-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

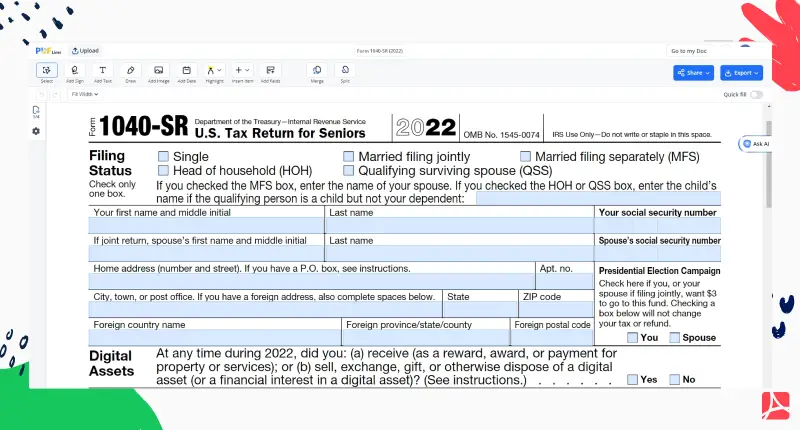

Fillable Form 1040-SR (2022)

Get your Form 1040-SR (2022) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Navigating the 2022 Form 1040-SR: A Step-by-Step Guide for Seniors

Navigating the IRS Form 1040-SR 2022 can be a daunting task for seniors seeking to file their taxes accurately and efficiently. This comprehensive guide aims to demystify the process, breaking it down into manageable sections, including a detailed walkthrough of how to complete the form. By familiarizing yourself with the requirements and steps outlined below, you can confidently fill out your 1040-SR 2022 tax form and ensure you're taking advantage of all the benefits available to senior taxpayers.

Understanding the 1040-SR Form

Introduced to simplify the tax filing process for seniors, the 2022 form 1040-SR is tailored for individuals aged 65 or older. It offers a more readable format with larger print and incorporates features specific to senior taxpayers, such as potentially higher standard deductions. The eligibility to use the 1040-SR is straightforward—any senior can opt for this form regardless of their income level, which marks a significant departure from previous iterations focused on simpler financial situations like the now-defunct 1040EZ.

Preparation Before You Start

Prior to diving into the form itself, gather all necessary paperwork and information. This encompasses, among others, W-2s, 1099s, statements of Social Security income, and documentation of any extra income or deductions, like medical costs or contributions to charity. Organization at this stage can significantly streamline the filling out process.

How to Fill Out the 1040-SR Form

Filling out the 1040-SR form involves several key steps:

- Personal Information: Begin by entering your name, address, Social Security Number, and filing status at the top of the form. Ensuring this information is correct is critical for the IRS to process your return accurately.

- Report Your Income: Accumulate your sources of income, including wages, pensions, Social Security benefits, and any other income like dividends on stocks. Enter these figures in the corresponding sections on the form.

- Determine Deductions: Whether opting for the standard deduction, which is higher for seniors, or itemizing deductions, fill in the relevant section. Keep in mind that the 1040-SR tax form for 2022 provides an increased standard deduction for individuals or their spouses who are 65 years of age or older.

- Calculate Tax and Credits: Subtract deductions from your total income to find your taxable income, then use IRS guidelines to calculate your tax liability. Don’t overlook potential credits for which you’re eligible.

- Final Calculations: After accounting for any taxes already paid through estimated payments or withholding, calculate whether you are due a refund or owe additional taxes.

Submitting Your 1040-SR Form

Once your 1040 SR 2022 form is complete, double-check for accuracy. You can then choose to file it electronically through IRS e-file or mail it to the designated address for your location. Remember, electronic filing can result in quicker processing and refund distribution.

Filing taxes doesn't have to be an overwhelming process. By taking the time to accurately prepare and understand how to properly complete the IRS 1040 SR 2022 form, seniors can navigate tax season with confidence.

Form Versions

2021

Fillable Form 1040-SR for 2021 tax year

2020

Fillable Form 1040-SR for 2021 tax year

Fillable online Form 1040-SR (2022)