-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 4

-

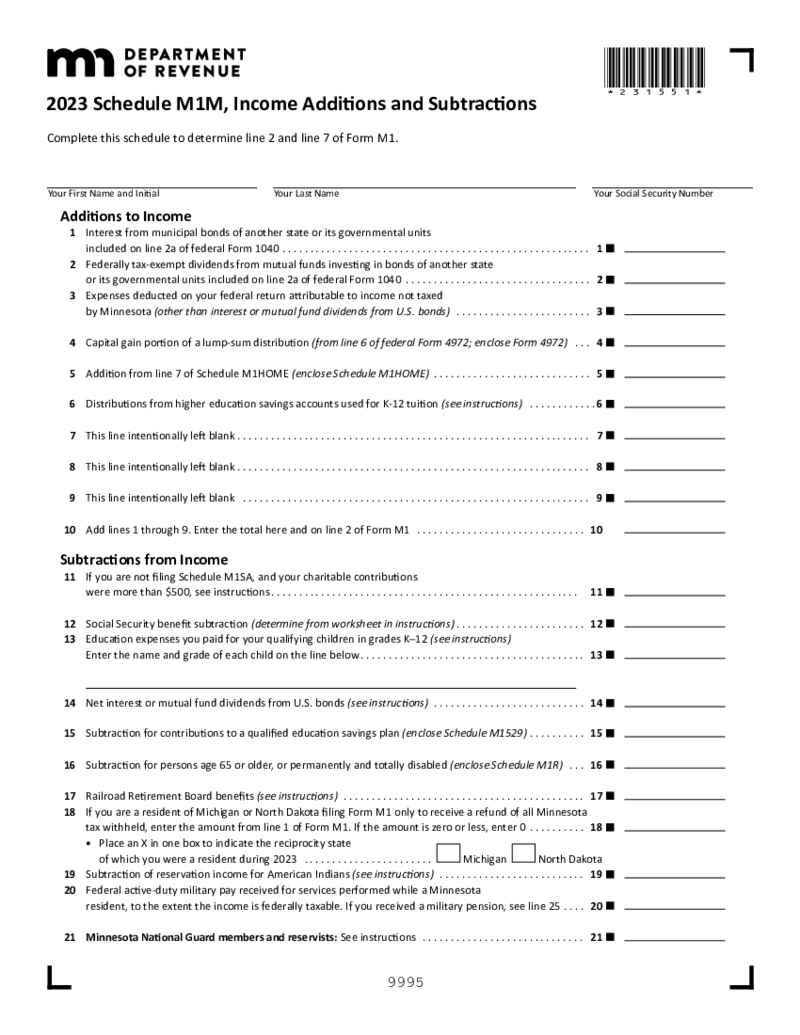

Minnesota Schedule M1M

What is Schedule M1M

Minnesota Schedule M1M is a supplemental schedule for the Form M1 individual income tax return. Taxpayers who need to report income additions, subtractions, or adjustments to their federal adjusted gross income must complete and attac

Minnesota Schedule M1M

What is Schedule M1M

Minnesota Schedule M1M is a supplemental schedule for the Form M1 individual income tax return. Taxpayers who need to report income additions, subtractions, or adjustments to their federal adjusted gross income must complete and attac

