-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Philippines Templates

-

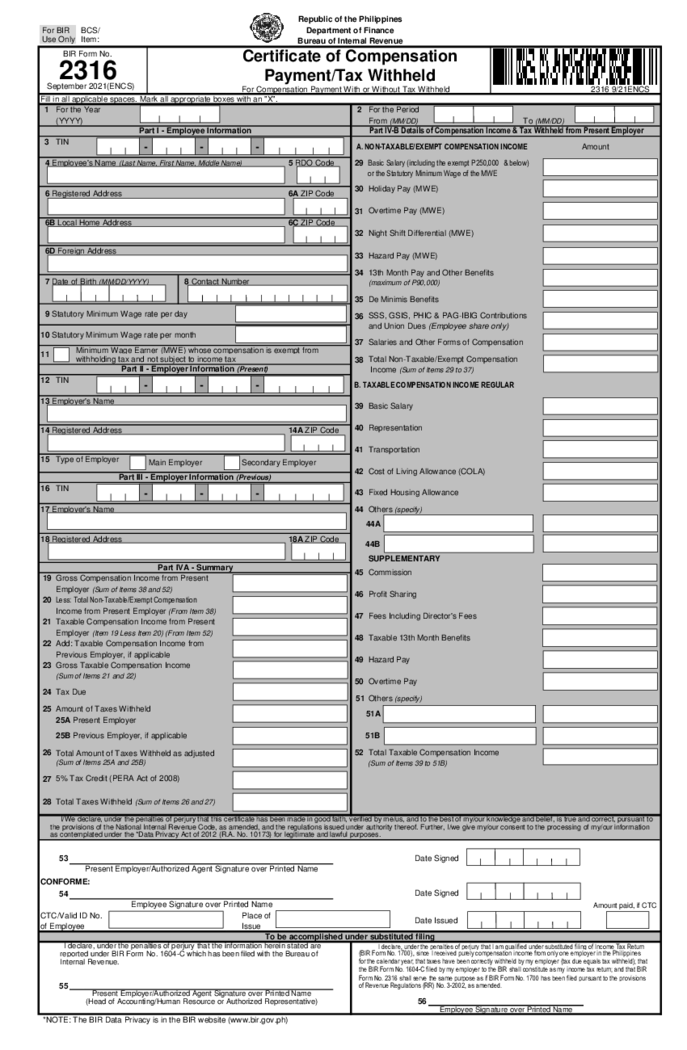

PH BIR 2316

What Is PH BIR 2316?

BIR 2316 is the document that determines the compensation given by an employer to an employee. It is also known as the Certificate of Compensation Payment or Income Tax Withheld.

What I need PH BIR 2316 for?

PH BIR 2316

What Is PH BIR 2316?

BIR 2316 is the document that determines the compensation given by an employer to an employee. It is also known as the Certificate of Compensation Payment or Income Tax Withheld.

What I need PH BIR 2316 for?

