-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1040-C (2020)

Get your Form 1040-C (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1040 C 2020?

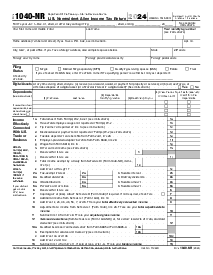

Form 1040-C, also known as the U.S. Departing Alien Income Tax Return, is not a final tax return, but rather an estimate of tax liability for nonresident aliens who intend to leave the United States or its territories. It's primarily used to demonstrate compliance with tax laws and ensure that all due taxes are paid before departure.

Who Needs to File the 1040 C Form 2020?

Not every individual will need to file this form. It is specifically designed for nonresident aliens who are preparing to leave the U.S. and who have received income from U.S. sources during the fiscal year. It's important to note that filing this form doesn't exempt individuals from filing an annual tax return, such as Form 1040-NR, if required.

How to Fill Out the 2020 1040 C Form

The process of filling out this IRS form effectively requires careful attention to detail. You'll need to provide personal information and details about your income and calculate the appropriate tax based on the current year's tax table or rate schedules.

- Start by inserting your name, as stated on your passport, and your U.S. Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) in the corresponding fields at the top of the form.

- Indicate your most recent U.S. home address in the spaces provided, ensuring you include the city, state, and ZIP code. If you have a foreign address, fill that in the designated area.

- Proceed to the section labeled "Presidential Election Campaign" and decide whether you want to allocate $3 to this fund. Check the box if you wish to contribute – this will not affect your tax or refund.

- Under the section designated for income, record all types of income you received while in the United States, such as wages, salaries, tips, interest, dividends, and any other compensation that applies. Ensure accurate reporting to avoid any discrepancies.

- Calculate the total income by adding all figures you've entered and write the sum in the field marked "Total Income."

- Understand and claim any appropriate adjustments to your income (these reduce your gross income to obtain the adjusted gross income).

- Subtract these adjustments from your total income to determine your adjusted gross income (AGI) and enter the result.

- Proceed to fill in the itemized deductions or standard deduction for your filing status, which can be found on the tax tables provided by the Internal Revenue Service (IRS).

- Subtract deductions from your AGI to calculate your taxable income and input the resulting number.

- Refer to the tax tables and other instructions to calculate the tax on your taxable income and report it. Include any additional taxes that may apply to your circumstances.

- Factor in any credits you're eligible for and subtract them from the total tax to determine your tentative tax.

- Include any tax you've already paid throughout the year, such as income tax withheld from your employer, estimated tax payments, or the amount applied from the previous year's return.

- Subtract the payments from your tentative tax to calculate the net amount owed or the overpayment.

- For net amounts owed, indicate how you will make the payment. If you have overpaid, specify how you would like the IRS to handle the excess, whether by refund or application to estimated taxes.

- Adjust for any amount subject to withholding and compute the balance due or refund.

- Confirm all personal and dependency exemptions, if applicable, ensuring accuracy in counts and amounts.

- Check all details, verify computations, and ensure nothing is missing or incorrect. Any mistakes can cause delays in processing.

- Find a safe and secure way to print your filled-out form if you wish to keep a physical copy or if you are required to mail it to the IRS.

Remember to sign and date your form before submission to validate the return. Unsigned forms will not be processed.

Important Tips and Considerations

- File Early: Aim to file 1040 C Form 2020 well before your planned departure date to avoid any last-minute issues or complications.

- Additional Forms: Depending on your situation, you may also need to attach schedules or other forms that apply to specific types of income.

- Professional Assistance: Given the complexity of tax laws, seeking advice from a tax professional can be prudent, especially if your tax situation is complicated.

Fillable online Form 1040-C (2020)