-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Canada Tax Forms - page 2

-

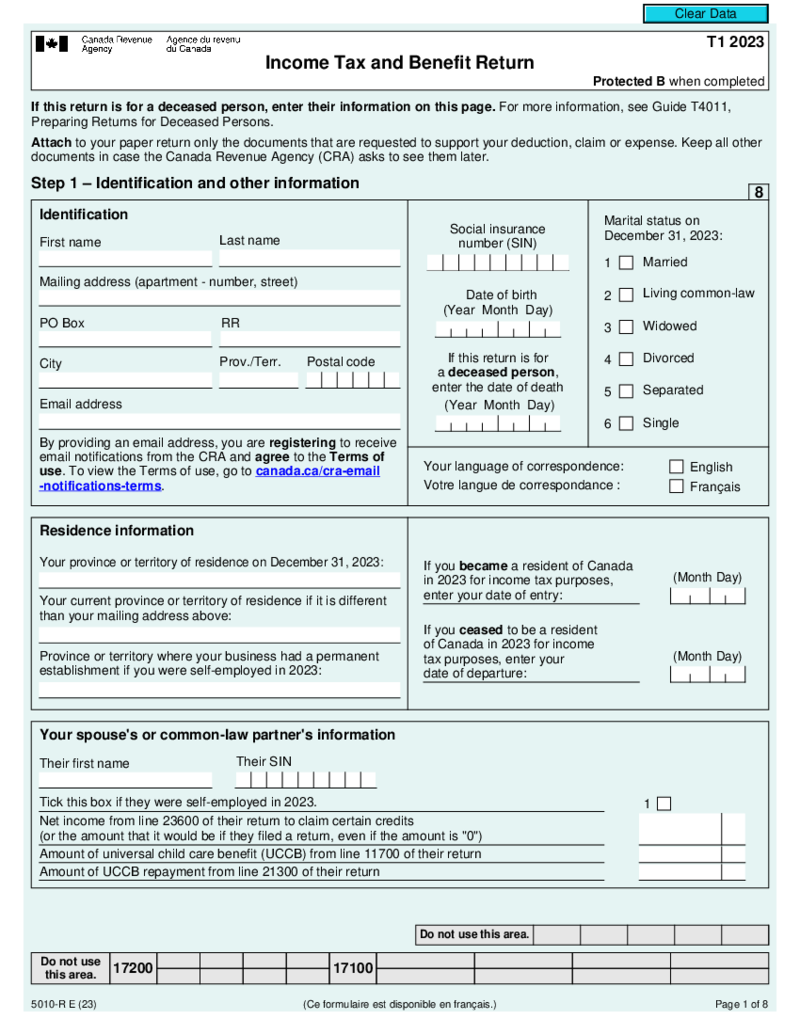

T1 BC Income Tax and Benefit Return

What is a T1 Form BC?

A T1 form is a tax return for individuals who are residents of British Columbia. This form is used to report income from all sources, including employment, business, investments, and other sources. The T1 form must be filed by April

T1 BC Income Tax and Benefit Return

What is a T1 Form BC?

A T1 form is a tax return for individuals who are residents of British Columbia. This form is used to report income from all sources, including employment, business, investments, and other sources. The T1 form must be filed by April