-

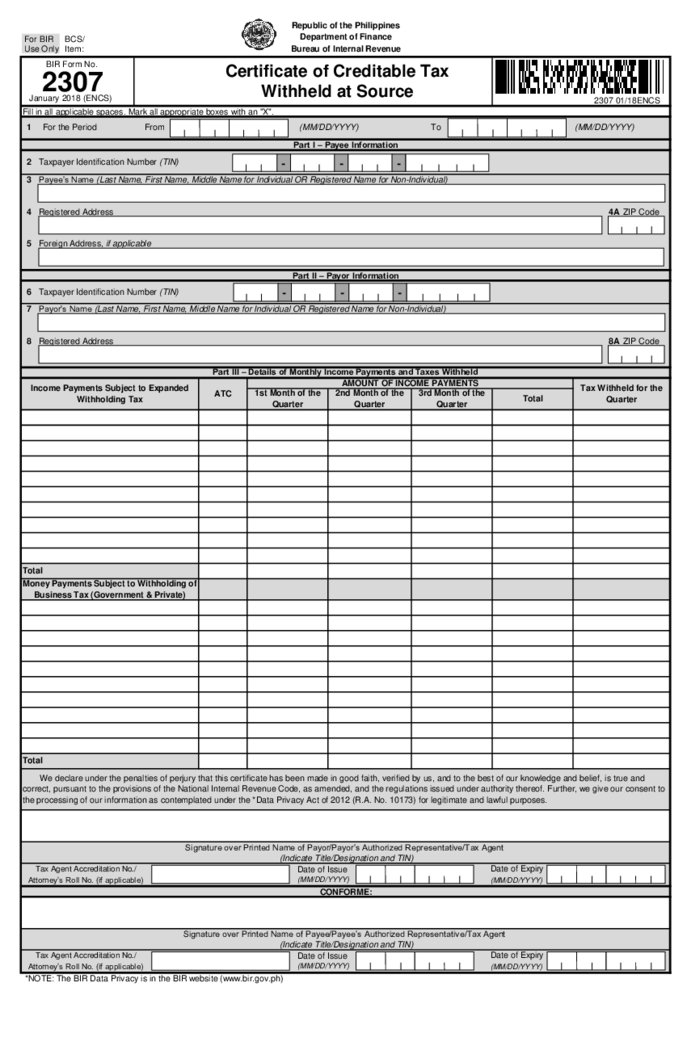

BIR Form 2307

What Is BIR Form No. 2307?

BIR form 2307 meaning is simple, it's the document that must be filled by employees who do the freelance job, and employers who order work from freelancers. It is also called a Certificate of Creditable Tax Withhe

BIR Form 2307

What Is BIR Form No. 2307?

BIR form 2307 meaning is simple, it's the document that must be filled by employees who do the freelance job, and employers who order work from freelancers. It is also called a Certificate of Creditable Tax Withhe

-

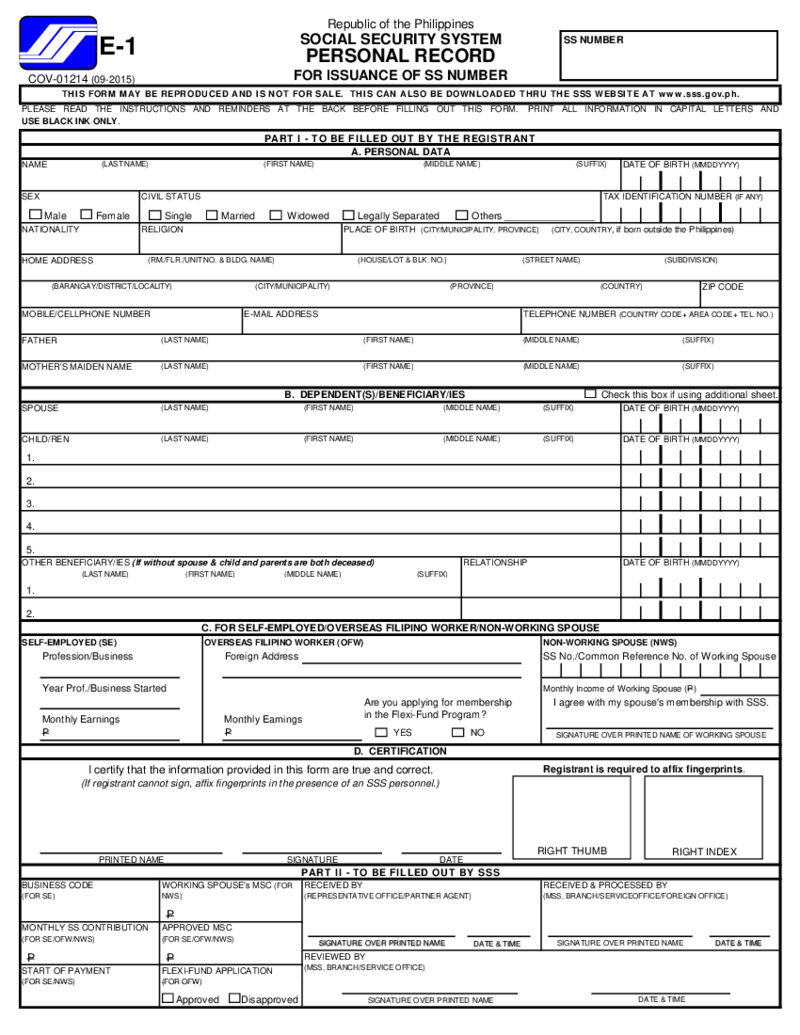

SSS E-1 Form

What Is a PH SSS E-1 Personal Record Form?

