-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 2

-

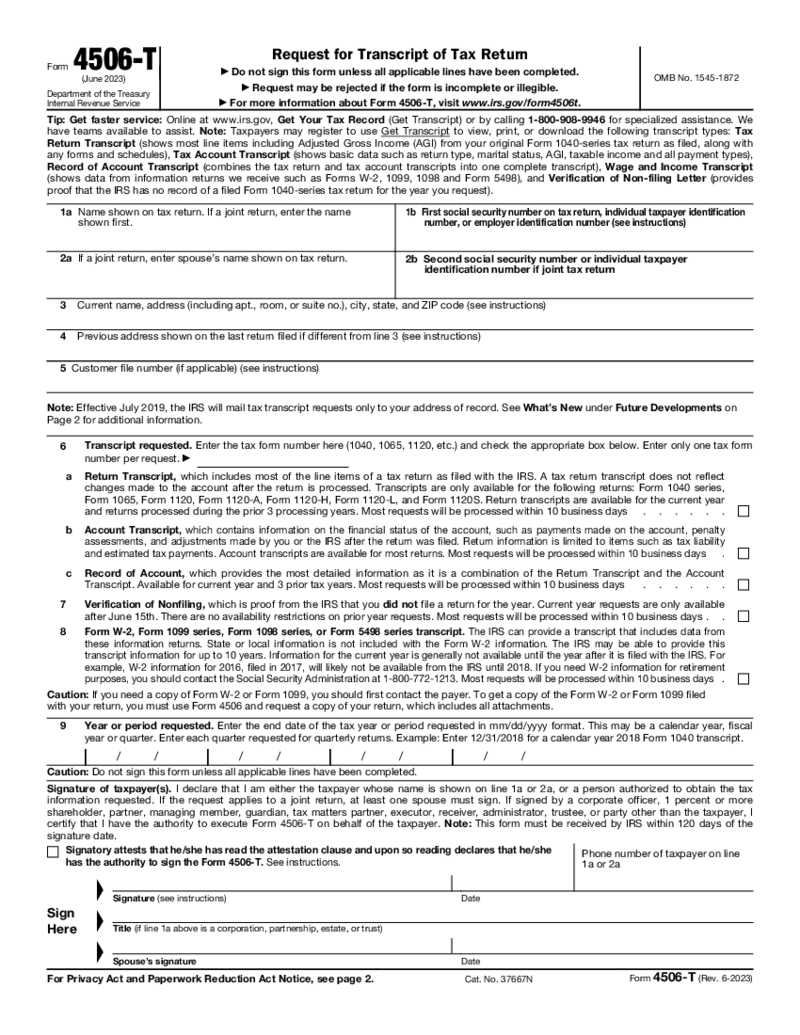

Form 4506-T

What is IRS 4506-T 2023?

Form IRS 4506-T is widely known as Request for Transcript of Tax Return. It was created for taxpayers who want to get a copy of tax return documents. It can be a printout of the previous tax return file or the transcript. You rece

Form 4506-T

What is IRS 4506-T 2023?

Form IRS 4506-T is widely known as Request for Transcript of Tax Return. It was created for taxpayers who want to get a copy of tax return documents. It can be a printout of the previous tax return file or the transcript. You rece