-

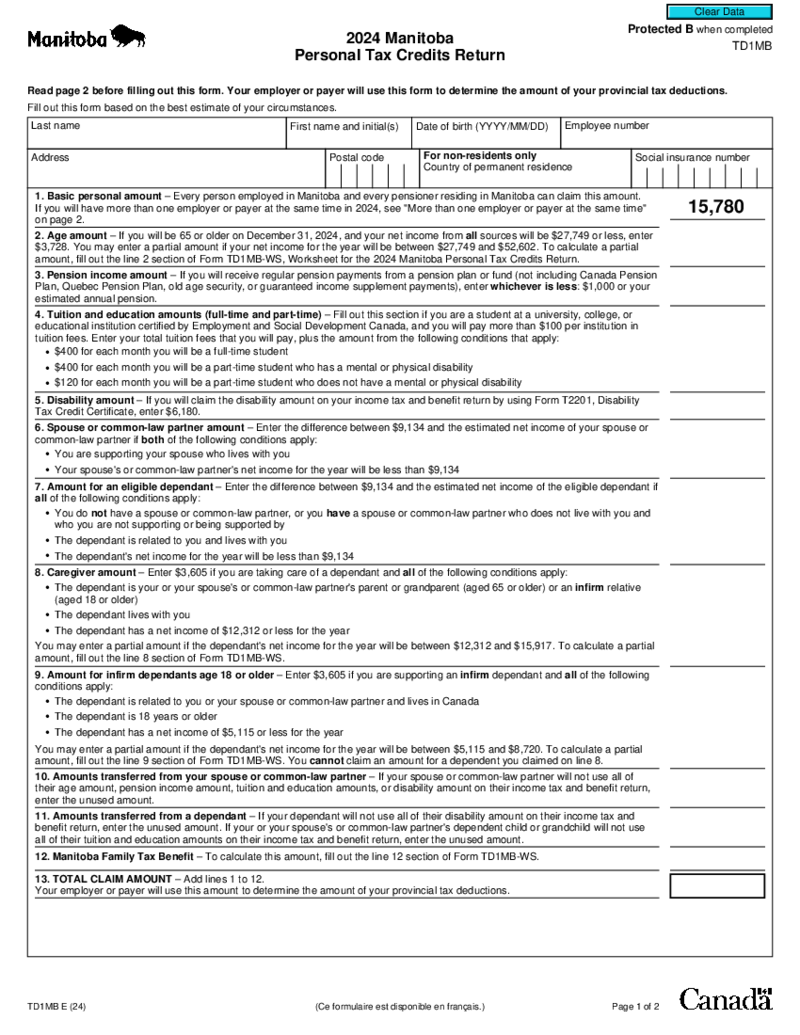

TD1MB Form (2024)

What Is the Manitoba Personal Tax Credits Return 2024 Form?

TD1MB 2024 is the Manitoba Personal Tax Credits Return form. You could use this form to calculate the income tax credits an individual is eligible to receive. Form must be completed and file

TD1MB Form (2024)

What Is the Manitoba Personal Tax Credits Return 2024 Form?

TD1MB 2024 is the Manitoba Personal Tax Credits Return form. You could use this form to calculate the income tax credits an individual is eligible to receive. Form must be completed and file

