-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Forms

-

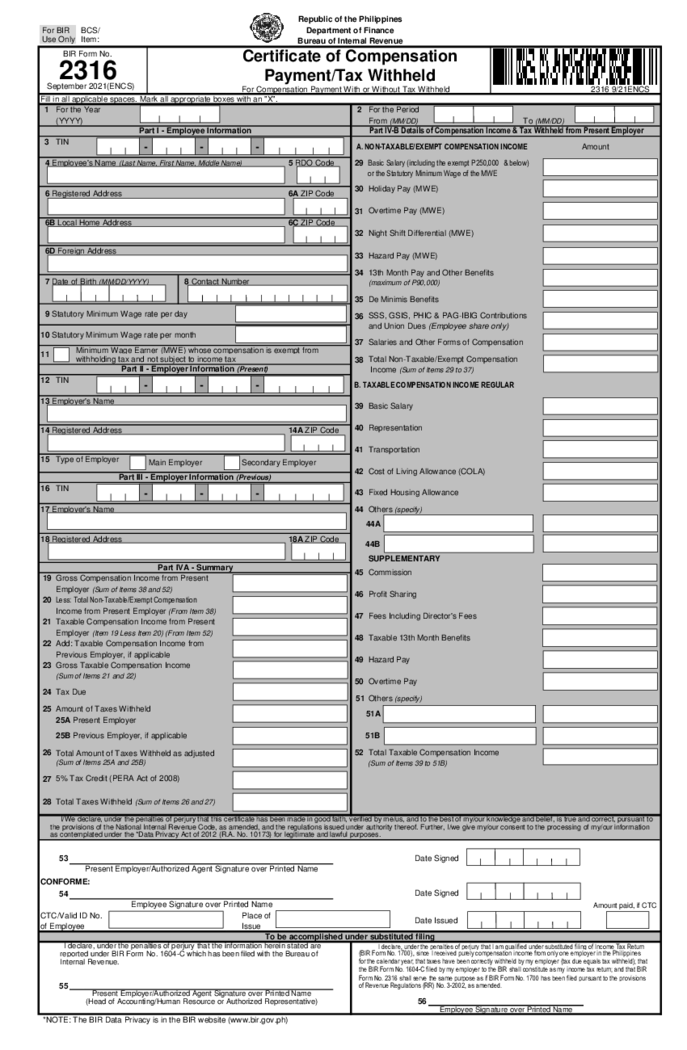

PH BIR 2316

What Is PH BIR 2316?

BIR 2316 is the document that determines the compensation given by an employer to an employee. It is also known as the Certificate of Compensation Payment or Income Tax Withheld.

What I need PH BIR 2316 for?

PH BIR 2316

What Is PH BIR 2316?

BIR 2316 is the document that determines the compensation given by an employer to an employee. It is also known as the Certificate of Compensation Payment or Income Tax Withheld.

What I need PH BIR 2316 for?

