-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Canada Governmental Forms

-

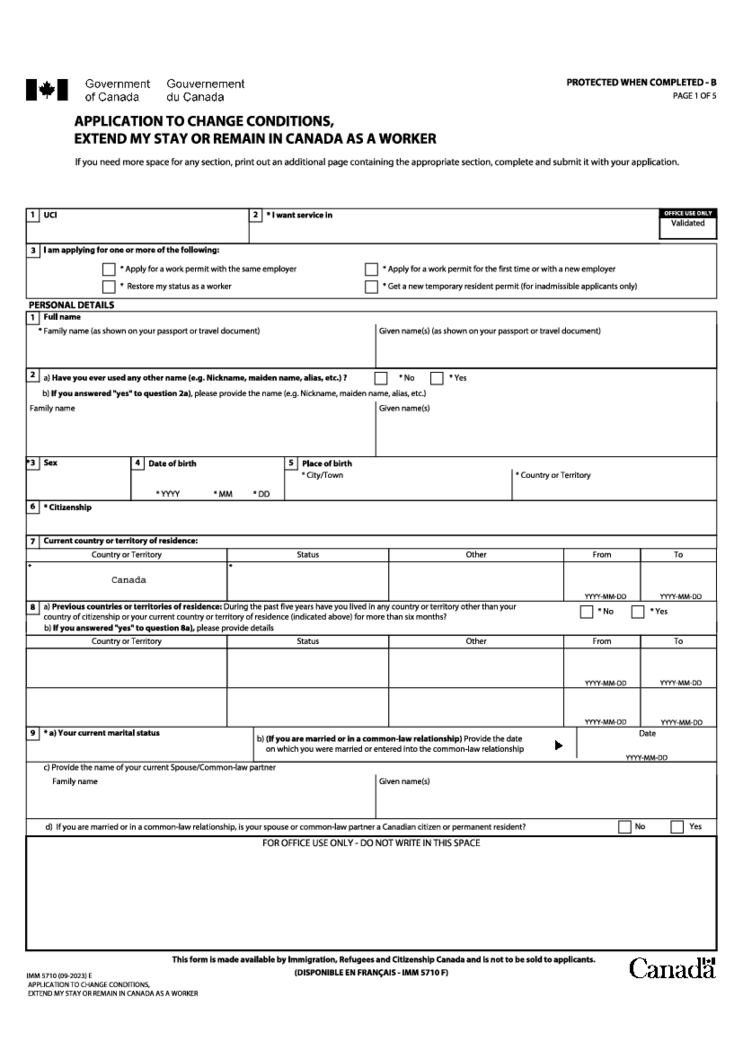

IMM 5710 Form

What Is IMM 5710 Form

Interested in extending your stay or changing your work conditions in Canada? The IMM 5710 form is what you need. It's an application designed by Immigration, Refugees, and Citizenship Canada for individuals looking to stay longe

IMM 5710 Form

What Is IMM 5710 Form

Interested in extending your stay or changing your work conditions in Canada? The IMM 5710 form is what you need. It's an application designed by Immigration, Refugees, and Citizenship Canada for individuals looking to stay longe

