-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

SCHEDULE C (Form 1040) for 2021

Get your SCHEDULE C (Form 1040) (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Schedule C (Form 1040) for 2021 tax year

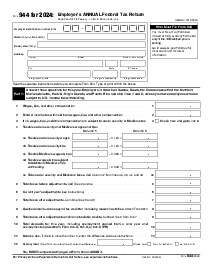

The 2021 Schedule C is structured to capture comprehensive details about a taxpayer’s business income and expenses. Here are the primary components:

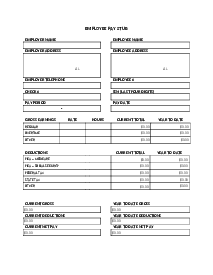

- General Information: The form begins with basic details such as the business name, Employer Identification Number (EIN), and the principal business or profession.

- Income: This section requires reporting the gross receipts or sales, returns, allowances, and other business income. It determines the total income earned by the business.

- Expenses: This extensive section allows the taxpayer to list deductible business expenses, categorized into various types such as advertising, car and truck expenses, contract labor, and more. This section aims to capture all expenses that can reduce taxable income.

- Cost of Goods Sold (COGS): For businesses that sell products, this section calculates the cost of goods sold, taking into account inventory at the beginning and end of the year, purchases, and other direct costs.

- Information on Your Vehicle: If the taxpayer used a vehicle for business purposes, this section collects information about the vehicle's usage and expenses.

- Other Expenses: This part allows listing any other business expenses not captured in the predefined categories.

- Net Profit or Loss: The final part of the form calculates the net profit or loss by subtracting total expenses from total income. This amount is then transferred to the taxpayer’s Form 1040.

Key Differences from the Current Version

The tax forms, including Schedule C, are periodically updated to reflect changes in tax laws, regulations, and IRS administrative requirements. Here are some notable differences between the 2021 Schedule C and the current version:

- Standard Mileage Rate: The IRS adjusts the standard mileage rate for business use of a car annually. For instance, the rate for 2021 was 56 cents per mile, whereas the rate for 2024 has increased to 65.5 cents per mile.

- Qualified Business Income Deduction (QBI): The QBI deduction rules and thresholds can change yearly. The 2021 form may have different instructions and thresholds compared to the current year’s form, reflecting legislative adjustments.

- Depreciation and Section 179: Changes in the rules governing depreciation and Section 179 expensing can impact how taxpayers report these deductions. The limits and eligibility criteria may differ from 2021 to the current year.

- COVID-19 Related Provisions: The 2021 tax year included specific provisions related to the COVID-19 pandemic, such as the Paycheck Protection Program (PPP) loan forgiveness and certain tax credits. These provisions may have been phased out or modified in the current version.

- Form Layout and Instructions: The IRS occasionally updates the layout of the form and the accompanying instructions to improve clarity and ease of use. The current version may have reorganized sections or added new guidance compared to the 2021 version.

- Tax Rates and Brackets: Changes in federal tax rates and brackets can influence the calculations on Schedule C. Although the form itself primarily deals with business income and expenses, these changes indirectly affect the taxpayer's overall tax liability.

Fillable online SCHEDULE C (Form 1040) (2021)