-

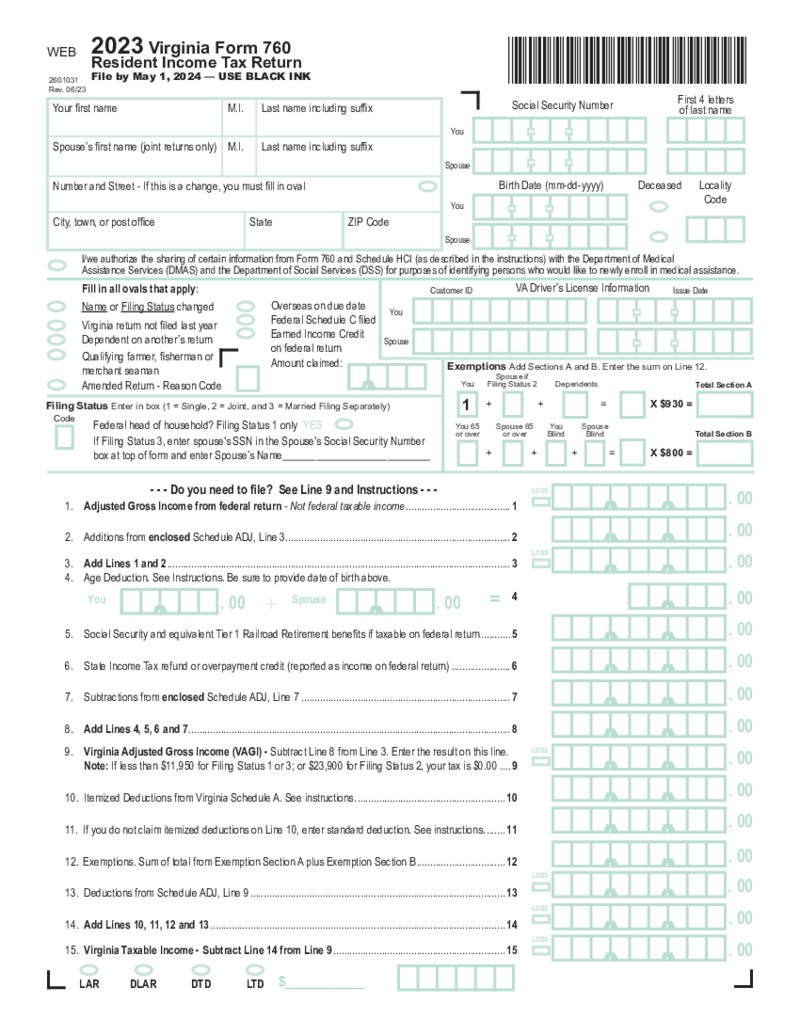

Virginia Form 760

What Is Virginia Tax Form 760?

Virginia Form 760, also known as Individual Income Tax Return is used to review and confirm the person’s tax ret

Virginia Form 760

What Is Virginia Tax Form 760?

Virginia Form 760, also known as Individual Income Tax Return is used to review and confirm the person’s tax ret

-

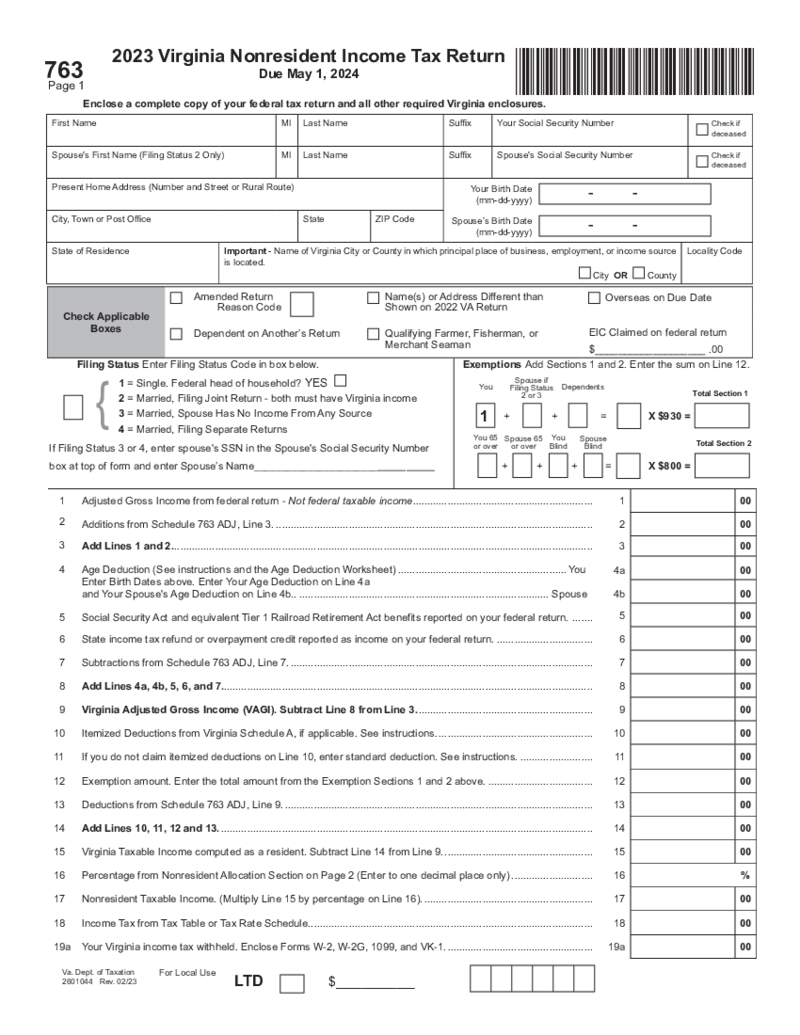

Virginia Schedule OSC

What is Virginia Schedule OSC form?

