-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 3

-

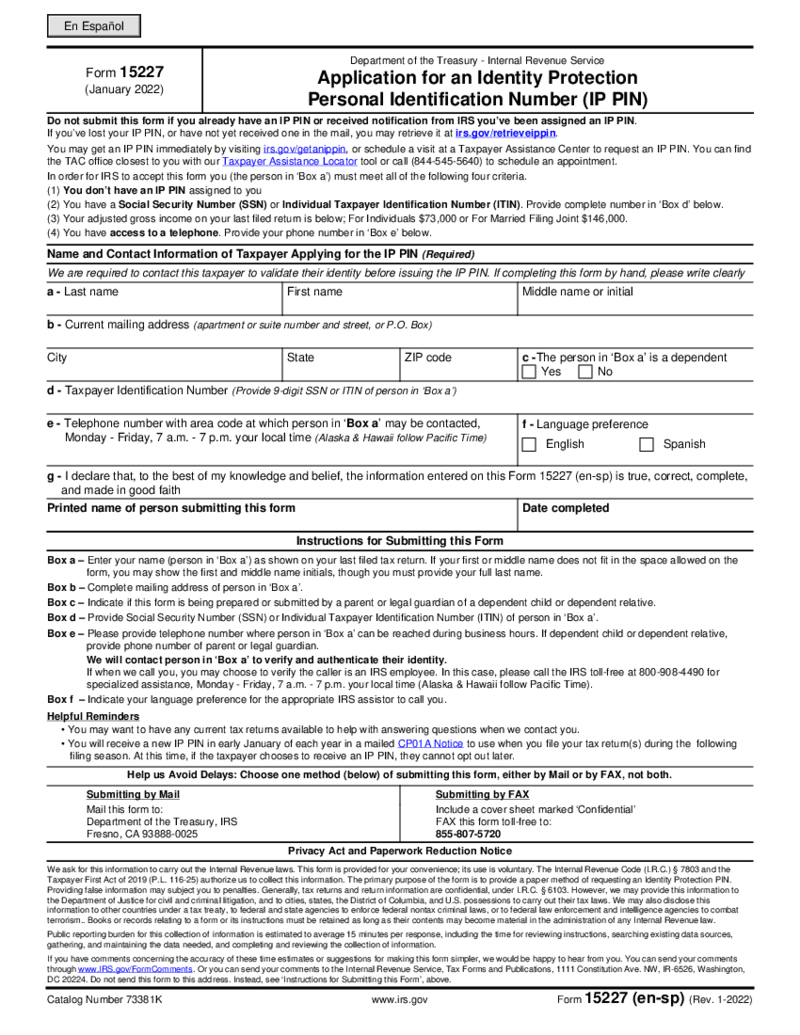

IRS IP PIN Application - Form 15227

What Is IRS Form 15227?

Also referred to as IRS IP PIN application, it’s a form that allows you to apply for an Identity Protection Personal Identification Number. Wondering what this number is all about? It’s a 6-digit number that shiel

IRS IP PIN Application - Form 15227

What Is IRS Form 15227?

Also referred to as IRS IP PIN application, it’s a form that allows you to apply for an Identity Protection Personal Identification Number. Wondering what this number is all about? It’s a 6-digit number that shiel

