-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Legal

- Real Estate

- Logistics

- Medical

- Bill of Sale

- Contracts

- All templates

![Picture of Legal Aid Queensland Application]() Legal Aid Queensland Application

Legal Aid Queensland Application

![Picture of Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors]() Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

![Picture of Trustee Resignation Form]() Trustee Resignation Form

Trustee Resignation Form

![Picture of Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment]() Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

![Picture of Pennsylvania Last Will and Testament Form]() Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

![Picture of AU Mod(JY), Parent(s), Guardian(s) details]() AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

![Picture of AF Form 1206, Nomination for Award]() AF Form 1206, Nomination for Award

AF Form 1206, Nomination for Award

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 4

-

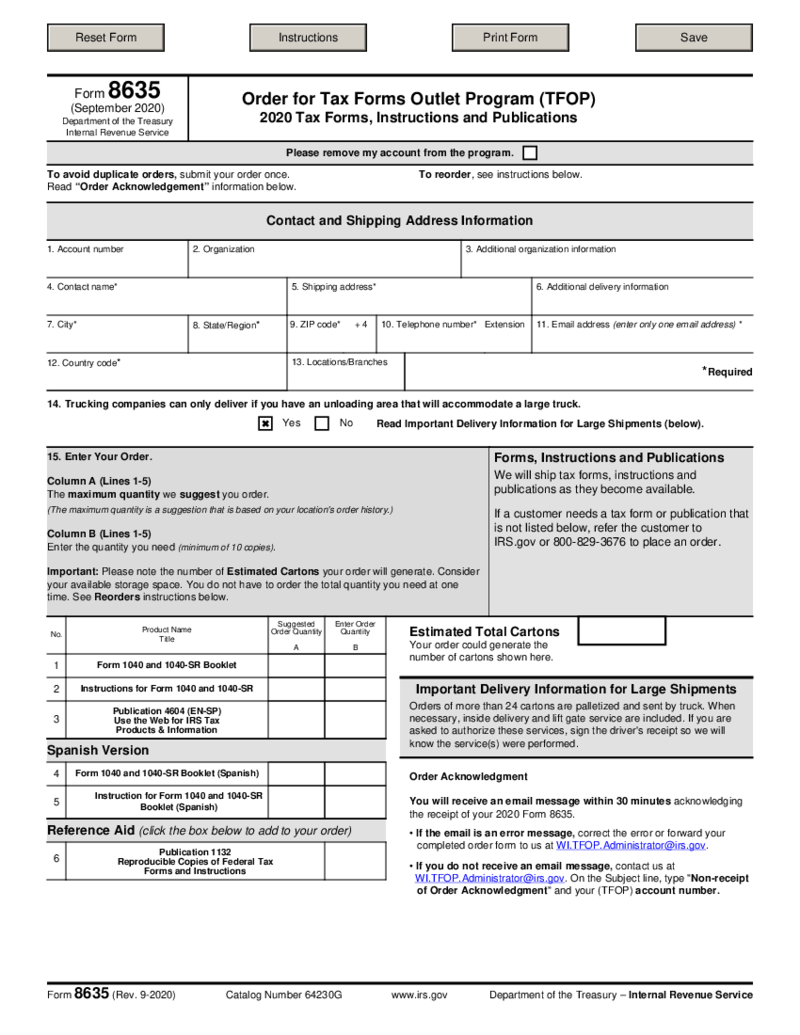

Form 8635

What Is Form 8635?

Form 8635, also known as the Taxpayer Order for Transcript of Tax Return, serves as a request form for those seeking a transcript of their past tax returns. This IRS form enables taxpayers to order multiple transcripts with a single req

Form 8635

What Is Form 8635?

Form 8635, also known as the Taxpayer Order for Transcript of Tax Return, serves as a request form for those seeking a transcript of their past tax returns. This IRS form enables taxpayers to order multiple transcripts with a single req