Virginia Schedule OSC is a supplemental schedule that should be attached to Virginia Tax Form 760. It is used for the residents of Virginia working in other states to claim a credit for taxes paid to those states. This

Virginia Schedule OSC

What is Virginia Schedule OSC form?

Virginia Schedule OSC is a supplemental schedule that should be attached to Virginia Tax Form 760. It is used for the residents of Virginia working in other states to claim a credit for taxes paid to those states. This

-

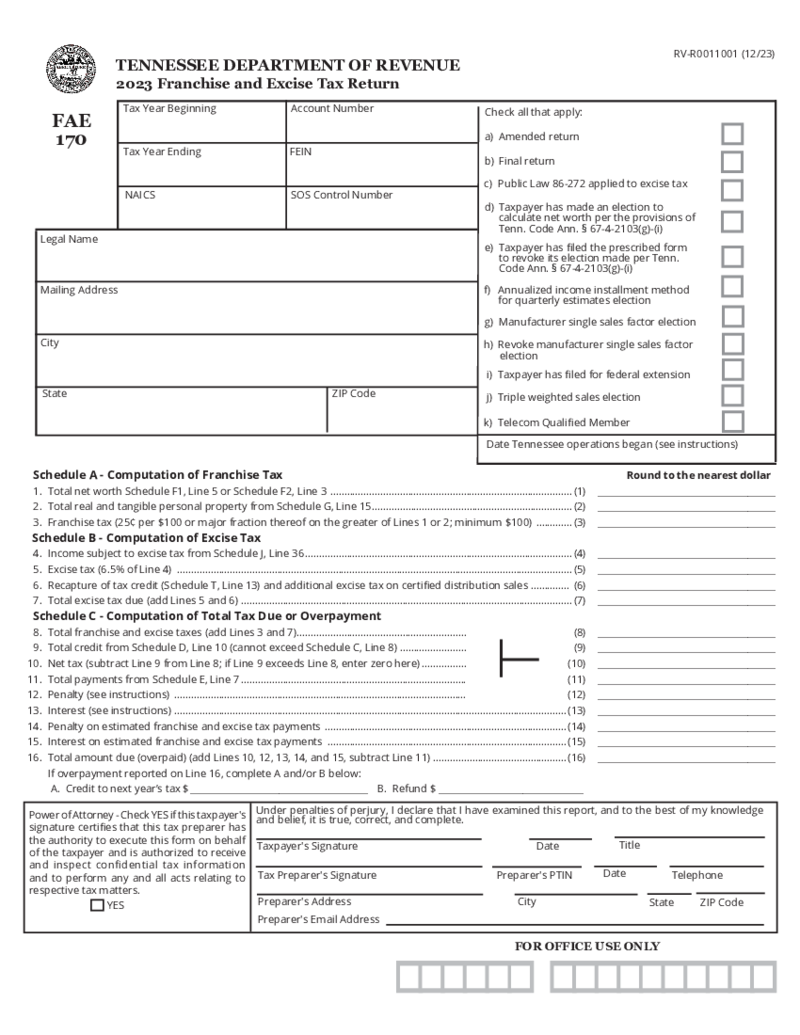

Tennessee Form FAE 170 Franchise and Excise Tax Return

What Is Form FAE170 2023

Form FAE170 is the designated document businesses in Tennessee utilize to report and remit their franchise and excise tax obligations. This form plays a crucial role in the financial and regulatory landscape of the state. For any

Tennessee Form FAE 170 Franchise and Excise Tax Return

What Is Form FAE170 2023

Form FAE170 is the designated document businesses in Tennessee utilize to report and remit their franchise and excise tax obligations. This form plays a crucial role in the financial and regulatory landscape of the state. For any