-

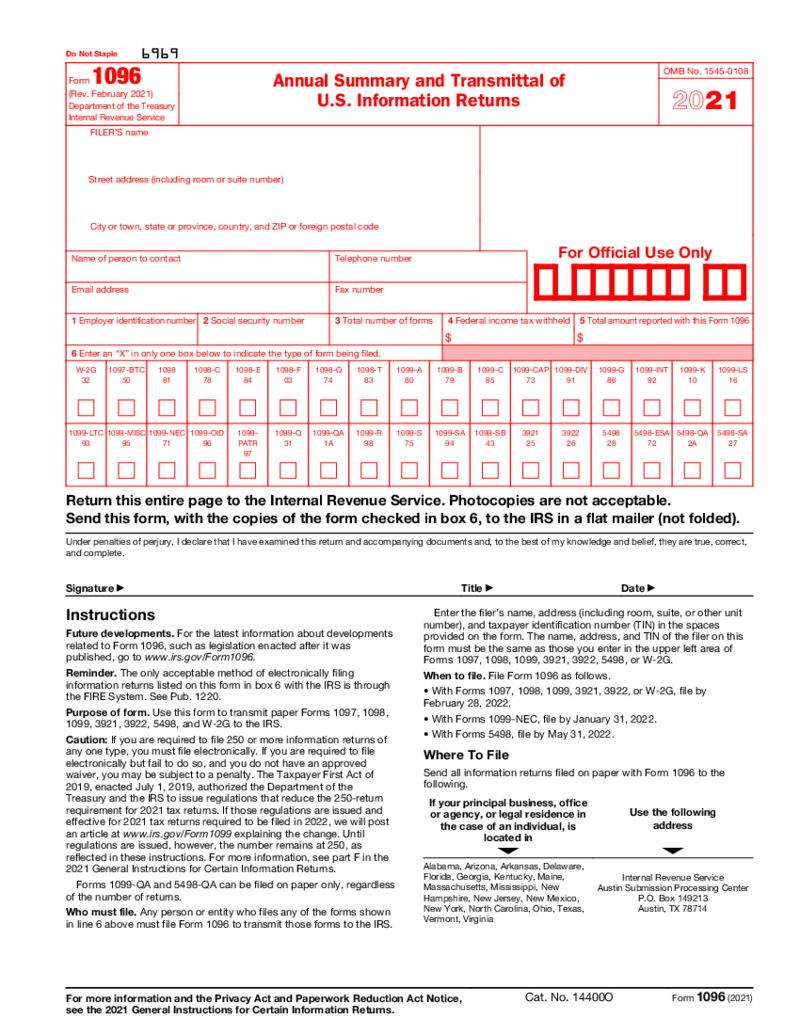

Form 1096 (2021)

What Is a 1096 Form?

The 1096 Form IRS requires it to accompany a batch of tax documents, such as Form 1099, Form 1098, and other related forms when you are sending them to the IRS. Its purpose is to summarize the totals from these information returns and

Form 1096 (2021)

What Is a 1096 Form?

The 1096 Form IRS requires it to accompany a batch of tax documents, such as Form 1099, Form 1098, and other related forms when you are sending them to the IRS. Its purpose is to summarize the totals from these information returns and

