-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form NYS-45-X

Get your New York Form NYS-45-X in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is New York Form NYS 45 X

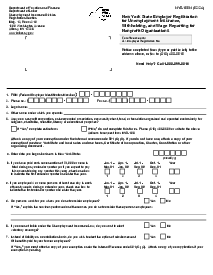

New York Form NYS 45 X, also known as the Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves as a mechanism for employers in New York State to correct previously submitted information regarding withholding taxes, wage reporting, and unemployment insurance. It's essential for maintaining accurate tax records and ensuring compliance with state tax regulations.

When to Use New York Form NYS 45 X

Under various circumstances, employers should use form NYS 45 X to adjust prior filings. Here are the key situations where an amendment would be necessary:

- Correcting wages reported for unemployment insurance contributions.

- Adjusting the amount of state, New York City, or Yonkers tax withheld.

- Reporting any discrepancies in the number of employees and corresponding wages.

- Ensuring the total contributions for unemployment insurance are accurate.

- After error reporting withholding tax payments on previous NYS-45 or NYS-45-X forms.

- Adjusting any overpayment or underpayment identified after filing the original return.

Employers should proactively file an amended return when an error is discovered to avoid potential penalties or interest due to incorrect reporting.

How To Fill Out New York Form NYS 45 X

- Enter your UI Employer registration number and Withholding identification number at the top of the form.

- Write the legal name of the employer in the designated space.

- Part A – Unemployment Insurance (UI) Information:

- Mark an "X" in the box if you are a seasonal employer.

- Indicate the quarter you are amending by marking the corresponding box (1 for Jan 1 - Mar 31, 2 for Apr 1 - Jun 30, 3 for Jul 1 - Sep 30, and 4 for Oct 1 - Dec 31) and enter the year.

- Write the previously reported total remuneration and the corrected total remuneration. Calculate the difference and enter it in the 'Difference' column.

- For remuneration paid more than the UI wage base since January 1, write the previously reported, corrected amounts and differences.

- Calculate wages subject to contribution by subtracting line 2 from line 1 and writing in the corresponding column.

- Enter your total UI rate as instructed.

- Calculate the UI contributions, overpayment to be applied, and any additional unemployment insurance amount due.

- Part B – Withholding Tax (WT) Information:

- Enter the previously reported New York State, New York City, and Yonkers taxes withheld. Write the corrected amounts and calculate any difference.

- If applicable, include the amount from your previous quarter's form NYS-45 indicating it was on line 20b.

- Write the form NYS-1 payments made for the quarter you are amending.

- Enter WT payments made with previously filed forms NYS-45 and/or form NYS-45-X for the quarter.

- Calculate the total payments by adding lines 12, 13, and 14 and write the total.

- If an overpayment is shown on previously filed forms, subtract it from the total payments.

- Calculate any overpayment to be applied or additional withholding tax amount due and write in the respective spaces.

- If there is an additional payment due, add lines 7 and 19.

- Part C – Amended Employee Wage and Withholding Information (Back of Form):

- Fill in the amended employee/payee wage reporting and withholding information, including Social Security numbers, names, and corrected amounts for UI remuneration and taxes withheld.

- Part D – Form NYS-1 Corrections/Additions (Back of form):

- Use this part only for corrections or additions for the quarter reported in Part B of this return.

- Input the original and correct last payroll dates and total withheld as needed.

- If you use a paid preparer or payroll service, complete the section for their information.

- Signature:

- Sign and print the signer's name and title.

- Provide a telephone number and the date of signing.

Fillable online New York Form NYS-45-X