-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Pag IBIG Fund Application for Housing Loan Revaluation Under

Get your Pag IBIG Fund Application for Housing Loan Revaluation Under in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Pag-IBIG Housing Loan: A Guide for Filipino Homeowners

Are you a Filipino citizen considering applying for a housing loan? Are you aware of the Pag-IBIG fund and how it can aid you in your quest for homeownership? In this comprehensive guide, we will explore the Pag-IBIG Housing Loan, its application process, eligibility criteria, and more. Stay tuned for detailed, simple, and user-friendly information.

Understanding Pag-IBIG Fund and Housing Loans

The Pag-IBIG fund, also known as the Home Development Mutual Fund (HDMF), is a government initiative to provide affordable housing loans to Filipino citizens. This scheme offers reasonable interest rates and flexible repayment options, making it a preferred choice for housing finance.

Eligibility Criteria for a Pag-IBIG Housing Loan

| Eligibility Criteria | Description |

|---|---|

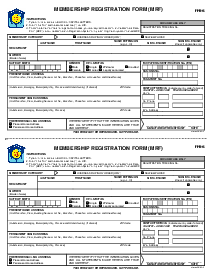

| Membership Status | Applicant must be an active member of Pag-IBIG for at least 24 months. |

| Age | Applicant must be below 65 years at the time of loan application and below 70 at loan maturity. |

Step-wise Process to Apply for a Pag-IBIG Housing Loan

- Secure all necessary requirements and complete the Pag-IBIG Housing Loan form.

- Submit the accomplished form and required documents to the nearest Pag-IBIG branch.

- Wait for the loan approval, which usually takes about 20 working days.

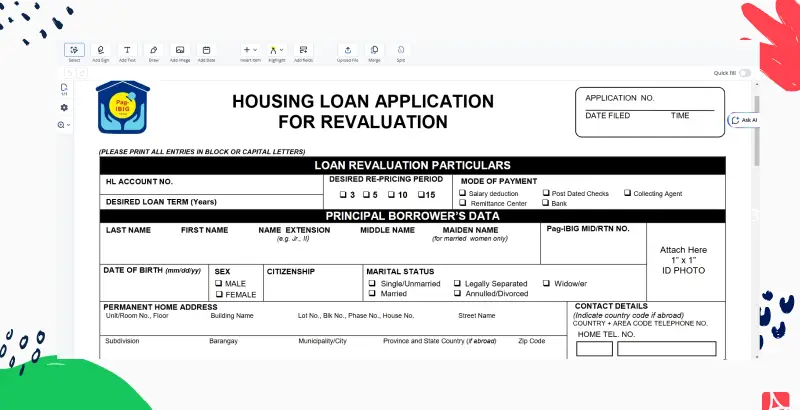

How to Fill the Pag-IBIG Housing Loan Form

This step-by-step guide will walk you through the process of filling out the Pag-IBIG Housing Loan form.

- Provide your Pag-IBIG Membership Identification (MID) number.

- Fill in your personal information, including full name, address, and contact details.

- Detail your employment information and income details.

Understanding Conformity on New/Subsequent Housing Availment

Conformity in housing availment means adhering to the Pag-IBIG Fund's policies for securing a new or subsequent housing loan. Ensure your application aligns with the fund's guidelines to increase your chances of approval.

Information about HDMF Housing Loan

The HDMF Housing loan is another government initiative similar to the Pag-IBIG Housing Loan. Both offer Filipino citizens affordable homeownership opportunities. Comparatively, they have similar interest rates and loan terms.

How to Apply Pag-IBIG Loan Online

- Visit the official Pag-IBIG Fund website.

- Navigate to the Services tab and click on 'Apply for Housing Loan'.

- Fill in the necessary details and upload the required documents.

- Submit your application and wait for an email confirmation.

Conclusion

Applying for a Pag-IBIG Housing Loan doesn't have to be a daunting task. With detailed guidance, a bit of patience, and adherence to the guidelines, homeownership is within your reach.

FAQ:

-

Who can apply for a Pag-IBIG Housing Loan?

All active Pag-IBIG members who have made at least 24 monthly contributions can apply.

-

What is the maximum loan amount I can avail?

The maximum loan amount is PHP 6 million depending on your contributory capacity.

-

Can I pay off my Pag-IBIG Housing Loan early?

Yes, you can settle your loan fully anytime without any pre-payment penalty.

Fillable online Pag IBIG Fund Application for Housing Loan Revaluation Under