-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Form 2307

Get your BIR Form 2307 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is BIR Form No. 2307?

BIR form 2307 meaning is simple, it's the document that must be filled by employees who do the freelance job, and employers who order work from freelancers. It is also called a Certificate of Creditable Tax Withheld At Source.

What I need 2307 BIR form for?

You need to fill the form if you order or accept the freelance job. Together with BIR Form 2307 new version, you also need to submit the following documents:

- Quarterly/Annual Income Tax Return – BIR Forms 1701Q / 1701 for individuals or BIR Form 1702Q/ 1702 for non-individuals;

- Quarterly Percentage Tax return (BIR Form No. 2551M and 2551Q) — for Percentage Taxes on Government Money Payments;

- Monthly VAT Declaration (BIR Form No. 2550M) and Quarterly VAT Return (BIR Form No. 2550Q) — for VAT Withholding.

Filling out BIR Form No. 2307

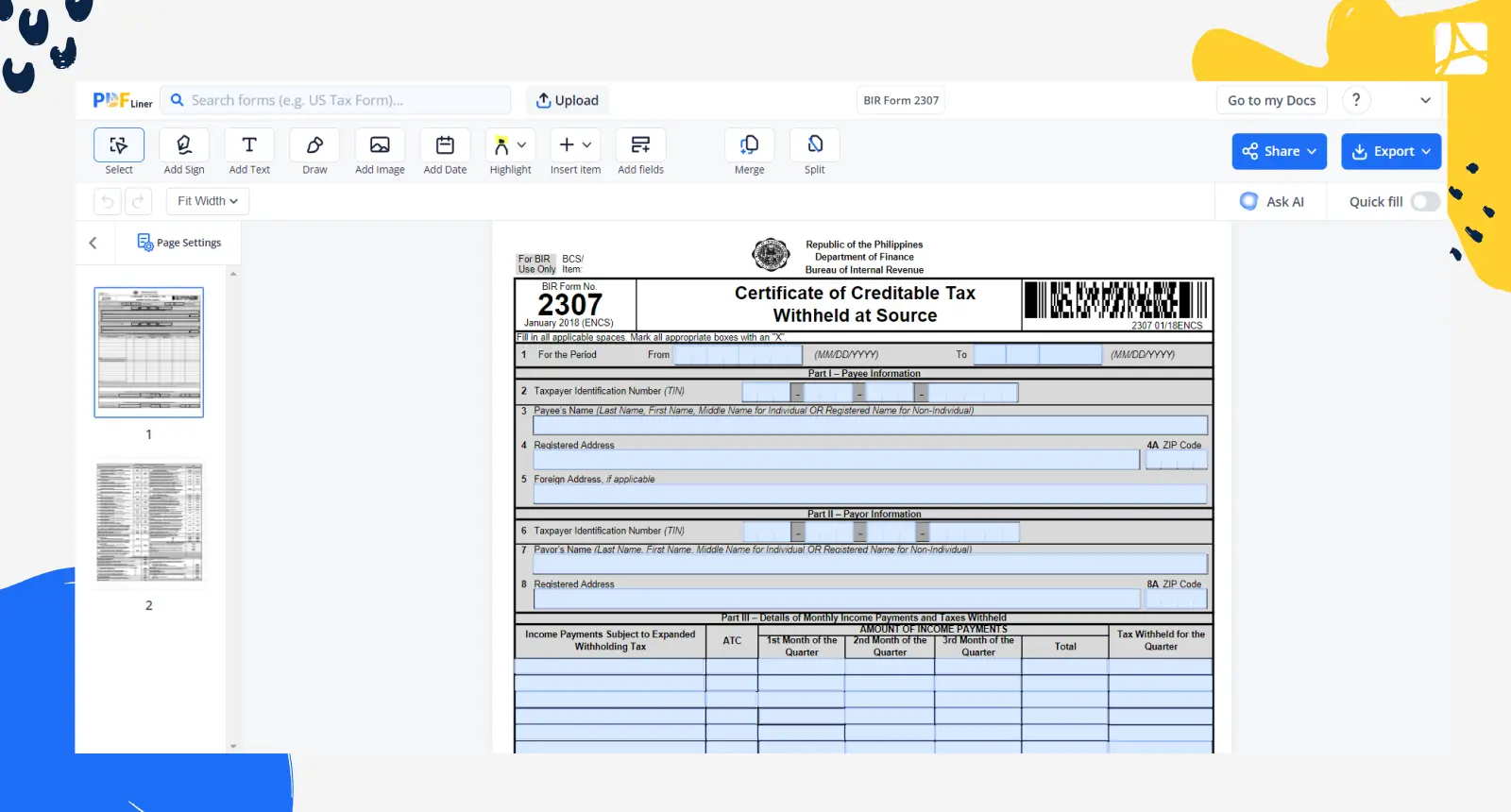

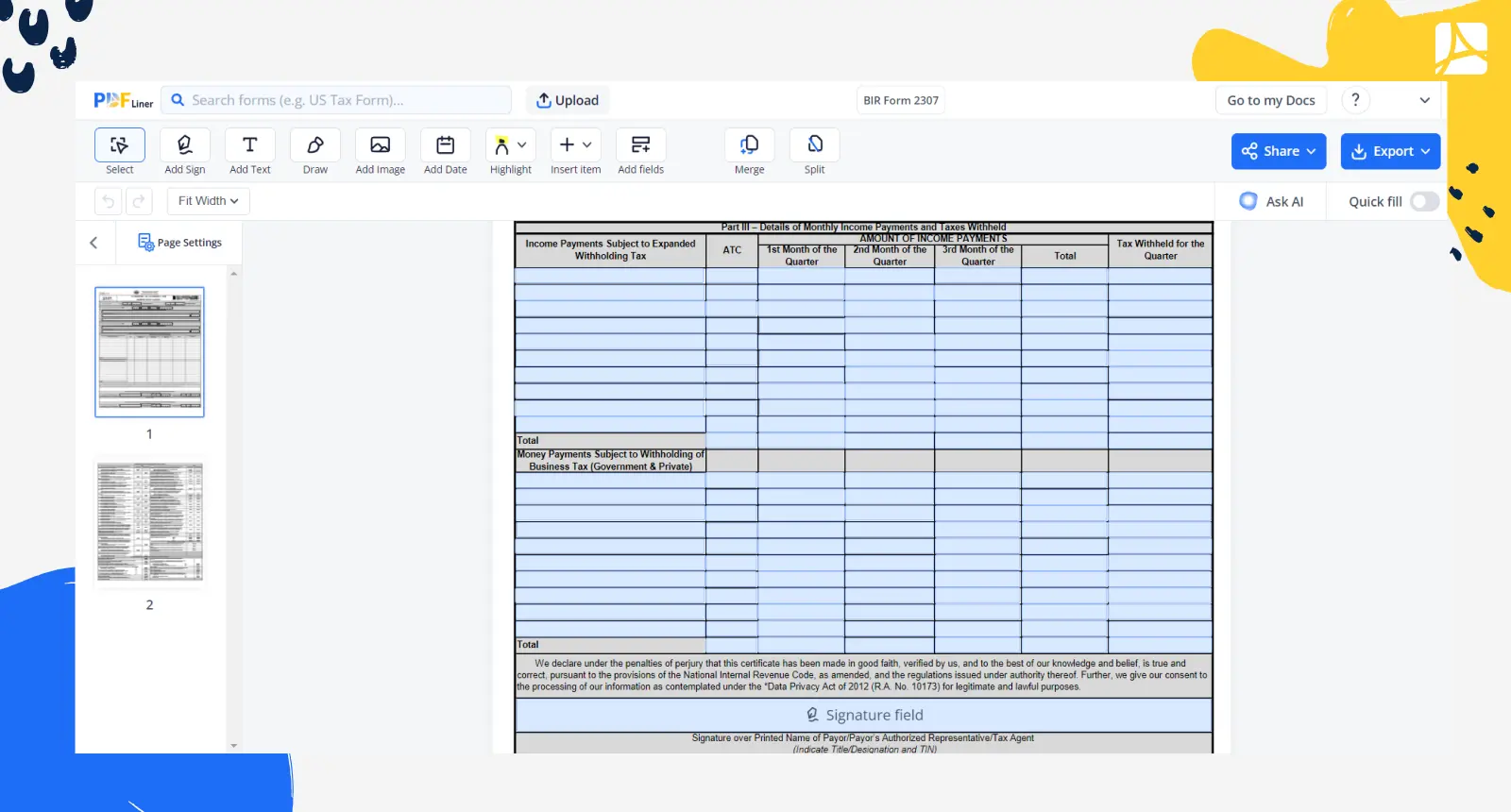

The form has only one page. In addition, there are also the Schedules of Alphanumeric Tax Codes. BIR Form No.2307 has two parts:

- Part I contains the questions about payee and payor, such as TIN, name, and full address;

- Part II covers the details of monthly income payments and taxes that were withheld throughout the quarter. The table divides into two parts: income payments subject to expanded withholding tax and money payment subject to withholding of business tax. The amount of income payments table includes the columns related to each month in the quarter.

