-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

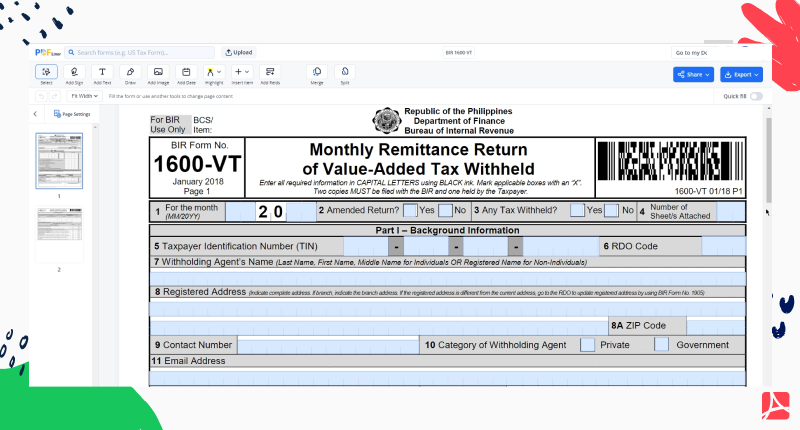

BIR 1600-VT

Get your BIR 1600-VT in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is BIR Form 1600-VT

Also referred to as Monthly Remittance Return of Value-Added Tax Withheld, BIR Form 1600-VT is a document used in the Philippines to report and remit value-added tax (VAT) withheld from payments made to suppliers or service providers. This doc is typically submitted by withholding agents, such as businesses and government agencies, to the Bureau of Internal Revenue (BIR) on a monthly basis. It ensures proper reporting and compliance with VAT regulations.

What Is 1600 VT BIR Form Used For

The document serves a vital function in the Philippine tax system, specifically related to value-added tax withholding. Its main uses include:

- reporting VAT withheld: businesses and government agencies report the VAT withheld from payments to suppliers or service providers;

- remittance of VAT: the form facilitates the remittance of the withheld VAT to the BIR;

- ensuring tax compliance: the doc helps ensure accurate reporting and compliance with VAT regulations, contributing to a fair and efficient tax system.

How to Fill Out BIR Form 1600 VT

Filling out the file online using the PDFLiner online editor is a convenient and efficient process. Follow these 9 vital steps for accurate completion:

- Visit the PDFLiner website and find the BIR Form 1600-VT template in the vast template gallery.

- Click on the template to open it in the PDFLiner online editor.

- Enter the taxpayer's name, TIN, RDO code, and other necessary information.

- Fill in the withholding agent's name, TIN, address, and contact details.

- Enter the total VAT withheld from payments made to suppliers or service providers.

- If applicable, compute penalties and interest on late or underpaid VAT.

- Thoroughly review all entries for accuracy and completeness.

- Electronically sign the form using PDFLiner's e-signature feature.

- Save the completed form to your device or directly submit it online to the BIR.

Using the PDFLiner online editor simplifies the process, ensuring accurate completion of BIR Form 1600-VT for proper VAT reporting and remittance. Our digital file management system was designed with your convenience and effortlessness in mind.

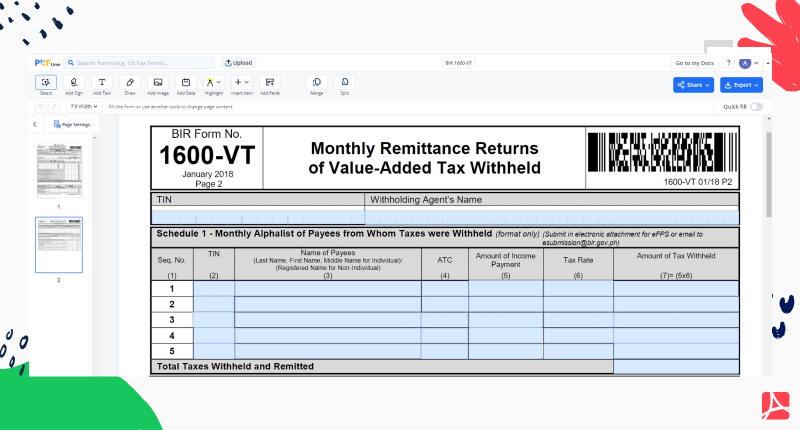

How to File BIR Form 1600-VT

Once you've completed the file, submitting it is a straightforward process. First, ensure all required details are filled accurately, including taxpayer and withholding agent information. Next, attach supporting documents such as receipts and invoices that verify the VAT withheld. Double-check the form for any errors or omissions. Finally, submit the form and supporting documents to the nearest Revenue District Office (RDO) or through the designated online platform the BIR provides. Keep copies of the resulting doc and supporting files for your personal records.

Fillable online BIR 1600-VT