-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

1040 forms - page 5

-

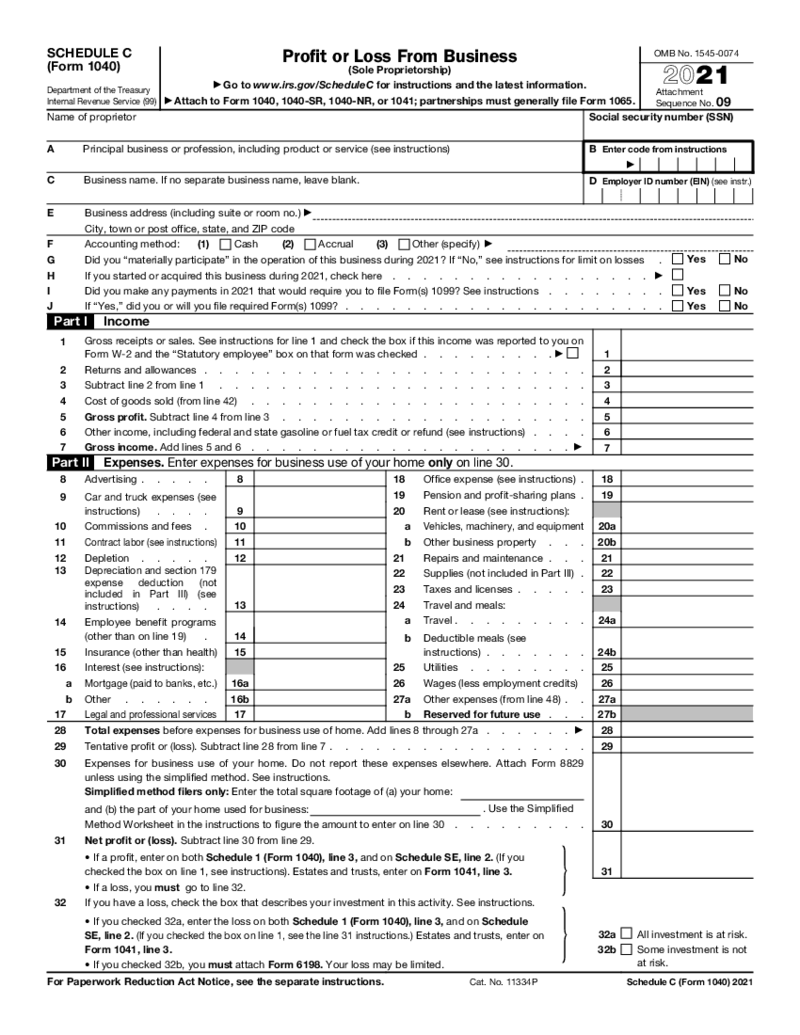

SCHEDULE C (Form 1040) (2021)

What Is Schedule C (Form 1040) for 2021 tax year

The 2021 Schedule C is structured to capture comprehensive details about a taxpayer’s business income and expenses. Here are the primary components:

General Information: The for

SCHEDULE C (Form 1040) (2021)

What Is Schedule C (Form 1040) for 2021 tax year

The 2021 Schedule C is structured to capture comprehensive details about a taxpayer’s business income and expenses. Here are the primary components:

