-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Form 0619-E

Get your BIR Form 0619-E in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is BIR Form 0619 E

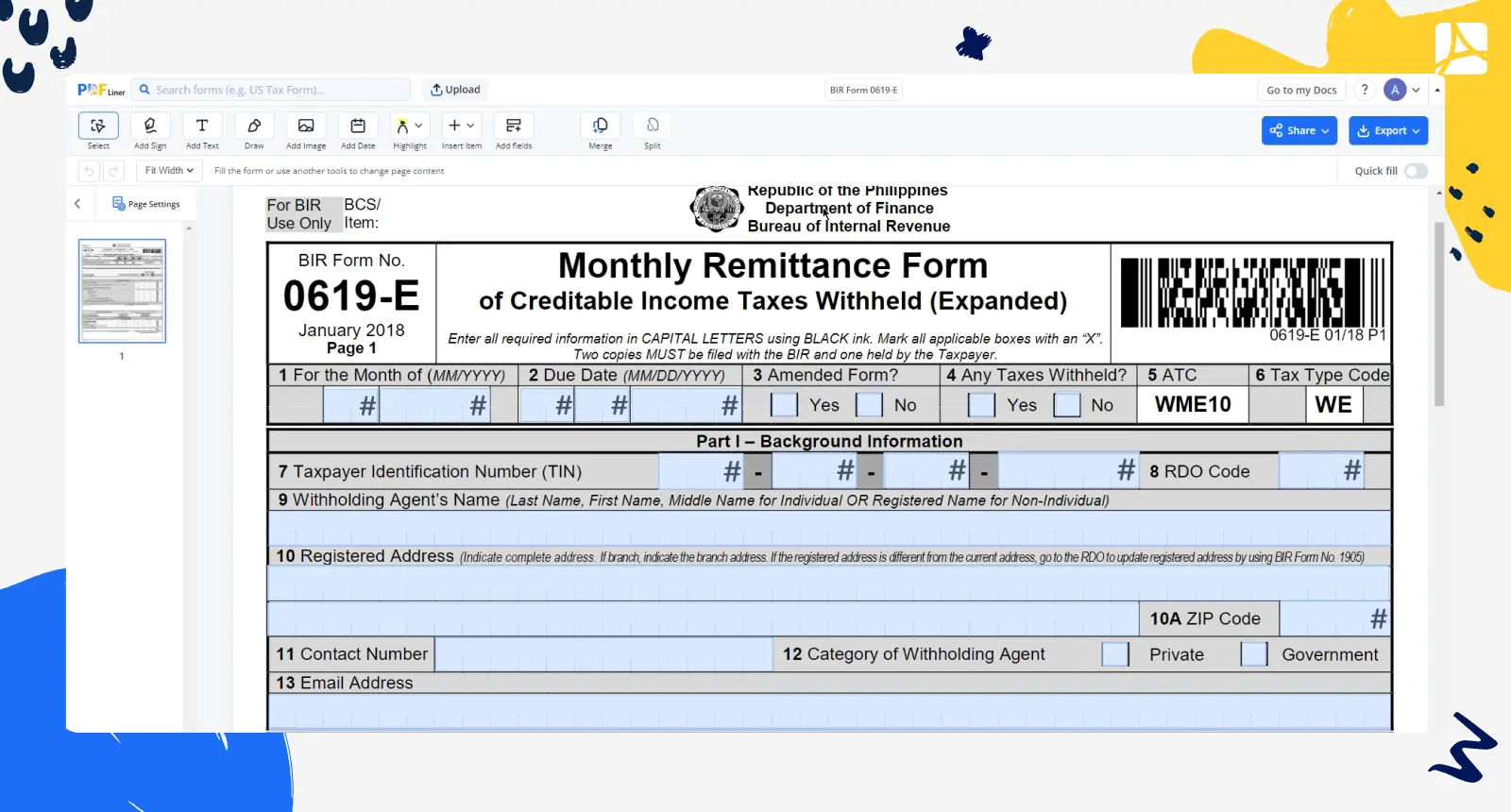

Also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded), BIR Form 0619 E is a crucial tax doc used by corporations, partnerships, and non-individual taxpayers in the Philippines. It serves to report their monthly Expanded Withholding Tax (EWT) liabilities.

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue (BIR).

What Is BIR 0619 E Form Used For

The doc is utilized for:

- declaring income payments subject to withholding tax;

- providing details of corresponding taxes withheld during the month;

- facilitating accurate tax reporting to the BIR;

- ensuring adherence to tax regulations and financial transparency;

- helping in the proper assessment and collection of income taxes.

Use the PDFLiner template of the BIR 0619E Form and enjoy its numerous benefits. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process. Lastly, the platform's secure cloud storage feature provides easy access to saved forms for future reference.

How to Fill Out Downloadable BIR Form 0619 E

Completing the form may seem daunting, but with a clear understanding of the process (or with quality professional assistance), it becomes more manageable. Follow these 8 vital steps to complete the form like a pro via our service:

- Log in to your PDFLiner account and find the form in our template catalog.

