-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

1040 forms - page 2

-

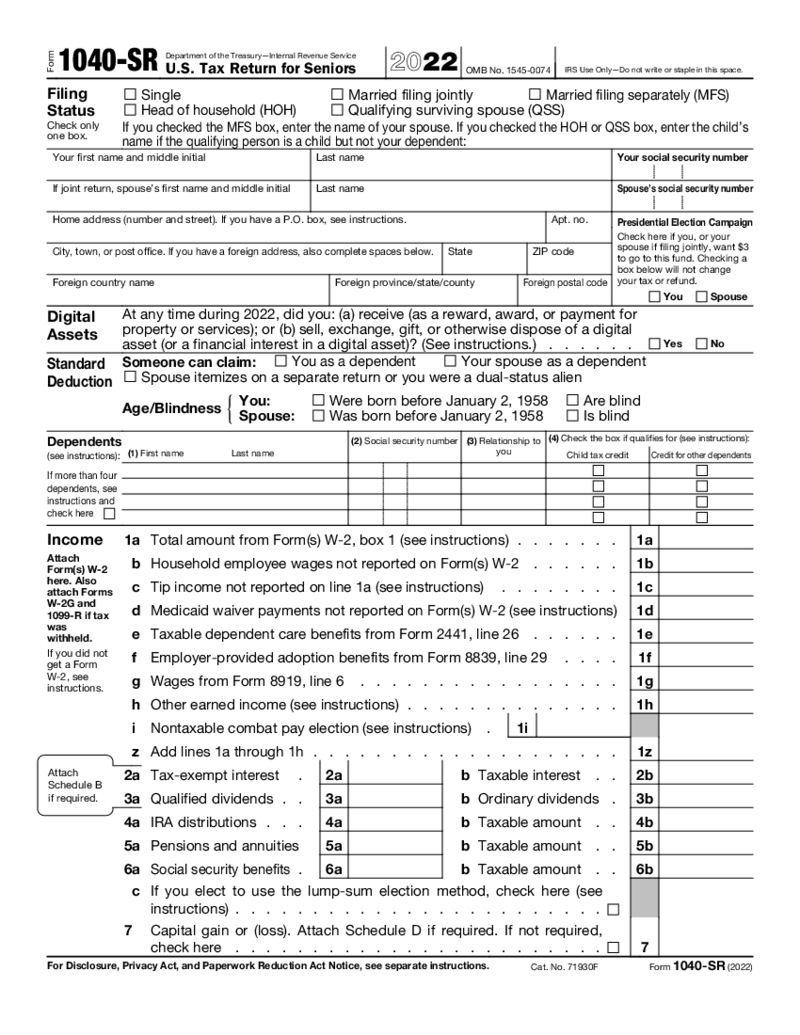

Form 1040-SR (2022)

Navigating the 2022 Form 1040-SR: A Step-by-Step Guide for Seniors

Navigating the IRS Form 1040-SR 2022 can be a daunting task for seniors seeking to file their taxes accurately and efficiently. This comprehensive guide aims to demystify the process, brea

Form 1040-SR (2022)

Navigating the 2022 Form 1040-SR: A Step-by-Step Guide for Seniors

Navigating the IRS Form 1040-SR 2022 can be a daunting task for seniors seeking to file their taxes accurately and efficiently. This comprehensive guide aims to demystify the process, brea