-

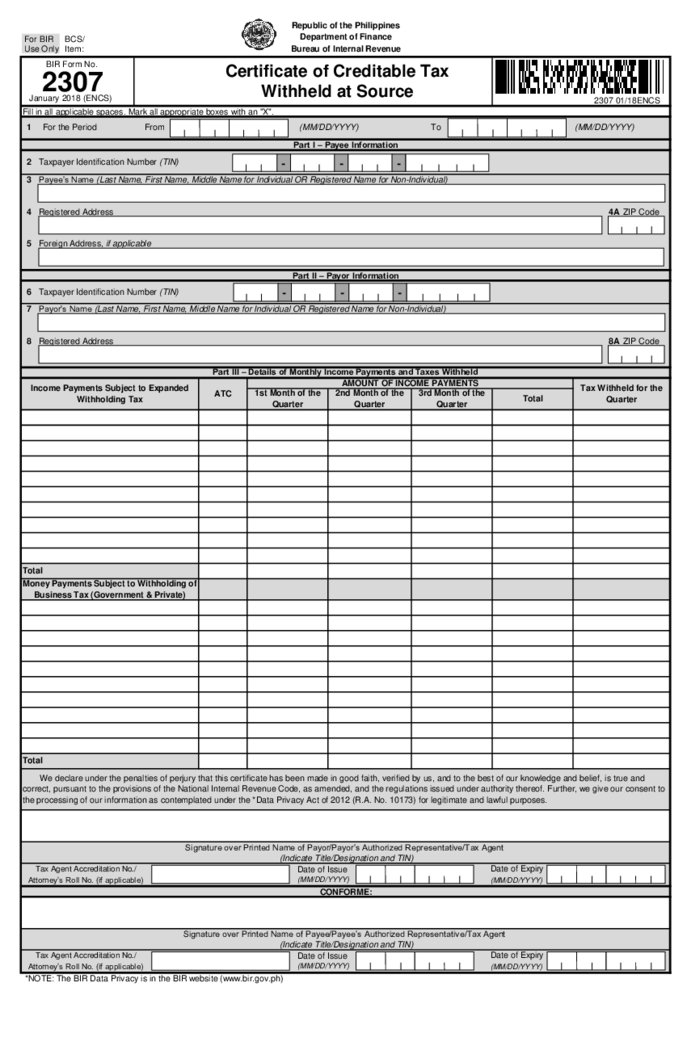

BIR Form 2307

What Is BIR Form No. 2307?

BIR form 2307 meaning is simple, it's the document that must be filled by employees who do the freelance job, and employers who order work from freelancers. It is also called a Certificate of Creditable Tax Withhe

BIR Form 2307

What Is BIR Form No. 2307?

BIR form 2307 meaning is simple, it's the document that must be filled by employees who do the freelance job, and employers who order work from freelancers. It is also called a Certificate of Creditable Tax Withhe

-

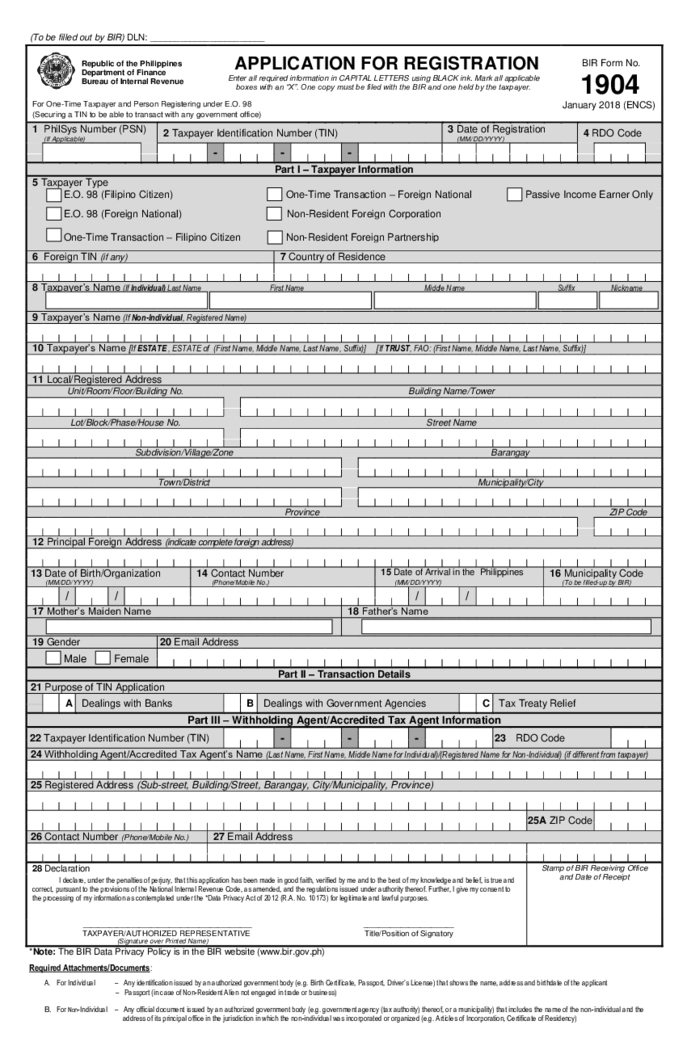

BIR Form 1904

What Is BIR Form 1904

Also known as Application for Registration, it’s a document used in the Philippines for individuals seeking to register as a new taxpayer. This form is typically submitted by individuals starting a new business, establishing th