General Information: The for

-

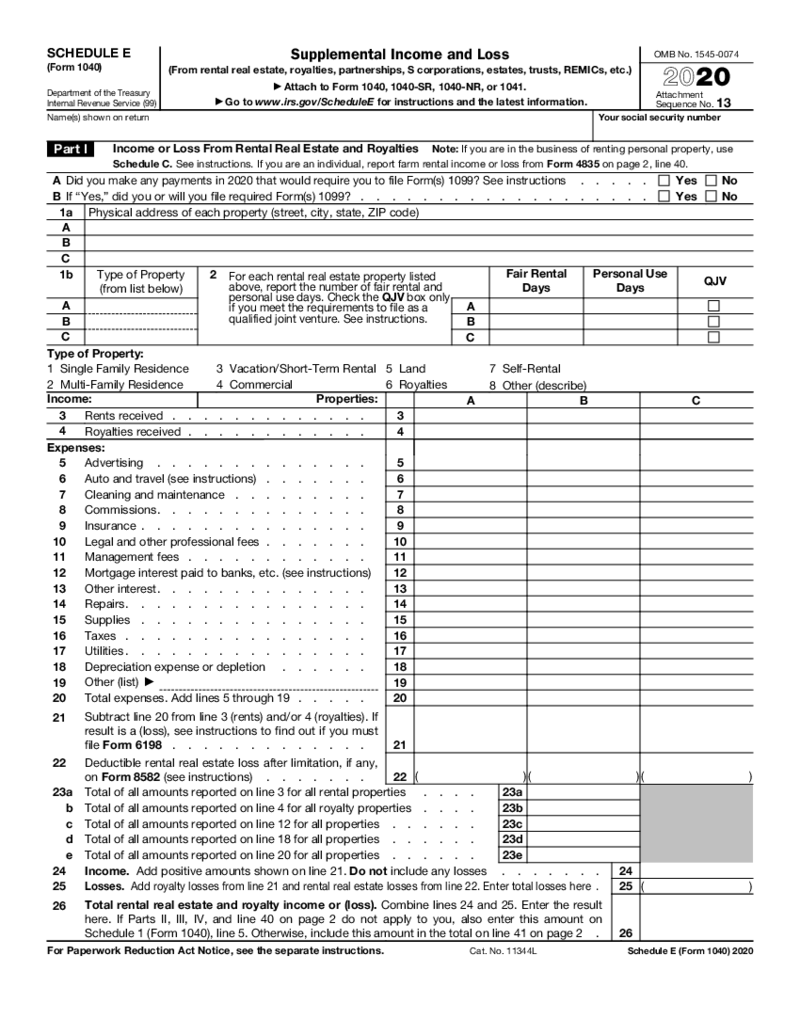

Form 1040 Schedule E (2020)

What Is a Form 1040 Schedule E 2020

Form 1040 Schedule E for 2020 is a tax document used by individuals to report their income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. T

Form 1040 Schedule E (2020)

What Is a Form 1040 Schedule E 2020

Form 1040 Schedule E for 2020 is a tax document used by individuals to report their income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. T

-

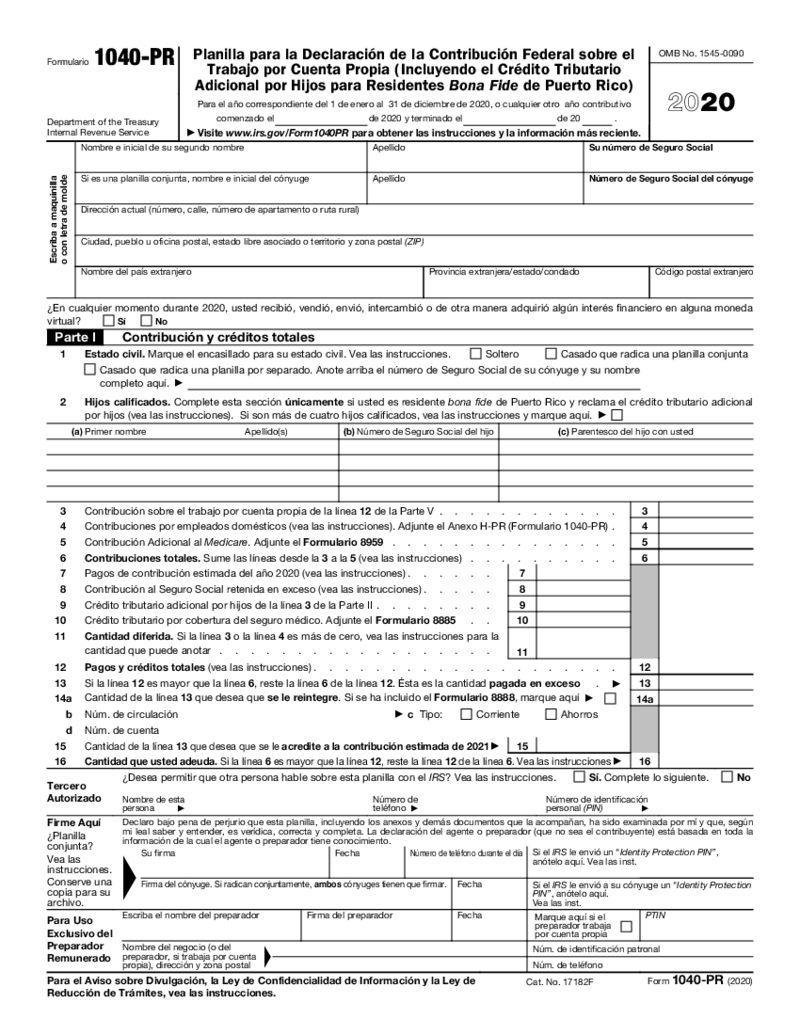

Form 1040-PR (2020)

