-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

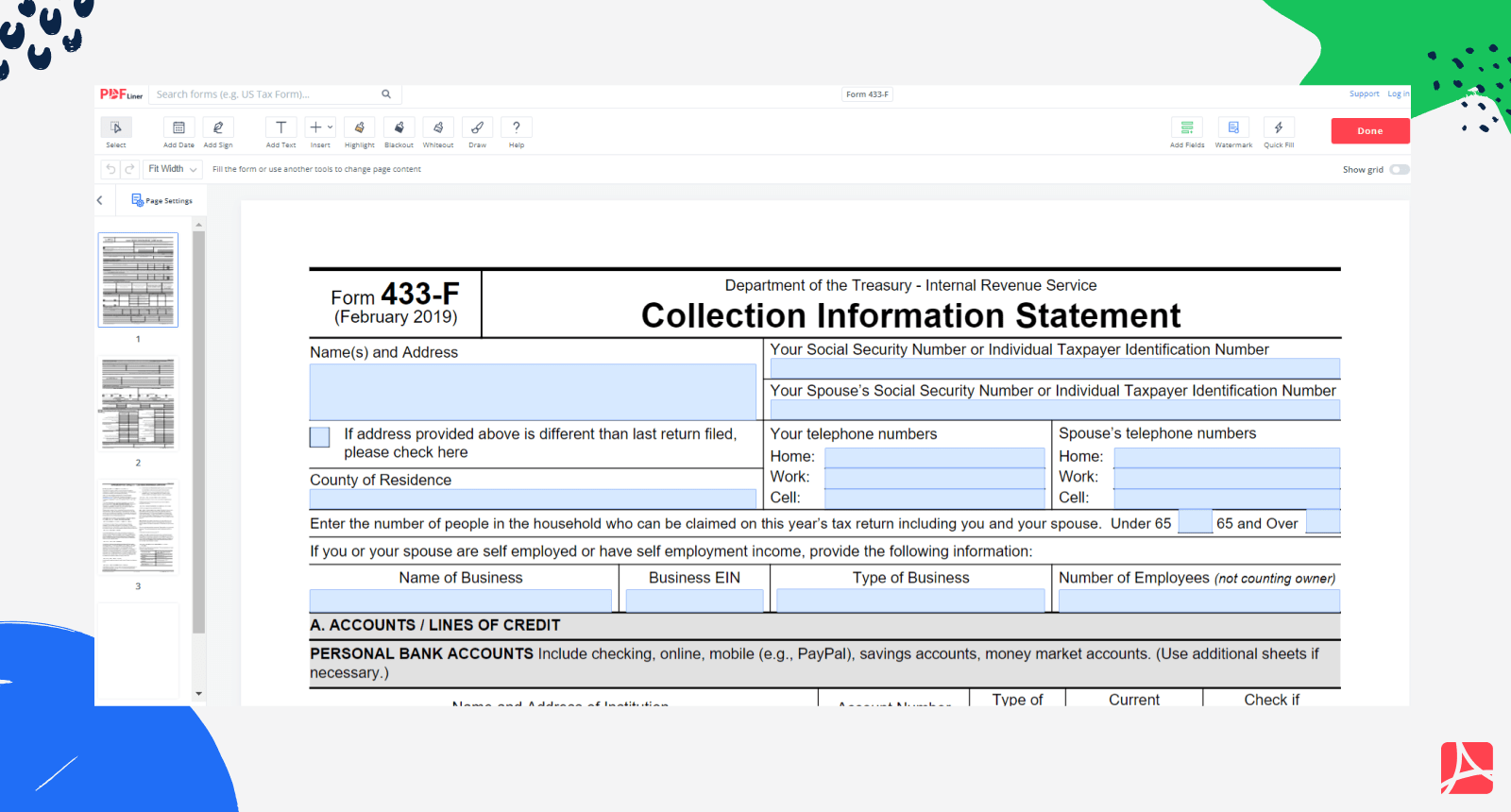

Form 433-F

Get your Form 433-F in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 433-F?

The IRS Form 433 F Collection Information Statement is a two-page blank that allows you to tell the IRS in detail about your financial situation. To complete it, you will need information from your last tax return and Form 9465 to request a revision of your payment plan (as a rule).

What do I need the IRS Form 433-F for?

- Use the Form 433-F fillable when you are having trouble paying your tax liability.

- It might be necessary when your tax liability has exceeded $50000 or when your income and current plan do not allow you to pay off your debt for the next six years.

- If you cannot pay off your debts, the IRS will ask you for an explanation of your current financial situation and offer an acceptable payment plan.

- With IRS Form 433 F PDF, you can also request “hardship status.”

How to Fill Out Tax Form 433 F?

- Enter your name, SSN, residence country, and contact details. If you are self-employed, fill in your business details. Also, include the same information for your spouse if you sent your last Form 1040 as married filing jointly.

