-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

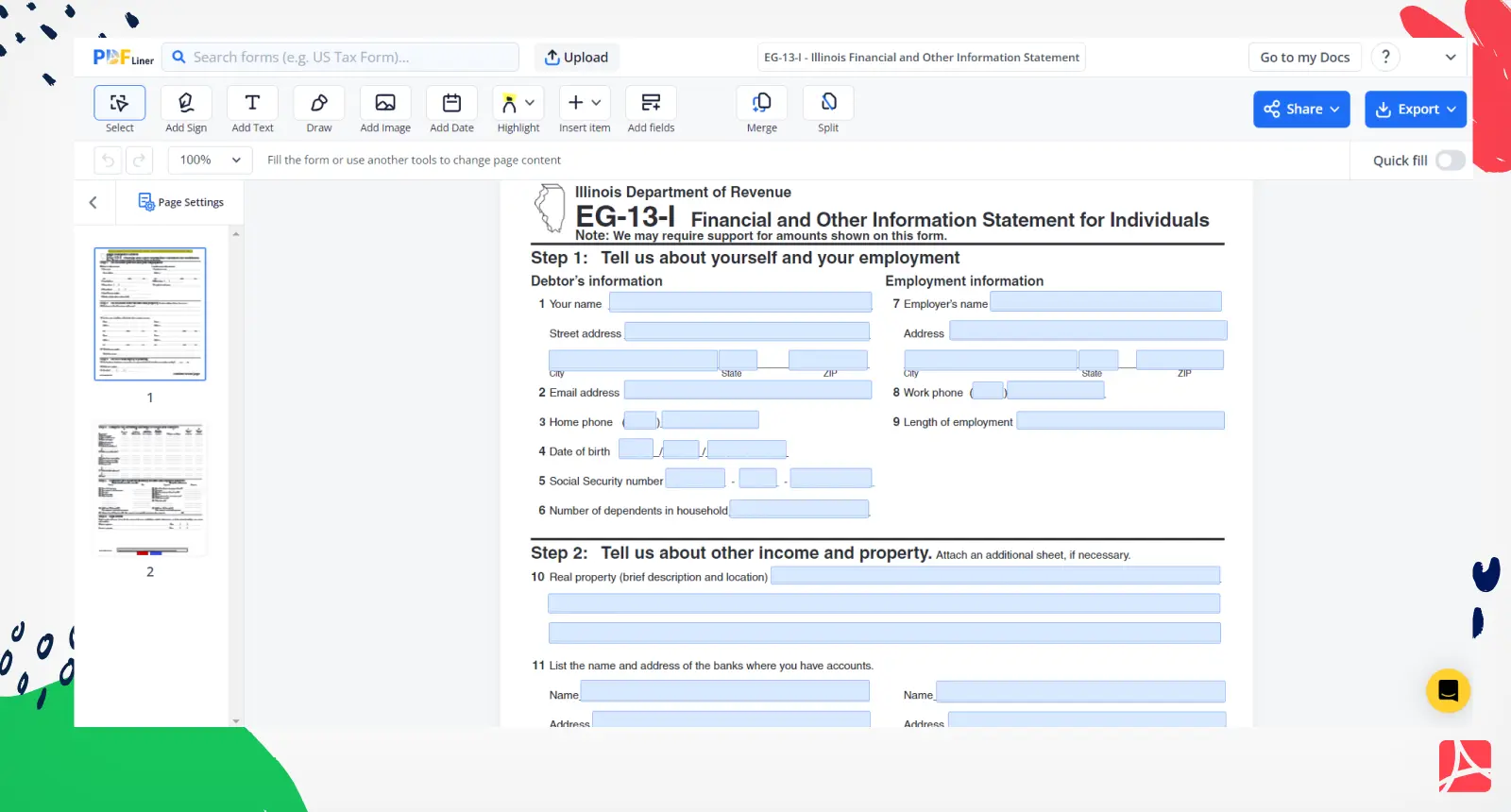

EG-13-I - Illinois Financial and Other Information Statement

Get your EG-13-I - Illinois Financial and Other Information Statement in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Illinois Form EG 13 I Detailed Explanation

The EG-13-I form, specifically designated for Illinois state residents, plays a significant role in financial proceedings. The Illinois Department of Revenue Form EG-13-I efficiently collects a multiplicity of information dealing with financial matters from taxpayers, which helps officials understand the taxpayer's financial circumstances and make informed decisions regarding payments and taxes.

Purpose of Illinois form EG-13-I

To understand why this form is important, it's crucial to know its primary purpose. The Illinois department of revenue form EG-13-I is used by taxpayers to declare their financial and other relevant information. This data helps the department assess the taxpayer's ability to pay or settle existing debt.

Structuring the EG 13 I form

The Illinois EG-13-I form is divided into several sections, each designed to collect detailed information about different aspects of the user's financial situation.

- Individual Information: requires basic information such as your name, address, social security number, etc.

- Employment Information: note your employment details, including your designation, employer, address, and wage details.

- Spousal Information: you need to provide your spouse's information in this section.

- Dependent Information: you are required to provide details of any dependents.

- Financial Information: requires details regarding your financial status, including income, expenses, and any outstanding debts.

How to Fill Out the Form EG 13 I

Anyone can master the Illinois Department of Revenue form EG 13 I filling process with a little guidance and patience. Here are some general steps to guide you:

- Begin by filling out your personal details in the "Debtor's Information" section. This includes your name, street address, city, state, zip code, email address, home phone, date of birth, social security number, and the number of dependents in your household.

- Proceed to the "Employment Information" section. Input your Employer’s name, address, city, state, zip code, work phone number, and the duration of your employment so far.

- In the "Real Property" section, provide a brief description and location of any real estate you own. This should include property types, appraisal values, and amounts of any unpaid mortgages or liens.

- For the next section, include details of all your bank accounts - both current and savings accounts. Input the name of each bank, its address, city, state, and zip code.

- In the section related to vehicle information, enter your vehicle license number and provide a brief description of the vehicle.

- Explain if there are any foreclosures, bankruptcy, receivership, or assignment for the benefit of creditors proceedings pending against you. If yes, provide your bankruptcy number and the date it was filed.

- In the following section, detail all of your assets and liabilities. This might include savings, investments, real estate, credit card balances, loans, etc. It must be as accurate as possible as it will be used to assess your financial position.

- Following this, you'll need to complete the "Monthly income and expense analysis" section. This includes detailing your monthly income and expenditure. Be sure to include all possible income channels and expenses.

- Once all sections of the form are completed, sign the document electronically in the "Debtor's Signature" field and enter the current date.

- If applicable, have your spouse sign and date the form in the "Spouse's Signature" section.

- Ensure all the information provided is true and correct, then submit the form as per the instructions.

Remember that providing false information could be considered perjury, which is a serious offense.

Who needs to fill out the state of Illinois form EG 13 I?

The form EG 13 I is typically required to be filled out by Illinois state residents who have an outstanding tax liability or balance with the Illinois Department of Revenue. Particularly, if the taxpayer is requesting for the department to consider settling their outstanding tax debt for less than what is owed or looking for a payment plan, this form becomes necessary.

This document provides detailed insights into the individual's financial health and their ability to pay their taxes, therefore enabling the Illinois Department of Revenue to make informed decisions about tax assessments, payments, or debt settlements.

Fillable online EG-13-I - Illinois Financial and Other Information Statement