-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Pag IBIG Fund Conformity New Subsequent Housing Availment

Get your Pag IBIG Fund Conformity New Subsequent Housing Availment in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Guide to the Pag-IBIG Fund's New Policies for Housing Benefits

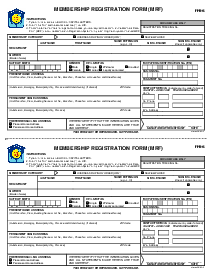

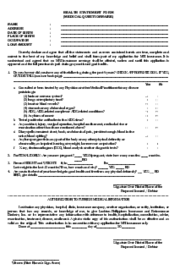

Pag IBIG Fund, a crucial partner in housing finance in the Philippines, offers comfortable payment methods for loans related to housing availment. The agency has now introduced the Pag IBIG Fund Conformity New Subsequent Housing Availment Form, designed to be user-friendly and more streamlined in application. This evolution means that Filipinos, both domestic and abroad, can now avail housing benefits with greater ease and efficiency.

Understanding the Pag IBIG Fund Conformity Form

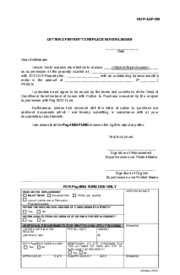

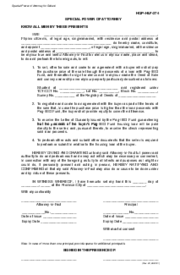

The Pag IBIG Conformity Form is essentially an agreement between the loan applicant and Pag IBIG Fund which outlines the terms and conditions of the housing availment. It includes details such as loan amount, period of availing, interest rates, and payment modes. Moreover, the form helps the Fund assess the loan eligibility of the individual. This essential document can be conveniently accessed and filled out via the PDFliner website.

Pag IBIG Fund in the international arena

Overseas, the Pag IBIG Fund is fully committed to its members, supporting Filipinos worldwide. Among its international offices, the Pag IBIG Fund New York branch stands out due to its active performance in providing services and support to its members in the U.S. It caters to inquiries, processes member contributions and loan repayments, and assists in loan application processes for members in the region.

How to Fill Out Conformity New Subsequent Housing Availment

Here's a detailed guide on how to fill out the Pag-IBIG Fund Conformity on New/Subsequent Housing Availment template on the PDFliner website:

- Begin by entering the current date at the top of the form where it is indicated.

- Address the letter to the appropriate recipient by starting with "Dear Sir/Madam:" and then skip a line to begin the body of the letter.

- Fill in the name of the principal borrower or co-borrower where it says "This refers to the Pag-IBIG housing loan application of Mr./Mrs. __ under the __," which pertains to the specific housing loan program they are applying under.

- In the section that follows, mention the housing loan account number or identifier where indicated as HAN __.

- Provide the borrower's or co-borrower's name again in the section that reads "In this regard, I/we hereby consent and conform with the following cross-default provisions of Mr./Mrs. __ new/subsequent housing loan availment."

- Review the implications of the cross-default policy stated in the numbered sections, ensuring understanding and agreement, as this will affect the existing housing loan accounts in the case of default.

- Complete the form by adding the signatures of all required parties:

- The principal borrower or buyer signs over their printed name at the designated space.

- If applicable, the co-borrower or buyer also signs over their printed name in the provided area.

- Include additional co-borrower or buyer signatures over printed names if more parties are involved in the housing account.

- Double-check all entered information for accuracy and completeness to ensure all fields are filled correctly and no essential details are omitted.

Fillable online Pag IBIG Fund Conformity New Subsequent Housing Availment