form CT-1040 EXT is no exception. This form serves as an application for Connecticut residents who need an extension of time to file their state income tax return.

Connecticut Form CT-1040 EXT

Understanding CT Form 1040 EXT

Navigating tax documents can be challenging, and Connecticut Form CT-1040 EXT is no exception. This form serves as an application for Connecticut residents who need an extension of time to file their state income tax return.

-

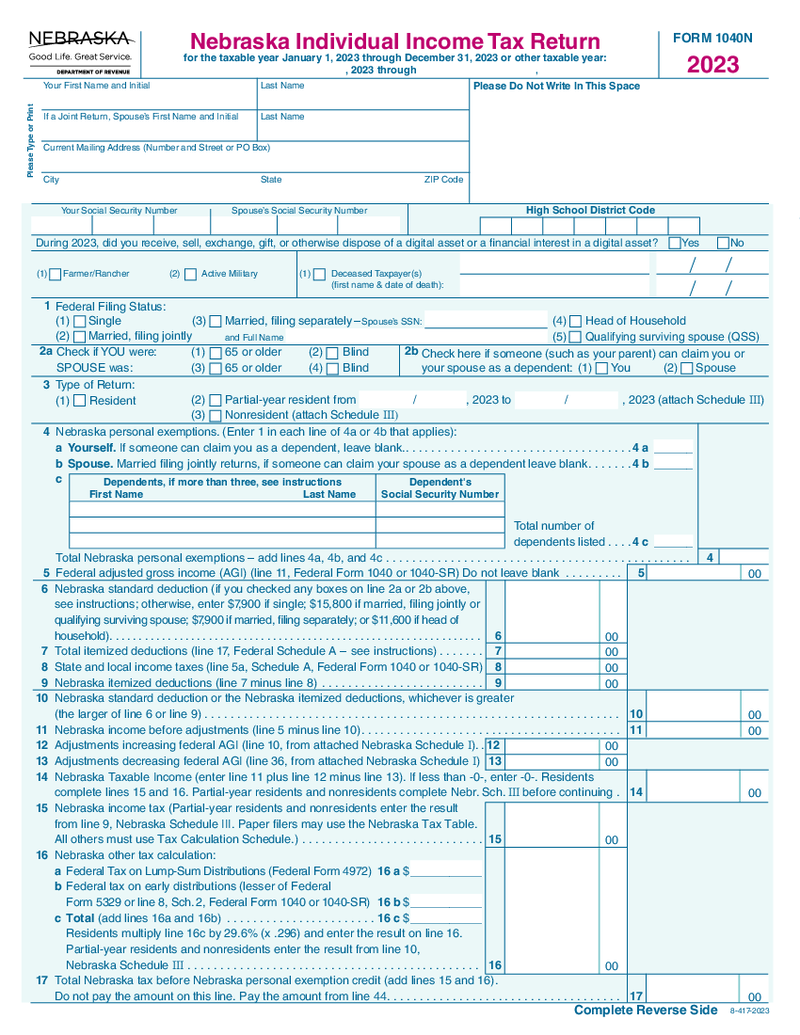

Nebraska Individual Income Tax Return - Form 1040N

What is a 1040N Form

Simply put, the Nebraska individual income tax return Form 1040N is the form you'll use to file your state income tax if you're a resident, part-year resident, or non-resident who has earned income in Nebraska. It's the st

Nebraska Individual Income Tax Return - Form 1040N

What is a 1040N Form

Simply put, the Nebraska individual income tax return Form 1040N is the form you'll use to file your state income tax if you're a resident, part-year resident, or non-resident who has earned income in Nebraska. It's the st