What Is Form 1040 PR 2020

Form 1040 PR 2020 is a tax document utilized by Puerto Rican residents to report their self-employment income along with calculating their contributions to Social Security and Medicare. This specific form serves as a critical too

Form 1040-PR (2020)

What Is Form 1040 PR 2020

Form 1040 PR 2020 is a tax document utilized by Puerto Rican residents to report their self-employment income along with calculating their contributions to Social Security and Medicare. This specific form serves as a critical too

-

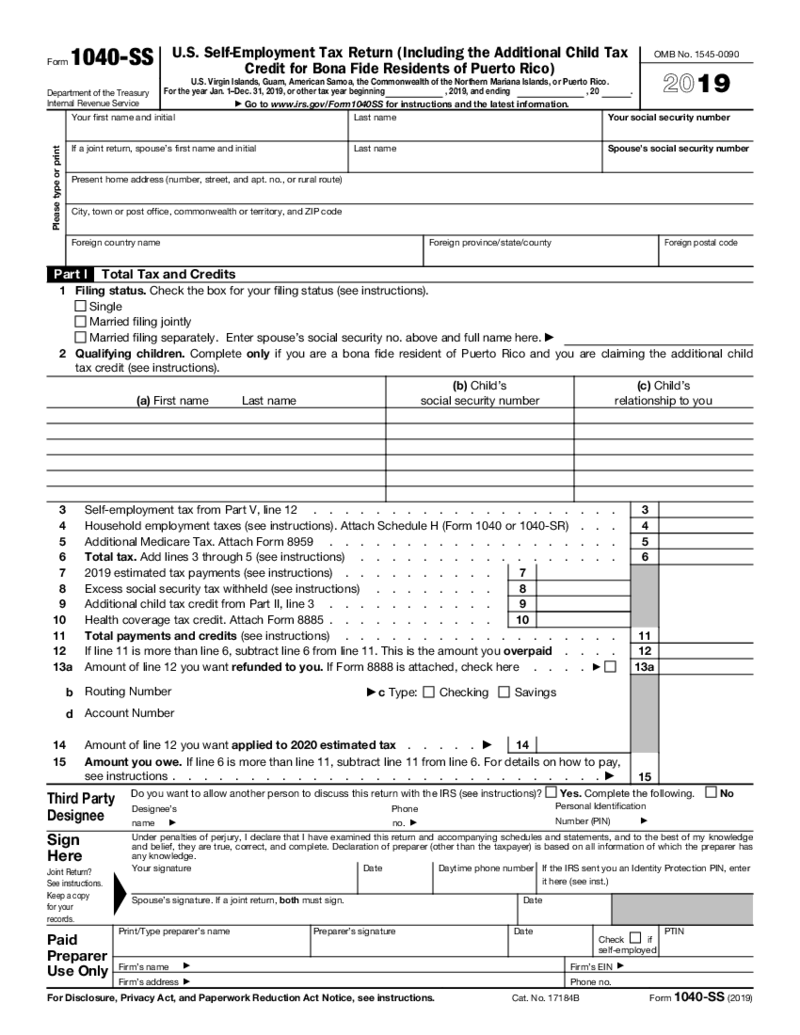

Form 1040-SS (2019)

What Is Form 1040 SS

For individuals residing in the United States, tax documentation often involves understanding and completing various forms during tax season. Form 1040-SS is a crucial document geared towards particular groups of taxpayers. Essentiall

Form 1040-SS (2019)

What Is Form 1040 SS

For individuals residing in the United States, tax documentation often involves understanding and completing various forms during tax season. Form 1040-SS is a crucial document geared towards particular groups of taxpayers. Essentiall