If you want to know what is E1 form sss, you have come to the right place. The PH SSS E-1 form is an online application for a loan restructuring program offered by the Social Security System (SSS) of the Philippi

SSS E-1 Form

What Is a PH SSS E-1 Personal Record Form?

If you want to know what is E1 form sss, you have come to the right place. The PH SSS E-1 form is an online application for a loan restructuring program offered by the Social Security System (SSS) of the Philippi

-

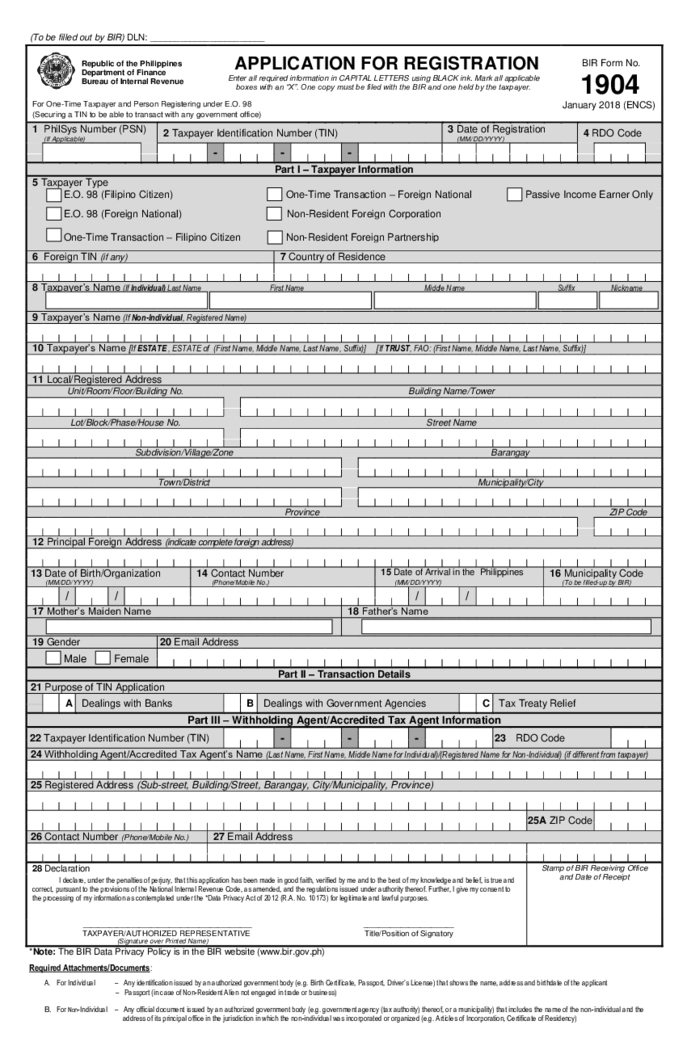

BIR Form 1904

What Is BIR Form 1904

Also known as Application for Registration, it’s a document used in the Philippines for individuals seeking to register as a new taxpayer. This form is typically submitted by individuals starting a new business, establishing th

BIR Form 1904

What Is BIR Form 1904

Also known as Application for Registration, it’s a document used in the Philippines for individuals seeking to register as a new taxpayer. This form is typically submitted by individuals starting a new business, establishing th