-

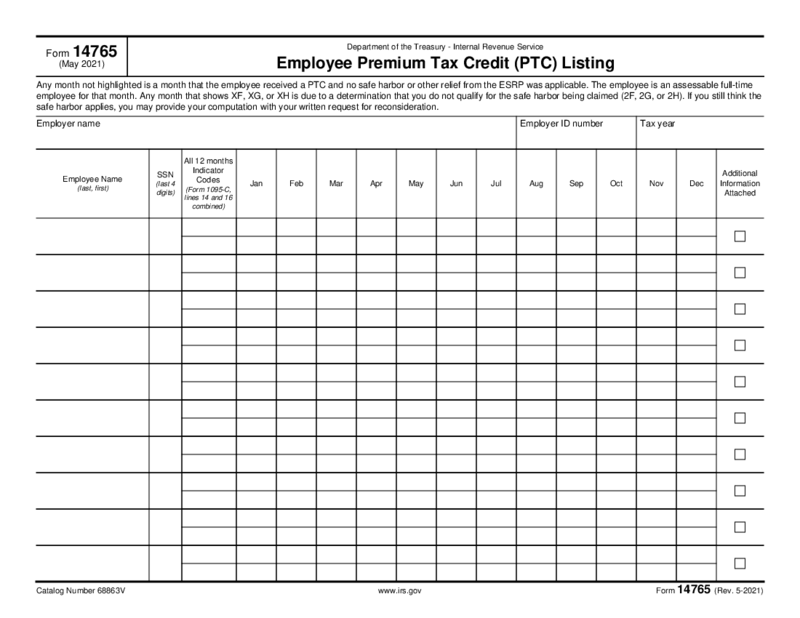

Form 14765

What is IRS Form 14765?

IRS Form 14765 is a tool used by the Internal Revenue Service (IRS) to communicate specific information about employees who may have triggered a penalty, or an Affordable Care Act Employer Shared Responsibility Payment (ESRP). Empl

Form 14765

What is IRS Form 14765?

IRS Form 14765 is a tool used by the Internal Revenue Service (IRS) to communicate specific information about employees who may have triggered a penalty, or an Affordable Care Act Employer Shared Responsibility Payment (ESRP). Empl

-

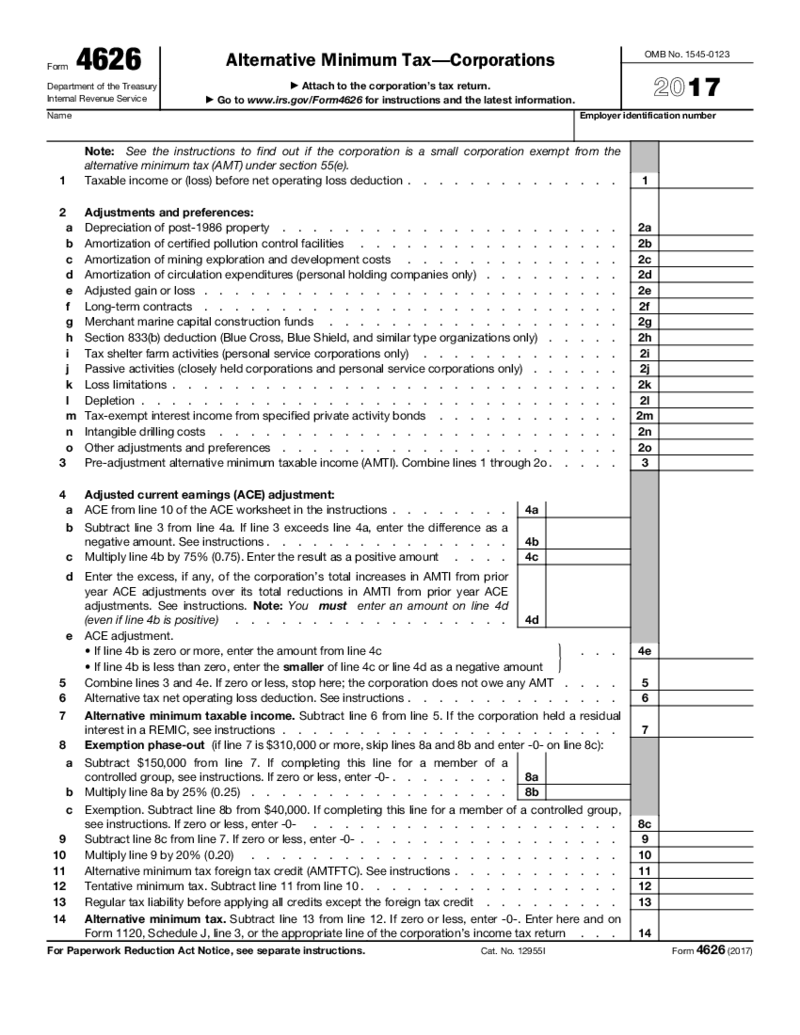

IRS Form 4626

What Is IRS Form 4626?

Form 4626 is utilized by corporations that are subject to the AMT. This form calculates the alternative minimum taxable income (AMTI), determines the tax liability, and identifies any tentative minimum tax due. The AMT applies when

IRS Form 4626

What Is IRS Form 4626?