On the bottom of the document, both sides representatives have to put their signatures alongside the Tax Agent Accreditation representative’s signature. See a BIR form 2307 sample to visualize the filled document.

Organizations that work with BIR form 2307

- Businesses that order a freelance job.

Relevant to BIR 2307 form

w 9 form 2020, ds 11 forms for passports, fillable 1099 misc template

FAQ: Let’s Go Through BIR Form 2307 Popular Questions

-

What is the use of BIR Form 2307?

The BIR form 2307 form is also known as Certificate of Creditable Tax Withheld as Source. This is a certificate that must be completed and supplied to the income subject recipients in order to expand the withholding tax that has been paid by a Withholding Agent or Payor. This form is necessary to apply for the payor in order to withhold the tax agent for the payee. The document is addressed to the EWT paid by the agent.

-

How to compute BIR form 2307?

It is easy to get lost in the document. You have to learn how to calculate the expenses before completing the form. Once you receive this form, you need to perform the next steps:

- The amount of withholding tax must be accepted as the tax credit on the tax liability income. The form must be submitted along with the annual or quarterly income tax return. Don’t miss the deadlines. Besides, you have to attach it to the EWT, Percentage Tax, and VAT Withholding;

- Mention the numbers in the SAWT;

- State the period you are describing in the form;

- Provide taxpayer number, name of payee, and addresses. The information must be on both payee and payor;

- In part 2 of the form, you have to specify your monthly income numbers.

Fillable online BIR Form 2307 PDF