-

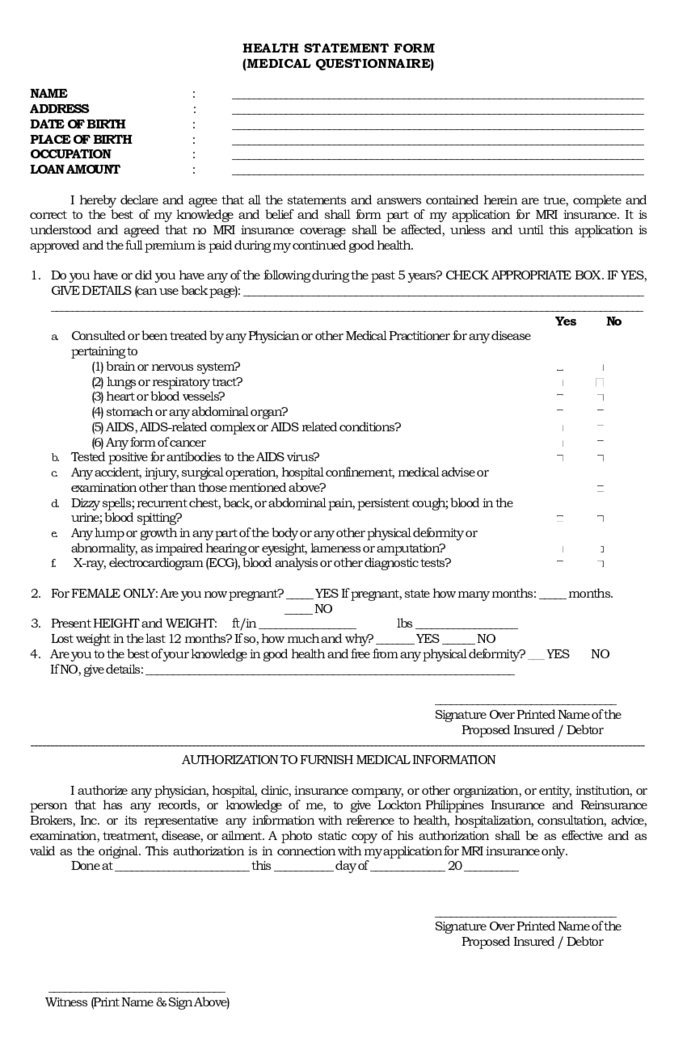

Pag IBIG Fund Health Statement Form

Welcome to our comprehensive guide on the Pag-IBIG Health Statement Form and the Physician Statement Form. As an individual applying for health benefits or a loan in the Philippines, understanding these forms is vital. This guide will provide an overview of these ess

Pag IBIG Fund Health Statement Form

Welcome to our comprehensive guide on the Pag-IBIG Health Statement Form and the Physician Statement Form. As an individual applying for health benefits or a loan in the Philippines, understanding these forms is vital. This guide will provide an overview of these ess