-

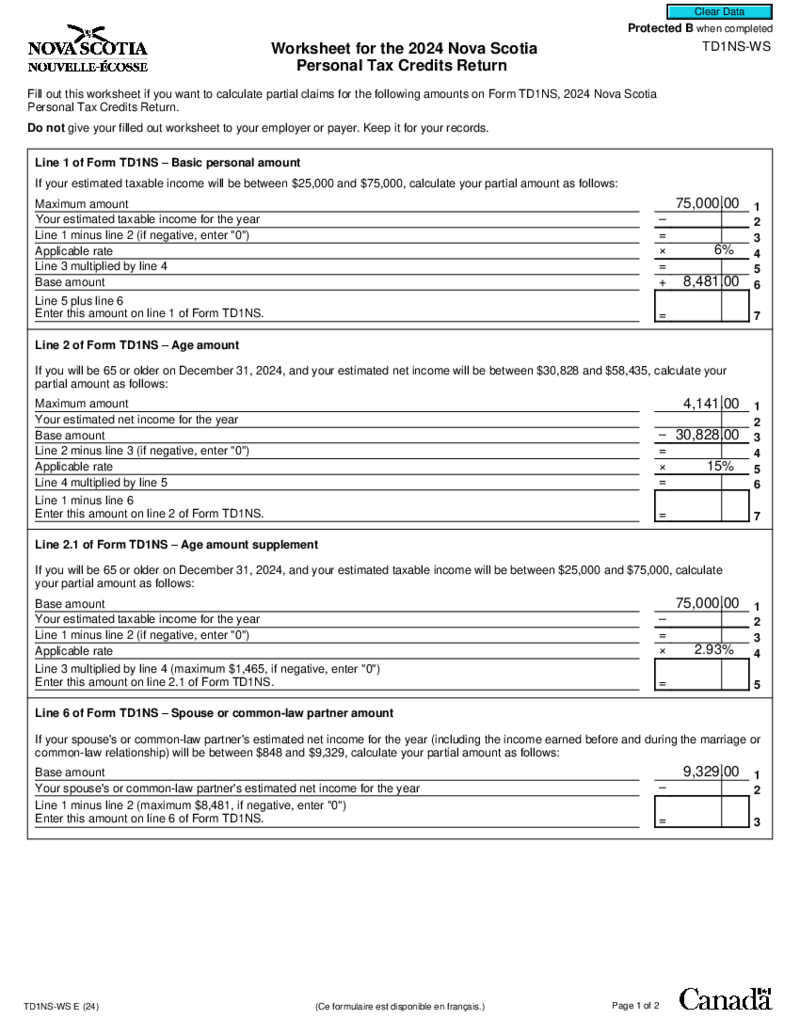

TD1NS-WS Form 2024

What Is the TD1NS-WS Form 2026?

The Nova Scotia Personal Tax Credit Refund Form is a tool that Nova Scotia residents should use to calculate personal tax credits. This worksheet you may download from the Nova Scotia government website.

What Is

TD1NS-WS Form 2024

What Is the TD1NS-WS Form 2026?

The Nova Scotia Personal Tax Credit Refund Form is a tool that Nova Scotia residents should use to calculate personal tax credits. This worksheet you may download from the Nova Scotia government website.

What Is

-

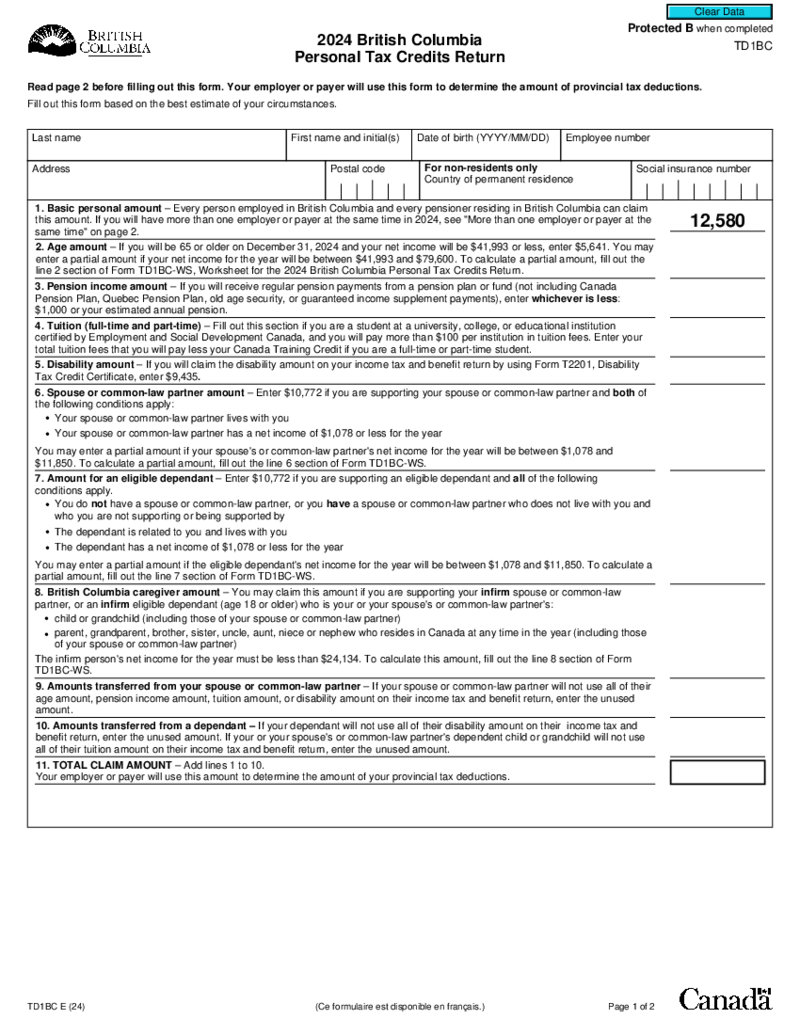

TD1BC Form (2024)

What Is the Fillable TD1BC 2026 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

TD1BC Form (2024)

What Is the Fillable TD1BC 2026 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