BIR Form 1904

What Is BIR Form 1904

Also known as Application for Registration, it’s a document used in the Philippines for individuals seeking to register as a new taxpayer. This form is typically submitted by individuals starting a new business, establishing th

-

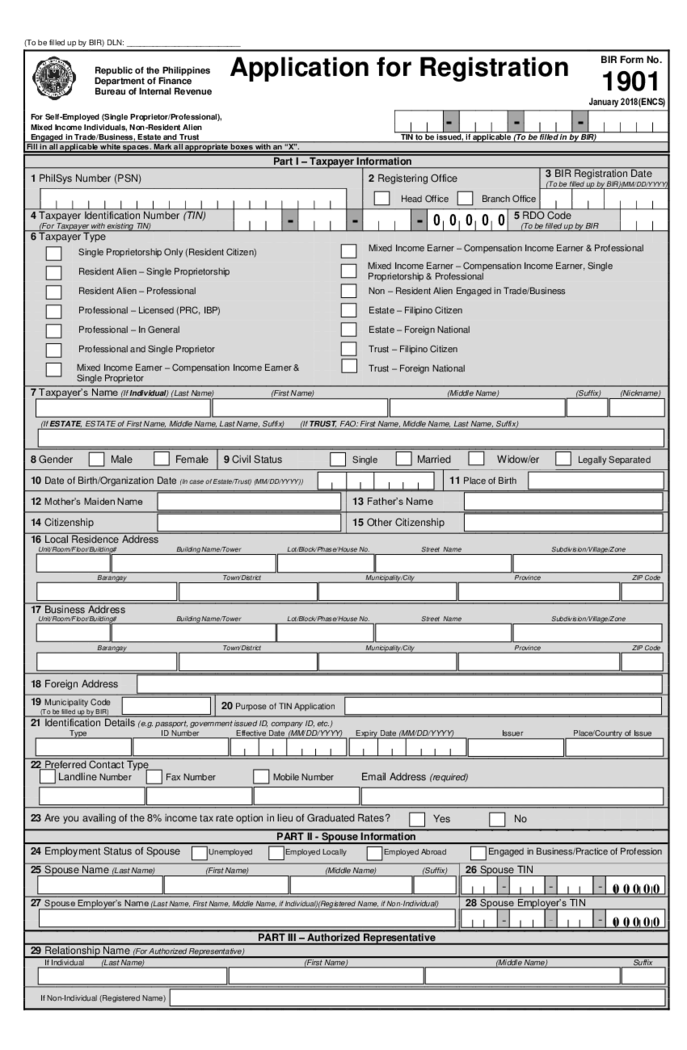

BIR Form 1901

What Is the BIR Form 1901?

The BIR form 1901 is a document required by the Philippines' Bureau of Internal Revenue for registering and applying for a Taxpayer Identification Number. This form is essential for self-employed individuals, mixed-income ea

BIR Form 1901

What Is the BIR Form 1901?

The BIR form 1901 is a document required by the Philippines' Bureau of Internal Revenue for registering and applying for a Taxpayer Identification Number. This form is essential for self-employed individuals, mixed-income ea