-

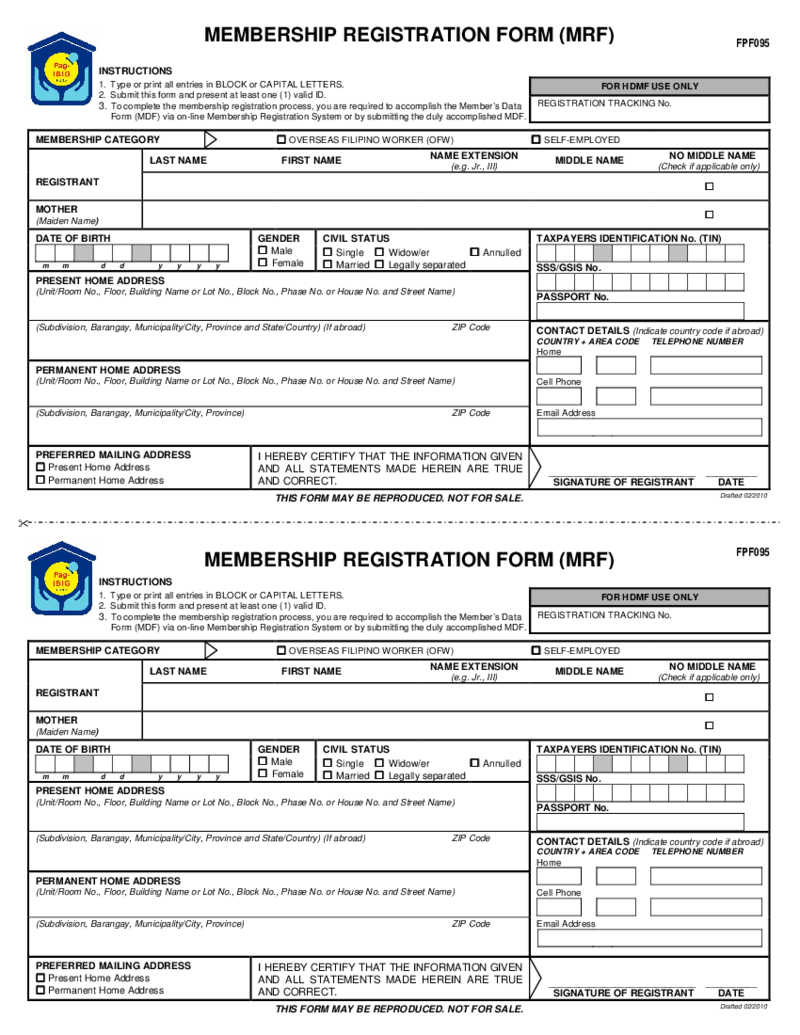

Pag-IBIG Fund Membership Registration Form

What Is Membership Registration Form?

This membership registration form was created for programs and benefits services. It is a part of the Pag-IBIG Home Equity Appreciation Loan (HEAL) for Developers program. The form is widely used among those who want

Pag-IBIG Fund Membership Registration Form

What Is Membership Registration Form?

This membership registration form was created for programs and benefits services. It is a part of the Pag-IBIG Home Equity Appreciation Loan (HEAL) for Developers program. The form is widely used among those who want

-

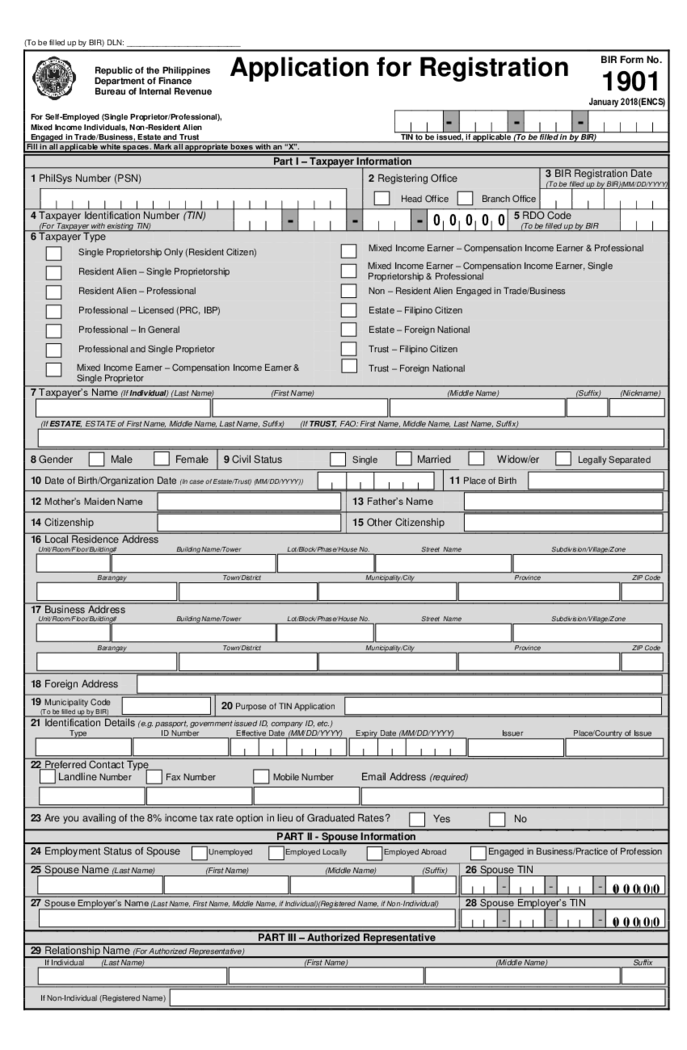

BIR Form 1901

What Is the BIR Form 1901?

The BIR form 1901 is a document required by the Philippines' Bureau of Internal Revenue for registering and applying for a Taxpayer Identification Number. This form is essential for self-employed individuals, mixed-income ea

BIR Form 1901

What Is the BIR Form 1901?