-

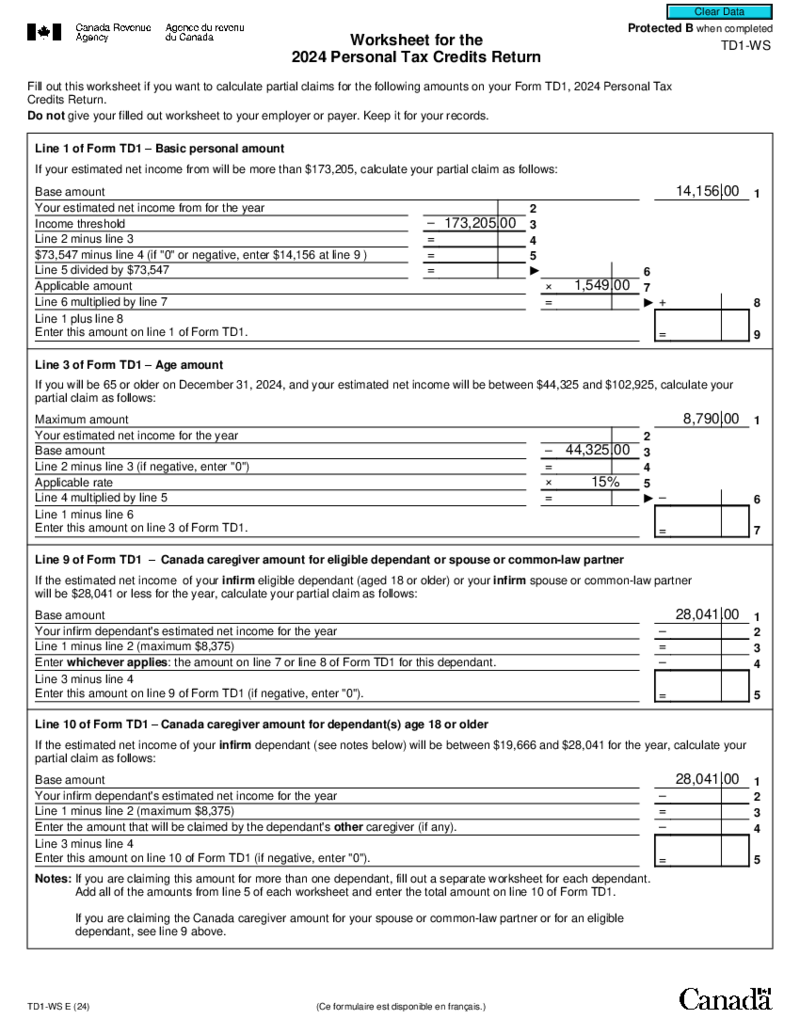

TD1-WS Worksheet for Personal Tax Credits Return 2024

TD1-WS Worksheet for Personal Tax Credits Return 2024

Gathering Necessary Documentation

Before you start filling out the worksheet, compile all necessary documents that can affect your tax credits, such as your previous year's notice of as

TD1-WS Worksheet for Personal Tax Credits Return 2024

TD1-WS Worksheet for Personal Tax Credits Return 2024

Gathering Necessary Documentation

Before you start filling out the worksheet, compile all necessary documents that can affect your tax credits, such as your previous year's notice of as