-

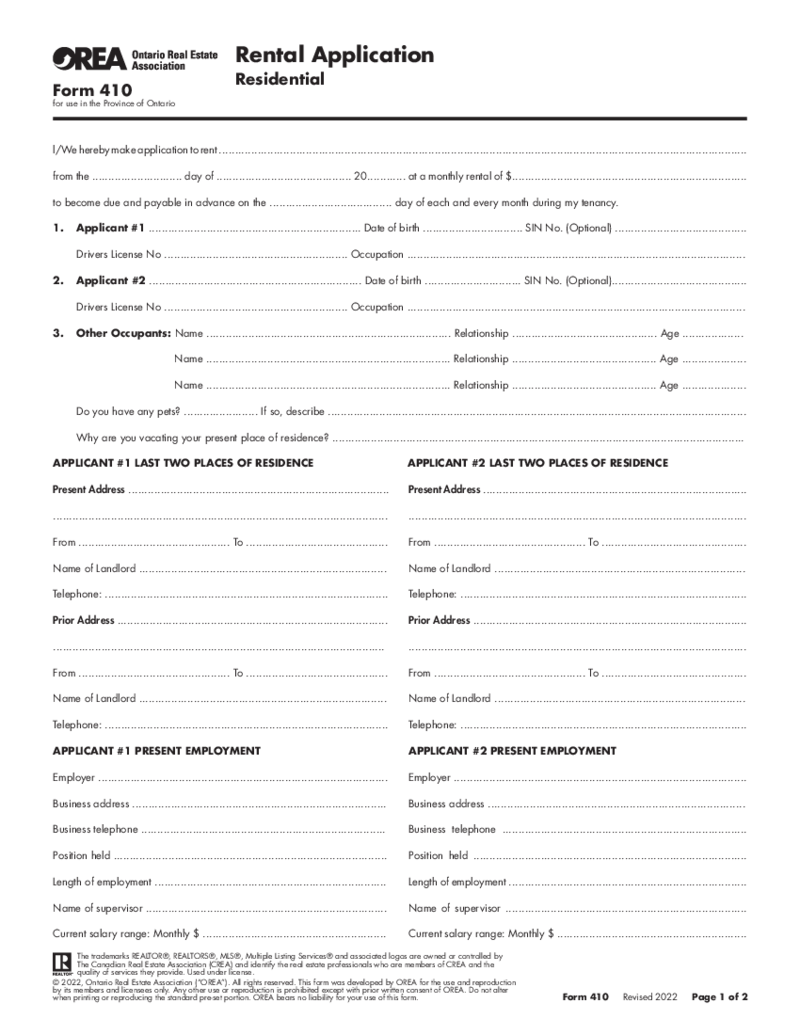

Ontario Rental Application Form 410

What Is Ontario Form 410

Landlords in Ontario often use OREA renter application 410 to screen tenants. It helps them gather all the necessary information about applicants to make an informed decision on whether to rent the property to them.

How

Ontario Rental Application Form 410

What Is Ontario Form 410

Landlords in Ontario often use OREA renter application 410 to screen tenants. It helps them gather all the necessary information about applicants to make an informed decision on whether to rent the property to them.

How

-

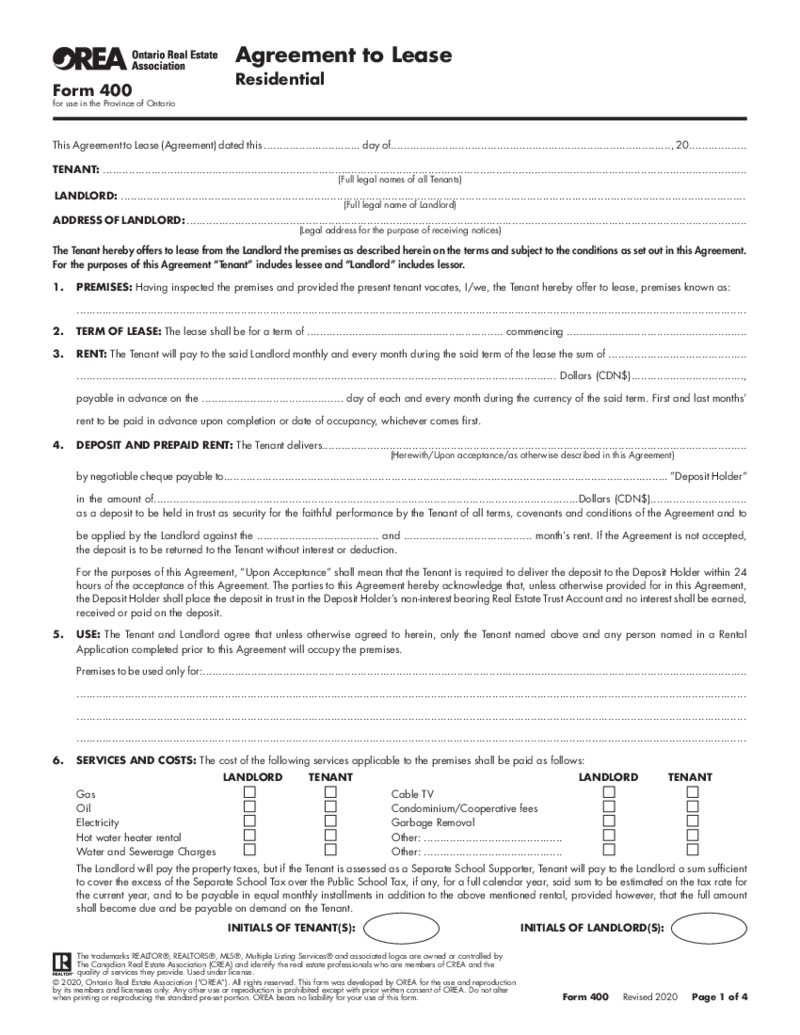

OREA Form 400 Agreement to Lease Residential

What Is Fillable OREA Form 400?

An OREA Form 400 fillable PDF is an official document based on which a landlord and tenant agree on the lease of premises, fix a rent and advance payment, and deal on additional services. It is three pages long and requires

OREA Form 400 Agreement to Lease Residential

What Is Fillable OREA Form 400?