-

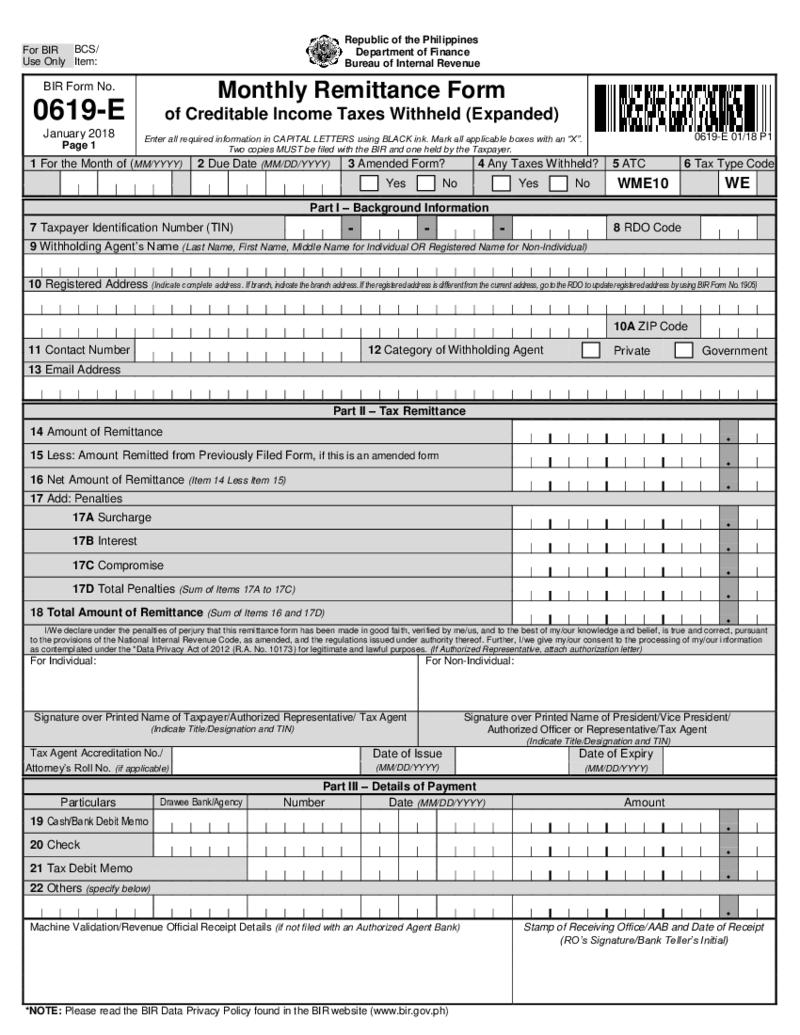

BIR Form 0619-E

What Is BIR Form 0619 E

Also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded), BIR Form 0619 E is a crucial tax doc used by corporations, partnerships, and non-individual taxpayers in the Philippines. It serves to report t

BIR Form 0619-E

What Is BIR Form 0619 E

Also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded), BIR Form 0619 E is a crucial tax doc used by corporations, partnerships, and non-individual taxpayers in the Philippines. It serves to report t