Form 4626 is utilized by corporations that are subject to the AMT. This form calculates the alternative minimum taxable income (AMTI), determines the tax liability, and identifies any tentative minimum tax due. The AMT applies when

-

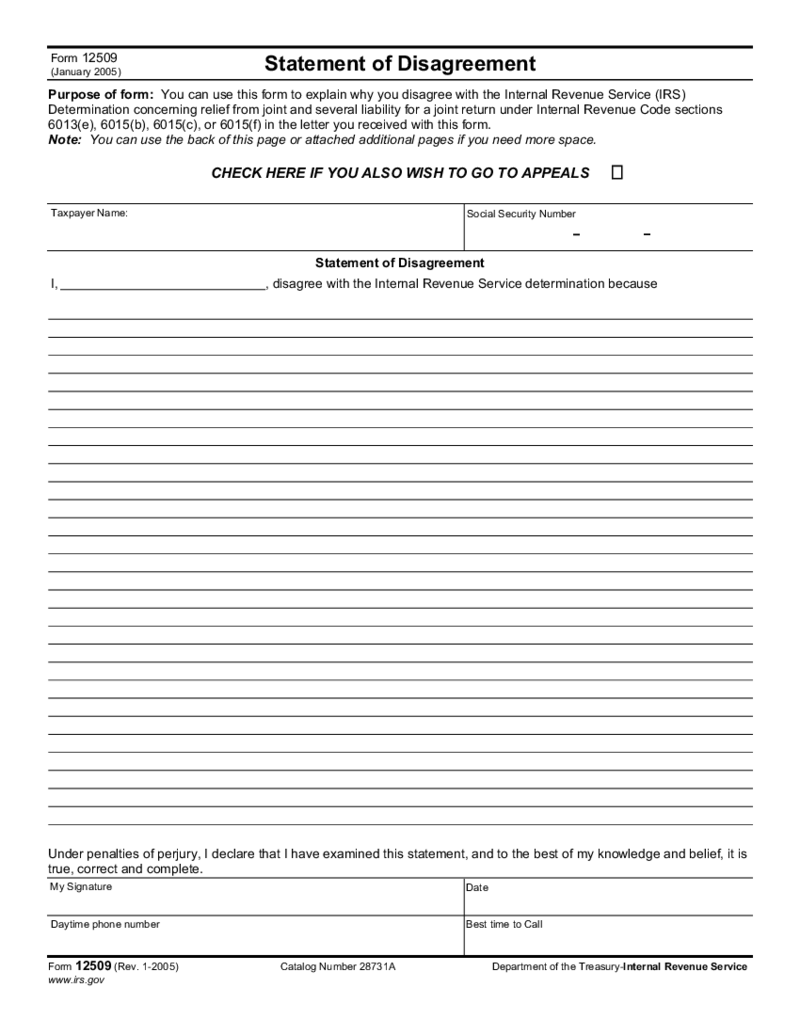

IRS Form 12509

Understanding the IRS Form 12509

The IRS Form 12509 is a crucial piece of documentation, particularly for citizens with alleged tax delinquencies. It serves a specific purpose, helping taxpayers dispute collection actions. Decoding this IRS form and under

IRS Form 12509

Understanding the IRS Form 12509

The IRS Form 12509 is a crucial piece of documentation, particularly for citizens with alleged tax delinquencies. It serves a specific purpose, helping taxpayers dispute collection actions. Decoding this IRS form and under

