-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Form 1601-EQ

Get your BIR Form 1601-EQ in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a BIR Form 1601-EQ

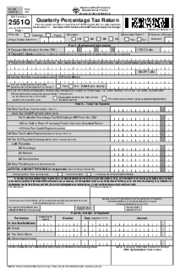

A BIR 1601EQ is also identified as the quarterly remittance return form of Creditable Income Taxes Withheld (Expanded). It is a crucial document issued by the Bureau of Internal Revenue in the Philippines. This form is an integral component of their improved tax filing system designed to streamline the tax computation process for businesses.

This chiefly functions as a BIR payment document that allows professionals and businesses to transfer their creditable income taxes, which have been deductively obtained from their expanded withholding taxes.

For a real-world example, picture that you're a freelance graphic designer. Each time you invoice a client, a certain amount — defined by existing withholding tax rates — is retracted from the payment and becomes a part of your comprehensive withholding taxes. This is somewhat of an advanced payment towards your income taxes that will be credited against your year-end tax liability.

The 1601 EQ form replaced the previous monthly remittance forms, consolidating three monthly payroll tax deductions into a more manageable quarterly format. This form includes an attachment, the SAWT or Summary Alphalist of Withholding Taxes.

When to Use Form 1601-EQ

There are specific situations where you will need to file the 1601-EQ form:

- All withholding agents must use the 1601 EQ version 7 to remit expanded withholding taxes quarterly. This includes individuals, trusts, partnerships, and corporations.

- Expanded withholding taxes include, but are not limited to, rental income, prizes, or professional fees subject to creditable withholding tax.

- If you, as a withholding agent, fail to withhold tax during payroll or withholding, the requirement to file the form still exists. However, you must accomplish it upon remittance of the withholding tax.

- Filing a 1601EQ form is also crucial during the final payment of the purchase or exchange of property. The taxable year when this happens determines the exact filing period.

What is the deadline for 1601EQ

Each quarter of the year has a specified deadline for filing and remitting the 1601EQ form. Here are the details:

- For the first quarter (January to March) - the deadline is on or before April 30.

- For the second quarter (April to June) - the deadline is on or before August 15.

- For the third quarter (July to September) - the deadline is on or before November 15.

- For the fourth quarter (October to December) - the deadline is on or before February 15 of the following year.

How To Fill Out BIR Form 1601 EQ

- To complete the BIR 1601-EQ form, click the "Fill this form" button.

- Identification: Enter your Taxpayer Identification Number (TIN), registered name, and address. File RDO Code, category of the taxpayer, Relevant Date, and line of business/occupation.

- Declaration: Respond to questions regarding substitute filing and whether you avail of the tax relief under Special Law or International Tax Treaty.

- Withholding Agents’ Information: Here, you record the taxes withheld at the source. Don’t forget to provide your name and TIN here.

- Schedule Section: Provide a detailed breakdown of income payments, the corresponding tax rate, and the tax paid for each.

- Summary Section: Tally the total amount of taxes payable for the quarter. If there is an excess from your previous quarter, apply it here.

- 1601EQ Form Download: To download Form 1601 EQ from the PDFLiner website, click the “Export” button in the upper right corner and select the desired format.

These steps will help simplify the tax filing process. PDFLiner streamlines bureaucratic procedures with user-friendly, downloadable forms, making them straightforward and efficient.

Fillable online BIR Form 1601-EQ