-

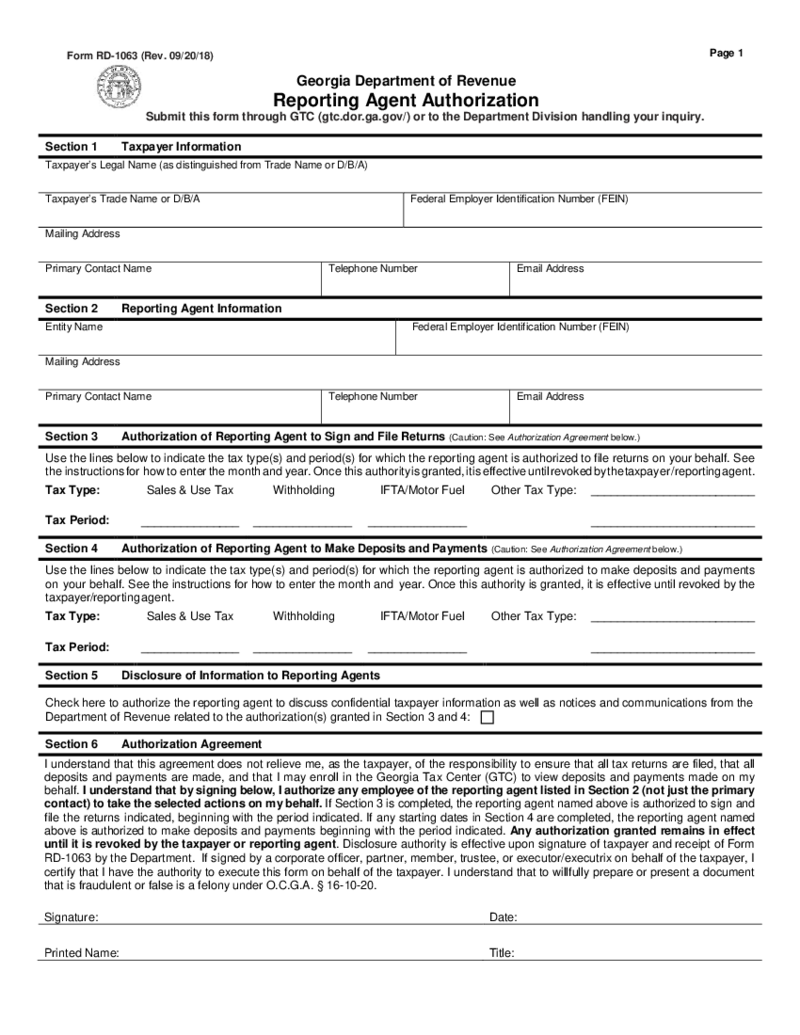

Reporting Agent Authorization (Form RD-1063)- Georgia Department of Revenue

Understanding Form 1063, GA Form RD-1061, and RD-1063

Filing taxes can be a complex task, especially when dealing with numerous forms like Form 1063, GA Form RD-1061, and RD-1063. These forms serve specific purposes and understanding them is crucial for b

Reporting Agent Authorization (Form RD-1063)- Georgia Department of Revenue

Understanding Form 1063, GA Form RD-1061, and RD-1063

Filing taxes can be a complex task, especially when dealing with numerous forms like Form 1063, GA Form RD-1061, and RD-1063. These forms serve specific purposes and understanding them is crucial for b

-

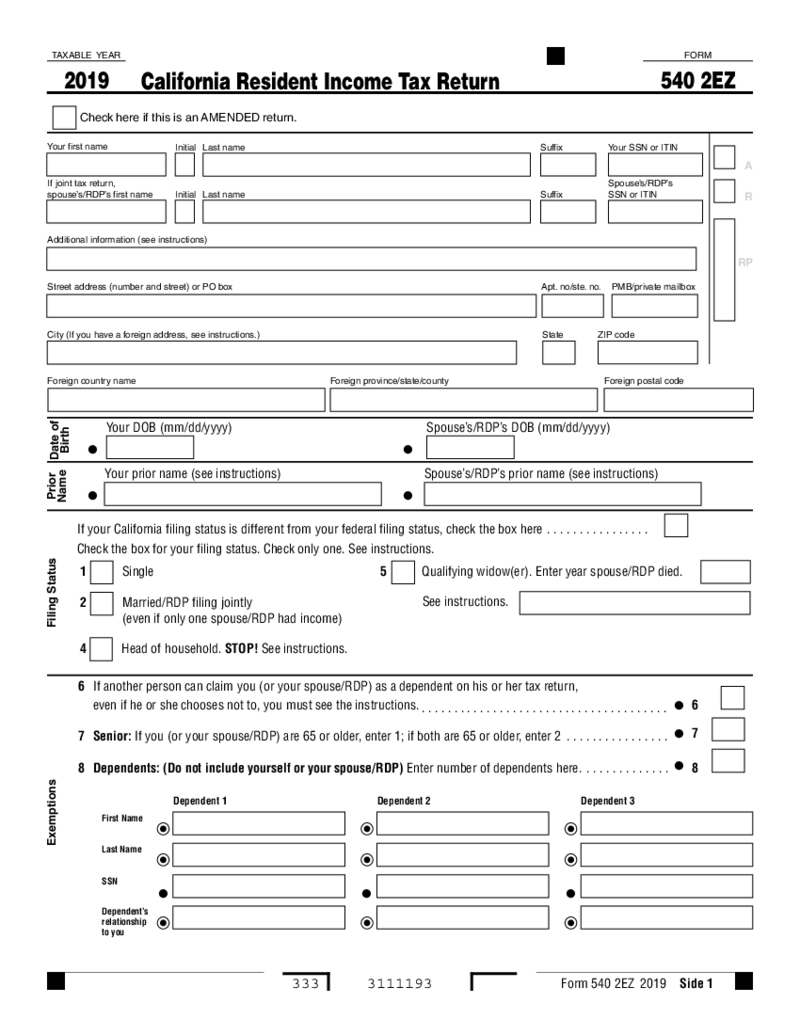

2019 Form 540 2EZ California Resident Income Tax Return

Introduction to Form 540 2EZ

Form 540 2EZ is a simplified version of California's standard state income tax form, aimed at making tax filing easier for eligible residents. This form is generally used by individuals with relatively uncomplicated financ

2019 Form 540 2EZ California Resident Income Tax Return

Introduction to Form 540 2EZ

Form 540 2EZ is a simplified version of California's standard state income tax form, aimed at making tax filing easier for eligible residents. This form is generally used by individuals with relatively uncomplicated financ