An OREA Form 400 fillable PDF is an official document based on which a landlord and tenant agree on the lease of premises, fix a rent and advance payment, and deal on additional services. It is three pages long and requires

-

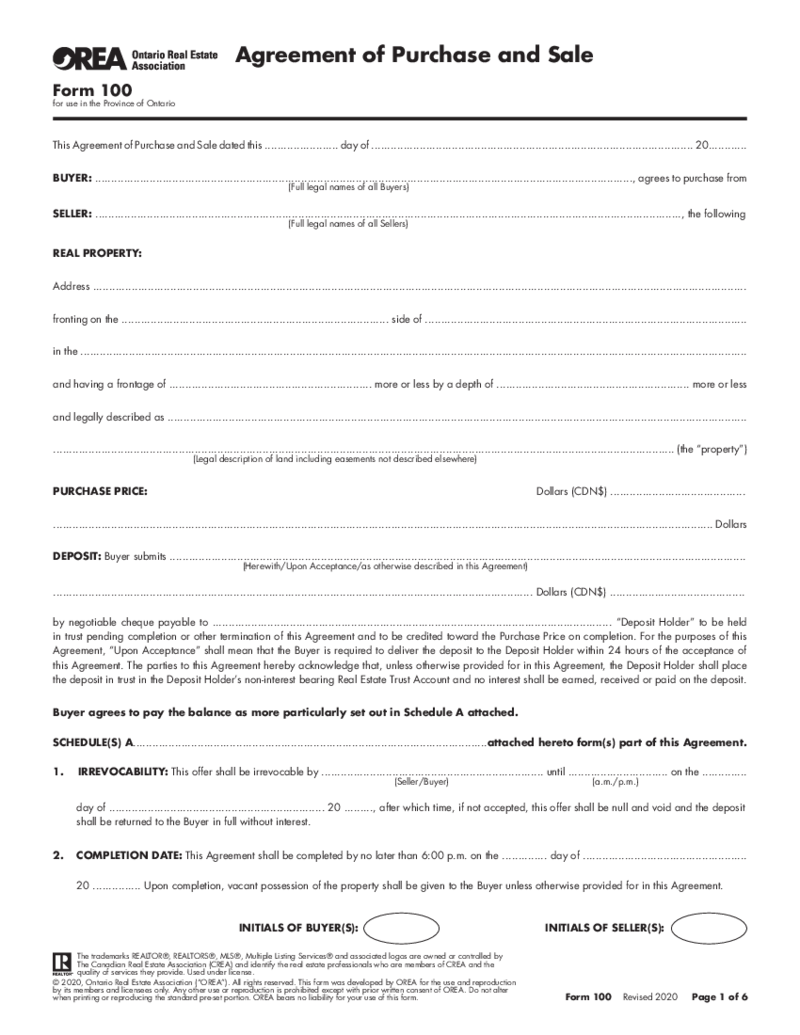

OREA Form 100 Agreement of Purchase and Sale

What Is OREA Form 100 2025?

OREA Form 100 is an agreement of the purchase and sale between two parties in the Province of Ontario. The form was created to reveal the intention of the buyer to purchase the property. It documents the process of negotiations

OREA Form 100 Agreement of Purchase and Sale

What Is OREA Form 100 2025?

OREA Form 100 is an agreement of the purchase and sale between two parties in the Province of Ontario. The form was created to reveal the intention of the buyer to purchase the property. It documents the process of negotiations