-

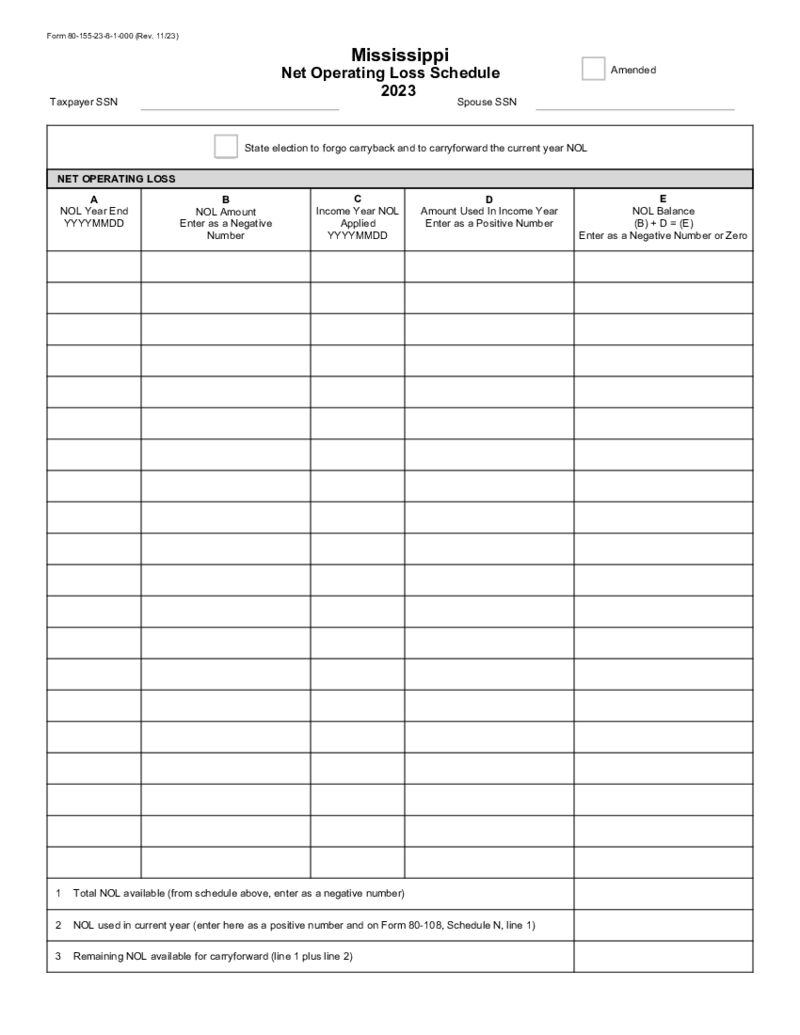

Mississippi Form 80-155 - Net Operating Loss Schedule

What Is Form 80 155

Form 80 155, known as the Mississippi Net Operating Loss Schedule, is a tax document used by taxpayers in Mississippi. This form allows individuals and businesses to calculate and report a net operating loss (NOL) for

Mississippi Form 80-155 - Net Operating Loss Schedule

What Is Form 80 155

Form 80 155, known as the Mississippi Net Operating Loss Schedule, is a tax document used by taxpayers in Mississippi. This form allows individuals and businesses to calculate and report a net operating loss (NOL) for

-

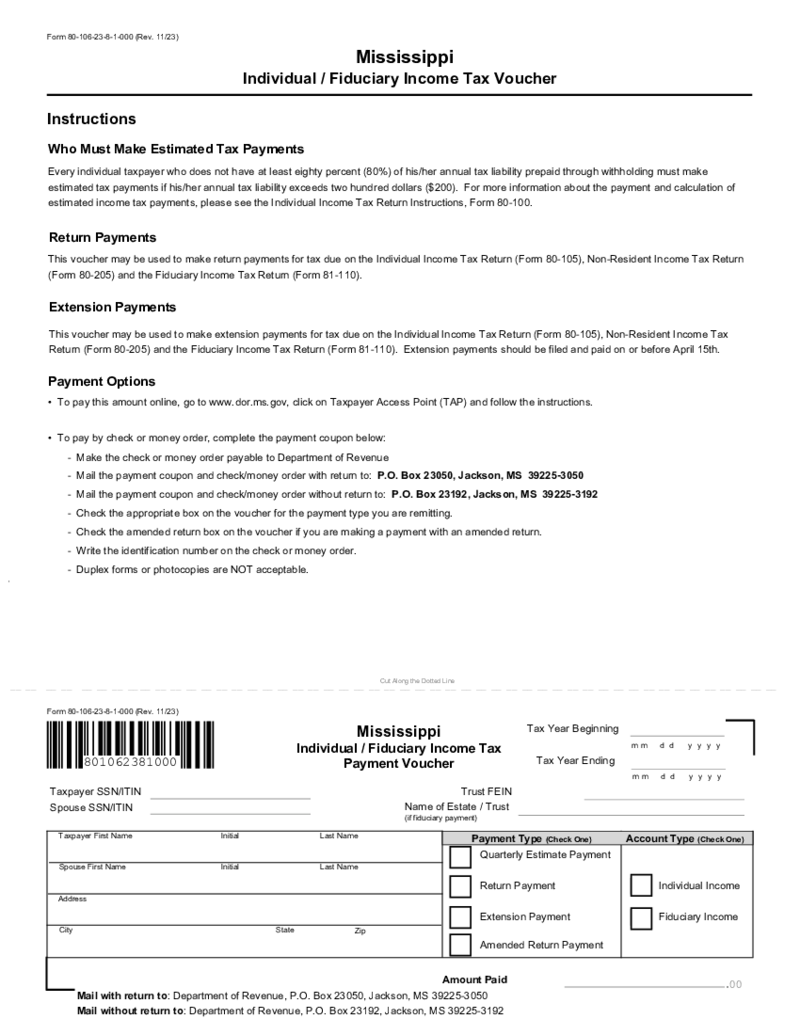

Mississippi Form 80-106 Individual-Fiduciary Income Tax Voucher

What Is A Ms Form 80 106

The Mississippi form 80-106 is an Individual-Fiduciary Income Tax Voucher designed to facilitate income tax payments. This form serves as a remittance document for taxpayers who need to make payments for tax due o

Mississippi Form 80-106 Individual-Fiduciary Income Tax Voucher

What Is A Ms Form 80 106

The Mississippi form 80-106 is an Individual-Fiduciary Income Tax Voucher designed to facilitate income tax payments. This form serves as a remittance document for taxpayers who need to make payments for tax due o

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.