-

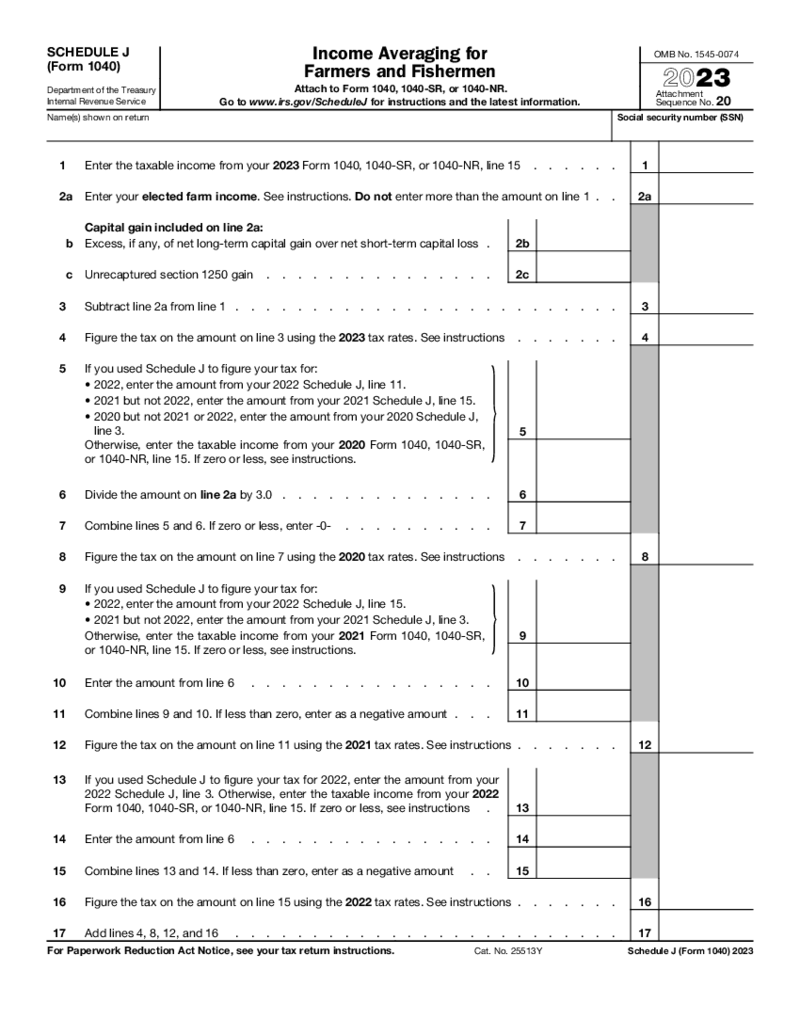

Form 1040 (Schedule J)

What is IRS Form 1040 Schedule J

First, let's clarify what Form 1040 Schedule J is. Farmers and fishermen use this tax form from the Internal Revenue Service (IRS) to average their income over the past three years. The form allows you to spread your t

Form 1040 (Schedule J)

What is IRS Form 1040 Schedule J

First, let's clarify what Form 1040 Schedule J is. Farmers and fishermen use this tax form from the Internal Revenue Service (IRS) to average their income over the past three years. The form allows you to spread your t

-

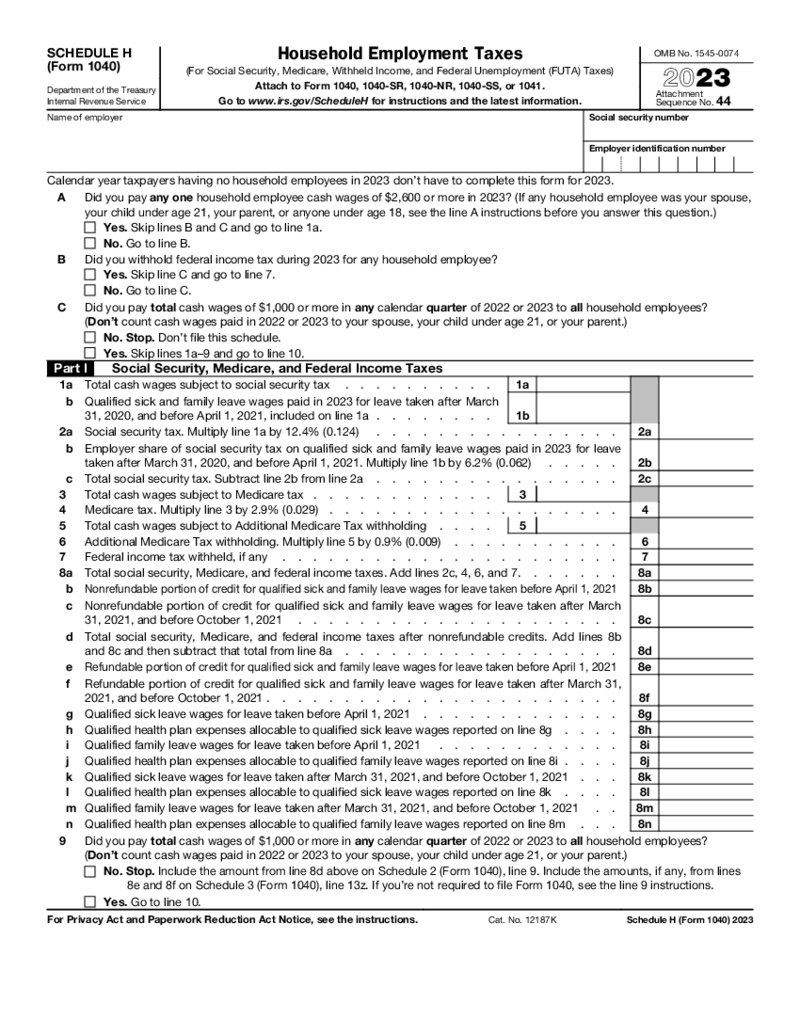

Schedule H Form 1040 (2023)

What is Form 1040 Schedule H 2023?

IRS Schedule H Form 1040 is a document required in case you hire employees to do household chores regularly. You need to file Schedule H only if the total salary you pay to these people exceeds particular threshold

Schedule H Form 1040 (2023)

What is Form 1040 Schedule H 2023?