-

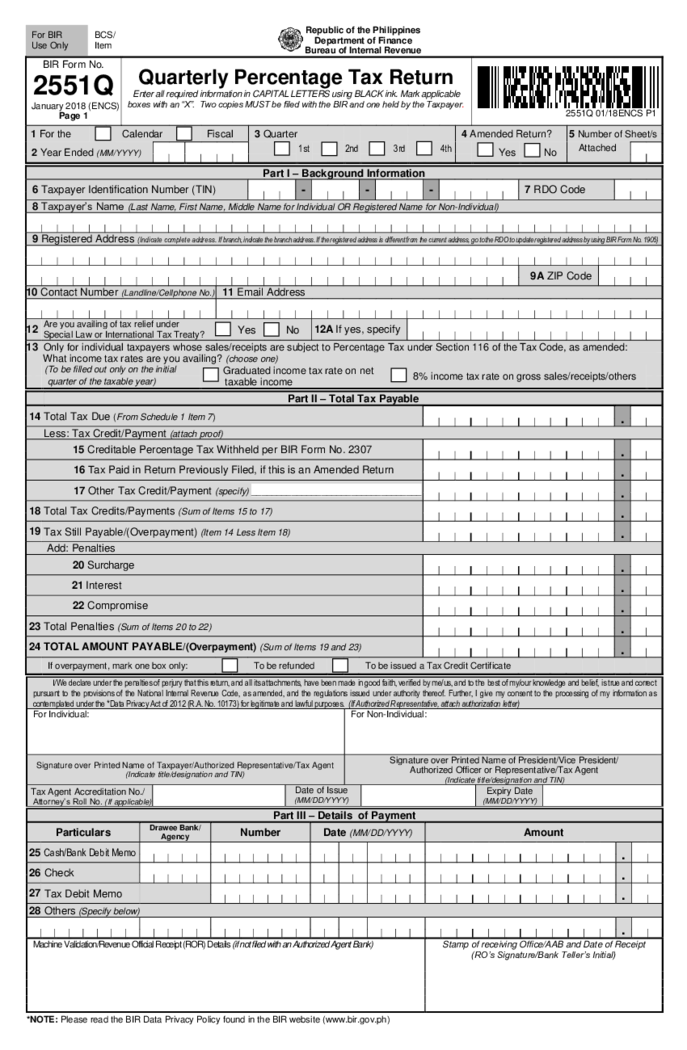

BIR Form 2551Q

Understanding tax forms is crucial for any individual or business. One such essential document is the BIR Form 2551Q. With the help of PDFliner, downloading and editing this form becomes a breeze. This guide will provide you with a comprehensive overview of BIR Form

BIR Form 2551Q

Understanding tax forms is crucial for any individual or business. One such essential document is the BIR Form 2551Q. With the help of PDFliner, downloading and editing this form becomes a breeze. This guide will provide you with a comprehensive overview of BIR Form

-

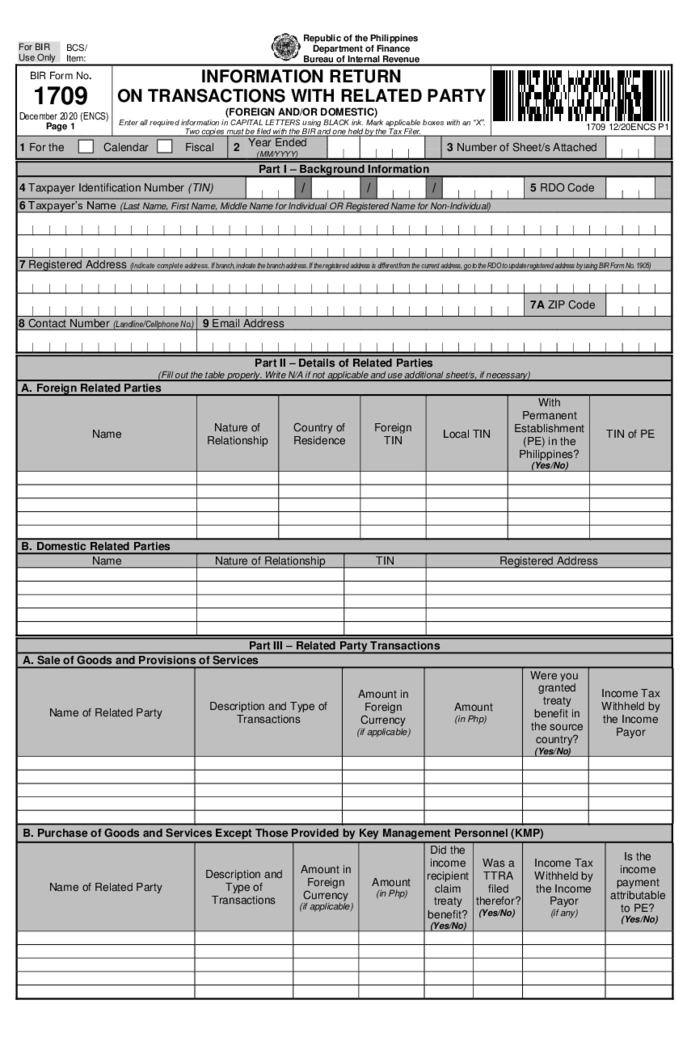

BIR Form 1709

Complete Guide to BIR Form 1709: Everything You Need to Know

Often, taxpayers encounter numerous forms in their tax filing journey. One of them is the BIR form 1709. This document is also known as the Information Return on Related Party Transactions and i

BIR Form 1709

Complete Guide to BIR Form 1709: Everything You Need to Know

Often, taxpayers encounter numerous forms in their tax filing journey. One of them is the BIR form 1709. This document is also known as the Information Return on Related Party Transactions and i