-

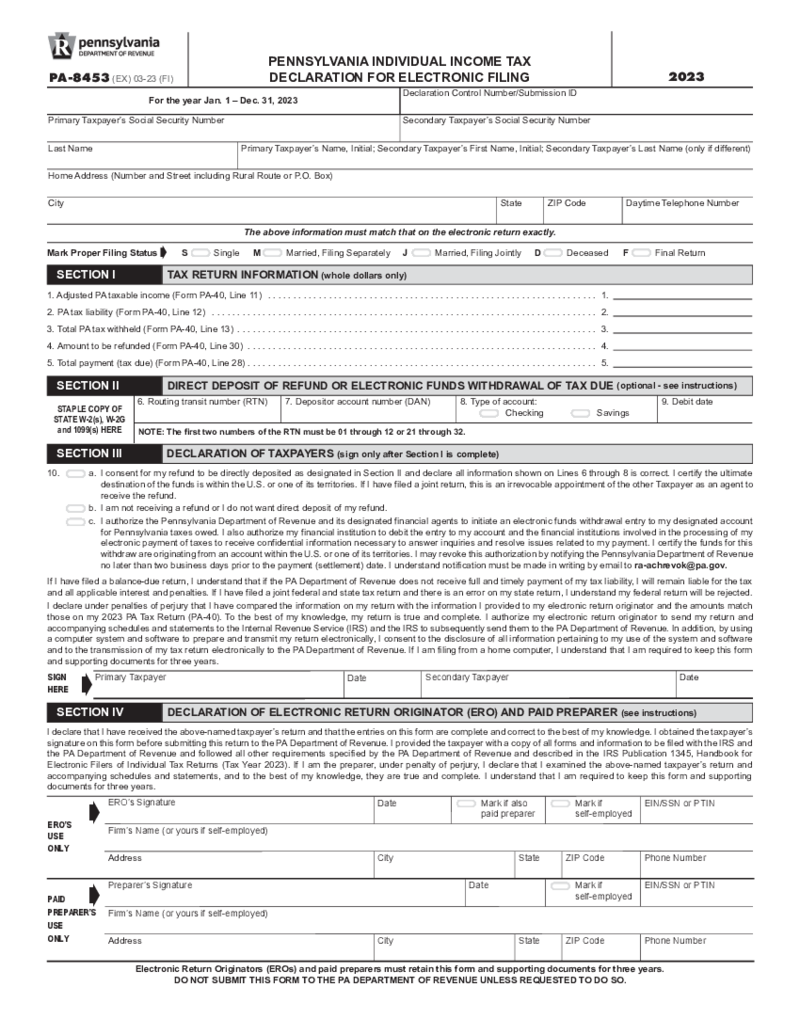

Pennsylvania Form PA-8453

What is the PA-8453 Form?

The fillable PA-8453 form is made for the declaration of individual tax income from Pennsylvania citizens via electronic fi

Pennsylvania Form PA-8453

What is the PA-8453 Form?

The fillable PA-8453 form is made for the declaration of individual tax income from Pennsylvania citizens via electronic fi