-

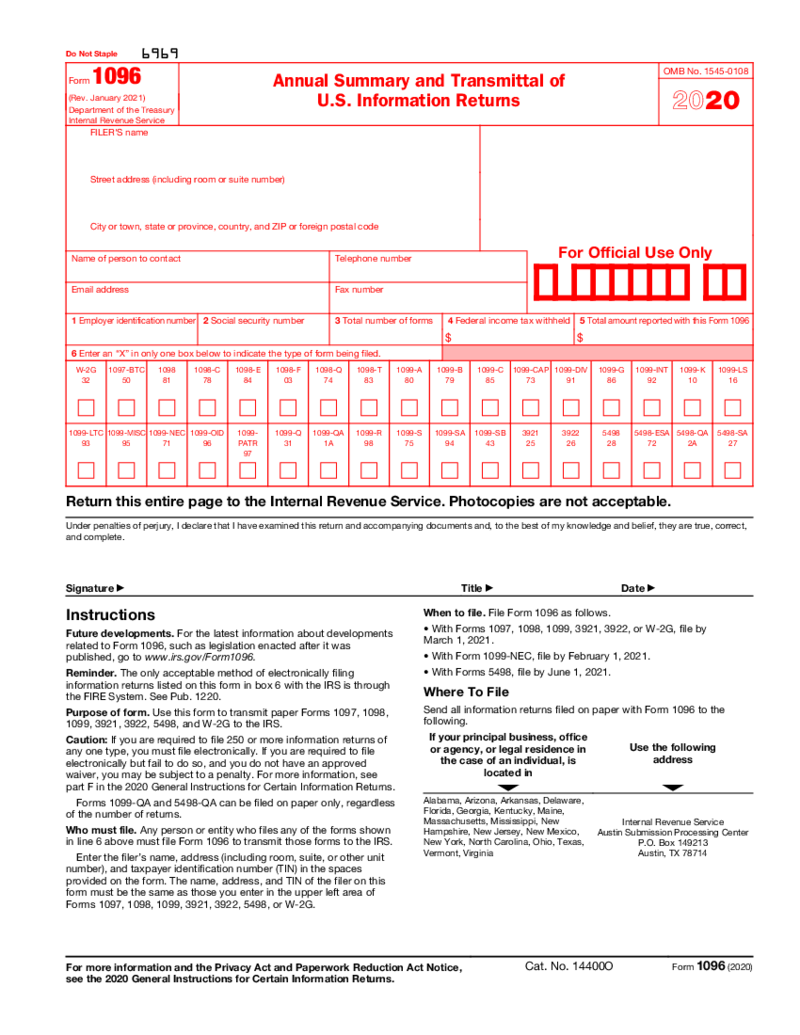

Form 1096 (2020)

What Is 1096 Form 2020?

The 1096 form 2020 serves as a cover sheet to report the totals from information returns, which may include forms such as 1099, 1098, and other tax documents. It is important to note that Form 1096 is utilized when submitting paper

Form 1096 (2020)

What Is 1096 Form 2020?

The 1096 form 2020 serves as a cover sheet to report the totals from information returns, which may include forms such as 1099, 1098, and other tax documents. It is important to note that Form 1096 is utilized when submitting paper

