-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Form 12509

Get your IRS Form 12509 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the IRS Form 12509

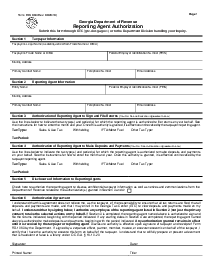

The IRS Form 12509 is a crucial piece of documentation, particularly for citizens with alleged tax delinquencies. It serves a specific purpose, helping taxpayers dispute collection actions. Decoding this IRS form and understanding the correct way to fill it out can save you from headaches down the road.

Deciphering the form 12509

The crux of the 12509 form is making an articulate case that explains the incorrectness of the recorded tax due from the citizen's perspective. Essentially, it allows the taxpayer to appeal a lien, levy, or seizure. To effectively convey your stance, precise documentation that backs up your claims is necessary.

The form has sections to detail inaccuracies, misinterpretations, or administrative errors leading to the alleged tax delinquency. It's a valuable tool, allowing the resolution of disputes without needing to resort to more complex legal processes.

How to Fill Out the Form 12509

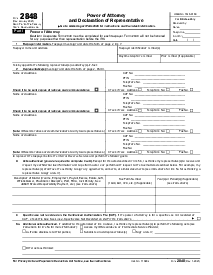

Understanding how to fill out this form template properly requires meticulous attention to detail and some time. Here's a simplified breakdown of the steps:

- Begin by inputting your name in the designated field. Make sure to write your legal name as seen on your tax records.

- Input your Social Security Number (SSN) without any spaces or dashes. Take the time to double-check this number for accuracy, as it’s crucial for the IRS to match your filled form with your tax information.

- Under the section titled "Statement of Disagreement," write a statement indicating your disagreement with the Internal Revenue Service determination. Start by putting your name and explain your reasoning thoroughly and accurately. This part is vital as it helps the IRS to understand your point of view and craft a decision based on the reasonings provided.

- Towards the bottom of the form, find the "My Signature" field and append your signature. Signatures are usually created by either drawing your signature using your mouse or touchpad or by using a pre-saved image of your signature.

- Adjacent to the "My Signature" field, input the date in the "Date" section. Ensure you fill in the current date using the format recommended by the IRS (MM/DD/YYYY).

- Proceed to fill in your "Daytime Phone Number" accurately. The IRS may need to reach you for further clarification or updates, and this will be their primary mode of contact.

- After Inputting your daytime phone number, indicate your "Best Time to Call" in the designated field. Make sure to specify when you'll be available and ready to discuss any matters relating to your disagreement with the IRS.

- Once you’ve confirmed that all sections in the 12509 form are filled out completely and accurately, you may send your document to the right IRS department or save and print it.

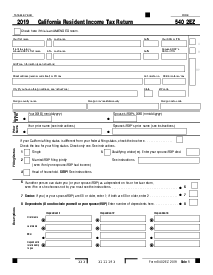

Where to mail form 12509

Concerning where to mail form 12509, it should be sent to the IRS office responsible for your case. The office's address typically can be found on the notice you received. Ensure it's sent via certified mail for documentation purposes. Retaining proof of mailing and delivery is necessary if any disputes arise later.

Fillable online IRS Form 12509