- Open the form in the PDFLiner online editor.

- Fill in the necessary details, including taxpayer name, TIN (Tax Identification Number), RDO (Revenue District Office) code, and the applicable taxable year and month.

- Report all income payments subject to Expanded Withholding Tax and corresponding amounts.

- Compute the total tax due by multiplying the applicable tax rate with the taxable amount.

- Subtract any allowable tax credits from the total tax due to determine the final amount payable.

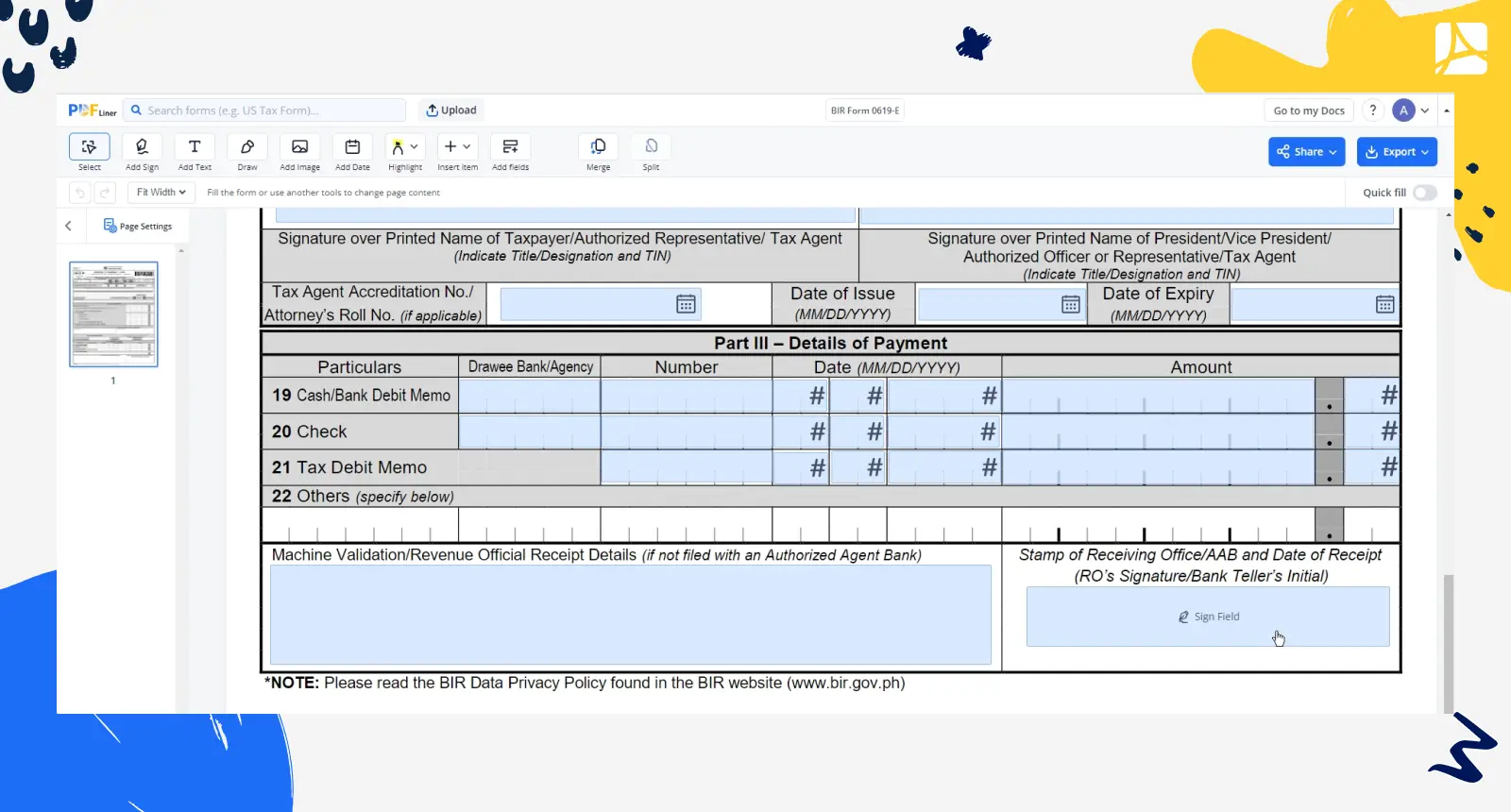

- Sign and submit the form, along with the necessary attachments and supporting documents, to the appropriate BIR office.

- Retain a copy of the filled-out form and supporting documents for your records and future reference.

How to File 0619 E BIR Form PDF

To file the form, ensure its maximum accuracy post-completion. Sign the form via the PDFLiner e-signature tool. Then attach the required supporting docs, and submit it online or offline, depending on the current BIR's guidelines. Don’t forget to double-check the form before submission. Make the most of the BIR form 0619 E download option whenever necessary. With all that said, PDFLiner is where you’ll access a treasure trove of effective and convenient document management tools and valuable tips on document management.

Fillable online BIR Form 0619-E