-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

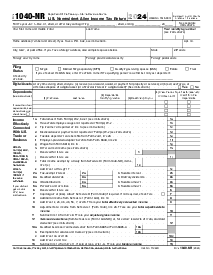

Form 1040-SS (2019)

Get your Form 1040-SS (2019) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1040 SS

For individuals residing in the United States, tax documentation often involves understanding and completing various forms during tax season. Form 1040-SS is a crucial document geared towards particular groups of taxpayers. Essentially, Form 1040-SS is a U.S. Self-Employment Tax Return that is intended for residents of the U.S. territories, as well as for those who need to report self-employment income. This form facilitates reporting income earned from self-employment activities and calculates the self-employment tax owed to the IRS.

When to Use Form 1040 SS 2019

Form 1040-SS 2019 should be utilized in a range of specific situations, which include:

- Residents of Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, or the Commonwealth of the Northern Mariana Islands.

- U.S. citizens or resident aliens with a tax home in a foreign country meet one of the self-employment income thresholds.

- Self-employed individuals whose net earnings were $400 or more for the tax year. This includes earnings from a trade, business, or profession conducted as an individual or partner.

- Recipients of church employee income of $108.28 or more.

Individuals who fall into these categories must file Form 1040-SS to accurately report their earnings and determine their Social Security and Medicare tax contributions.

How To Fill Out Form 1040 SS 2019

Filling out the 2019 version of Form 1040-SS involves a multi-step process:

Personal Information:

At the top of the form, fill in your full name, Social Security Number, and, if applicable, your spouse’s name and SSN.

Income Calculation:

Enter your total income derived from self-employment. Subtract any applicable deductions to calculate your net earnings from self-employment.

Church Employee Income:

If you received income as a church employee, report this on the designated line.

Self-Employment Tax:

Use the provided worksheet to calculate your self-employment tax owed. This ensures the right Social Security and Medicare contribution amounts based on your net earnings.

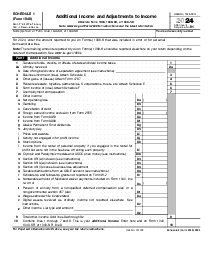

Additional Tax and Credits:

Apply any additional child tax credit or credits for the health coverage tax credit as necessary.

Payments:

Record any estimated tax payments you made during the year.

Refund or Amount Owed:

Deduct your credits from your self-employment tax to determine whether you are due a refund or owe additional tax.

Filing Status and Dependents:

Check the appropriate box for your filing status and list any dependents.

Form Versions

2021

Fillable Form 1040-SS for 2021 tax year

2022

Fillable Form 1040-SS for 2022 tax year

Fillable online Form 1040-SS (2019)