-

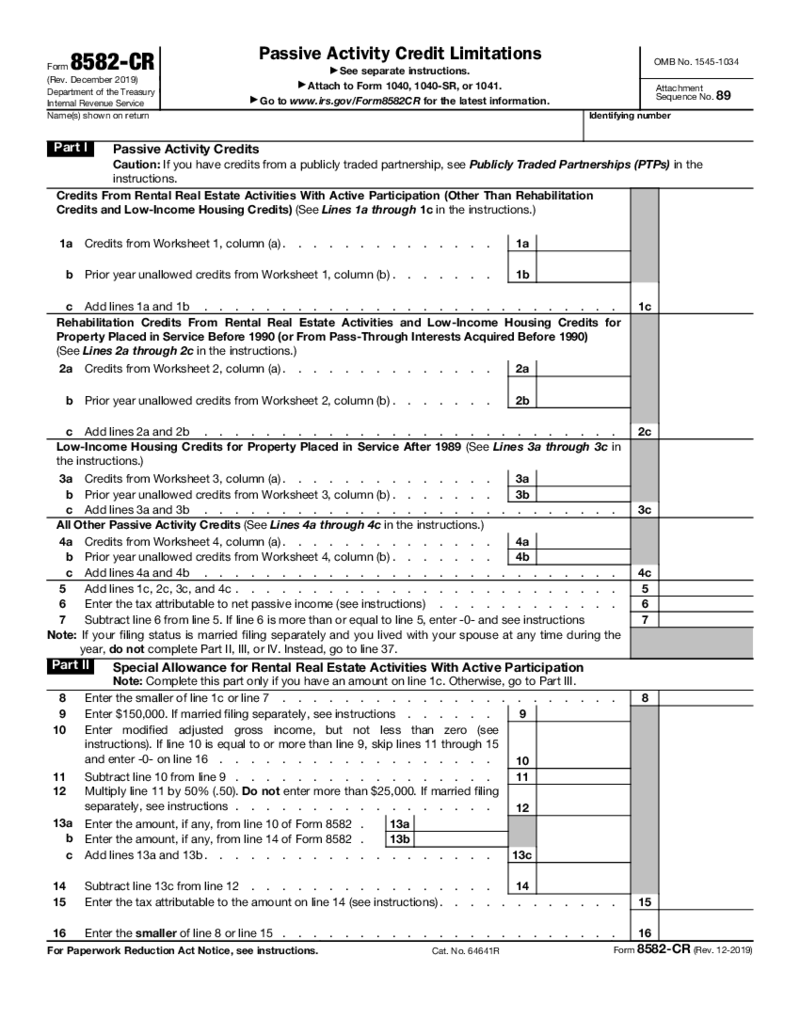

Form 8582-CR

What is Form 8582-CR

Form 8582-CR is a United States Internal Revenue Service (IRS) tax form titled "Passive Activity Credit Limitations." It is utilized to compute the amount of any passive activity credit carryovers that can be applied in the

Form 8582-CR

What is Form 8582-CR

Form 8582-CR is a United States Internal Revenue Service (IRS) tax form titled "Passive Activity Credit Limitations." It is utilized to compute the amount of any passive activity credit carryovers that can be applied in the

-

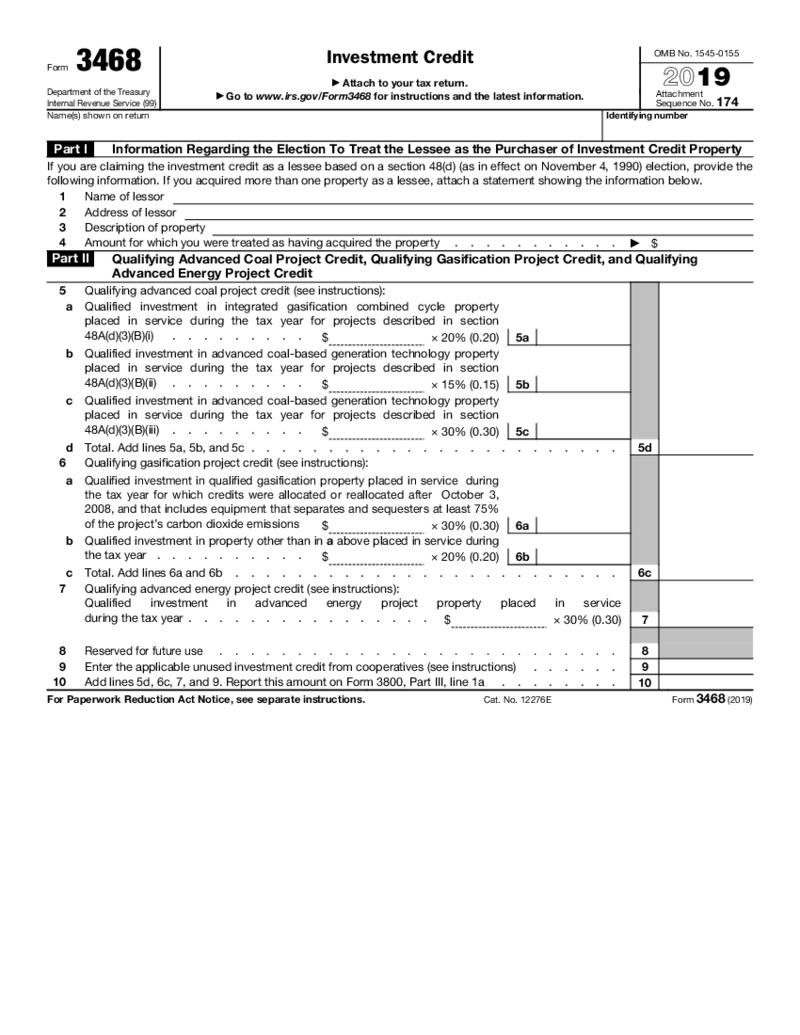

Form 3468

What is IRS Form 3468?