-

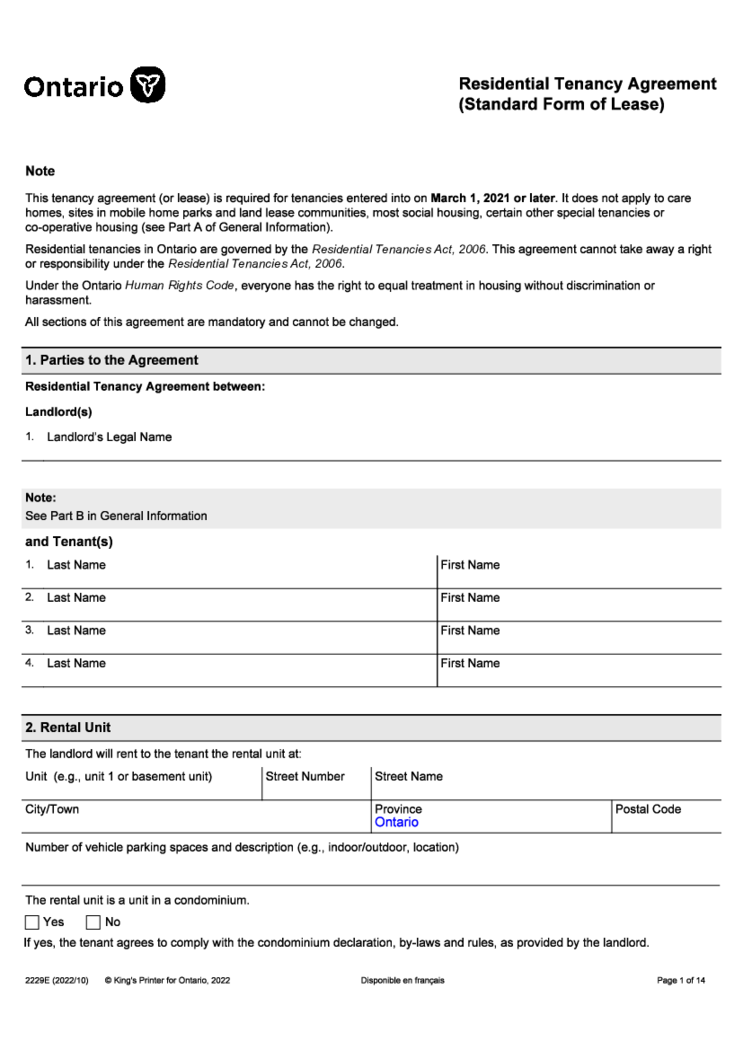

Ontario Standard Lease Agreement

Ontario Standard Lease Agreement: What Is It For

The fillable Ontario Standard Lease form is a contract between a landlord and a tenant created by the Government of Ontario to standardize rental agreements within the province, ensuring all parties have a

Ontario Standard Lease Agreement

Ontario Standard Lease Agreement: What Is It For

The fillable Ontario Standard Lease form is a contract between a landlord and a tenant created by the Government of Ontario to standardize rental agreements within the province, ensuring all parties have a

-

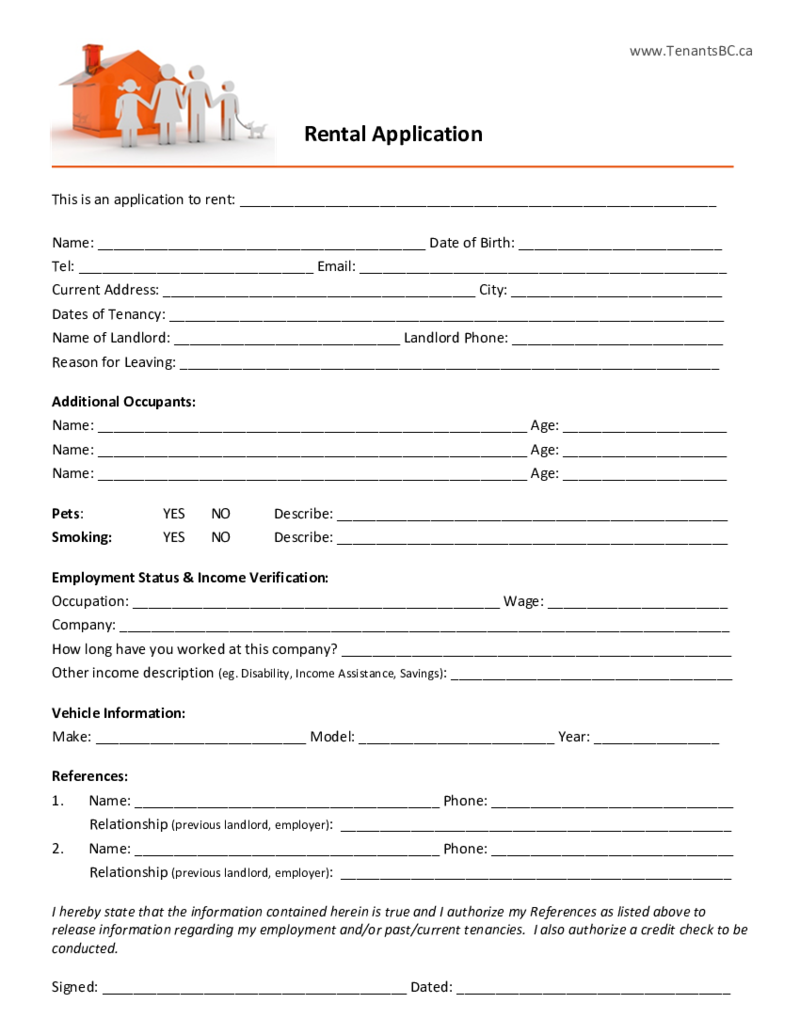

Tenants BC Rental Application

Understanding the BC Tenant Rental Application Form

The BC Tenant Rental Application is designed to give landlords an all-encompassing view of potential renters. It usually requires information about your rental history, employment, and references. A

Tenants BC Rental Application

Understanding the BC Tenant Rental Application Form

The BC Tenant Rental Application is designed to give landlords an all-encompassing view of potential renters. It usually requires information about your rental history, employment, and references. A