IRS Schedule H Form 1040 is a document required in case you hire employees to do household chores regularly. You need to file Schedule H only if the total salary you pay to these people exceeds particular threshold

-

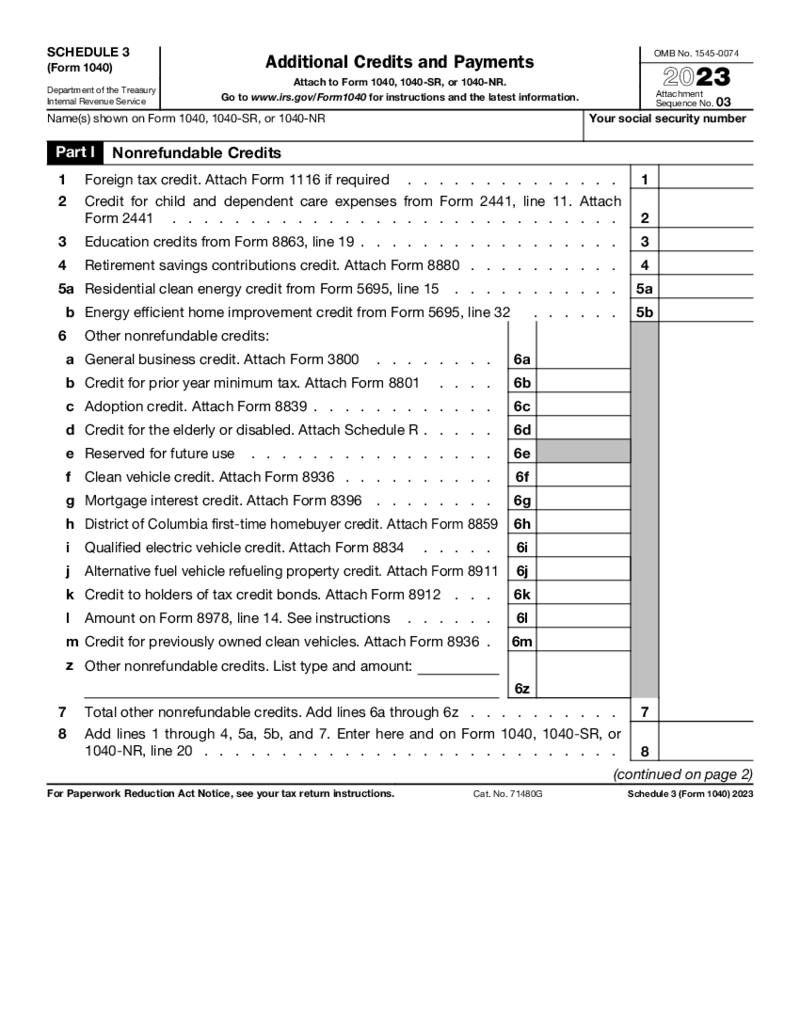

Form 1040 Schedule 3 (2023)

What is the Fillable Form 1040 Schedule 3?

Fillable Form 1040 Schedule 3 is a form that was created by the Internal Revenue Service. Here you have to fill out Additional Credits and Payments. This Form should be attached to the Form 1040, 1040-SR, or 1040

Form 1040 Schedule 3 (2023)

What is the Fillable Form 1040 Schedule 3?

Fillable Form 1040 Schedule 3 is a form that was created by the Internal Revenue Service. Here you have to fill out Additional Credits and Payments. This Form should be attached to the Form 1040, 1040-SR, or 1040