-

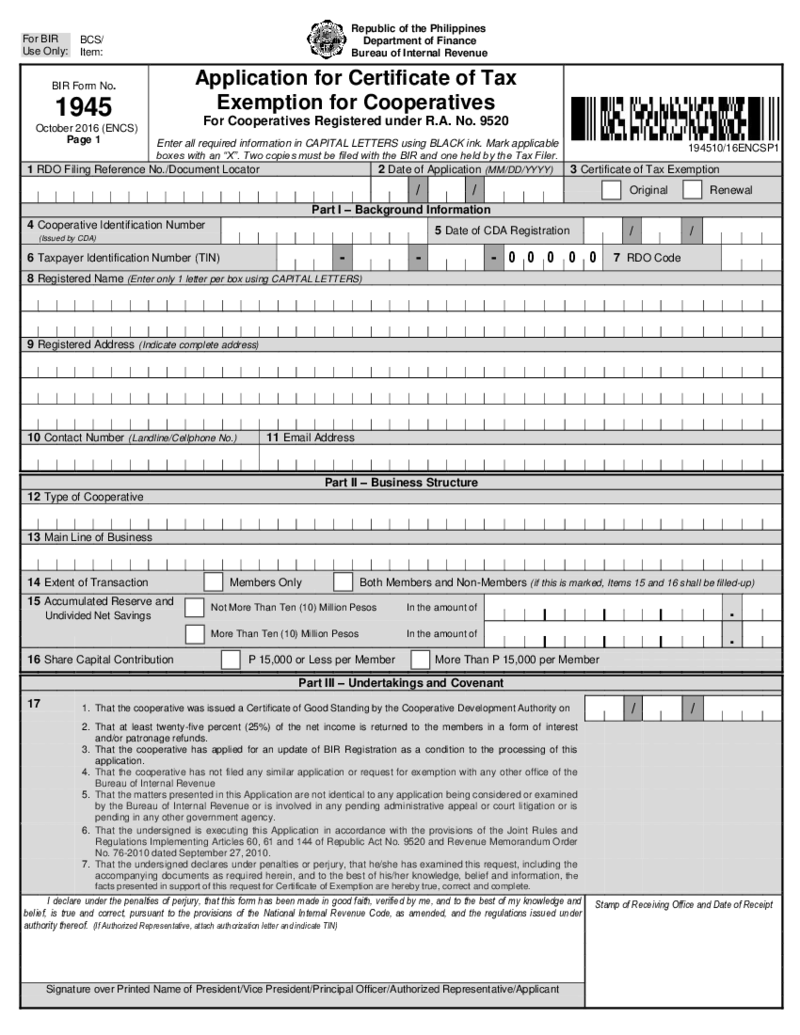

BIR Form 1945

Understanding BIR Form 1945 and Its Importance

The BIR Form 1945 is a crucial document that every taxpayer in the Philippines should be familiar with. This legal document outlines the penalties and charges that can be applied to a taxpayer for various inf

BIR Form 1945

Understanding BIR Form 1945 and Its Importance

The BIR Form 1945 is a crucial document that every taxpayer in the Philippines should be familiar with. This legal document outlines the penalties and charges that can be applied to a taxpayer for various inf

-

BIR Form 2000

Understanding the 2000 BIR Form

The 2000 BIR Form is a document specifically constructed by the Bureau of Internal Revenue (BIR) in the Philippines. This tax return form is used for Documentary Stamp Tax (DST) on: Lease and other hiring arrangements, Char

BIR Form 2000

Understanding the 2000 BIR Form

The 2000 BIR Form is a document specifically constructed by the Bureau of Internal Revenue (BIR) in the Philippines. This tax return form is used for Documentary Stamp Tax (DST) on: Lease and other hiring arrangements, Char