-

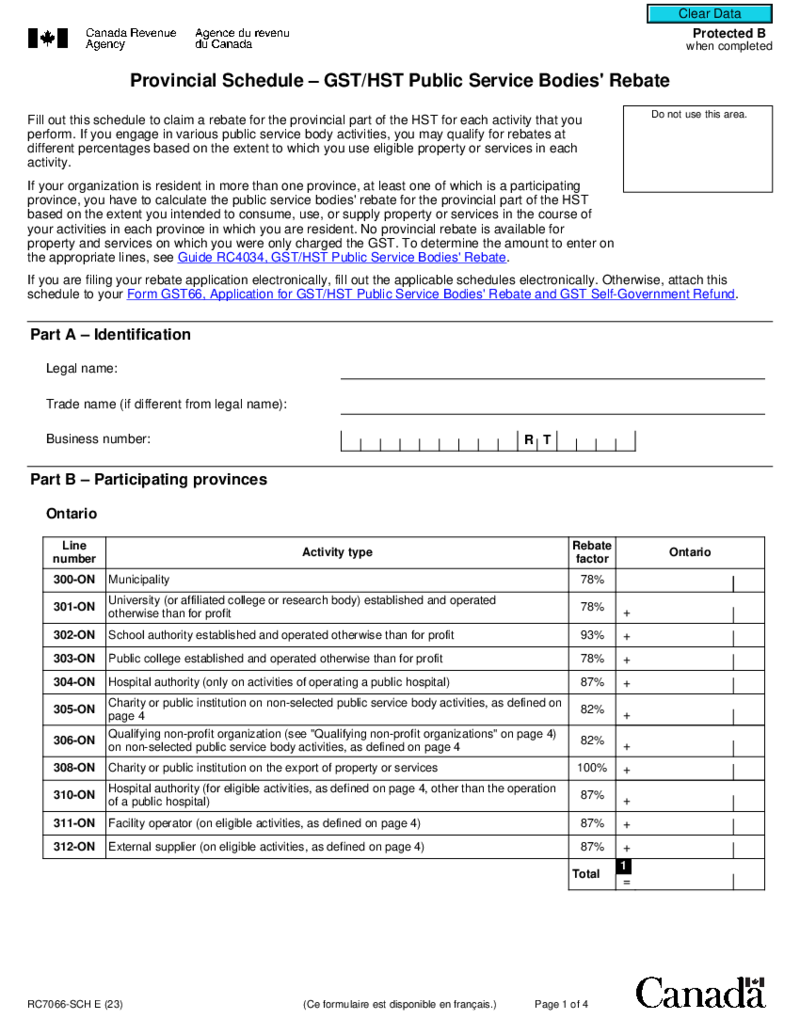

RC7066-SCH Provincial Schedule - GST HST Public Service Bodies Rebate

What is the RC7066-SCH Form

Provincial Schedule GST HST Public Service Bodies' Rebate form is a federal government form that allows public service bodies to claim a rebate for the provincial portion of the GST/HST paid on their purchases. The rebate i

RC7066-SCH Provincial Schedule - GST HST Public Service Bodies Rebate

What is the RC7066-SCH Form

Provincial Schedule GST HST Public Service Bodies' Rebate form is a federal government form that allows public service bodies to claim a rebate for the provincial portion of the GST/HST paid on their purchases. The rebate i

-

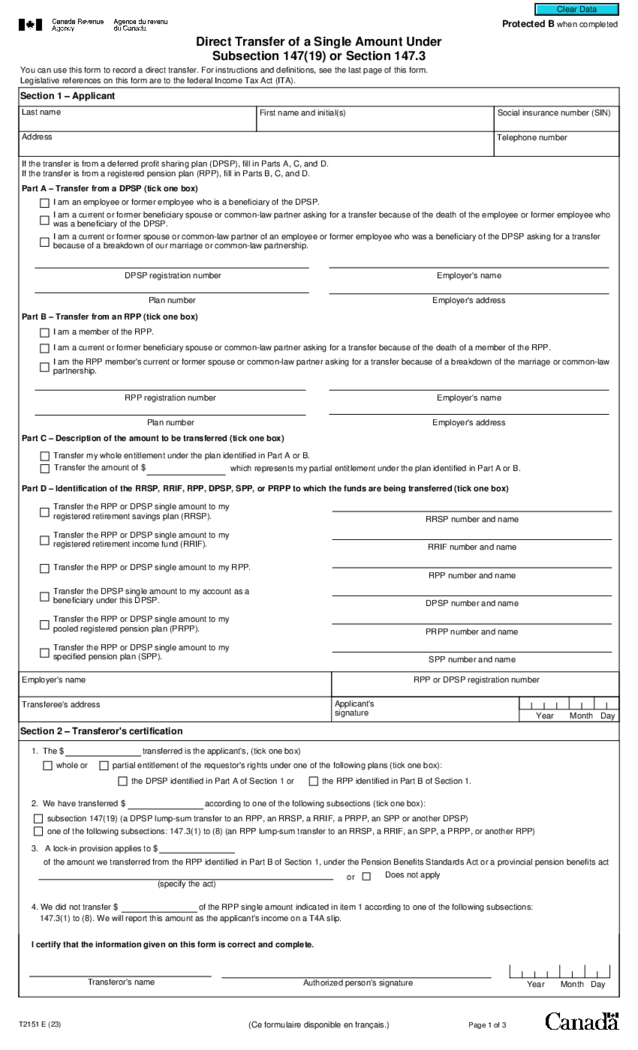

Form T2151

What Is a T2151 Form?