-

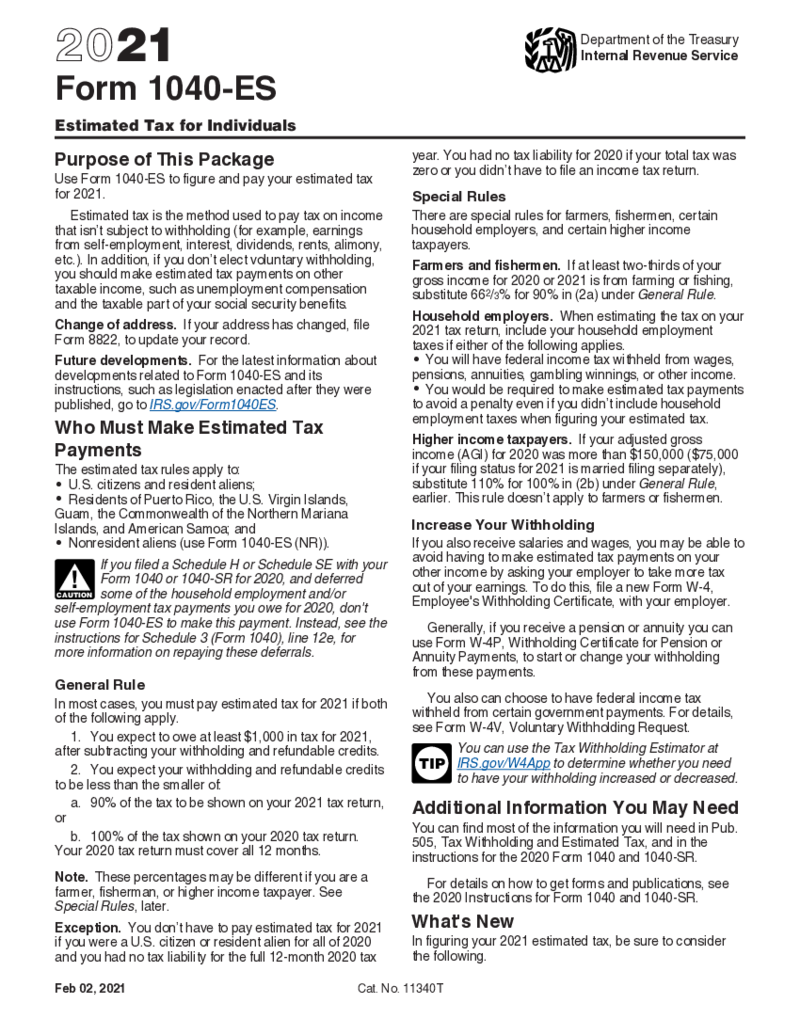

Form 1040-ES (2021)

What Is Form 1040 ES 2021?

Form 1040-ES, also known as the Estimated Tax for Individuals, is a form taxpayers use to pay estimated taxes to the IRS on income that is not subject to withholding. This could include income from self-employment, dividends, re

Form 1040-ES (2021)

What Is Form 1040 ES 2021?

Form 1040-ES, also known as the Estimated Tax for Individuals, is a form taxpayers use to pay estimated taxes to the IRS on income that is not subject to withholding. This could include income from self-employment, dividends, re