The Internal Revenue Service (IRS) oversees and implements tax laws in the United States. Among the numerous forms they administer, one that stands out for investors is IRS Form 3468. This form is specifically designed for those who

Form 3468

What is IRS Form 3468?

The Internal Revenue Service (IRS) oversees and implements tax laws in the United States. Among the numerous forms they administer, one that stands out for investors is IRS Form 3468. This form is specifically designed for those who

-

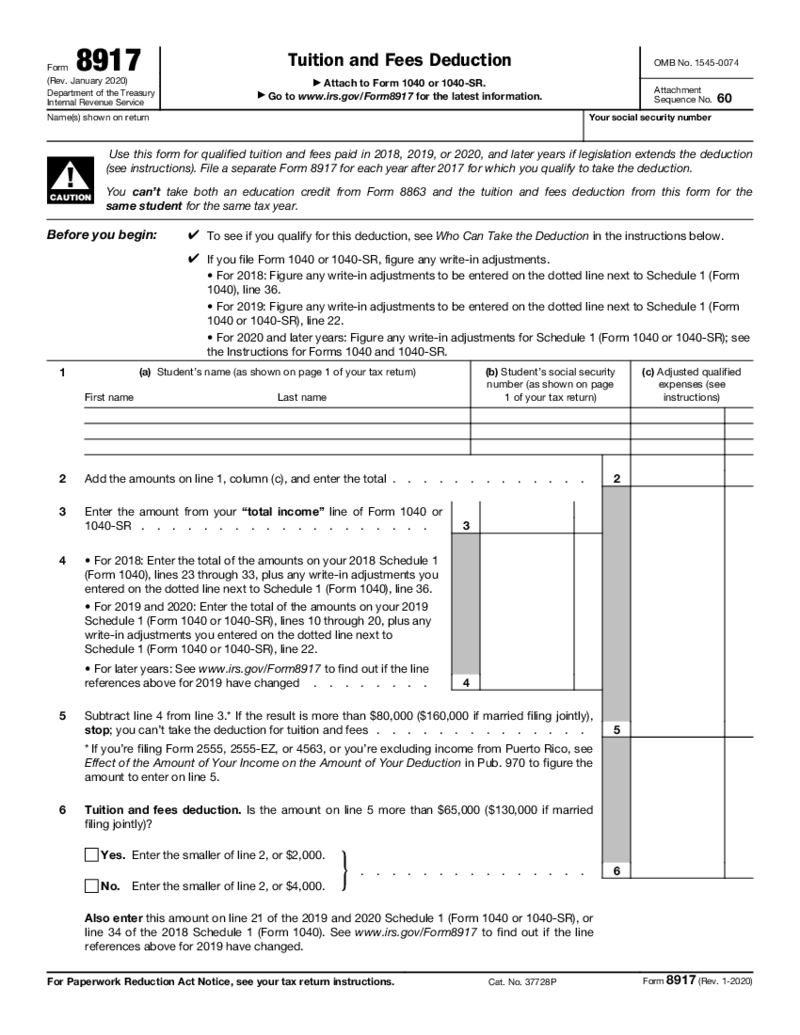

Form 8917

What is an 8917 form?

This form is used for partial deduction of higher education costs. The document should be accompanied by Form 1098-T, completed by a school, which indicates your transaction amount per tax year. The sum you can get back depends on th

Form 8917

What is an 8917 form?

This form is used for partial deduction of higher education costs. The document should be accompanied by Form 1098-T, completed by a school, which indicates your transaction amount per tax year. The sum you can get back depends on th

