-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

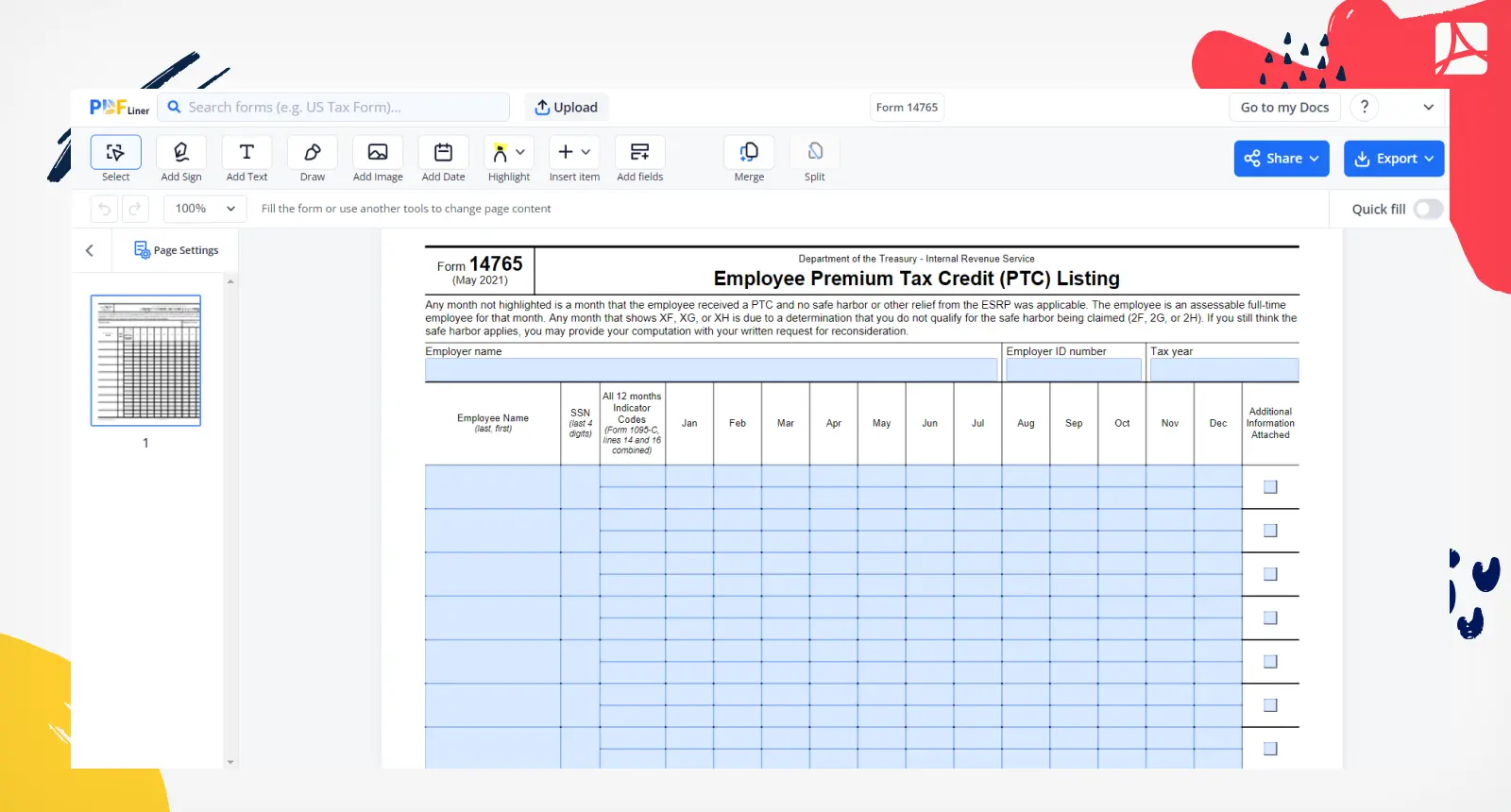

Form 14765

Get your Form 14765 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS Form 14765?

IRS Form 14765 is a tool used by the Internal Revenue Service (IRS) to communicate specific information about employees who may have triggered a penalty, or an Affordable Care Act Employer Shared Responsibility Payment (ESRP). Employers receive this form if one or more of their employees obtained a premium tax credit.

The form itself provides details about each employee who was offered coverage, including the offer's cost and whether the employee chose to participate in the coverage or opted to take a premium tax credit from the government marketplace instead.

Understanding employee premium tax credit

An integral component of IRS Form 14765 is the Employee Premium Tax Credit (PTC). The PTC is a refundable credit that eligible individuals can use to lower their monthly insurance premiums. If an employee does not receive a sufficient health coverage offer from their employer, they can opt to purchase insurance through a government marketplace and receive a premium tax credit.

Importantly, if an employee claims this credit, it can potentially trigger an ESRP for the employer, especially if the coverage offered by the employer is not considered "affordable" or doesn't provide "minimum value" as per ACA's guidelines.

Deciphering form 14765 codes

One of the complexities of IRS Form 14765 is understanding the form 14765 codes. Each line of Form 14765 corresponds to an employee, and column (b) of the form contains a two-character alpha-numeric indicator code.

These codes provide information about the type of coverage offered to each employee, the employee's share of the lowest cost monthly premium, and the safe harbor or other relief applicable to the employee, if any. Understanding these codes is crucial for employers as they help identify potential discrepancies or issues that could lead to ESRP penalties.

IRS Form 14765 Instructions: Completing the Form

The process of completing IRS Form 14765 is actually quite straightforward as it's a form provided by the IRS to the employer, not a form the employer must complete and submit.

When you receive IRS Form 14765, it means the IRS has identified employees who may have triggered a potential ESRP for your business. In response, you need to review the form carefully, confirm the accuracy of the information presented, and, if necessary, prepare a response. If you disagree with the data provided, you need to use the IRS-provided Form 14764 (ESRP Response) to clarify or correct the information.

If you find discrepancies in the information or disagree with it, you need to prepare a response. This is crucial because it can help you avoid a potential ESRP.

To communicate your response to the IRS, use Form 14764, also known as the ESRP Response. This is the form where you can provide any necessary corrections or clarifications to the information presented in Form 14765.

Fillable online Form 14765