The T2151 transfer form of a single amount under the Subsection form is used to request the direct transfer of a single amount from one financial institution to another. This form is used when the amount to be transferred less than $

Form T2151

What Is a T2151 Form?

The T2151 transfer form of a single amount under the Subsection form is used to request the direct transfer of a single amount from one financial institution to another. This form is used when the amount to be transferred less than $

-

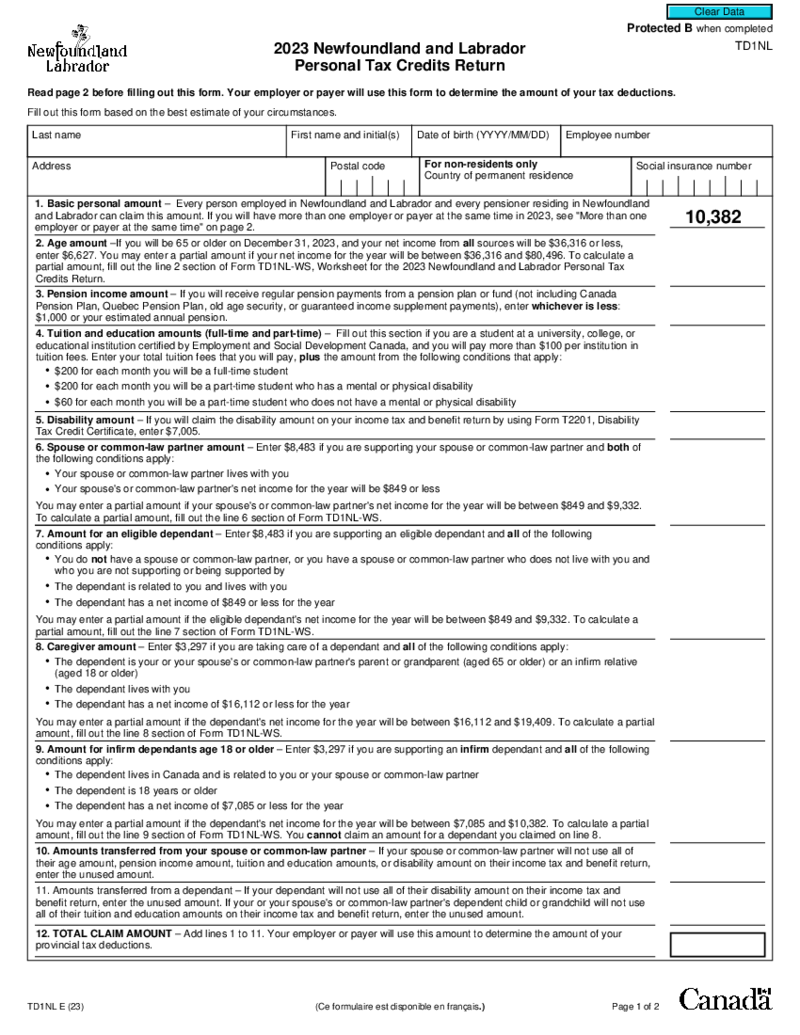

Form TD1NL

What Is Form TD1NL?

If you are a resident of Newfoundland and Labrador, you are required to file a Personal Tax Credit Return (PTCR). You will use PTCR to figure out your tax credits, which are then used to reduce the amount of tax you owe.

Form TD1NL

What Is Form TD1NL?

If you are a resident of Newfoundland and Labrador, you are required to file a Personal Tax Credit Return (PTCR). You will use PTCR to figure out your tax credits, which are then used to reduce the amount of tax you owe.