-

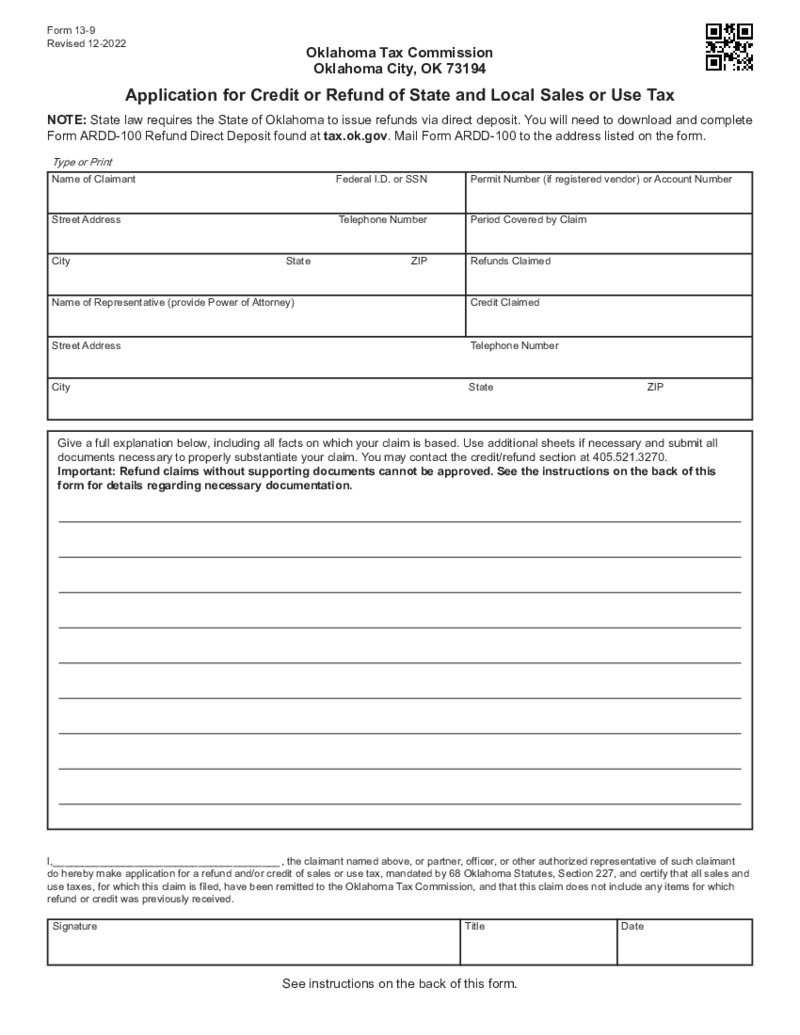

Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax

What Is Form 13 9?

Oklahoma Form 13-9 is a state-specific document utilized by taxpayers to request refunds or credits for overpaid sales or use taxes. These overpayments can occur for various reasons, such as erroneous computations, canceled transactions

Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax

What Is Form 13 9?

Oklahoma Form 13-9 is a state-specific document utilized by taxpayers to request refunds or credits for overpaid sales or use taxes. These overpayments can occur for various reasons, such as erroneous computations, canceled transactions

-

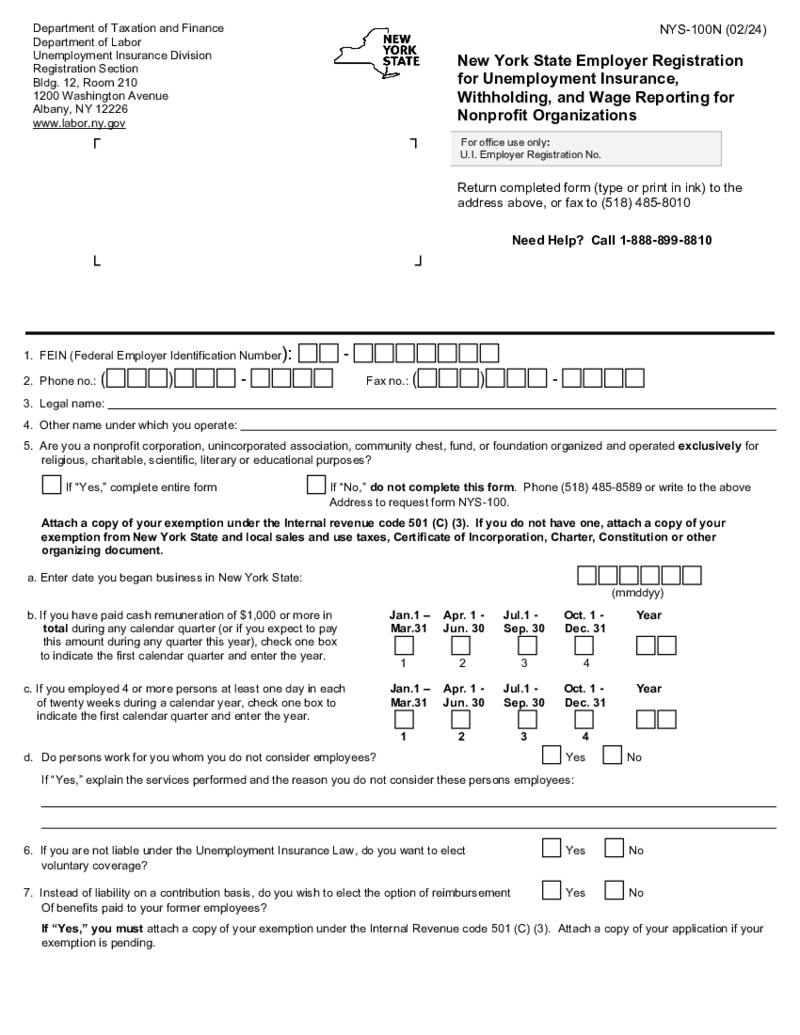

New York Form NYS-100N

What Is NYS 100N Form

The NYS 100N form, officially titled "New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations," is a mandatory document for nonprofit org

New York Form NYS-100N

What Is NYS 100N Form

The NYS 100N form, officially titled "New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations," is a mandatory document for nonprofit org

-

Form IT-1099-R

Overview: Tax Form It 1099 R

Form IT-1099-R is a tax document that reports distributions from retirement accounts, such as individual retirement accounts (IRAs) and pensions. This form is used to report distributions made during the tax year and is sent t