-

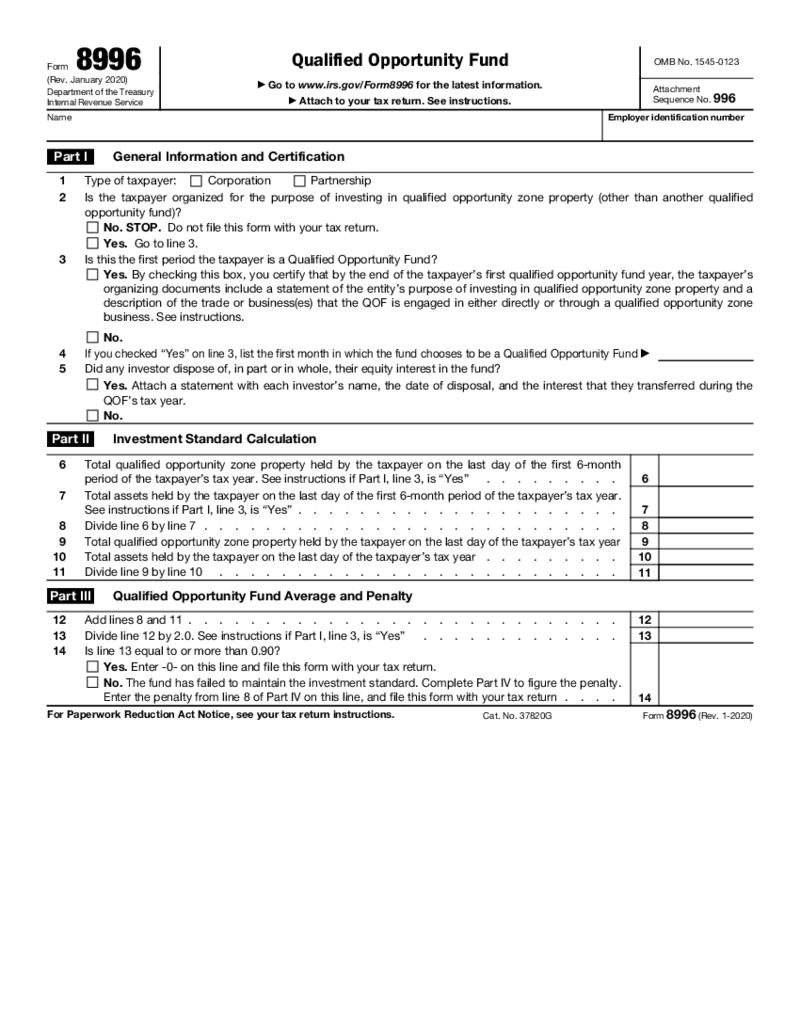

Form 8996

What is form 8996

This is a standard tax form necessary for launching a Qualified Opportunity Fund (QOF). It is a special type of fund that seeks to invest in the so-called qualified Opportunity Zones. They include depressed areas, small towns, etc. You c

Form 8996

What is form 8996

This is a standard tax form necessary for launching a Qualified Opportunity Fund (QOF). It is a special type of fund that seeks to invest in the so-called qualified Opportunity Zones. They include depressed areas, small towns, etc. You c

-

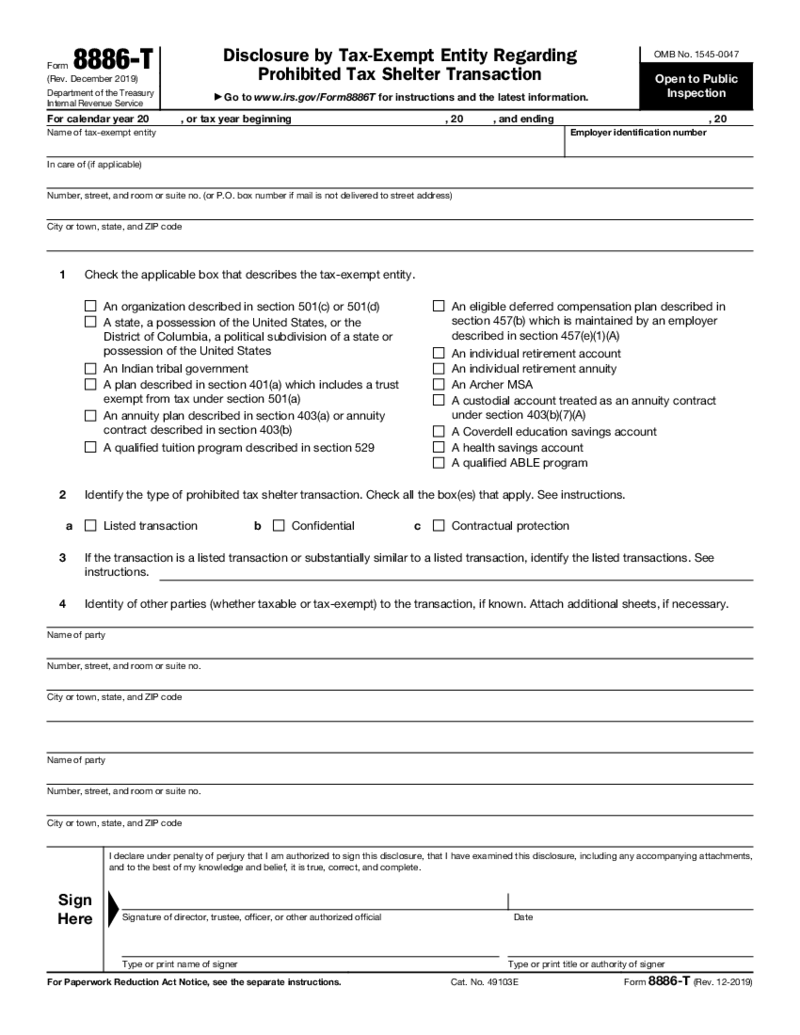

Form 8886-T

What Is A Form 8886-T

Form 8886-T, also known as the Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction, is a tax document required by the Internal Revenue Service (IRS) for tax-exempt entities to disclose inform