-

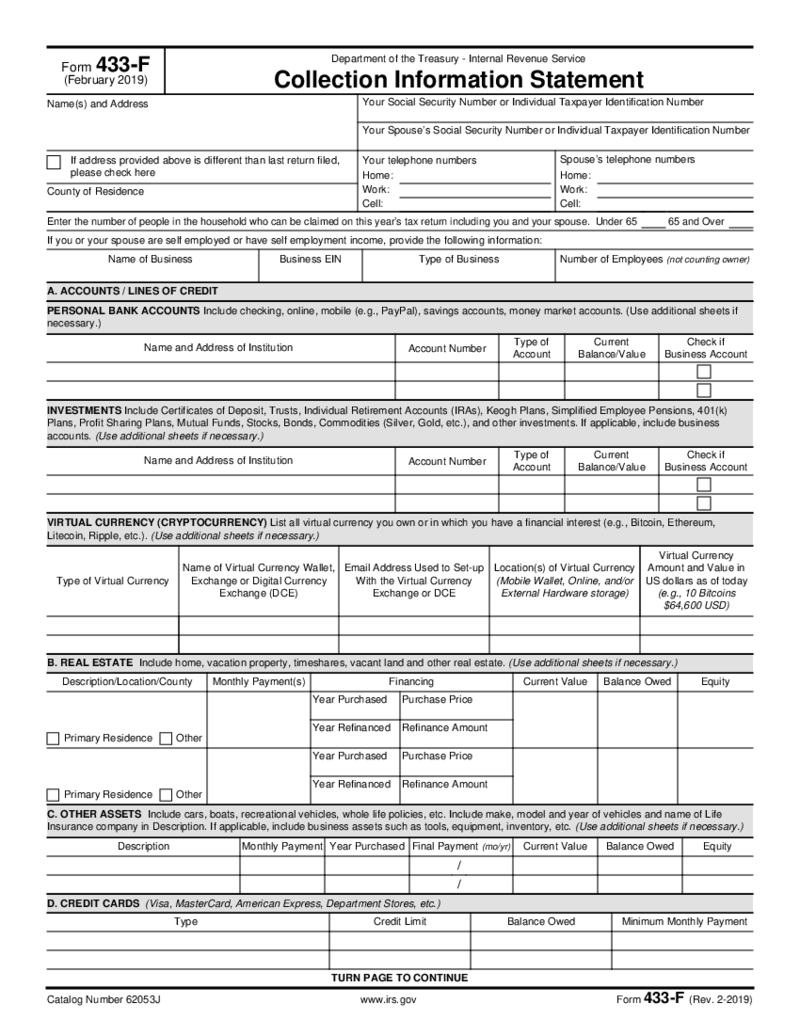

Form 433-F

What is Form 433-F?

The IRS Form 433 F Collection Information Statement is a two-page blank that allows you to tell the IRS in detail about your financial situation. To complete it, you will need information from your last tax return and Form 9465 to requ

Form 433-F

What is Form 433-F?

The IRS Form 433 F Collection Information Statement is a two-page blank that allows you to tell the IRS in detail about your financial situation. To complete it, you will need information from your last tax return and Form 9465 to requ