Form IT-1099-R

Overview: Tax Form It 1099 R

Form IT-1099-R is a tax document that reports distributions from retirement accounts, such as individual retirement accounts (IRAs) and pensions. This form is used to report distributions made during the tax year and is sent t

-

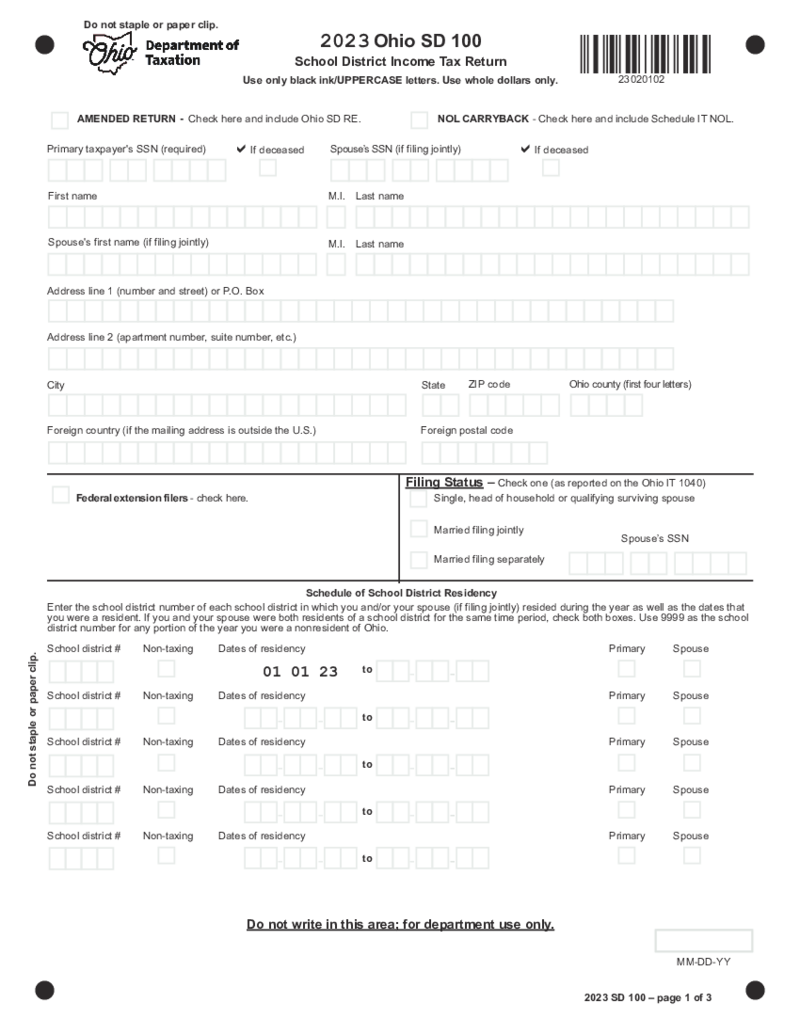

Ohio Form SD100

What Is the Ohio SD100 Form?

The Ohio form SD100 is used by residents to report their school district income tax return. The tax collected from this form is allocated directly to the individual's corresponding school district, significantly contributi

Ohio Form SD100

What Is the Ohio SD100 Form?

The Ohio form SD100 is used by residents to report their school district income tax return. The tax collected from this form is allocated directly to the individual's corresponding school district, significantly contributi