Form 8886-T

What Is A Form 8886-T

Form 8886-T, also known as the Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction, is a tax document required by the Internal Revenue Service (IRS) for tax-exempt entities to disclose inform

-

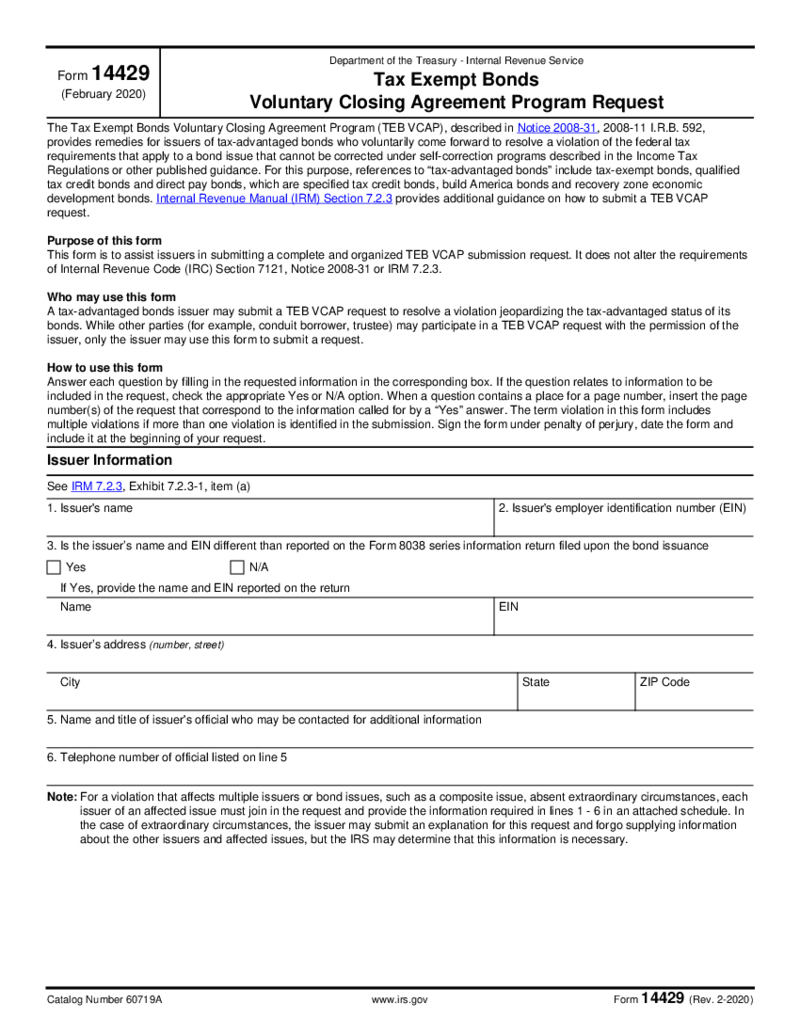

Form 14429

1. What is a 14429 Form?

The IRS Form 14429 (full title: Tax Exempt Bonds Voluntary Closing Agreement Program Request) is a federal tax form that is issued by the Internal Revenue Service to provide assistance to issuers who need to submit a TEB VCAP subm

Form 14429

1. What is a 14429 Form?

The IRS Form 14429 (full title: Tax Exempt Bonds Voluntary Closing Agreement Program Request) is a federal tax form that is issued by the Internal Revenue Service to provide assistance to issuers who need to submit a TEB VCAP subm