-

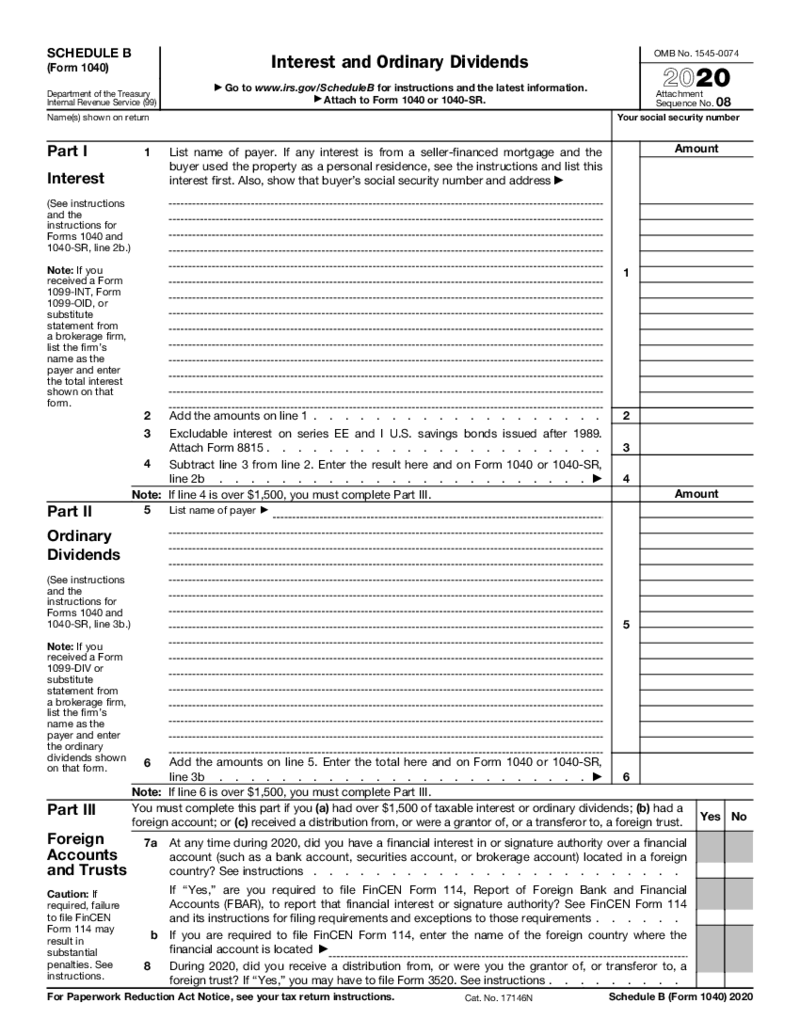

Schedule B - Form 1040 (2020)

What Is Schedule B Form 1040 for 2020?

Schedule B is an IRS document that pertains to the comprehensive Form 1040. It's primarily used to report interest and ordinary dividends exceeding $1,500 for the tax year 2020. It's crucial not only for indi

Schedule B - Form 1040 (2020)

What Is Schedule B Form 1040 for 2020?

Schedule B is an IRS document that pertains to the comprehensive Form 1040. It's primarily used to report interest and ordinary dividends exceeding $1,500 for the tax year 2020. It's crucial not only for indi