-

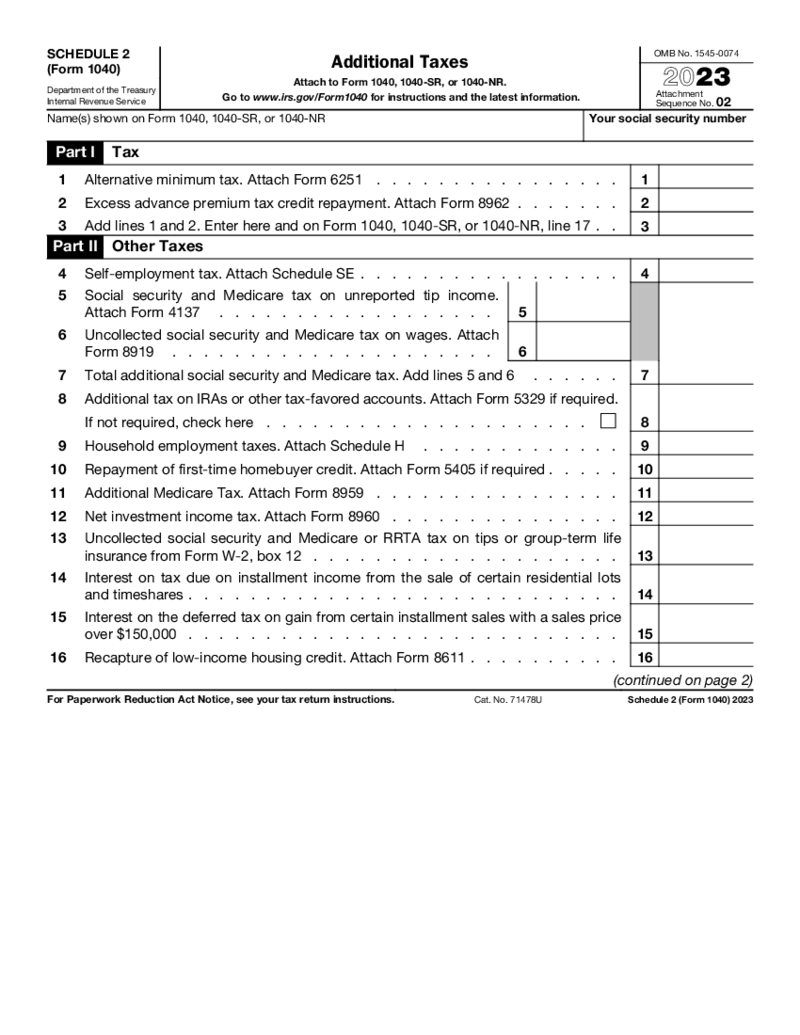

Form 1040 Schedule 2 (2023)

What Is Schedule 2 Form 1040?

Also known as Additional Taxes, this document covers various taxes apart from regular income tax. Examples may be the Alternative Minimum Tax (AMT) or taxes on certain types of income. Overall, the document s

Form 1040 Schedule 2 (2023)

What Is Schedule 2 Form 1040?

Also known as Additional Taxes, this document covers various taxes apart from regular income tax. Examples may be the Alternative Minimum Tax (AMT) or taxes on certain types of income. Overall, the document s

-

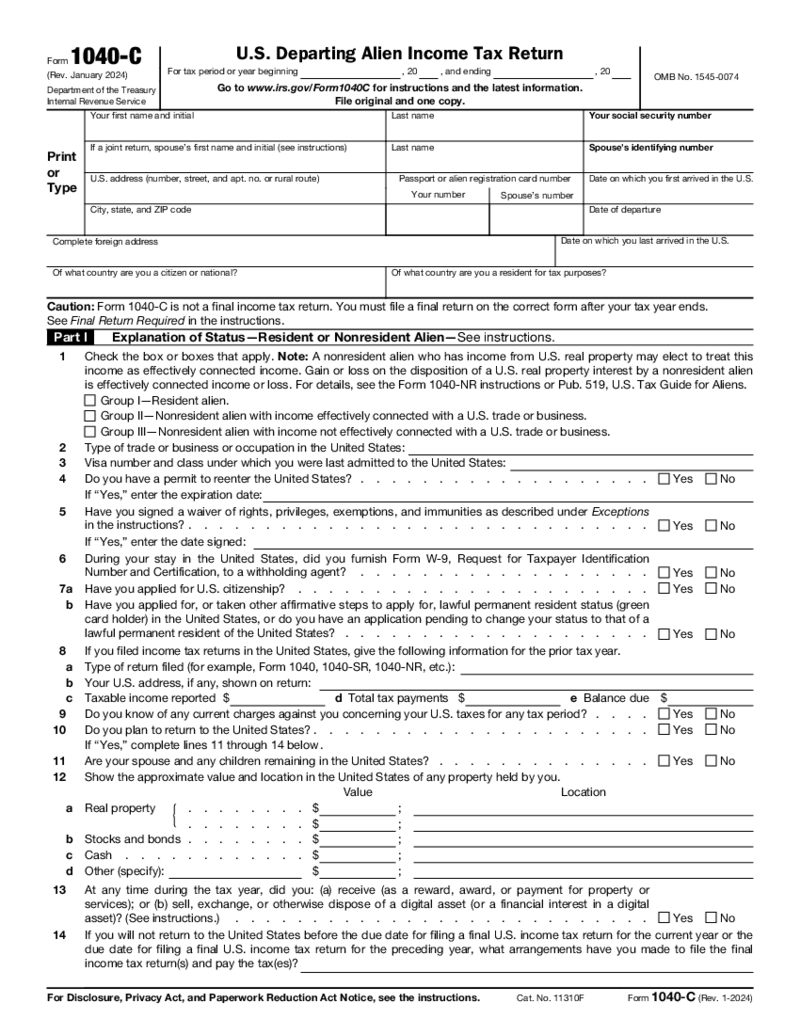

Form 1040-C

What Is Form 1040-C?

Are you a freelancer or a small business owner? Then Schedule C (or 1040-C form) is what you most likely should submit within the deadline stated by the IRS. With that being said, you fill out and file this form for the purpose of rep

Form 1040-C

What Is Form 1040-C?