-

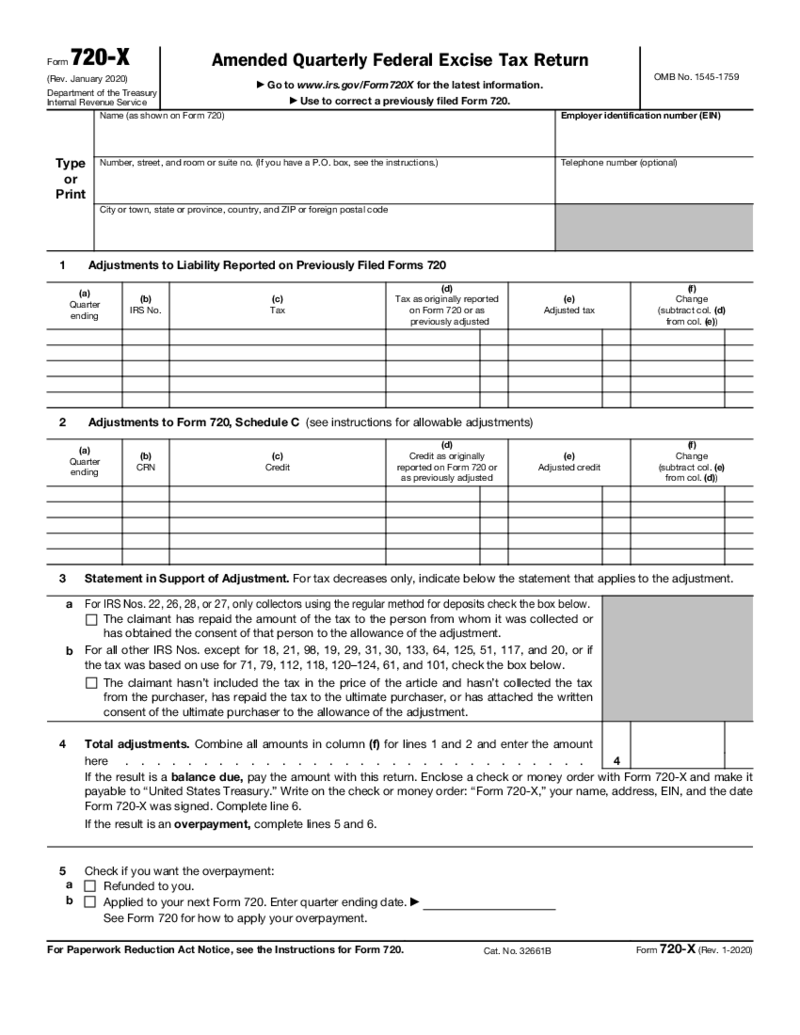

Form 720-X

What Is Form 720 X

Form 720-X is a document taxpayers use to adjust to previously filed form 720s, known as the Quarterly Federal Excise Tax Return. Taxpayers may need to correct errors or report additional excise tax liabilities through

Form 720-X

What Is Form 720 X

Form 720-X is a document taxpayers use to adjust to previously filed form 720s, known as the Quarterly Federal Excise Tax Return. Taxpayers may need to correct errors or report additional excise tax liabilities through

-

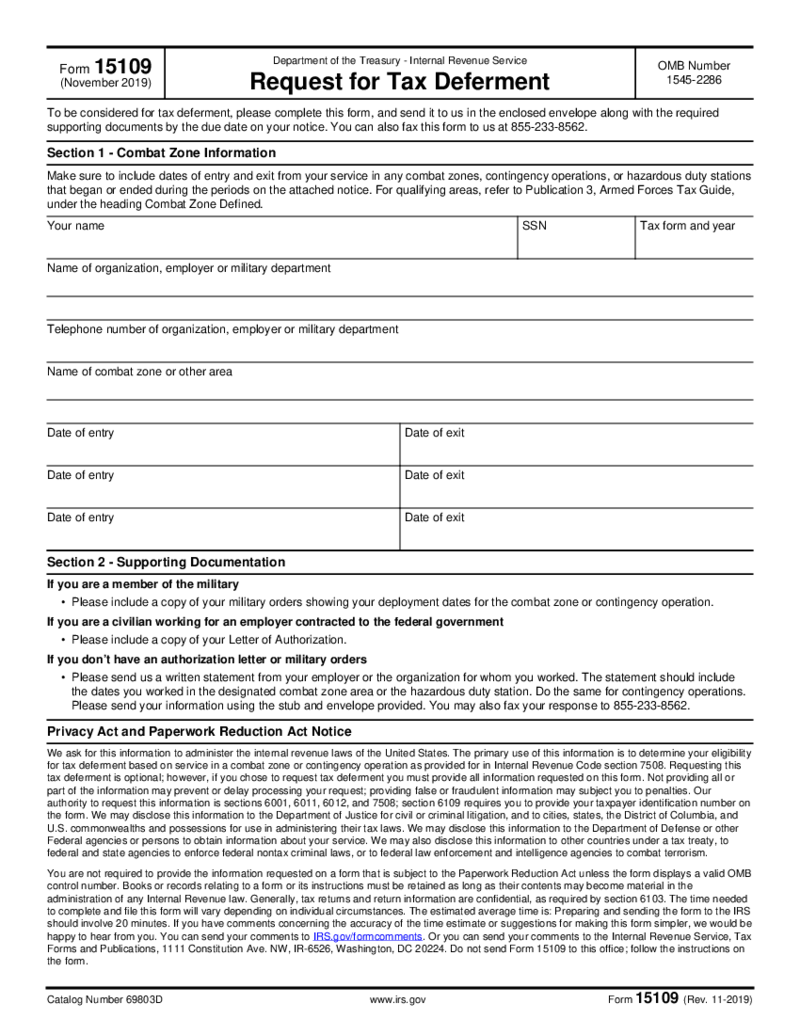

Form 15109

What is a 15109 Form?

Fillable Form 15109 is a free federal tax form issued by the Internal Revenue Service of the USA (IRS). This document is also called Request for Tax Deferment, and its primary purpose is to collect information about an applicant to c

Form 15109

What is a 15109 Form?