-

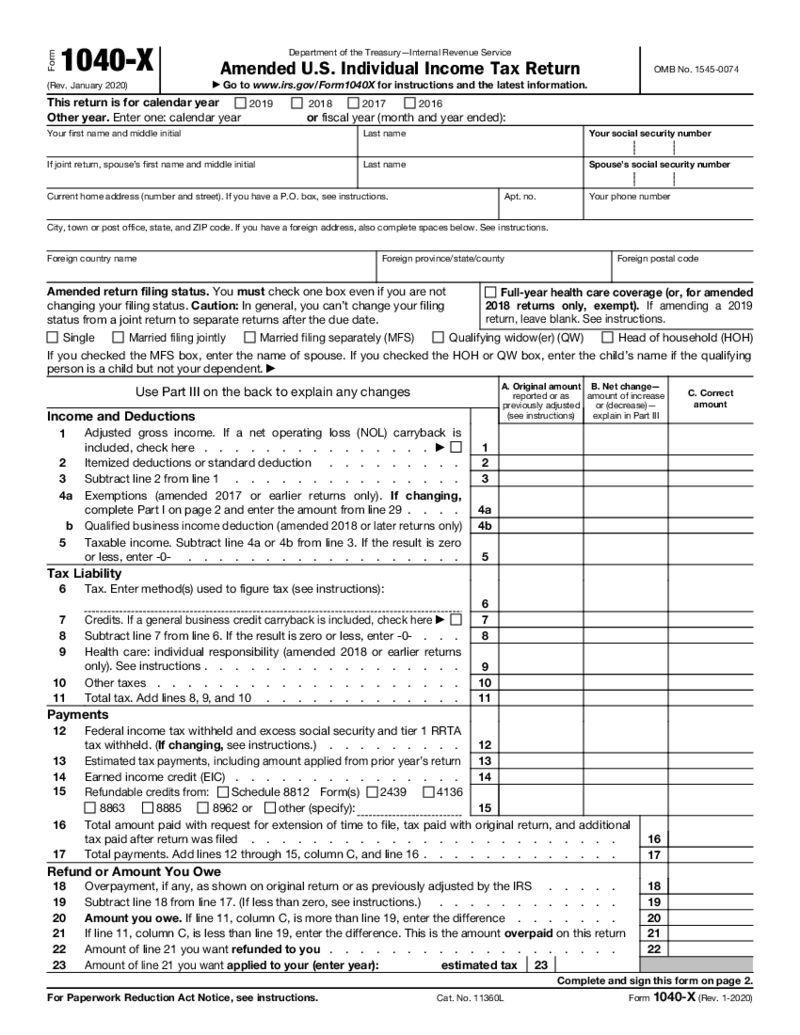

Form 1040-X (2020)

What Is 1040 X Form 2020?

Form 1040-X is known as the Amended U.S. Individual Income Tax Return. It's a revised version of the original tax return that allows individuals to correct their income, deductions, and tax credits for a specific tax year. Fo

Form 1040-X (2020)

What Is 1040 X Form 2020?

Form 1040-X is known as the Amended U.S. Individual Income Tax Return. It's a revised version of the original tax return that allows individuals to correct their income, deductions, and tax credits for a specific tax year. Fo

-

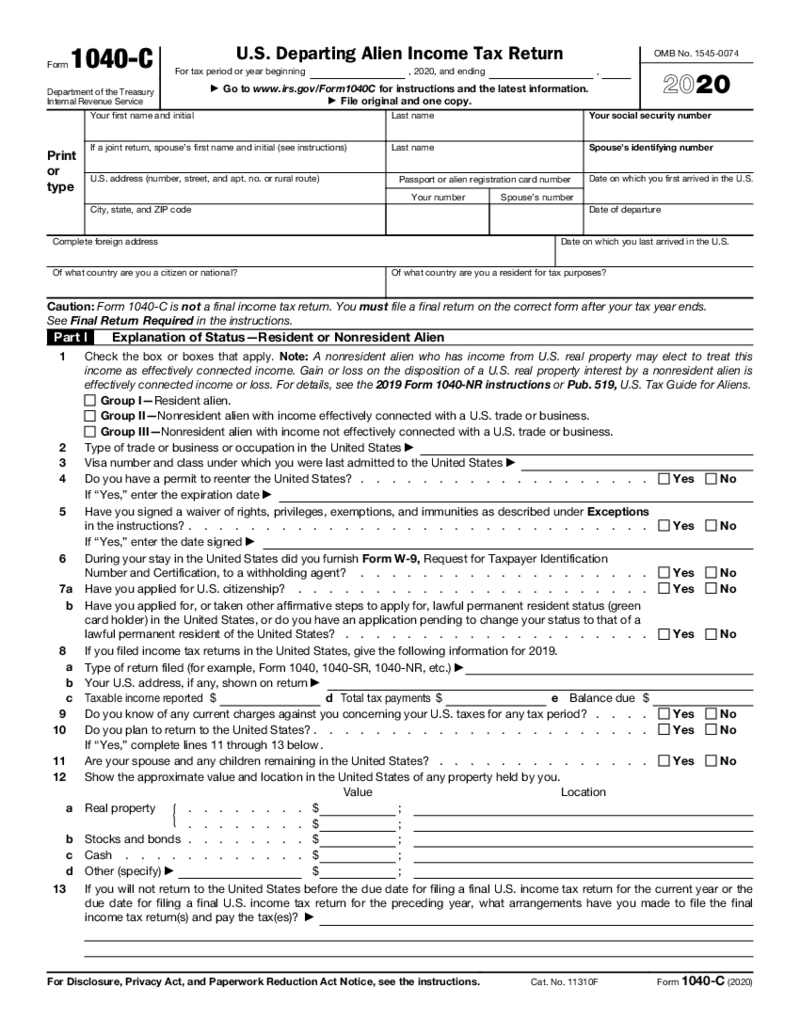

Form 1040-C (2020)

What Is Form 1040 C 2020?