-

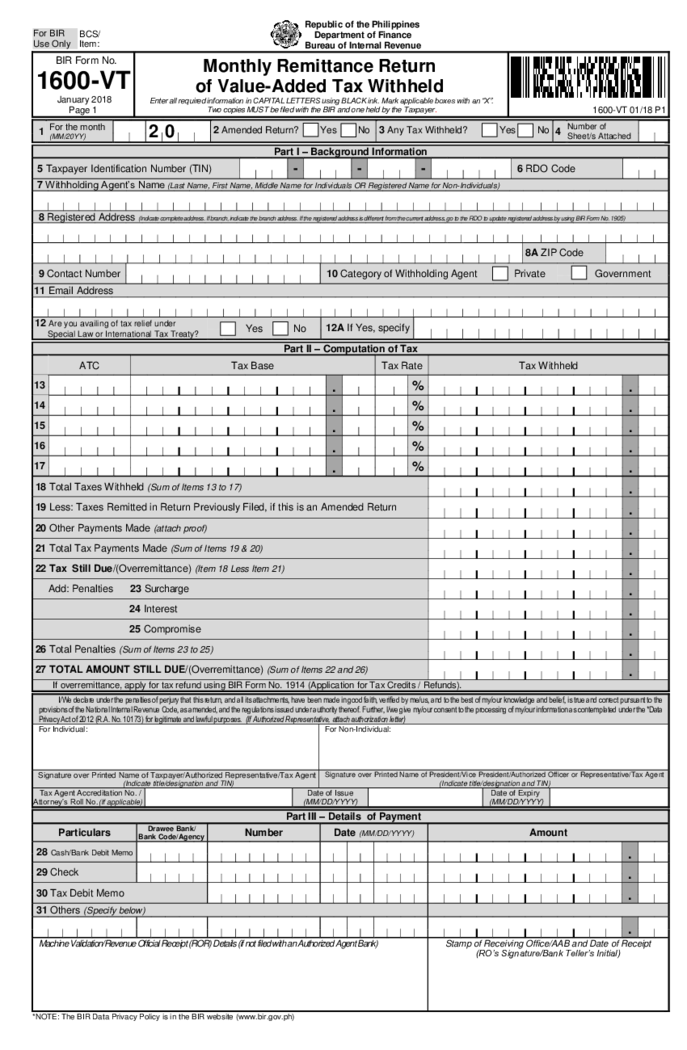

BIR 1600-VT

What Is BIR Form 1600-VT

Also referred to as Monthly Remittance Return of Value-Added Tax Withheld, BIR Form 1600-VT is a document used in the Philippines to report and remit value-added tax (VAT) withheld from payments made to suppliers or service provid

BIR 1600-VT

What Is BIR Form 1600-VT

Also referred to as Monthly Remittance Return of Value-Added Tax Withheld, BIR Form 1600-VT is a document used in the Philippines to report and remit value-added tax (VAT) withheld from payments made to suppliers or service provid