The BIR form 1901 is a document required by the Philippines' Bureau of Internal Revenue for registering and applying for a Taxpayer Identification Number. This form is essential for self-employed individuals, mixed-income ea

-

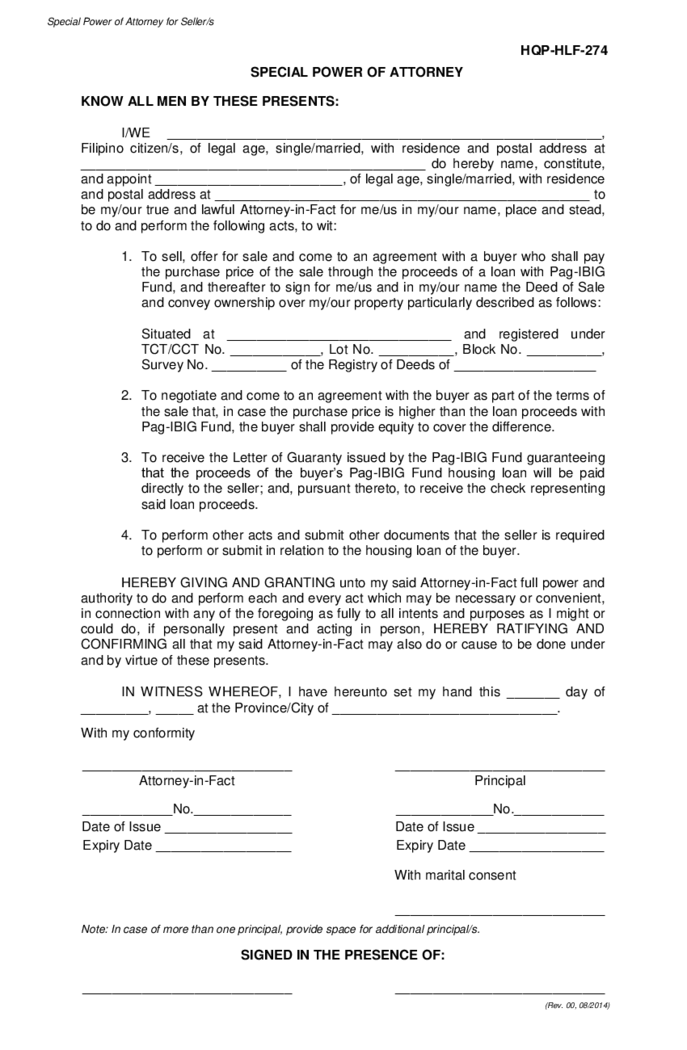

Pag IBIG Fund Special Power of Attorney for Sellers

Introduction to Pag Ibig SPA Form and its Importance

Understanding the relevance of Pag Ibig SPA Form is crucial for sellers. This form, issued by the Home Development Mutual Fund (HDMF) or Pag-IBIG Fund, empowers another individual to perform specif

Pag IBIG Fund Special Power of Attorney for Sellers

Introduction to Pag Ibig SPA Form and its Importance

Understanding the relevance of Pag Ibig SPA Form is crucial for sellers. This form, issued by the Home Development Mutual Fund (HDMF) or Pag-IBIG Fund, empowers another individual to perform specif