-

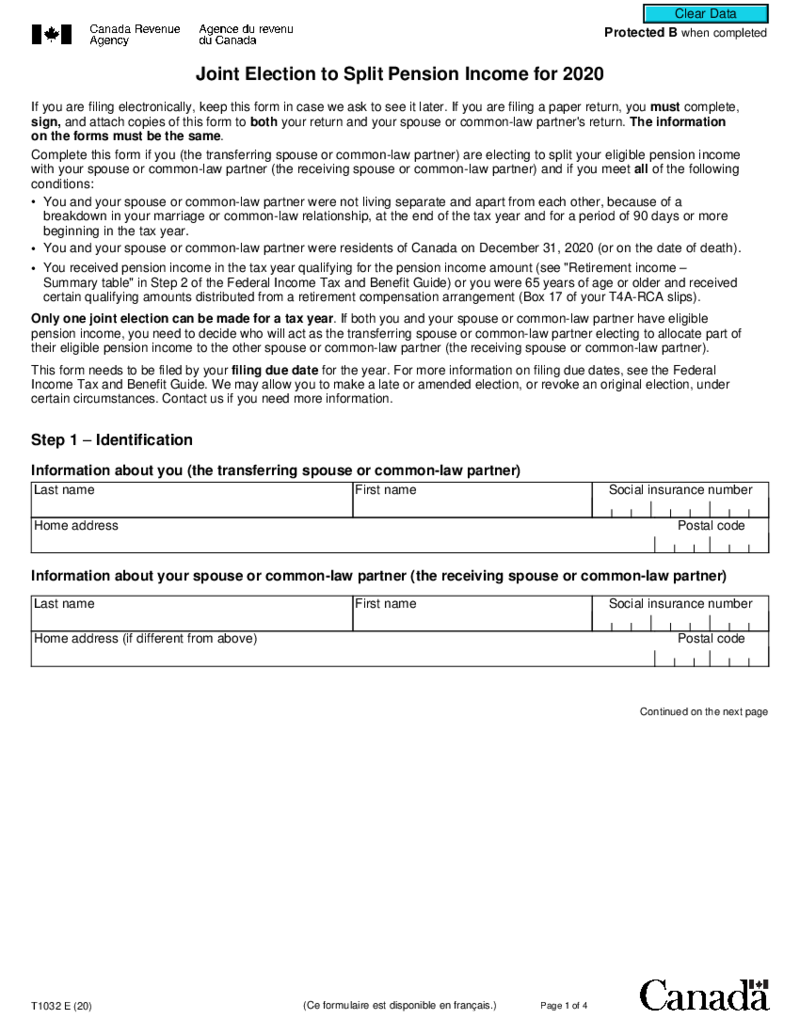

T1032 Joint Election to Split Pension Income for 2020

What is form T1032 Split Income for 2020?

Form t1032 joint election to split pension income is used to report pension income that has been split between you and your spouse or common-law partner. Under the Income Tax Act, there are restrictions on who can

T1032 Joint Election to Split Pension Income for 2020

What is form T1032 Split Income for 2020?

Form t1032 joint election to split pension income is used to report pension income that has been split between you and your spouse or common-law partner. Under the Income Tax Act, there are restrictions on who can