-

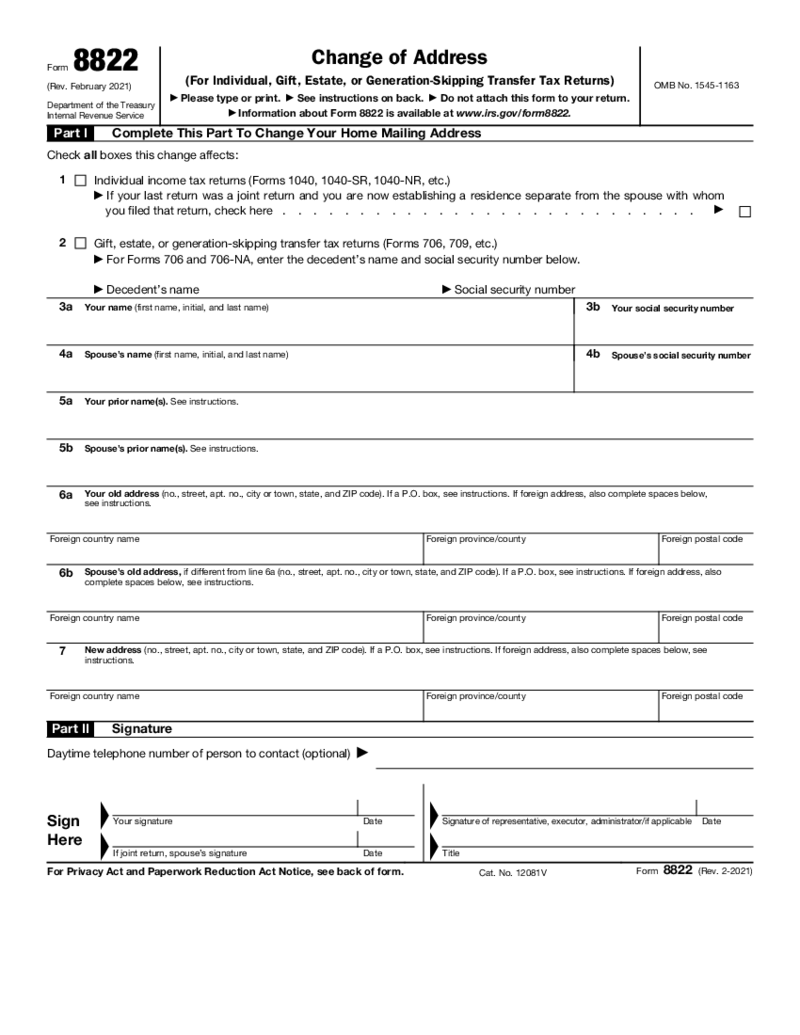

Form 8822 - Change of Address

What Is IRS Form 8822?

Also called Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns), Form 8822 is a document for updating your address with the IRS. It's used when you move or have new cont

Form 8822 - Change of Address

What Is IRS Form 8822?

Also called Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns), Form 8822 is a document for updating your address with the IRS. It's used when you move or have new cont