-

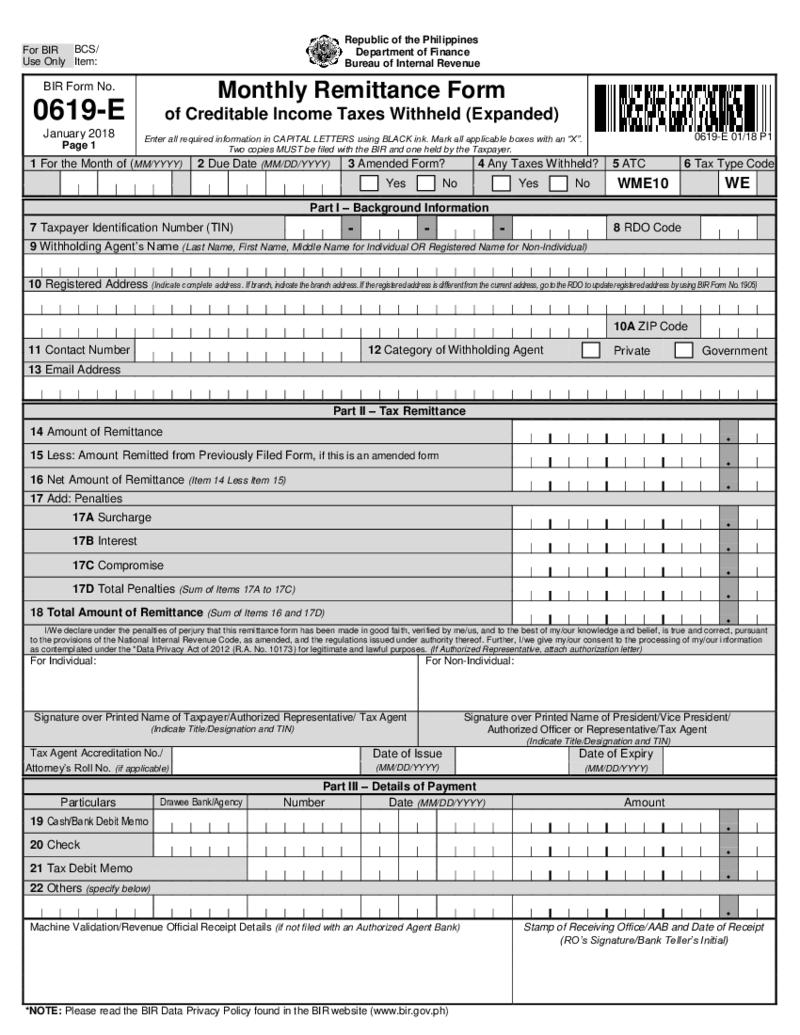

BIR Form 0619-E

What Is BIR Form 0619 E

Also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded), BIR Form 0619 E is a crucial tax doc used by corporations, partnerships, and non-individual taxpayers in the Philippines. It serves to report t

BIR Form 0619-E

What Is BIR Form 0619 E

Also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded), BIR Form 0619 E is a crucial tax doc used by corporations, partnerships, and non-individual taxpayers in the Philippines. It serves to report t

-

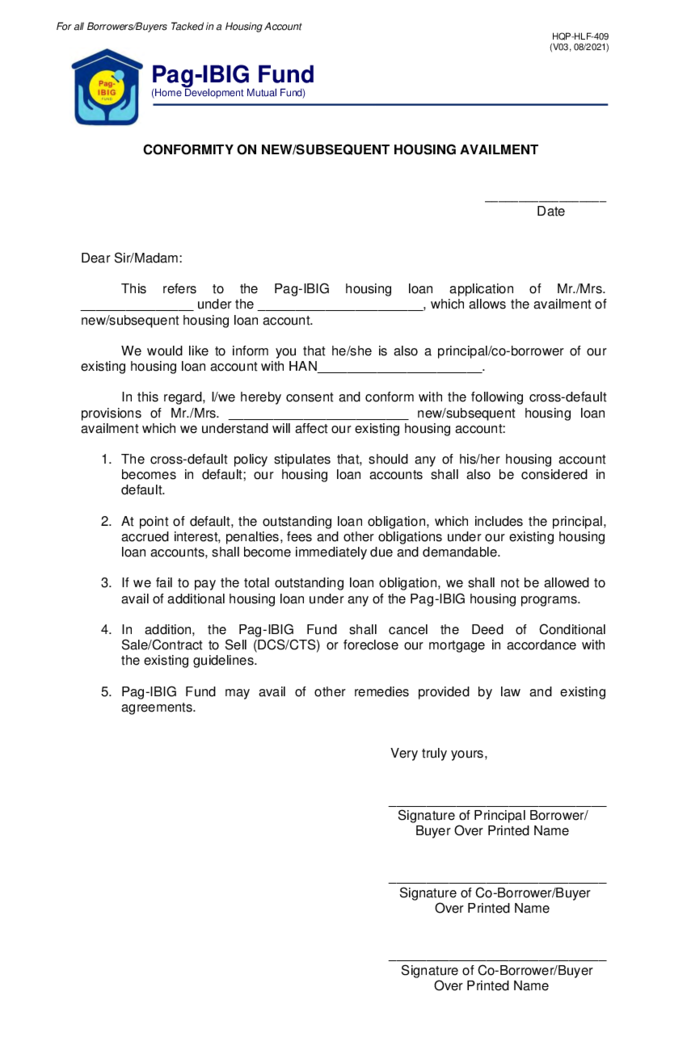

Pag IBIG Fund Conformity New Subsequent Housing Availment

Guide to the Pag-IBIG Fund's New Policies for Housing Benefits

Pag IBIG Fund, a crucial partner in housing finance in the Philippines, offers comfortable payment methods for loans related to housing availm

