-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

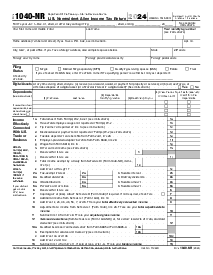

Schedule B - Form 1040 (2020)

Get your Schedule B - Form 1040 (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Schedule B Form 1040 for 2020?

Schedule B is an IRS document that pertains to the comprehensive Form 1040. It's primarily used to report interest and ordinary dividends exceeding $1,500 for the tax year 2020. It's crucial not only for individuals but also for estates and trusts that have received considerable income from these sources. Essentially, Schedule B allows taxpayers to provide details on the sources of their income, which helps the IRS ensure that all income is accurately reported and taxed accordingly.

Who needs 2020 form 1040 Schedule B

Understanding who requires the IRS 2020 Form 1040 Schedule B is vital. Generally, you must file Schedule B if:

- The total interest or dividend income you received in the year exceeded $1,500.

- You received interest from a seller-financed mortgage, and the buyer used the property as a personal residence.

- You have accrued interest over $1,500 from a foreign source, or you have a financial interest in or signature authority over a foreign account.

If you fall into any of these categories, you'll need to provide additional information on your tax form, which is where IRS form 1040 Schedule B 2020 comes into play. Also, you can check this information on the form itself or on the official IRS website.

How to Fill Out Form 1040 Schedule B 2020

Filling out the form requires attention to detail. Here are key 2020 Form 1040 Schedule B instructions you may follow:

- Begin with Part I, 'Interest'. Enter any interest income from banks, savings, and loans, including the name of the payer and the amount of interest income in the respective fields.

- If you had interest from any seller-financed mortgage and you were the recipient of the mortgage, input the payer's name, social security number, and the amount.

- In case you received interest from a foreign account, ensure you provide the country name and the respective amount in the designated fields.

- Move to Part II, 'Ordinary Dividends.' Write down the name of each payer from whom you received ordinary dividends and the respective amounts next to each name.

- If you received any exempt-interest dividends, input the information in the space provided for exempt-interest dividends from a mutual fund or other regulated investment company.

- In Part III, 'Foreign Accounts and Trusts,' if you had a foreign account or were involved with a foreign trust, read the instructions for this section on the form carefully.

- Check the box that applies to your situation—whether you had a signature authority over a financial account in a foreign country, or if you received a distribution from, or were a grantor of, or a transferor to a foreign trust.

- Review all the information you've entered to ensure accuracy and completeness.

Advantages of e-filing 2020 Schedule B form 1040

E-filing your Schedule B and other IRS templates via PDFliner platform offers multiple benefits:

- It's time-efficient, eliminating the need for mailing and reducing the risk of lost documents.

- PDFliner provides instant access to tax forms from previous years, so you can easily reference past filings.

- E-filing tends to result in faster processing times by the IRS, ensuring any refunds due are received promptly.

- You can send the finished document for signing to the other party.

- It provides a secure environment, with encrypted data transmission and safe storage for your sensitive financial information.

Fillable online Schedule B - Form 1040 (2020)