-

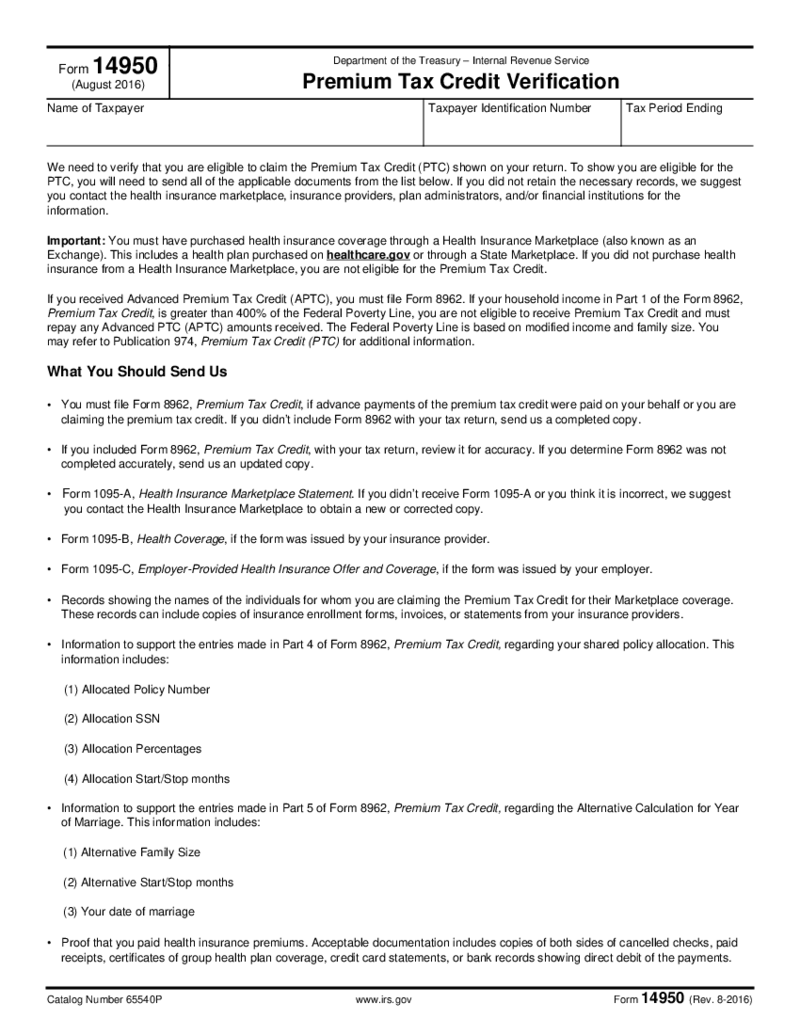

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

-

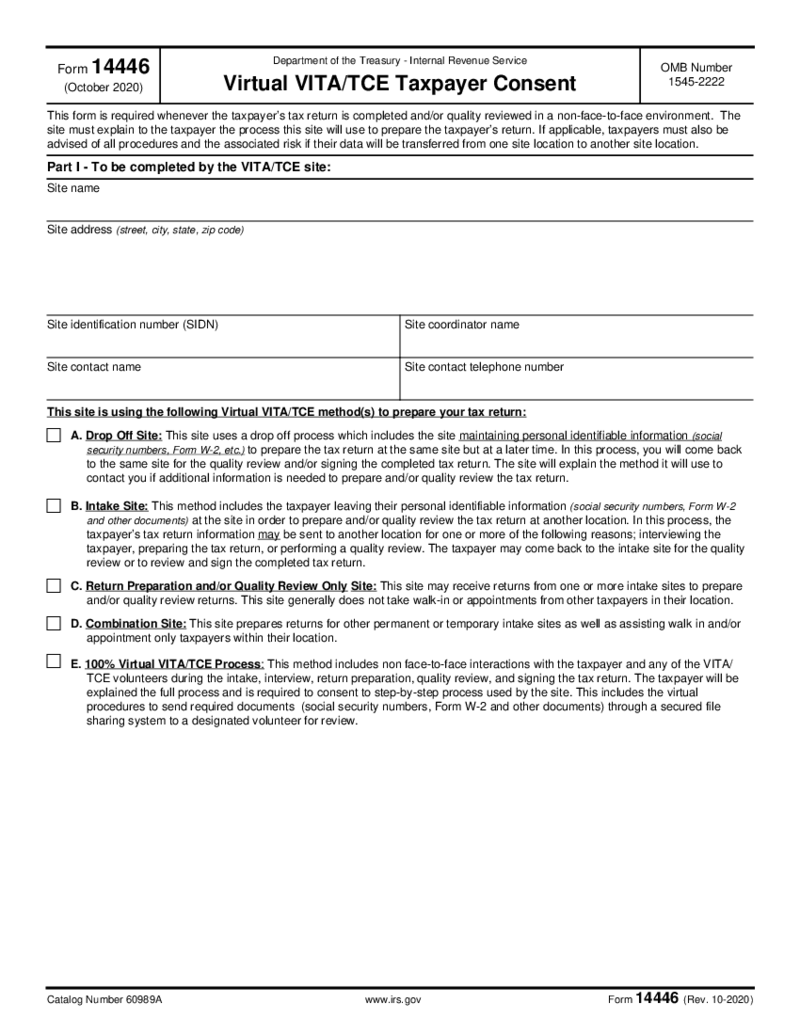

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

-

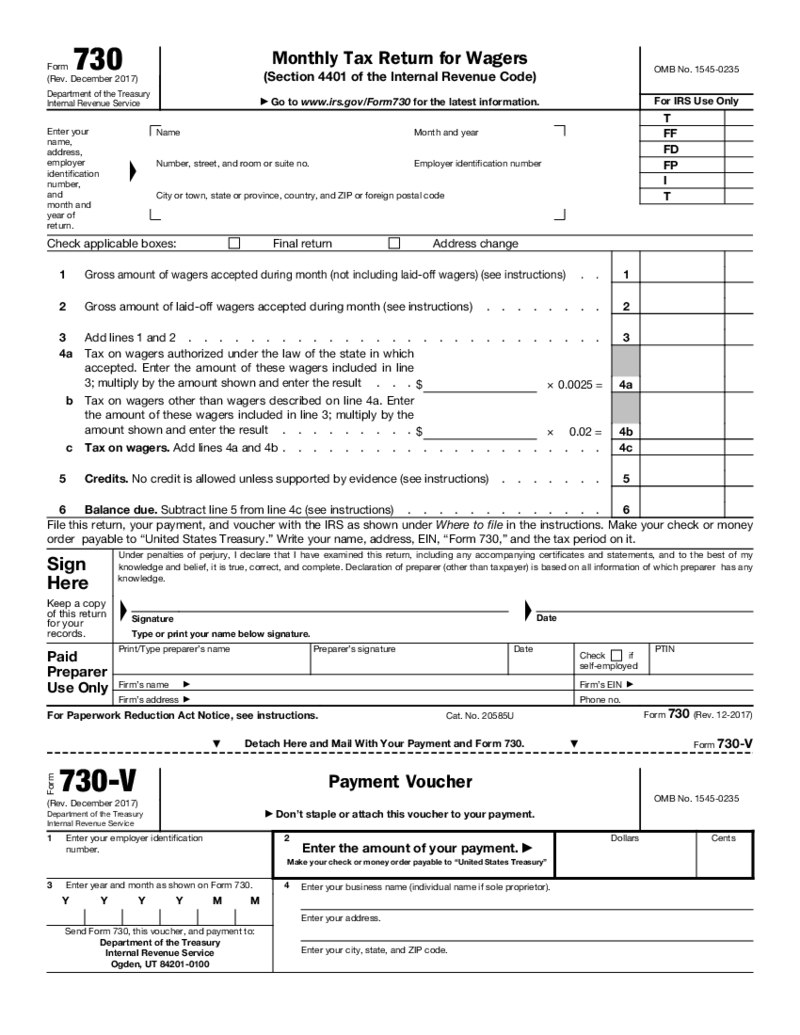

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

-

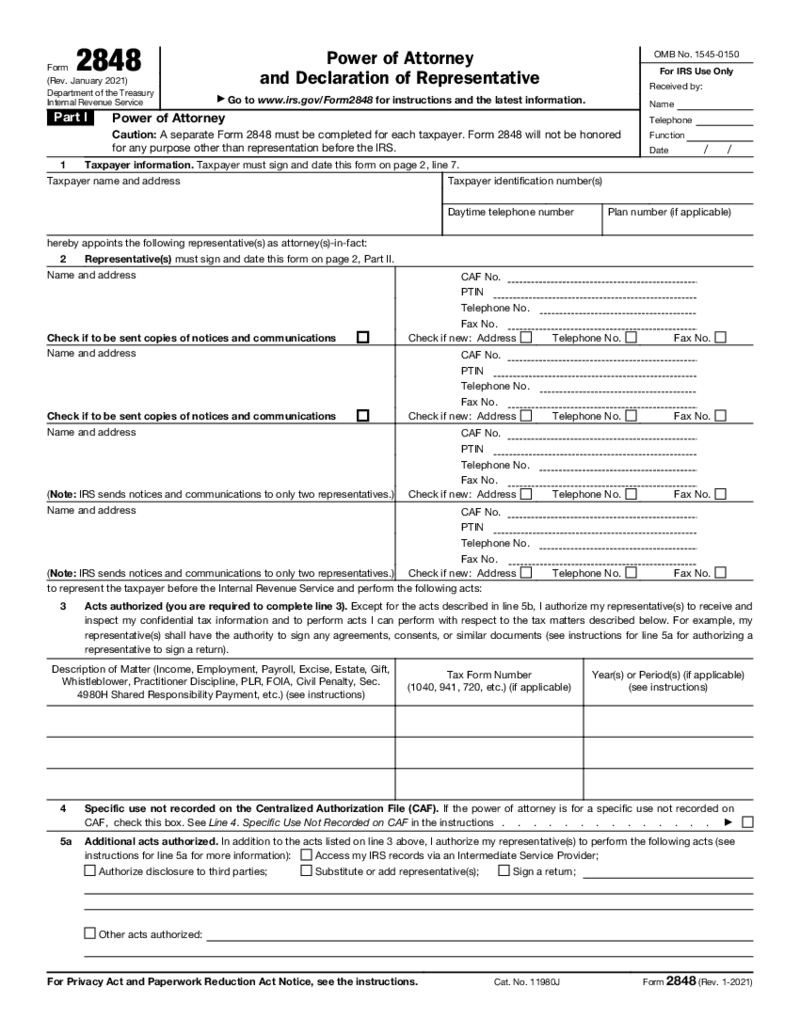

POA Form 2848

IRS Form 2848: Power of Attorney and Declaration of Representative

IRS Form 2848 is a legal document also known as the Power of Attorney and Declaration of Representative form. It is used by taxpayers to authorize an individual or organiz

POA Form 2848

IRS Form 2848: Power of Attorney and Declaration of Representative

IRS Form 2848 is a legal document also known as the Power of Attorney and Declaration of Representative form. It is used by taxpayers to authorize an individual or organiz

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.