Fillable Form 15109 is a free federal tax form issued by the Internal Revenue Service of the USA (IRS). This document is also called Request for Tax Deferment, and its primary purpose is to collect information about an applicant to c

-

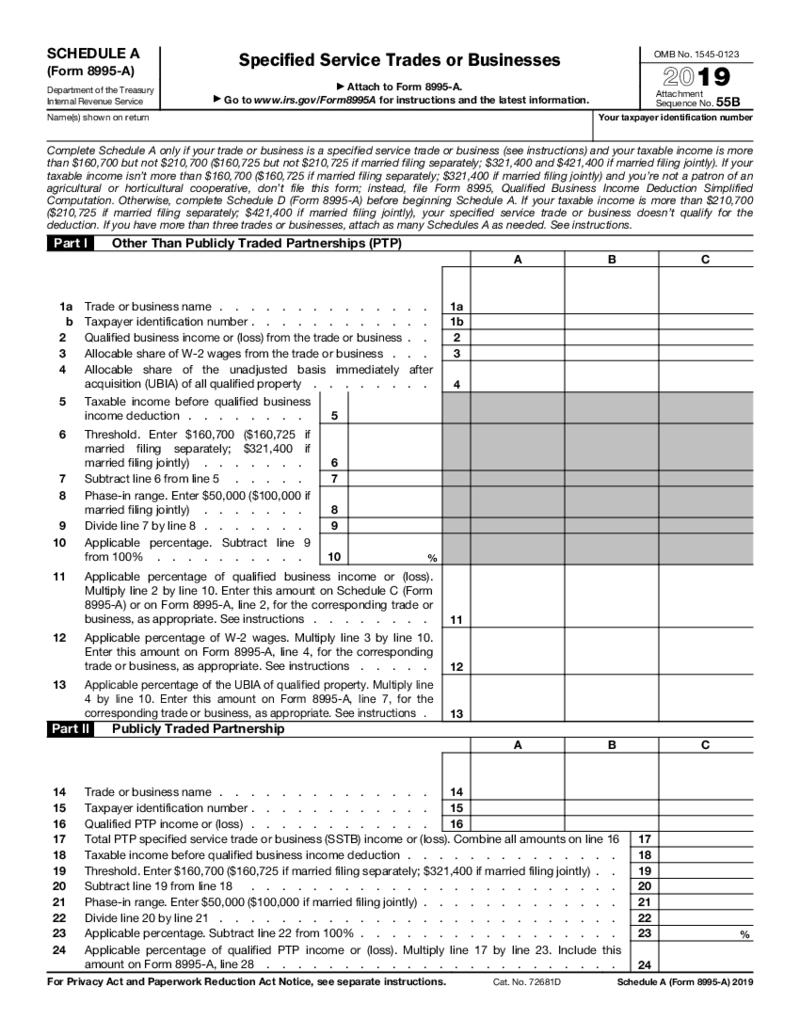

Form 8995-A (Schedule A)

What is Form 8995-A Schedule A?

The Form 8995-A is used for figuring your qualified business income (QBI) deduction. It consists of four schedules, and one of them is Schedule A. This document is provided for the defined service trades and businesses.&nbs

Form 8995-A (Schedule A)

What is Form 8995-A Schedule A?

The Form 8995-A is used for figuring your qualified business income (QBI) deduction. It consists of four schedules, and one of them is Schedule A. This document is provided for the defined service trades and businesses.&nbs