-

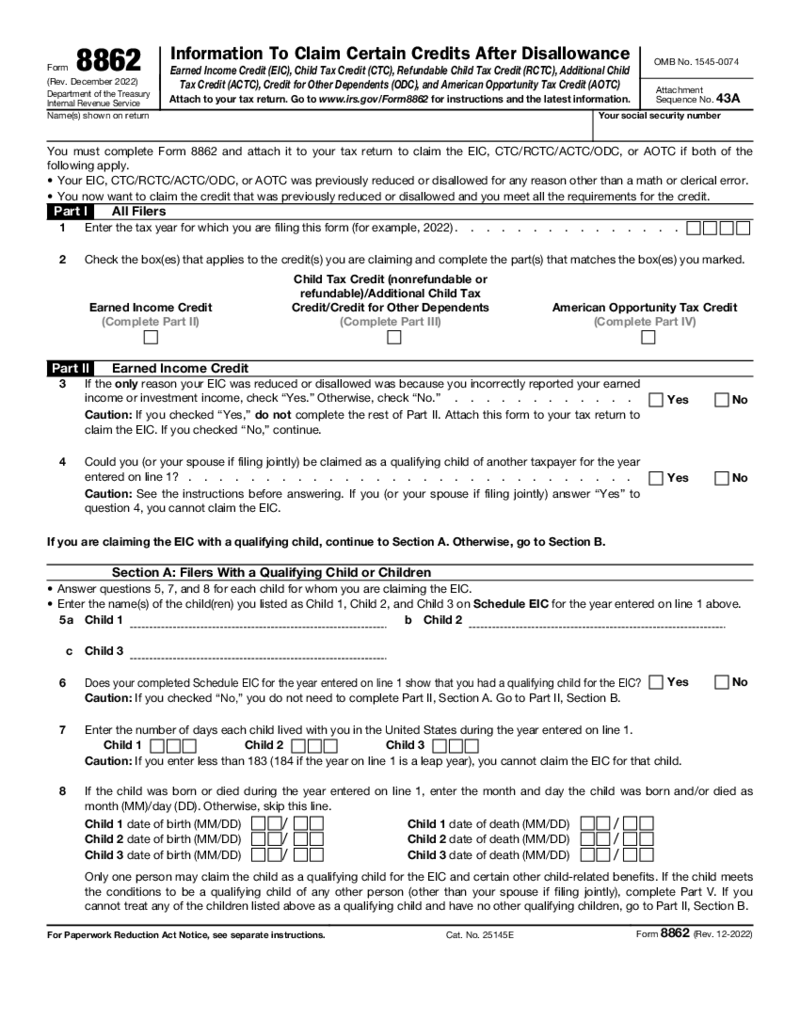

Form IRS 8862

What is Form 8862?

The IRS Form 8862 is a four-page document attached to your tax return. With it, you can re-request credits if the IRS denied them in the past for any reason. It allows you to claim only those tax reductions for which you are qualified.

Form IRS 8862

What is Form 8862?

The IRS Form 8862 is a four-page document attached to your tax return. With it, you can re-request credits if the IRS denied them in the past for any reason. It allows you to claim only those tax reductions for which you are qualified.

-

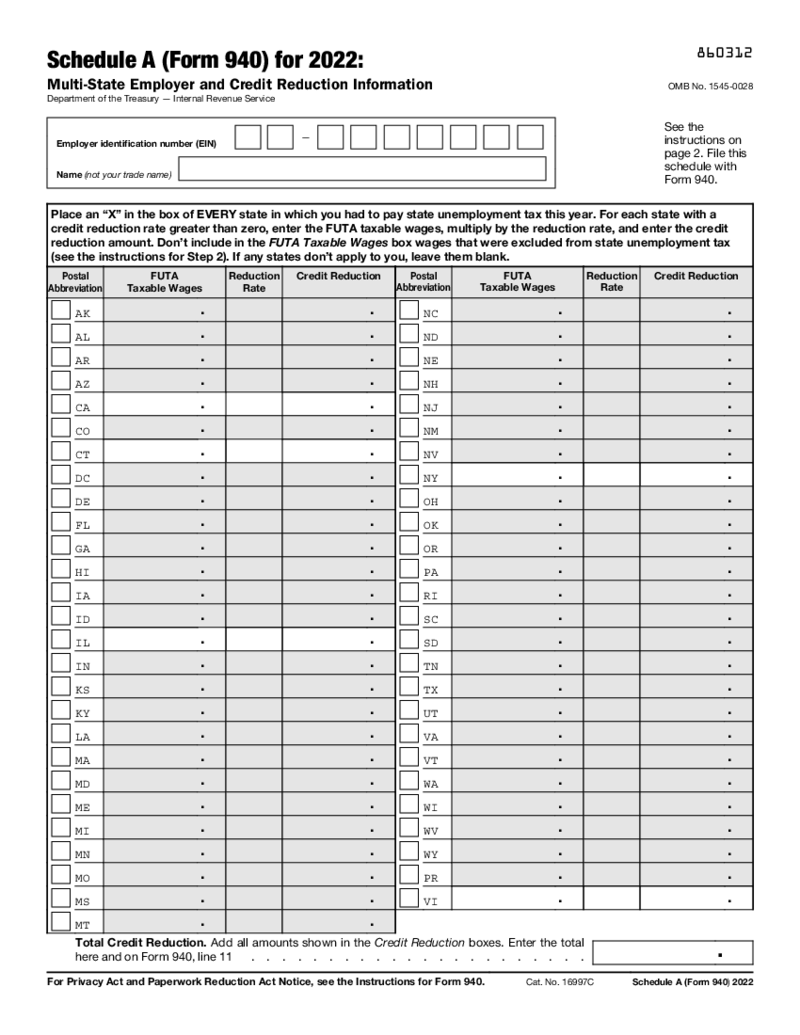

Form 940 Schedule A

What is Form 940 Schedule A?

Schedule A form 940 is called the Multi-State Employer and Credit Reduction Information document. You can use this template to calculate the yearly Federal Unemployment Tax Act taxes you have for the state with the credit redu

Form 940 Schedule A

What is Form 940 Schedule A?