-

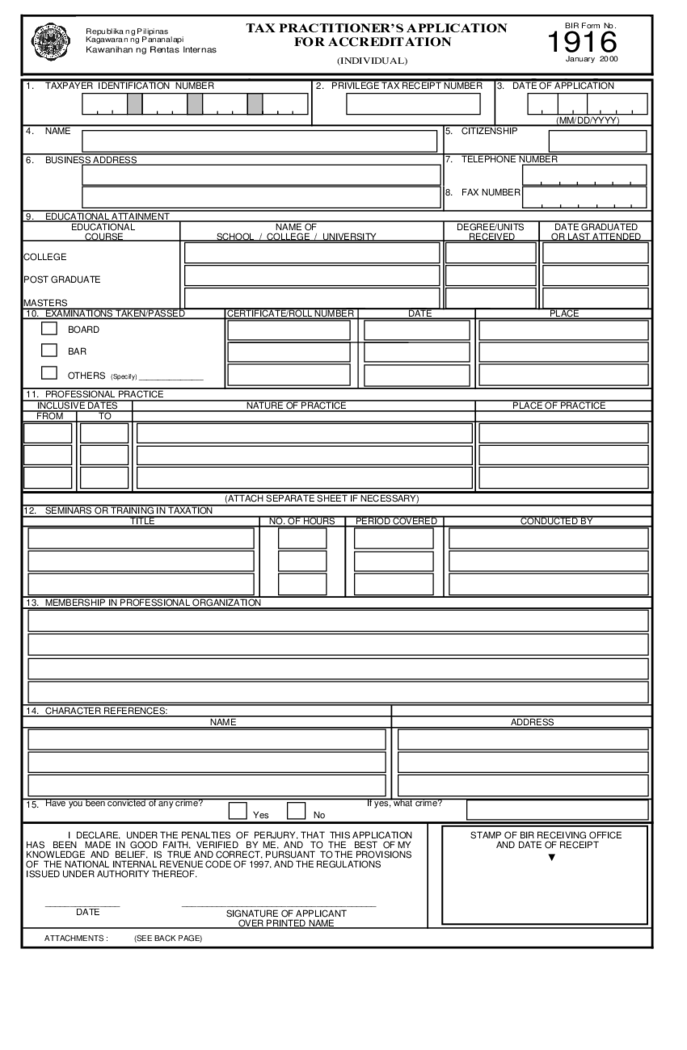

BIR Form 1916

Understanding the BIR Form 1916 and its purpose is crucial for businesses and individuals in the Philippines. This comprehensive guide will equip you with everything you need to know about this document.

Why You Need A BIR Form 1916

The BIR Form

BIR Form 1916

Understanding the BIR Form 1916 and its purpose is crucial for businesses and individuals in the Philippines. This comprehensive guide will equip you with everything you need to know about this document.

Why You Need A BIR Form 1916

The BIR Form

-

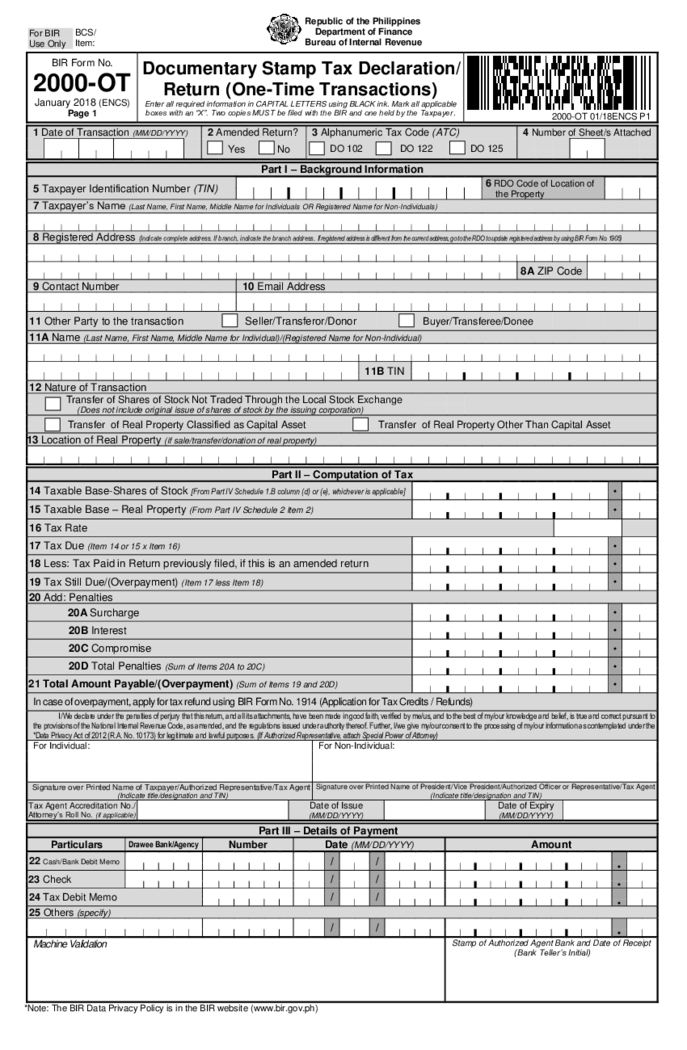

BIR Form 2000-OT

What BIR Form 2000 OT Is All About?

This specific form caters to specific transactions which include the issuance of certificates, debt instruments, bank checks, drafts, and acceptance of bills of exchange, among others. It also includes the assignment of

BIR Form 2000-OT

What BIR Form 2000 OT Is All About?

This specific form caters to specific transactions which include the issuance of certificates, debt instruments, bank checks, drafts, and acceptance of bills of exchange, among others. It also includes the assignment of