-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

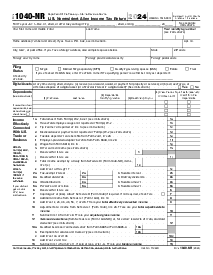

Form 1040-SR (2019)

Get your Form 1040-SR (2019) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is IRS Form 1040 SR 2019

IRS Form 1040 SR 2019 is a variant of the traditional tax form, specially designed for senior taxpayers aged 65 and older. This form was introduced to simplify tax filing by offering a larger font for easier reading and a standard deduction chart to make it more convenient for seniors to prepare their taxes. Just like the regular Form 1040, it covers all types of income, adjustments to income, taxes, and credits, and includes questions about health coverage.

When to Use 1040 SR 2019 Tax Form

The 1040 SR 2019 Tax Form should be used by taxpayers who meet the following requirements:

- Are 65 or older by the end of the tax year.

- Have any income, such as wages, dividends, IRA distributions, or Social Security benefits.

This form is not exclusive; seniors can file the standard Form 1040 if eligible.

How To Fill Out IRS Form 1040 SR Instructions 2019

Filling out the 1040 SR Form for 2019 can be completed in several steps:

Personal Information:

Include your full name, social security number, address, and filing status.

Income Reporting:

Next, report all types of income, such as wages on line 1, interest and dividends on lines 2b and 3b, and Social Security benefits on lines 5a and 5b.

Adjustments to Income:

You can claim adjustments such as educator expenses or student loan interest deductions; enter these on lines 10 through 22.

Standard Deduction:

For 2019, the 1040-SR includes a chart that lists standard deduction amounts based on your filing status and whether you and/or your spouse are 65 or older.

Calculating Tax:

Use the tax table to determine your tax liability and report it on line 12a.

Credits and Taxes Paid:

Enter any applicable tax credits on lines 12b through 12d, and total the amounts of any income tax withheld from wages and other payments on line 16.

Refund or Amount Owed:

If taxes paid exceed the liability, report the overpayment and indicate if you wish to have it refunded or applied to next year's taxes. Conversely, if you owe, do so on line 23.

Sign and Date:

Ensure you sign and date the form before filing. An unsigned tax return is like an unsigned check - not valid.

Where To File Federal Tax Form 1040 SR For 2019

When ready to file the Federal Tax Form 1040 SR for 2019, you have multiple options:

- Filing online through IRS-approved e-filing services is convenient and provides immediate confirmation of receipt.

- If you prefer paper filing, the correct mailing address depends on your residence and whether you are including a payment.

- A tax professional or preparer can file on your behalf.

Form Versions

2021

Fillable Form 1040-SR for 2021 tax year

2020

Fillable Form 1040-SR for 2020 tax year

Fillable online Form 1040-SR (2019)