-

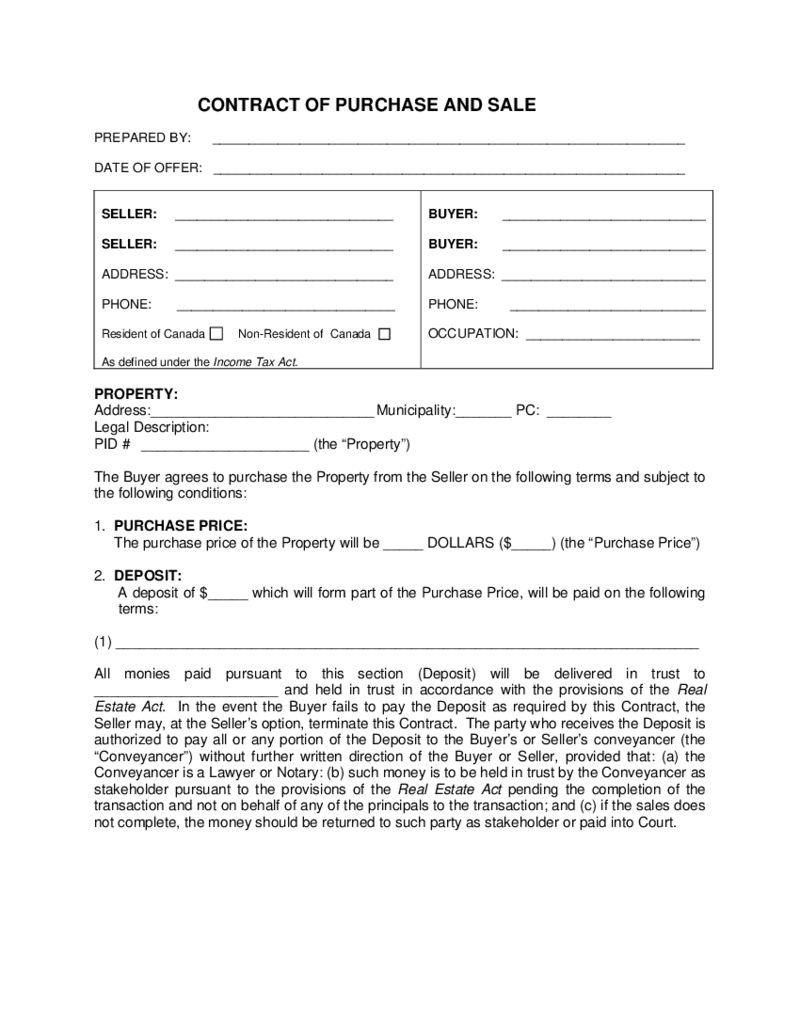

BC Contract of Purchase and Sale

What Is BC Contract of Purchase and Sale?

The BC contract of purchase and sale is an official document that contains the main aspects of the agreement between seller and buyer during the real estate purchase. This form is crucial in British Columbia. It c

BC Contract of Purchase and Sale

What Is BC Contract of Purchase and Sale?

The BC contract of purchase and sale is an official document that contains the main aspects of the agreement between seller and buyer during the real estate purchase. This form is crucial in British Columbia. It c