Are you a freelancer or a small business owner? Then Schedule C (or 1040-C form) is what you most likely should submit within the deadline stated by the IRS. With that being said, you fill out and file this form for the purpose of rep

-

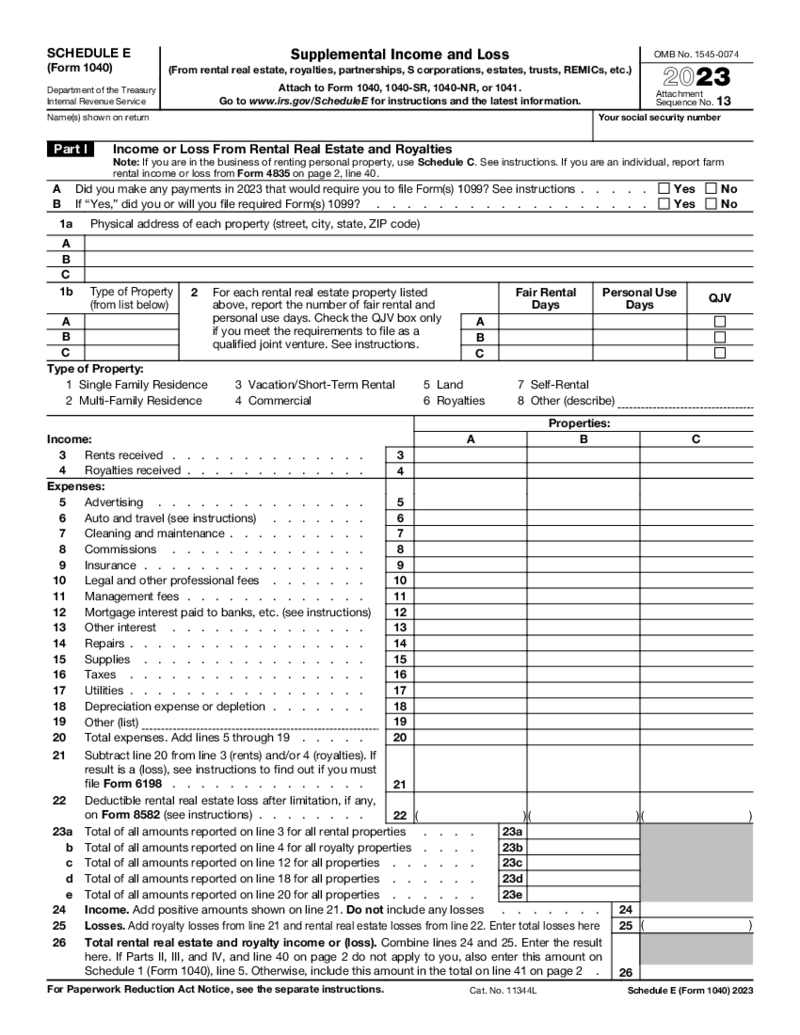

Form 1040 (Schedule E)

What Is 1040 Schedule E 2023 - 2024

Schedule E is part of Form 1040 supplements, all used for the purpose of annual tax reporting for US citizens. Its primary focus is supplemental income and loss as opposed to core ones.

Form 1040 (Schedule E)

What Is 1040 Schedule E 2023 - 2024

Schedule E is part of Form 1040 supplements, all used for the purpose of annual tax reporting for US citizens. Its primary focus is supplemental income and loss as opposed to core ones.

