-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

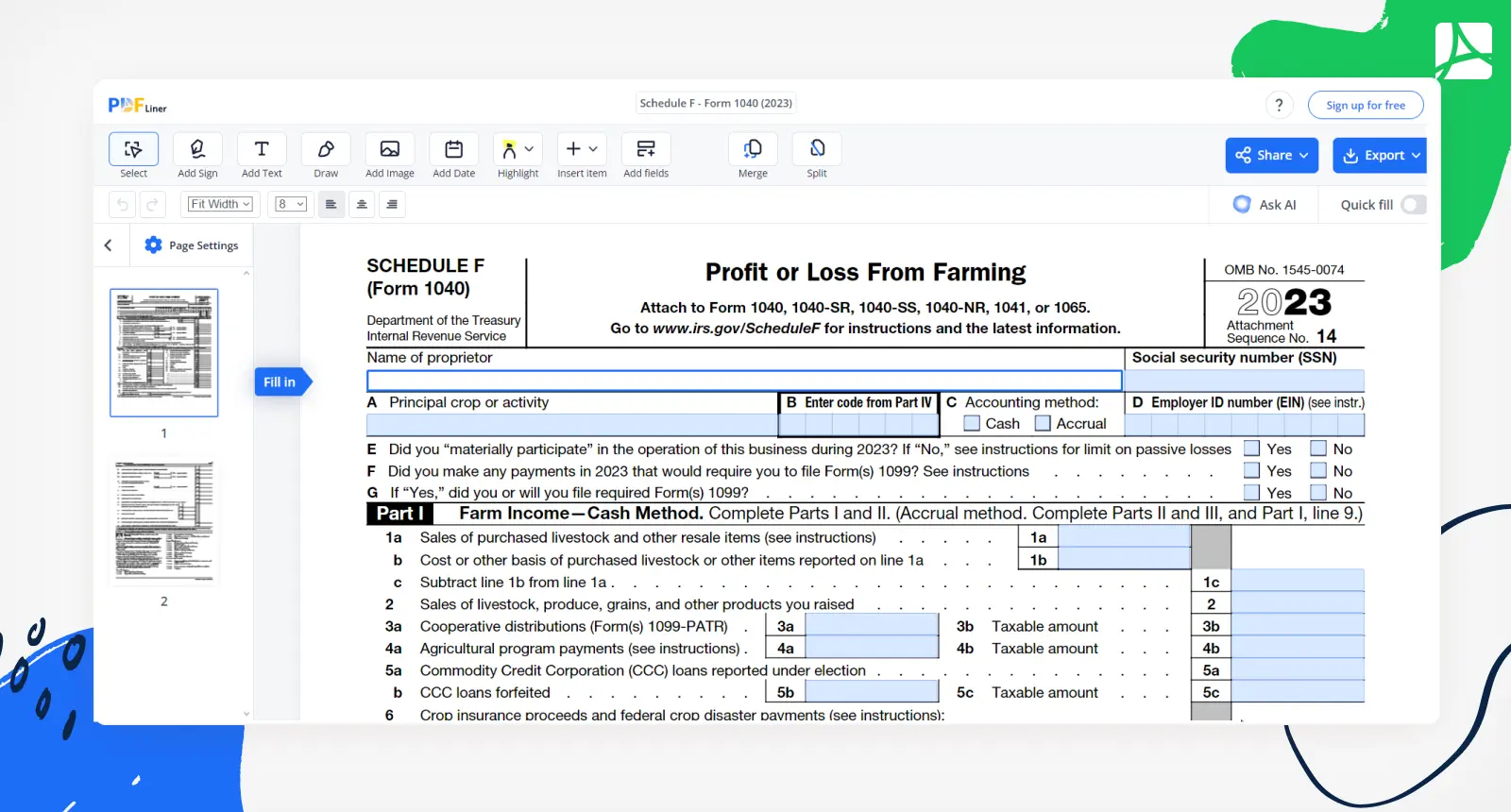

Schedule F - Form 1040 (2023)

Get your Schedule F - Form 1040 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding IRS Form 1040 Schedule F

The IRS Form 1040 Schedule F is a necessary tax form that American farmers must familiarize themselves with. If you're in the farming business - from dairy farming to aquaculture, from poultry raising to beekeeping - IRS Schedule F Form 1040 is designed specifically for you. This form is where you report your income and expenses from farming to the Internal Revenue Service (IRS).

A Step-by-Step Guide to Filing 1040 Form Schedule F

Navigating the process of filing your 1040 Form Schedule F can be complex, but we're here to break it down into a step-by-step guide to make the task more manageable.

Step 1: Gather Your Information

Firstly, gather all necessary information, including income and expenses related to your farming activities. This may include livestock and produce sales, agricultural program payments, cooperatives distributions, and more. For expenses, gather receipts for things like feed, fertilizer, insurance, and any farm-related labor costs.

Step 2: Download the Form

Next, download the most recent IRS Form 1040 Schedule F from the official IRS website. Be sure also to download the Schedule F instructions, as they provide valuable information on how to fill out the form.

Step 3: Fill Out the Form

Begin by filling out the top section of the form, including your name and Social Security Number. Then, move on to Part I, where you will report your farming income. Be thorough and include all sources of income.

Next, in Part II, you'll list your farm expenses. It's essential to categorize each expense accurately using the specific line items provided.

Step 4: Calculate Your Net Profit or Loss

Once you've filled out your income and expenses, subtract your total expenses from your total income to calculate your net farming profit or loss. This figure will be recorded in Part III of the form.

Step 5: Complete Additional Sections

If you have any applicable farm rental income or expenses, these will be detailed in Part IV. Parts V and VI are where you'll report soil and water conservation expenses, as well as amortization.

Step 6: Transfer the Result to your 1040 Form

Your net profit or loss from Schedule F needs to be reported on your 1040 tax return. If you have a profit, it will be included in your taxable income. A loss, on the other hand, can help reduce your taxable income.

Step 7: Double-Check and Submit

Lastly, double-check your form for accuracy. Ensure all information is correct and complete. Once you've done this, you can submit the form along with your main tax return.

Remember, the complexities of individual tax situations can vary widely, and this guide is meant to provide general steps. If you find yourself confused or overwhelmed, consulting with a tax professional who can provide guidance tailored to your situation might be beneficial.

Why IRS schedule F form 1040 is crucial

Completing the IRS Form 1040 Schedule F is a legal obligation and essential for managing your financial health. It provides a comprehensive record of your farming activities, helping you understand your farm's profitability, manage budgets, and plan for the future. Incorrect filing or omission of the IRS Schedule F Form 1040 can lead to potential audits and penalties, so taking this form seriously is essential.

Deciphering Schedule F Profit or Loss from Farming

Understanding how to calculate your Schedule F profit or loss from farming is key. Your gross farming income - everything you earned from farming activities - is pitted against your farming expenses. The result is your net farming income, which is either a profit (if your income exceeds expenses) or a loss (if your expenses are greater than your income).

By correctly completing your tax Form 1040 Schedule F, you ensure your farming income and expenses are accounted for accurately. This, in turn, provides an accurate snapshot of your farming operation's profitability or losses, helping you make informed business decisions.

Fillable online Schedule F - Form 1040 (2023)