Form 1040-C, also known as the U.S. Departing Alien Income Tax Return, is not a final tax return, but rather an estimate of tax liability for nonresident aliens who intend to leave the United States or its territories. It's p

Form 1040-C (2020)

What Is Form 1040 C 2020?

Form 1040-C, also known as the U.S. Departing Alien Income Tax Return, is not a final tax return, but rather an estimate of tax liability for nonresident aliens who intend to leave the United States or its territories. It's p

-

Form 1040-NR (2019)

What Is a Form 1040 NR 2019

Form 1040 NR 2019 is an Internal Revenue Service (IRS) form tailored for nonresident aliens engaged in business in the United States or otherwise earning income from U.S. sources. This form al

Form 1040-NR (2019)

What Is a Form 1040 NR 2019

Form 1040 NR 2019 is an Internal Revenue Service (IRS) form tailored for nonresident aliens engaged in business in the United States or otherwise earning income from U.S. sources. This form al

-

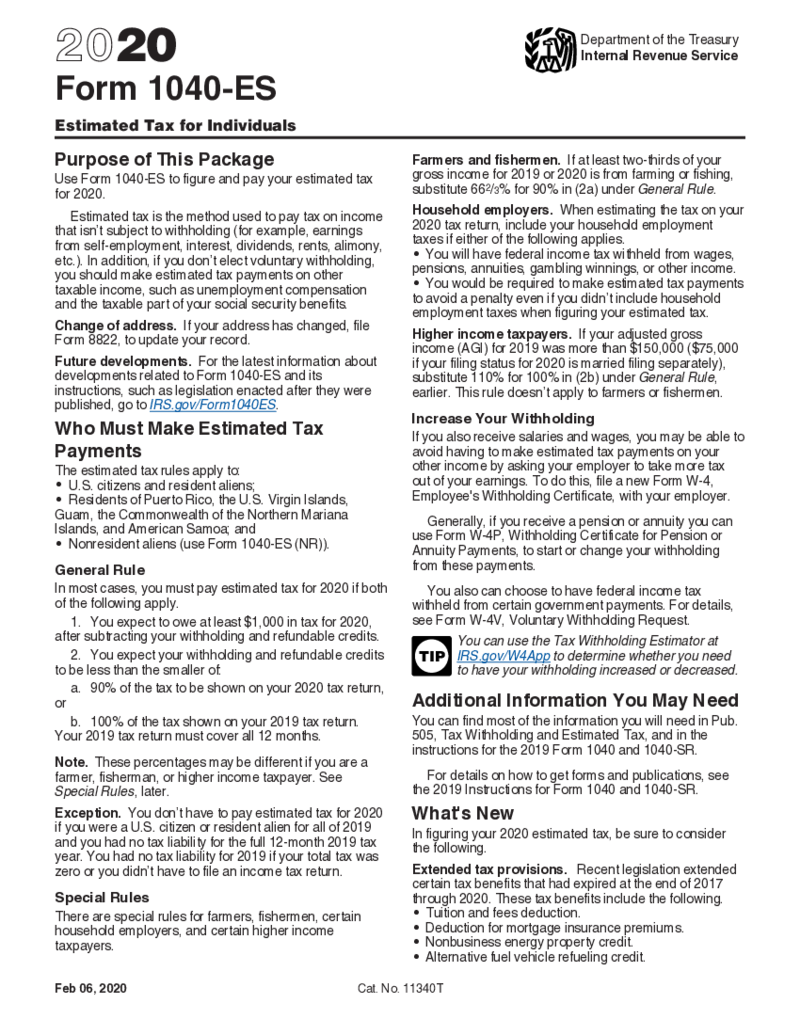

Form 1040-ES (2020)

What Is Form 1040 ES 2020?

Form 1040-ES is used by individuals to estimate their taxes for the year and make payments on a quarterly basis. This form includes a worksheet similar to the one used to determine annual tax in the

Form 1040-ES (2020)

What Is Form 1040 ES 2020?

