-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 13844

Get your Form 13844 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 13844?

IRS Form 13844, officially titled "Application for Reduced User Fee for Installment Agreements," serves individuals who are unable to pay their full tax liability immediately. By submitting this form, eligible taxpayers can request a reduction in the user fee typically associated with setting up an installment agreement with the IRS. The purpose of the form 13844 application for reduced user fee for installment agreements is a testament to the IRS's efforts to accommodate taxpayers in financial hardship.

IRS Tax Form 13844: Eligibility Criteria

To effectively utilize this IRS tax form, you must meet specific criteria. These include having an income below 250% of the federal poverty level and being unable to pay the standard installment agreement user fee. Keep in mind this form is not for everyone. High-income earners or those capable of paying the lump sum may not be eligible for the reduced fee.

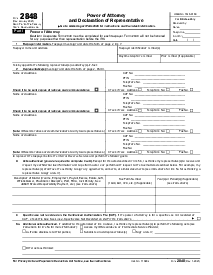

How to Fill Out the Form 13844

The process of filling out the 13844 form is straightforward but requires attention to detail. Here are the main form 13844 instructions for completing:

- Check the appropriate box if you can't make electronic payments via a debit instrument for the direct debit installment agreement. Simply select the corresponding checkbox on the form to indicate this.

- Indicate the number of individuals in your household. This includes you, your spouse, and any dependents you listed on your latest tax return. Enter this total figure in the designated field.

- Provide your most recently recorded adjusted gross income. Locate the field for this information and enter the amount from the applicable tax year.

- Fill in your personal details, including last name, first name, and middle initial. Next to your name, enter your SSN or TIN in the appropriate space.

- If filing jointly, include your spouse's full name—last, first, and middle initial—and their SSN or TIN in the corresponding fields.

Once all other sections are accurately filled, you need to sign the form. Write your signature and date the document to authenticate it. If this form is for joint liability, have your spouse sign and date the form as well in the provided spaces.

Where to mail IRS form 13844?

Once completed, you may wonder where to mail IRS Form 13844. The most up-to-date mailing address can be found on the IRS website or the instructions accompanying the form. Ensure that you mail all the documents to the correct address to prevent delays in the processing of your application. For the end of 2023 mailing address for form 13844 is: IRS, P.O. Box 219236, Stop 5050, Kansas City, MO 64121-9236.

Form Versions

2020

Fillable Form 13844 (2020)

Fillable online Form 13844