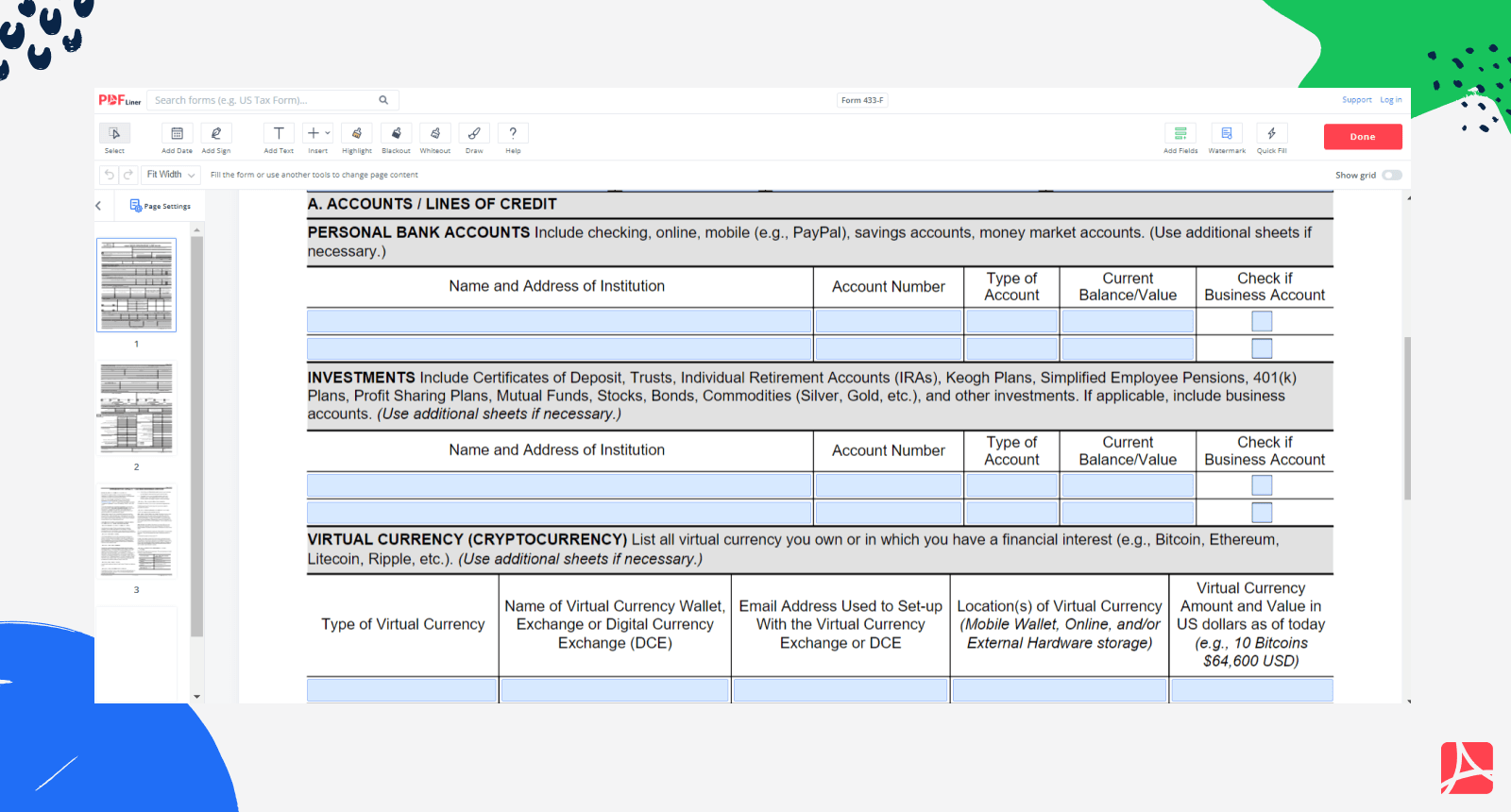

- Provide details of your bank accounts, cards, investments, and virtual currency (if any). Specify if you own any real estate or other valuable assets.

- If you own a business, complete section “E.” If not, leave this block empty.

- Fill in the table regarding your current place of employment and indicate income and taxes. Also, calculate approximate monthly expenses.

- Specify the date the file was completed and put your signature.

Where to mail Form 433 F?

The IRS offers addresses of several certified centers where you can send your completed document, depending on your state. You can find the full table on the official website of the tax service. This form is often sent along with Form 9465, which asks for a review of your payment plan. Both of these forms can also be submitted to the IRS along with your annual tax return. In this case, use the same address you sent Form 1040 to (you can find this information in the enclosed booklet).

Organizations that work with printable IRS Form 433-F

- IRS

Fillable online Form 433-F