Pag IBIG Fund Conformity New Subsequent Housing Availment

Guide to the Pag-IBIG Fund's New Policies for Housing Benefits

Pag IBIG Fund, a crucial partner in housing finance in the Philippines, offers comfortable payment methods for loans related to housing availm

-

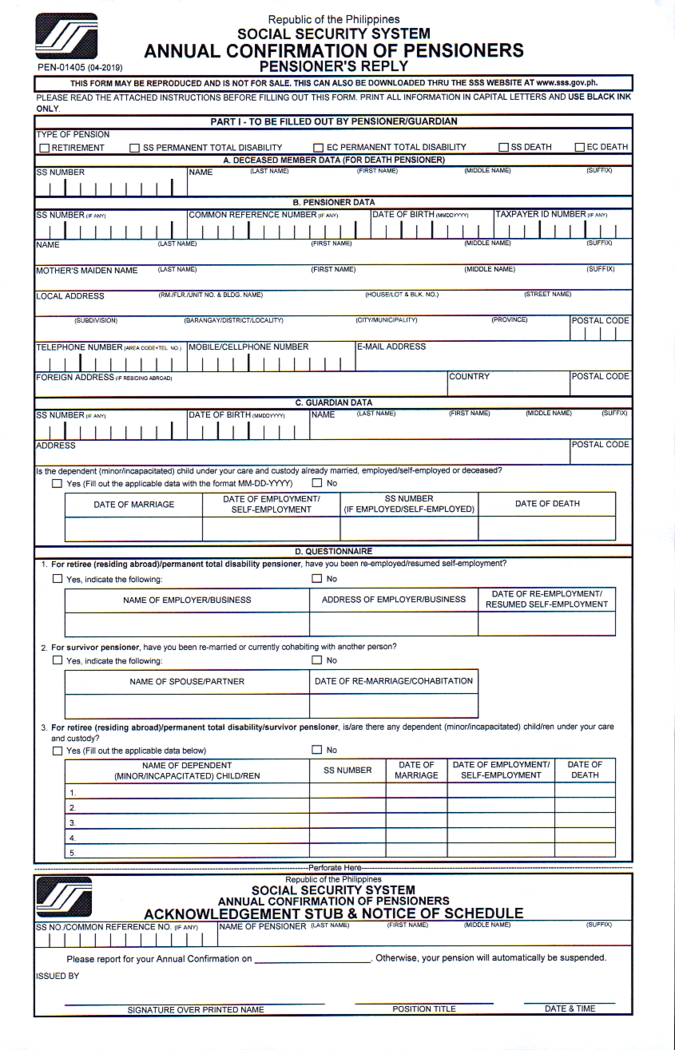

PH SSS PEN-01405

What Is a Annual Confirmation of Pensioner's Form?

The PH SSS PEN-01405 Form is a document that serves as proof of membership to the Philippine Social Security System (SSS). The sss pensioner form is issued to members who have updated their personal a

PH SSS PEN-01405

What Is a Annual Confirmation of Pensioner's Form?

The PH SSS PEN-01405 Form is a document that serves as proof of membership to the Philippine Social Security System (SSS). The sss pensioner form is issued to members who have updated their personal a

-

Pag IBIG Fund Application for Housing Loan Revaluation Under

Pag-IBIG Housing Loan: A Guide for Filipino Homeowners

Are you a Filipino citizen considering applying for a housing loan? Are you aware of the Pag-IBIG fund and how it can aid you in your quest for homeownership? In this comprehensive guide, we will expl

Pag IBIG Fund Application for Housing Loan Revaluation Under

Pag-IBIG Housing Loan: A Guide for Filipino Homeowners

Are you a Filipino citizen considering applying for a housing loan? Are you aware of the Pag-IBIG fund and how it can aid you in your quest for homeownership? In this comprehensive guide, we will expl