-

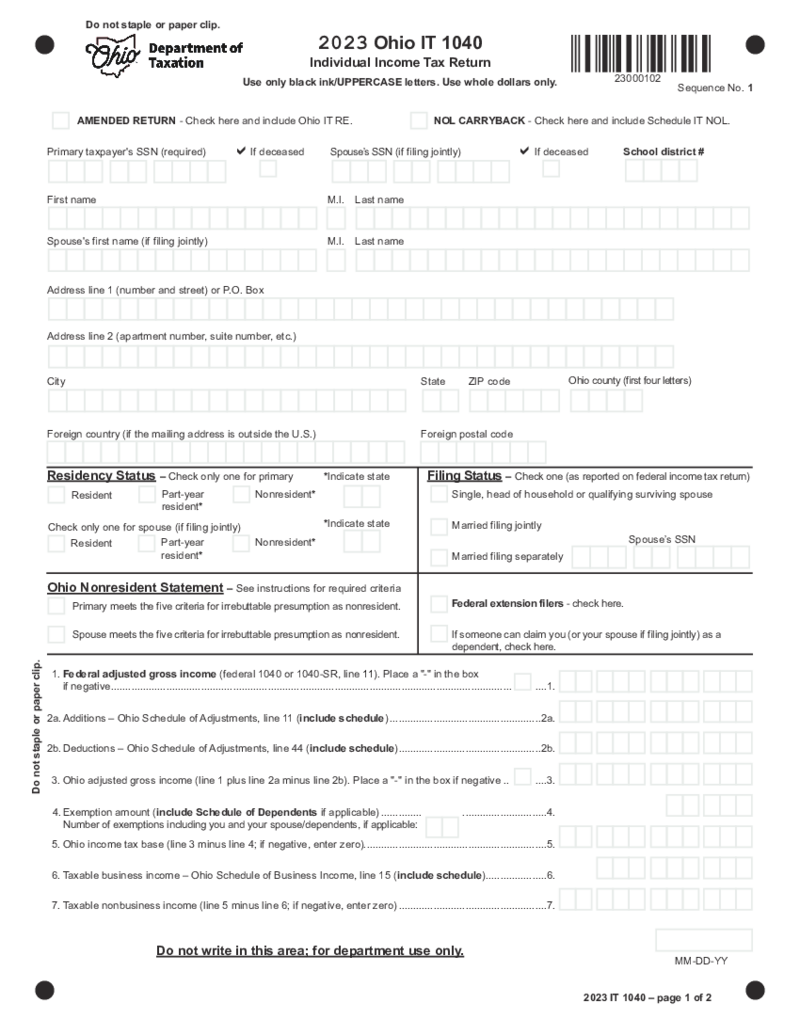

Ohio Form IT 1040

Ohio Form IT 1040: Overview

Ohio Tax Form IT 1040 is the individual income tax return form used by residents of Ohio to report their annual income to the Ohio Department of Taxation. This form is used for both full-year and part-year residents to calculat

Ohio Form IT 1040

Ohio Form IT 1040: Overview

Ohio Tax Form IT 1040 is the individual income tax return form used by residents of Ohio to report their annual income to the Ohio Department of Taxation. This form is used for both full-year and part-year residents to calculat

-

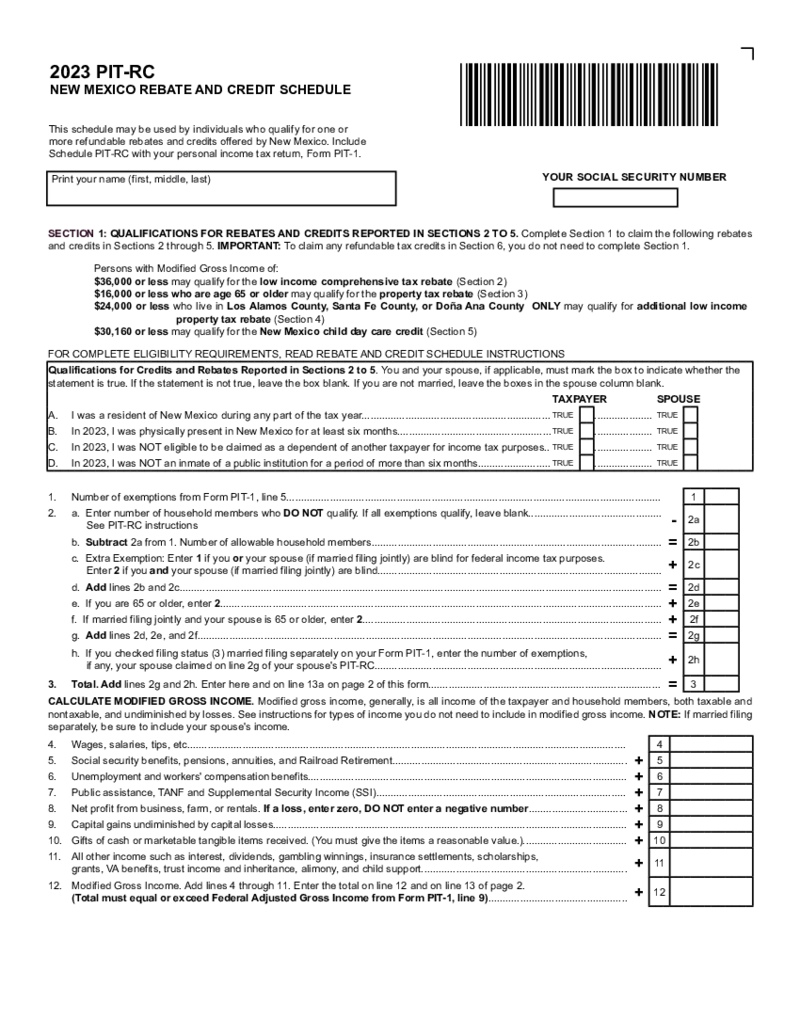

PIT-RC - New Mexico Rebate And Credit Schedule

What Is the New Mexico PIT RC Form?

