-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 12203

Get your Form 12203 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Tax Form 12203?

Tax form 12203 is a tool that taxpayers can use to request a review of an IRS decision that they find unsatisfactory. This document is applicable when you receive a letter from the IRS that proposes adjustments to your tax return and includes a paragraph offering you the right to request an appeals conference. Remember this form should be used if you want to settle your case without going to court, which can save both time and money.

Importance of tax form 12203

Tax Form 12203 is more than just a formality; it's a pathway for taxpayers to resolve disputes with the IRS in a less confrontational and more cost-effective manner than going to court. Appeals through this process are usually less formal and can often be conducted through correspondence or over the phone. This method is particularly beneficial for those looking to settle tax disagreements without undergoing the time-consuming and expensive court process.

How to Fill Out Form 12203

Filling out this template correctly is critical to ensure your appeal gets the attention it deserves. Here are some IRS form 12203 instructions:

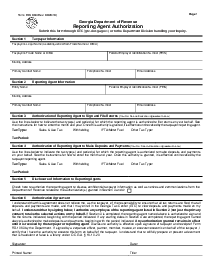

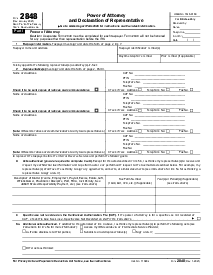

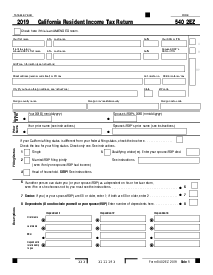

- Enter the full legal names of all individuals associated with the tax matter in the section allocated for taxpayer information.

- In the designated area for taxpayer identifiers, provide the taxpayer identification number relevant to the tax issue.

- Type in the current mailing details including house or building number, street name, and apartment or suite number if applicable.

- Specify the particular tax document number you are contesting (for example, "1040," "1120," etc.).

- Add the locality details: include the name of your city, the abbreviation of your state, and the five-digit postal code.

- Indicate the tax year or range of years in question by filling in the specified section for tax periods.

- Provide a telephone number where you can be reached, and note an optimal time slot for contact in the fields assigned for communication details.

- Under the areas intended for contested items, list out each specific charge or decision with which you take issue.

- For each contested item you listed, meticulously explain your rationale for disagreement in the provided spaces.

- Complete the declaration section at the bottom by typing in your full name as shown on the tax records.

- Sign your name electronically using the tools provided by PDFliner, then insert the current date next to your signature.

- If a co-taxpayer exists, have them replicate steps 10 and 11 providing their name, signature, and the date.

- Finalize the process by entering the name and signature of any authorized representative, if applicable, along with the date, their contact number, and the suitable time slot for correspondence.

Where to mail IRS form 12203?

Once you’ve completed the form template, you might wonder about the IRS form 12203 mailing address. The mailing address is often contingent on the IRS office that sent you the initial determination letter. Remember to review the correspondence you received from the IRS, as it typically specifies the correct mailing address. This ensures that your request gets to the right division and can be processed without unnecessary delays.

Form Versions

2020

Form 12203 (2020)

Fillable online Form 12203