Schedule A form 940 is called the Multi-State Employer and Credit Reduction Information document. You can use this template to calculate the yearly Federal Unemployment Tax Act taxes you have for the state with the credit redu

-

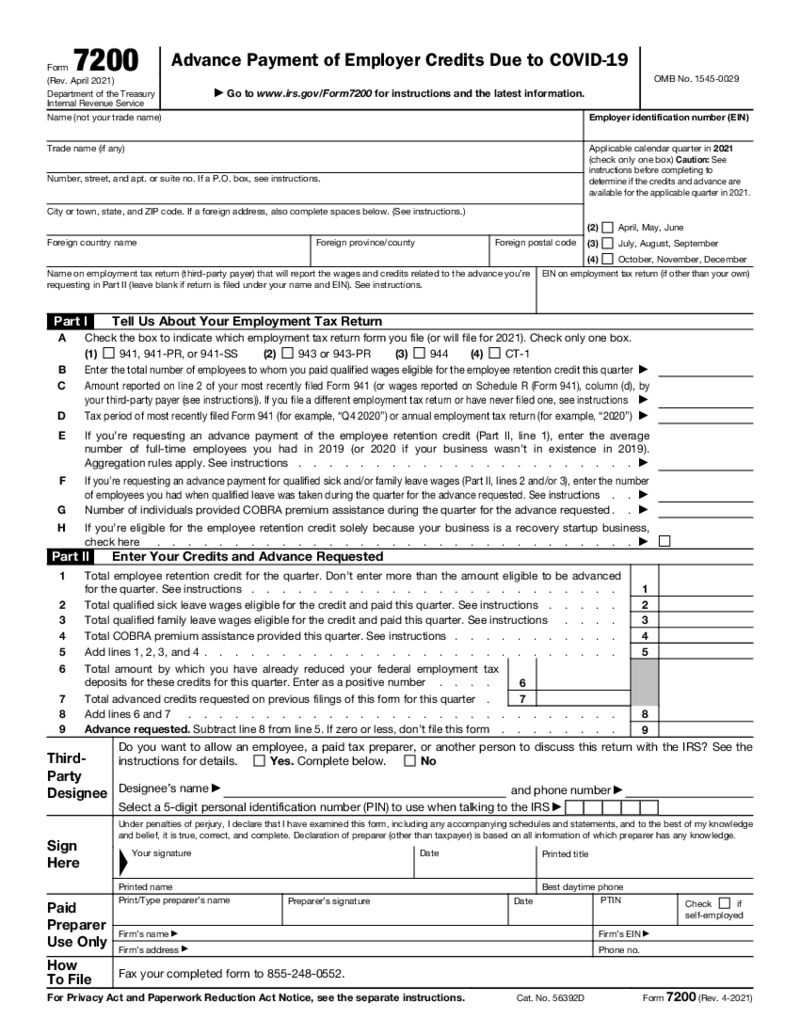

Form 7200

What is a 7200 Form?

Tax form 7200 is one of the most recent forms issued by the IRS. With this one-page document, employers can request additional assistance from the IRS if they have been adversely affected by the coronavirus pandemic and the lockdown.

Form 7200

What is a 7200 Form?

Tax form 7200 is one of the most recent forms issued by the IRS. With this one-page document, employers can request additional assistance from the IRS if they have been adversely affected by the coronavirus pandemic and the lockdown.