-

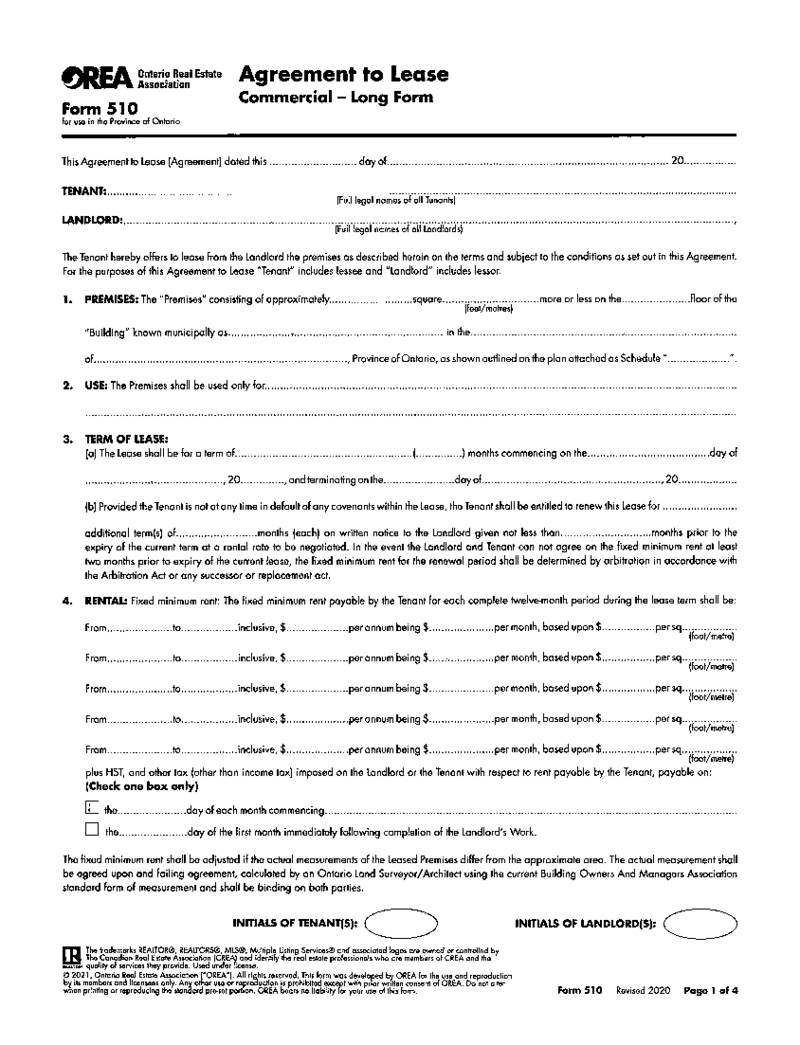

OREA Form 510, Agreement to Lease, Commercial

What Is OREA Form 510?

It's an official document utilized in real estate transactions in Ontario, Canada. It contains vital details of an offer to lease a commercial property: landlord and tenant information, as well as proposed terms and conditions.

OREA Form 510, Agreement to Lease, Commercial

What Is OREA Form 510?

It's an official document utilized in real estate transactions in Ontario, Canada. It contains vital details of an offer to lease a commercial property: landlord and tenant information, as well as proposed terms and conditions.

-

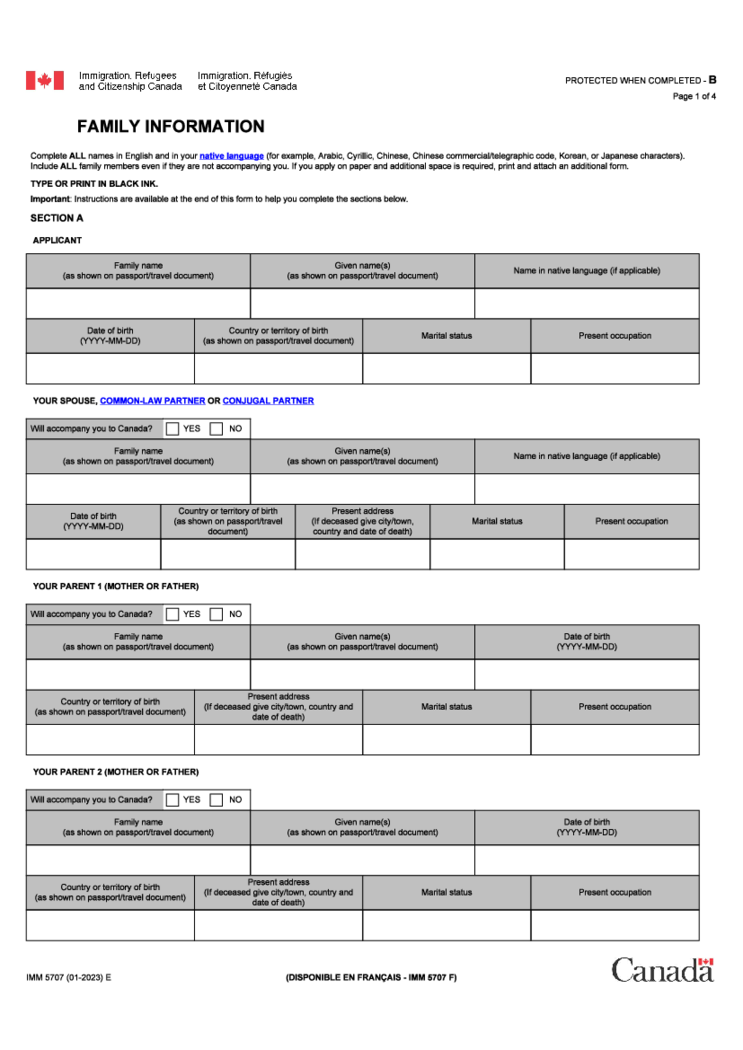

IMM 5707 Form

What Is IMM 5707 Family Information Form?

IMM 5707 PDF or a Canadian visa application family information form is a form to provide family information while applying for a temporary Canada resident visa (TRV). Persons over the age of 18 must use this form

IMM 5707 Form

What Is IMM 5707 Family Information Form?