Form 1040-ES is used by individuals to estimate their taxes for the year and make payments on a quarterly basis. This form includes a worksheet similar to the one used to determine annual tax in the

-

Form 1040-SR (2019)

What Is IRS Form 1040 SR 2019

IRS Form 1040 SR 2019 is a variant of the traditional tax form, specially designed for senior taxpayers aged 65 and older. This form was introduced to simplify tax filing by offering a larger font for easier reading and a sta

Form 1040-SR (2019)

What Is IRS Form 1040 SR 2019

IRS Form 1040 SR 2019 is a variant of the traditional tax form, specially designed for senior taxpayers aged 65 and older. This form was introduced to simplify tax filing by offering a larger font for easier reading and a sta

-

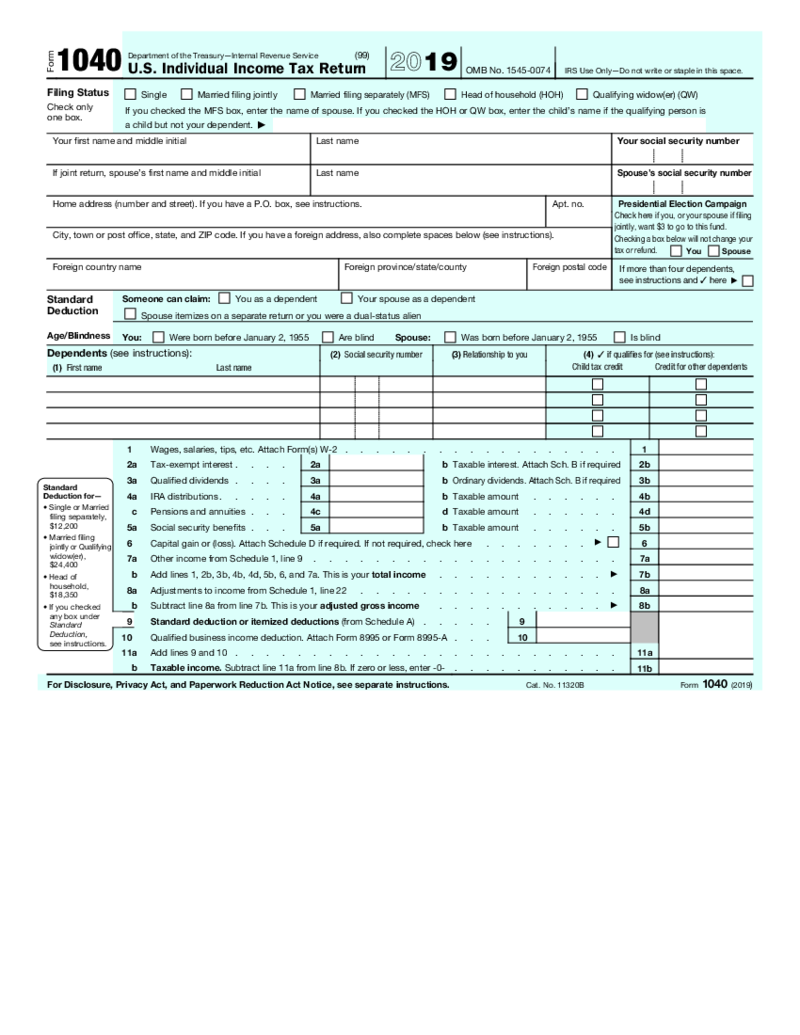

Form 1040 (2019)

What Is a Form 1040 2019

Form 1040 for 2019 is the cornerstone of personal tax filing in the United States, serving as the annual income tax return form for individual taxpayers. It encompasses details on income, deductions, and credits to calculate the o

Form 1040 (2019)

What Is a Form 1040 2019

Form 1040 for 2019 is the cornerstone of personal tax filing in the United States, serving as the annual income tax return form for individual taxpayers. It encompasses details on income, deductions, and credits to calculate the o

FAQ

-

Where can I get blank 1040 forms?

You can get these forms either on our website or on the website of the corresponding tax authorities. The benefit of using PDFLiner for this purpose is that here, you can easily proceed with working on the file by editing it via our digital instruments.

-

What does a 1040 stand for?

It’s a document used for calculating your total assessable earnings and pinpointing the amount to be paid or refunded by the authorities. And it’s one of the most widespread IRS tax forms 1040. Simple as that.

-

How many US taxes forms 1040 are there?

There are more than five popular types of this document. Assess this point in detail in order to determine the type you currently need.