-

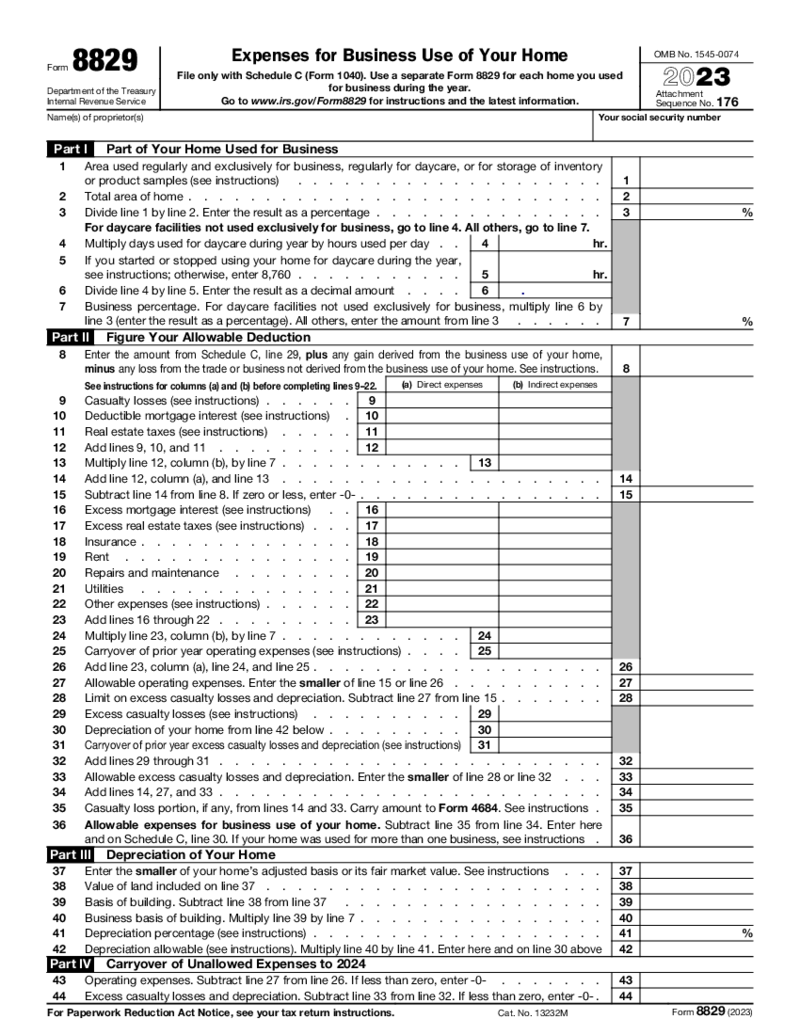

Form 8829 (2023)

What Is a Form 8829

Form 8829, Expenses for Business Use of Your Home, is an IRS document used by individuals who operate a business from home. This form allows taxpayers to calculate and claim deductions for expenses re

Form 8829 (2023)

What Is a Form 8829

Form 8829, Expenses for Business Use of Your Home, is an IRS document used by individuals who operate a business from home. This form allows taxpayers to calculate and claim deductions for expenses re

-

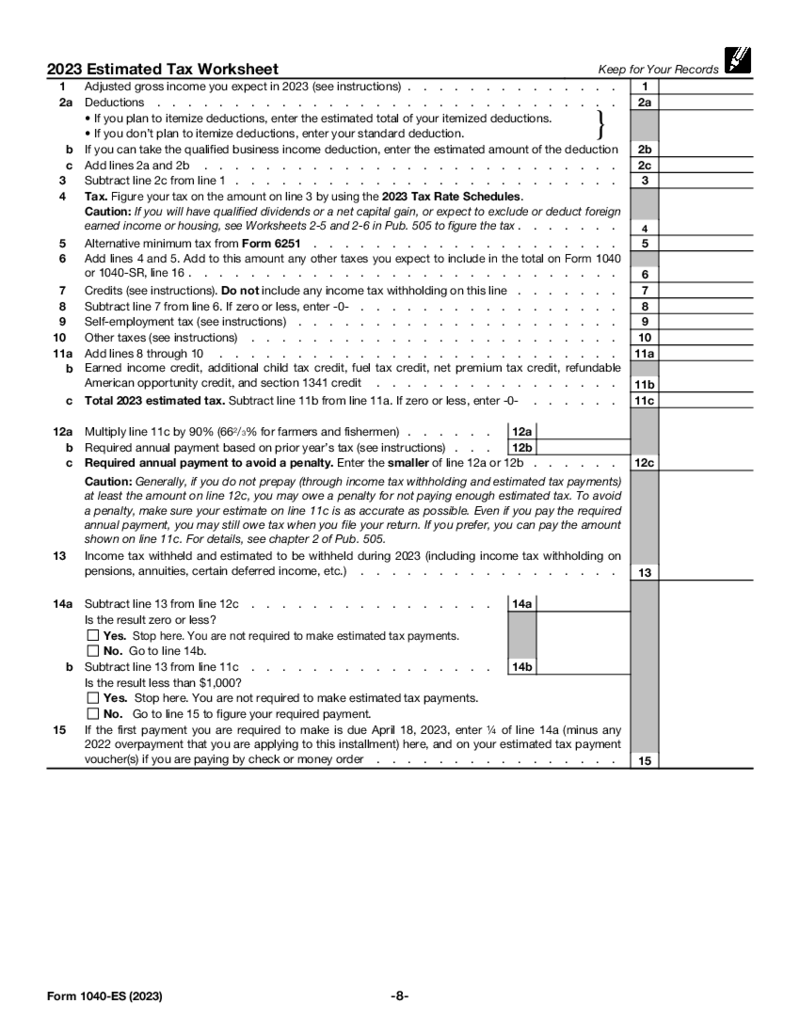

Form 1040-ES (2023)

The Ultimate Guide on How to Fill Out IRS Form 1040-ES 2023

The IRS Form 1040-ES 2023, also known as "Estimated Tax for Individuals," is a crucial document for individuals who are required to pay estimated taxes throughout the year. This include

Form 1040-ES (2023)

The Ultimate Guide on How to Fill Out IRS Form 1040-ES 2023

The IRS Form 1040-ES 2023, also known as "Estimated Tax for Individuals," is a crucial document for individuals who are required to pay estimated taxes throughout the year. This include