IMM 5707 PDF or a Canadian visa application family information form is a form to provide family information while applying for a temporary Canada resident visa (TRV). Persons over the age of 18 must use this form

-

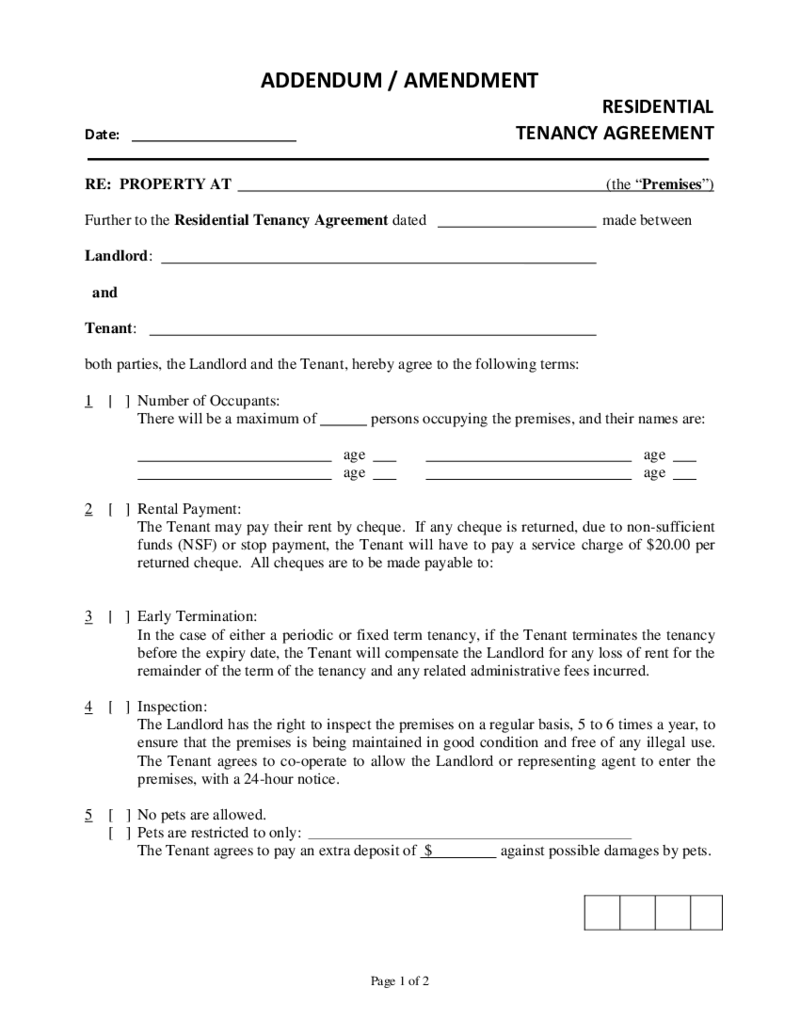

BC Tenancy Agreement Addendum

How to Expertly Fill Out a BC Tenancy Agreement Addendum

Navigating the complexities of rental agreements in British Columbia can be a challenging endeavor for both tenants and landlords. A critical component of these agreements is the BC Tenancy Agreemen

BC Tenancy Agreement Addendum

How to Expertly Fill Out a BC Tenancy Agreement Addendum

Navigating the complexities of rental agreements in British Columbia can be a challenging endeavor for both tenants and landlords. A critical component of these agreements is the BC Tenancy Agreemen