-

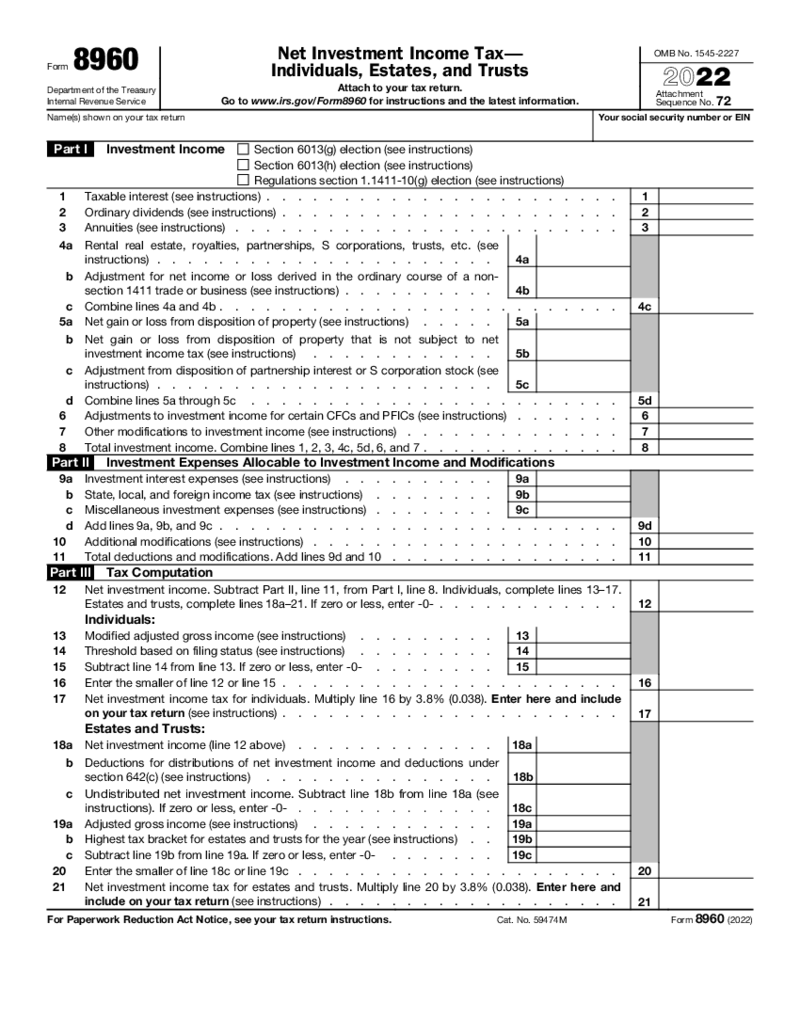

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

-

Form 1120-H (2021)

What Is IRS Form 1120 H 2021

IRS Form 1120 H 2021 is a specialized tax form for homeowners' associations, condominium management associations, and residential real estate management associations. This form allows these associations to benefit from cer

Form 1120-H (2021)

What Is IRS Form 1120 H 2021

IRS Form 1120 H 2021 is a specialized tax form for homeowners' associations, condominium management associations, and residential real estate management associations. This form allows these associations to benefit from cer

-

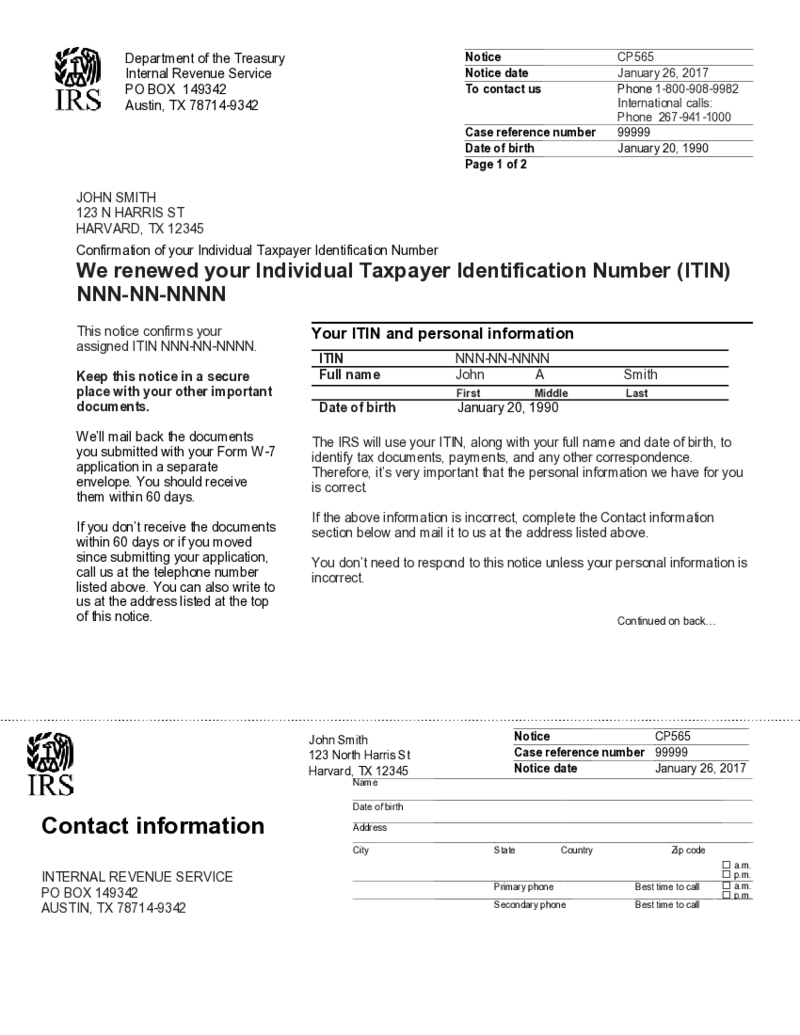

IRS CP565 Form

What Is Form CP565?

