-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form IT-2104-P

Get your New York Form IT-2104-P in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

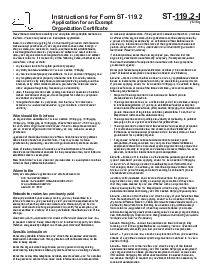

What Is the NY State Tax Form IT 2104 P?

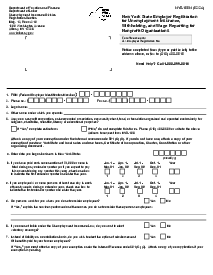

The IT-2104 P form, also referred to as the Nonresident Employee's Withholding Recertification Form, is specific to New York State. This form is critical for nonresident individuals working in New York State who wish to affirm they are not subject to New York State or New York City withholding.

It certifies a person’s exemption from withholding based on their residency and work situation. This form is an annual requirement, meaning it must be completed each year to maintain the withholding exemption.

Importance of New York State Tax Form IT 2104 P

The tax form IT 2104 P is designed specifically for recipients of pensions and annuities in New York State. It helps determine the proper withholding amount for state taxes based on your individual circumstances. This could include factors such as your filing status, other sources of income, and tax credits or deductions to which you're entitled.

How to Fill Out the NYS Tax Form IT 2104 P

Filling out tax forms can be daunting, but a step-by-step approach can make the process smoother. Firstly, it's essential to understand that the form comprises various sections, including detailed personal information and the certification of exemption. Here’s a brief guide on completion:

- Start by entering your first name and middle initial in the designated field.

- Move to the next field and provide your last name.

- Enter your social security number in the specified space.

- Type in your permanent mailing address, including the number and street, or a P.O. box if applicable.

- If you live in an apartment, fill in your apartment number in the next field.

- In case there is an annuity contract claim or identification number, input it in the corresponding field.

- Write down the name of the city, village, or post office where you reside.

- Select your state from the drop-down options or write it in the space provided.

- Fill in the ZIP code for your mailing address.

- Enter the dollar amount you wish to have withheld for New York State income tax from each payment.

- If you're a New York City resident, specify the desired withholding amount for New York City income tax.

- Yonkers residents should indicate the withholding amount for the Yonkers income tax surcharge.

- Confirming your request for voluntary withholding by entering your signature.

- Finally, add the date of the signature right next to it.

Benefits of completing a tax form IT 2104 P on the PDFliner

Filling out IRS document templates on the PDFliner website offers a streamlined, efficient process with the convenience of not requiring any software installation. It provides a secure platform for accessing and completing forms, with easy-to-use editing tools that let you fill, sign, and share your IT 2104-P printable form without a hassle. PDFliner's intuitive interface also ensures that you can handle your paperwork from any device, leading to a smooth and time-saving user experience.

Fillable online New York Form IT-2104-P