-

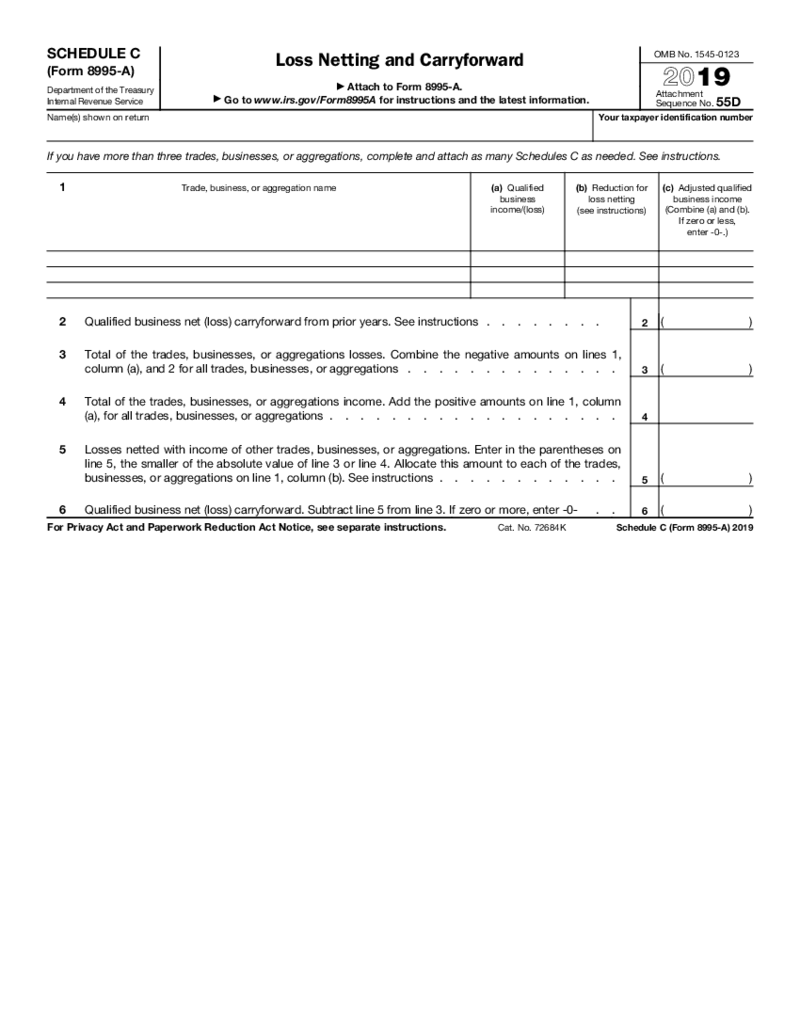

Form 8995-A (Schedule C)

1. What is an 8995 A Schedule C form?

The fillable 8995 A Schedule C form is a federal tax form by the IRS that is used for reporting loss netting and carryforward. It can be used as an independent form by business entities. With PDFLiner, you can downloa

Form 8995-A (Schedule C)

1. What is an 8995 A Schedule C form?

The fillable 8995 A Schedule C form is a federal tax form by the IRS that is used for reporting loss netting and carryforward. It can be used as an independent form by business entities. With PDFLiner, you can downloa

-

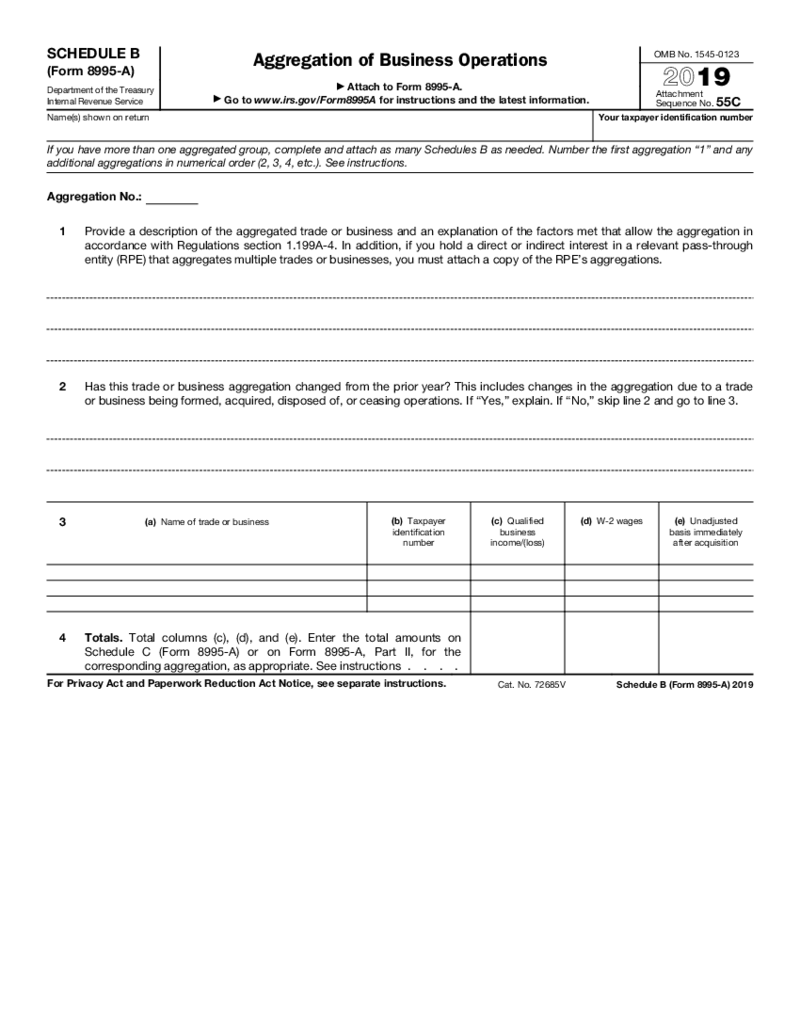

Form 8995-A (Schedule B)

1. What is the 8995-A form?

The fillable 8995-A form is also known as a qualified business income deduction. The form is used for calculating the qualified business income deduction. There are A, B, C, and D schedules for specific cases. The 8995 form is

Form 8995-A (Schedule B)

1. What is the 8995-A form?

The fillable 8995-A form is also known as a qualified business income deduction. The form is used for calculating the qualified business income deduction. There are A, B, C, and D schedules for specific cases. The 8995 form is

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.