The PIT-RC form, or New Mexico Rebate and Credit Schedule, is a supplemental document used by taxpayers in New Mexico to claim available rebates and credits. These rebates might be related to your income, location, or o

PIT-RC - New Mexico Rebate And Credit Schedule

What Is the New Mexico PIT RC Form?

The PIT-RC form, or New Mexico Rebate and Credit Schedule, is a supplemental document used by taxpayers in New Mexico to claim available rebates and credits. These rebates might be related to your income, location, or o

-

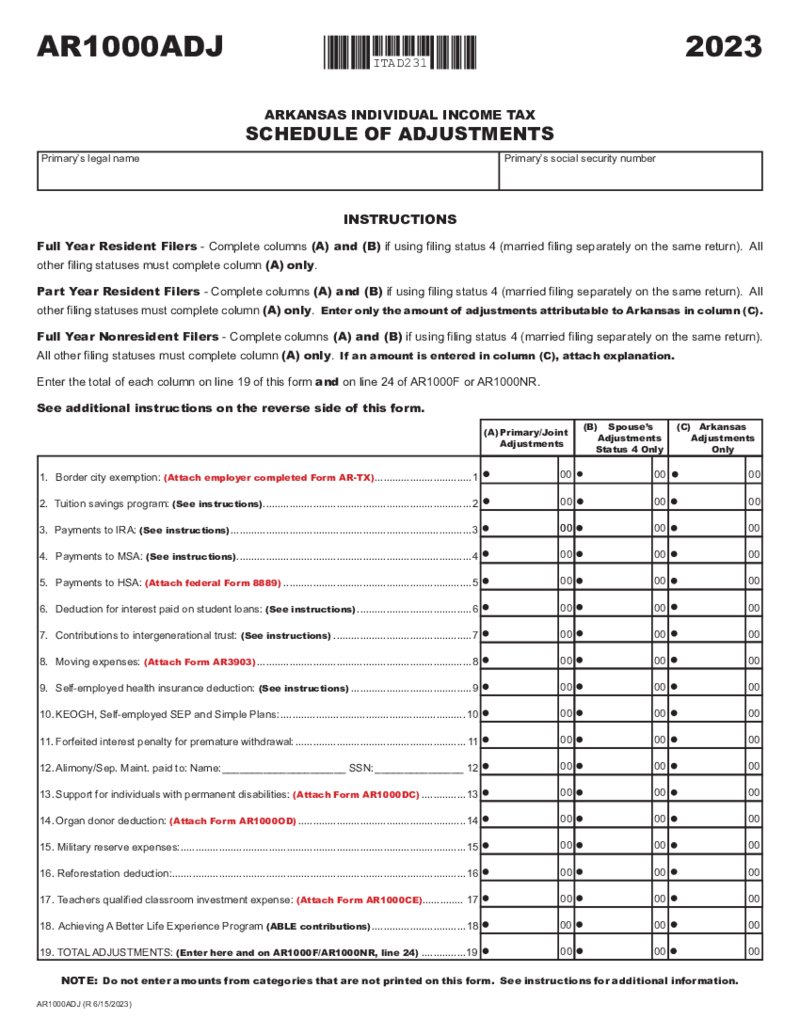

Arkansas Tax Form AR1000ADJ

What Is Arkansas Tax Form AR1000ADJ?

The AR1000ADJ is an income adjustment schedule for Arkansas residents. This form allows taxpayers to make specific adjustments to their gross income, which can affect their taxable income and, ultimately, their tax lia

Arkansas Tax Form AR1000ADJ

What Is Arkansas Tax Form AR1000ADJ?

The AR1000ADJ is an income adjustment schedule for Arkansas residents. This form allows taxpayers to make specific adjustments to their gross income, which can affect their taxable income and, ultimately, their tax lia

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.