The CP565 form is an IRS notice that informs an individual they have been issued an Individual Taxpayer Identification Number (ITIN). An ITIN is a

IRS CP565 Form

What Is Form CP565?

The CP565 form is an IRS notice that informs an individual they have been issued an Individual Taxpayer Identification Number (ITIN). An ITIN is a

-

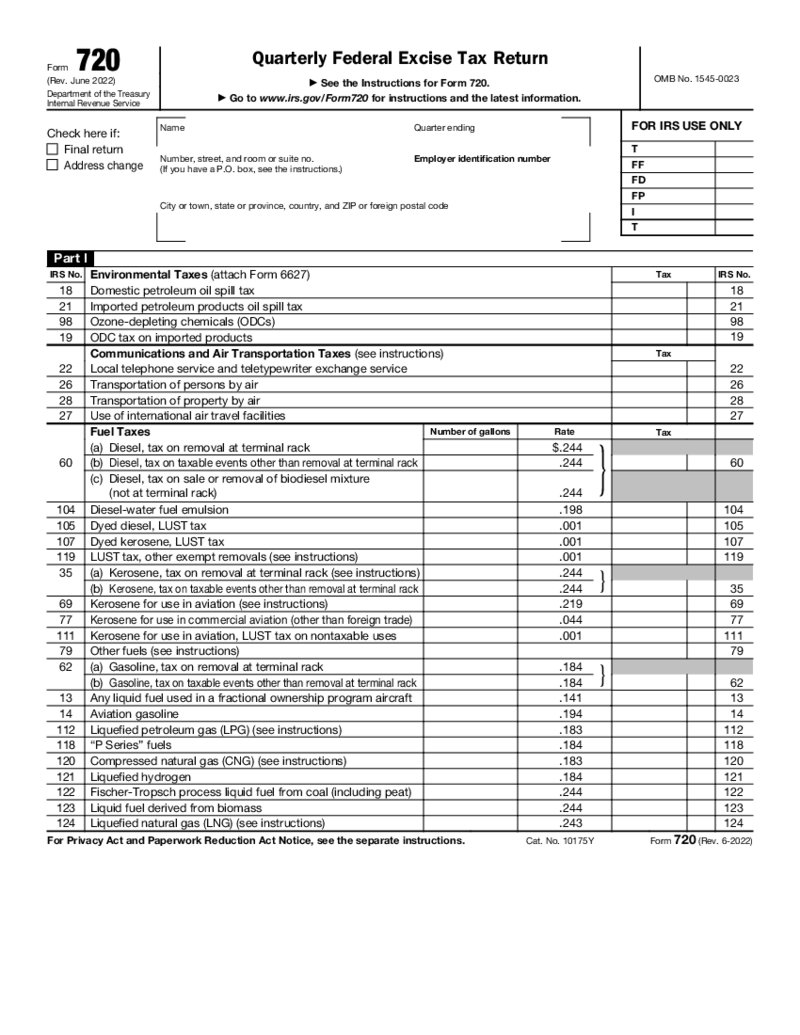

Form 720 (June 2022), Quarterly Federal Excise Tax Return

What is IRS Form 720?

Form 720, or the Quarterly Federal Excise Tax Return, is a document filed with the IRS by taxpayers who provide certain goods, services, and activities subject to excise taxes. IRS Form 720 for 2022 carries over the same purpose and

Form 720 (June 2022), Quarterly Federal Excise Tax Return

What is IRS Form 720?

Form 720, or the Quarterly Federal Excise Tax Return, is a document filed with the IRS by taxpayers who provide certain goods, services, and activities subject to excise taxes. IRS Form 720 for 2022 carries over the same purpose and

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.