-

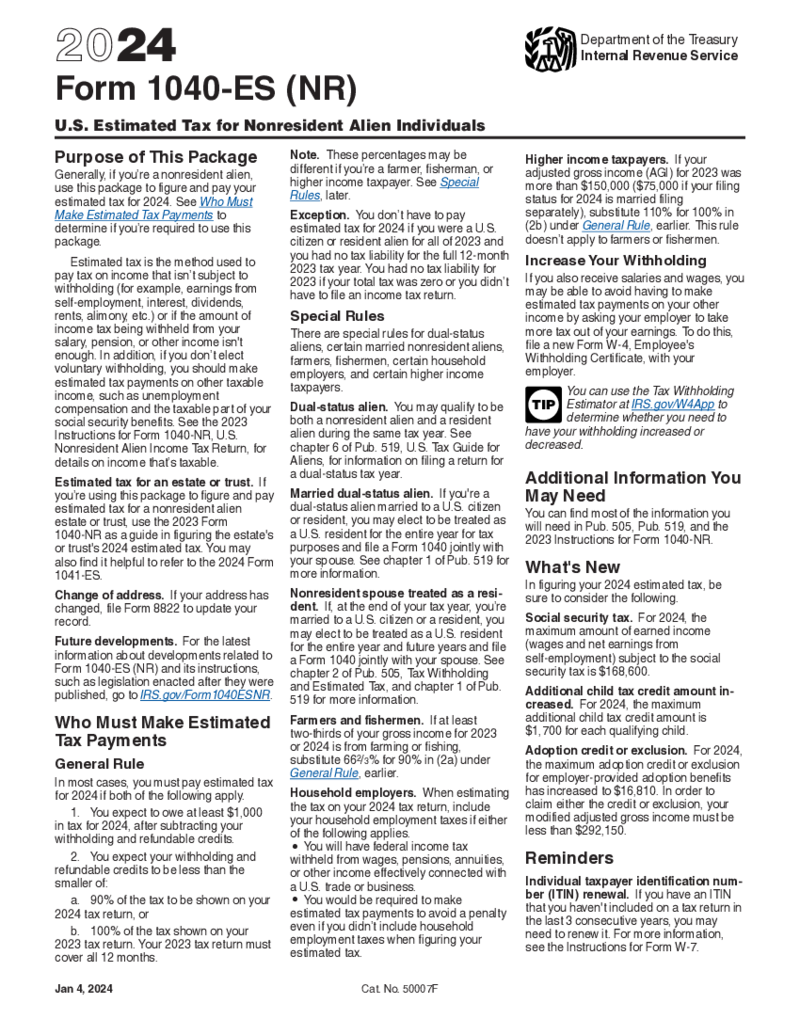

Form 1040-ES (NR) (2024)

What is a 1040 ES (NR) Form?

The IRS fillable Form 1040 ES (NR) (also called an Estimated Tax for Nonresident Alien) is a federal tax form that is used for collecting information from nonresident aliens who conduct financial activity within the US. If you

Form 1040-ES (NR) (2024)

What is a 1040 ES (NR) Form?

The IRS fillable Form 1040 ES (NR) (also called an Estimated Tax for Nonresident Alien) is a federal tax form that is used for collecting information from nonresident aliens who conduct financial activity within the US. If you

-

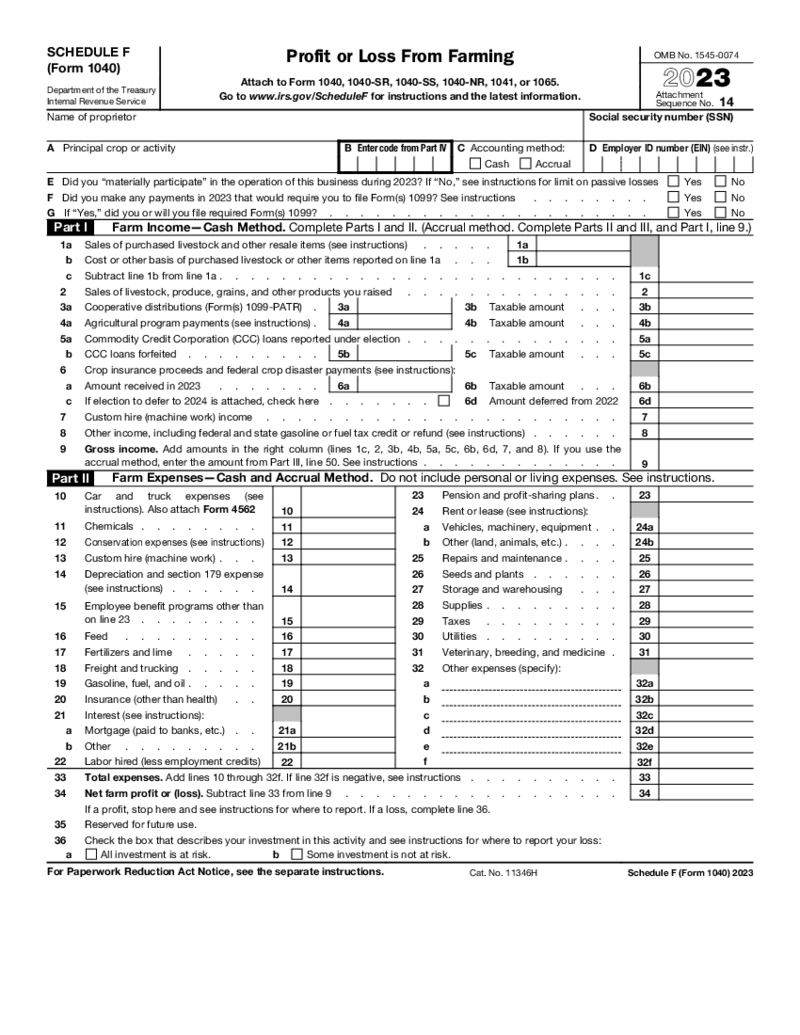

Schedule F - Form 1040 (2023)