-

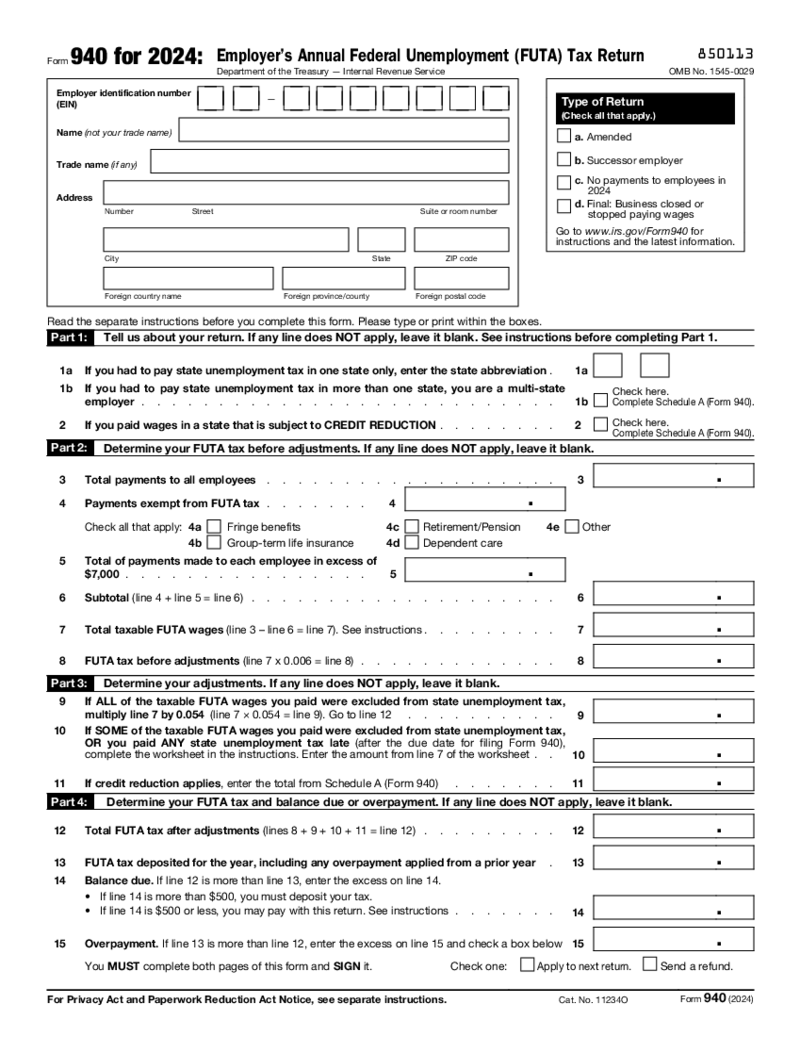

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

-

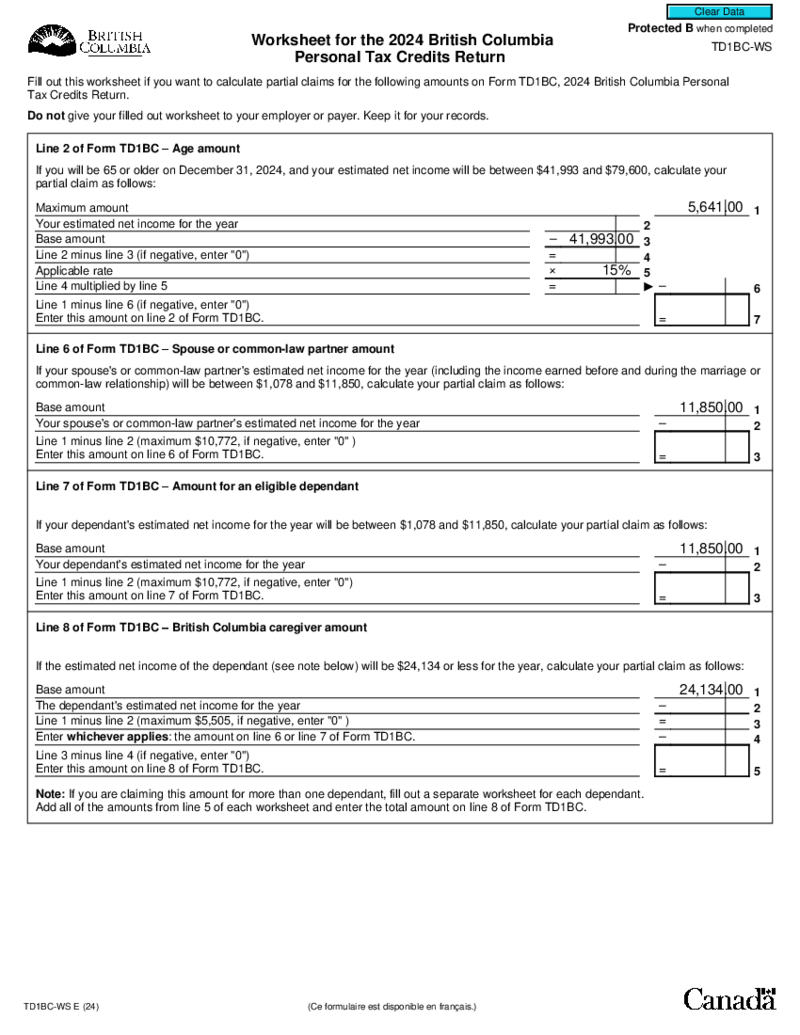

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

What Are the Government of Canada Forms Online?

Canada forms is a pretty self-explanatory notion. They are standard forms you need to fill out and submit if you’re in Canada. If you’re currently on the prowl for passport forms Canada or revenue Canada forms, today’s your lucky day. PDFLiner is where you can find any niche-specific template you need, as well as fill it out digitally (read as super fast), and submit it online. So, feel free to browse through this category or take advantage of our top-level search feature to find the template you’re currently on the hunt for.

What Do Government of Canada Forms Look Like?

At first sight, these forms resemble your typical multi-purpose templates catering to a multitude of fields. Parties’ names and addresses, dates, and signatures… Their elements are pretty much standard and recognizable. If you look closer, though, you’ll see one major distinction: these forms are Canada-oriented. That’s pretty much it when it comes to what Canada government-required forms look like.

If you’re here, it means you’re on your way to digitally transform your administrative affairs. Good for you. Online document management saves your time, allows for errorless form filing, and contributes to your enhanced file storage possibilities. PDFLiner is your best bet in this respect.

How to Get Canada Forms?

Whether you need service Canada forms or are looking for immigration forms Canada, this category is where you’ll look no further. Our catalog is filled with a multitude of all-purpose templates that cater to all your needs. You can look through this page to find the needed form or make use of our top-notch search feature. Irrespective of what you’ll choose, PDFLiner is all about saving your time and automating your administrative affairs. With us, you are bound to succeed in filling out your Canada revenue agency forms, along with other files required by the Canadian government.