Understanding IRS Form 1040 Schedule F

The IRS Form 1040 Schedule F is a necessary tax form that American farmers must familiarize themselves with. If you're in the farming business - from dairy farming to aquaculture, from poultry raising to beekeepi

Schedule F - Form 1040 (2023)

Understanding IRS Form 1040 Schedule F

The IRS Form 1040 Schedule F is a necessary tax form that American farmers must familiarize themselves with. If you're in the farming business - from dairy farming to aquaculture, from poultry raising to beekeepi

-

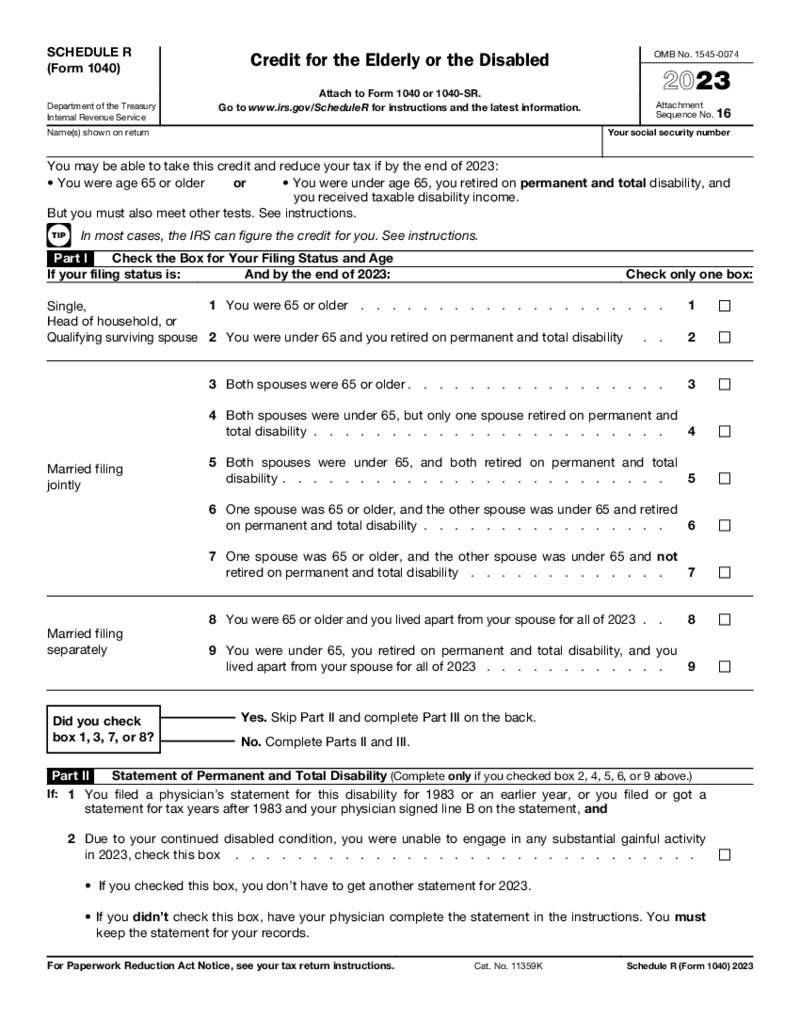

Schedule R Form 1040 (2023)

What is IRS Schedule R Form 1040

IRS Schedule R is attached to the standard Form 1040 individual income tax return. Taxpayers complete and file Schedule R to claim the Credit for the Elderly or the Disabled.

This tax credit allows eligible indiv

Schedule R Form 1040 (2023)

What is IRS Schedule R Form 1040

IRS Schedule R is attached to the standard Form 1040 individual income tax return. Taxpayers complete and file Schedule R to claim the Credit for the Elderly or the Disabled.

This tax credit allows eligible indiv

FAQ

-

Where can I get blank 1040 forms?

You can get these forms either on our website or on the website of the corresponding tax authorities. The benefit of using PDFLiner for this purpose is that here, you can easily proceed with working on the file by editing it via our digital instruments.

-

What does a 1040 stand for?

It’s a document used for calculating your total assessable earnings and pinpointing the amount to be paid or refunded by the authorities. And it’s one of the most widespread IRS tax forms 1040. Simple as that.

-

How many US taxes forms 1040 are there?

There are more than five popular types of this document. Assess this point in detail in order to determine the type you currently need.