-

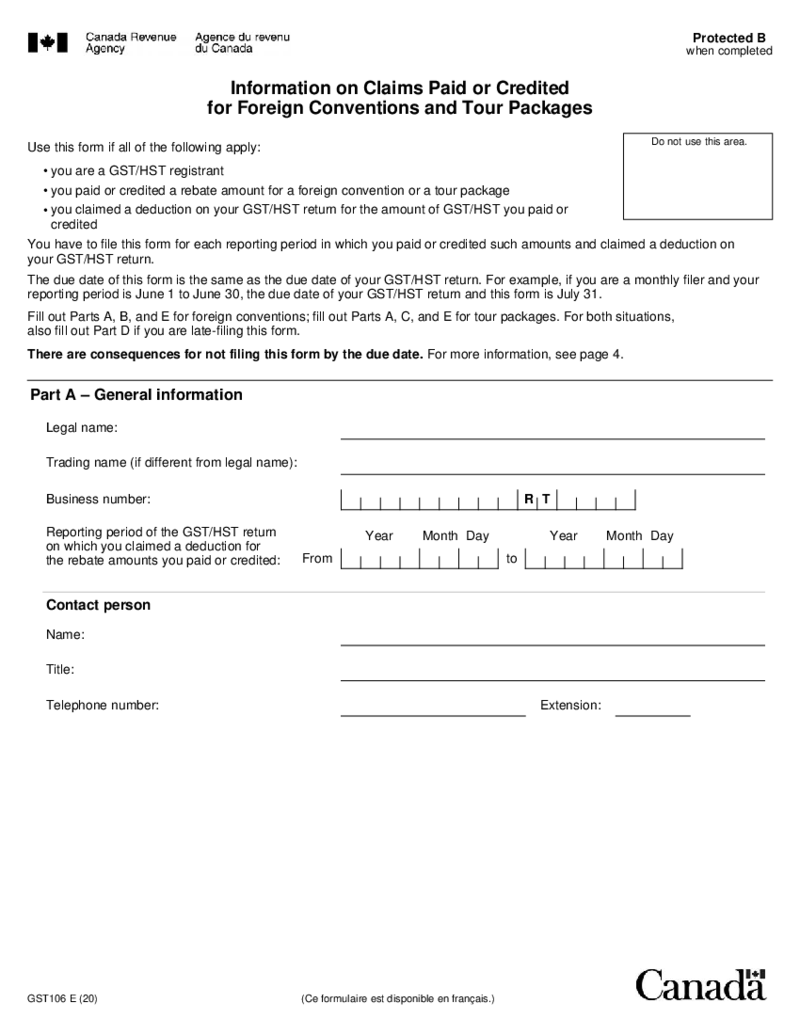

Form GST106

The Form GST106, also known as the Information on Claims Paid or Credited for Foreign Conventions and Tour Packages, is used by businesses to report their annual information about conventions, conferences, and tour packages that are held outside Canada.

Wh

Form GST106

The Form GST106, also known as the Information on Claims Paid or Credited for Foreign Conventions and Tour Packages, is used by businesses to report their annual information about conventions, conferences, and tour packages that are held outside Canada.

Wh

-

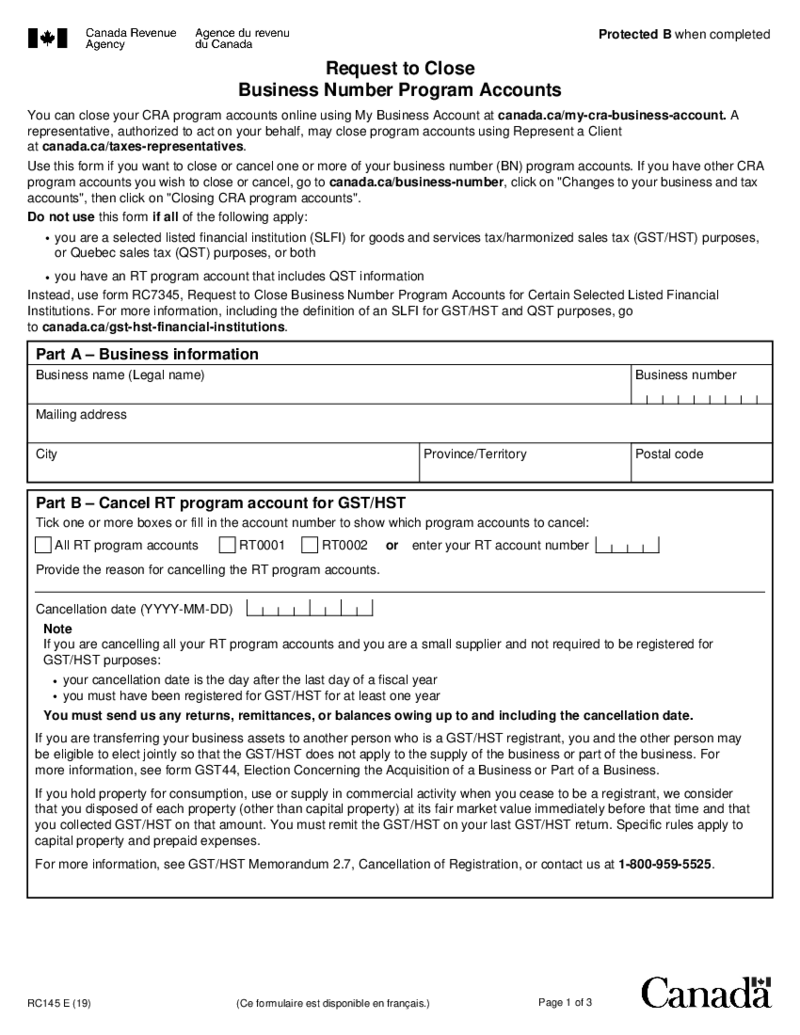

RC145 Request to Close Business Number Program Accounts

What Is RC145 Form?

Also known as Request to Close Business Number, this blank is a document required for terminating one or several

RC145 Request to Close Business Number Program Accounts

What Is RC145 Form?

Also known as Request to Close Business Number, this blank is a document required for terminating one or several

-

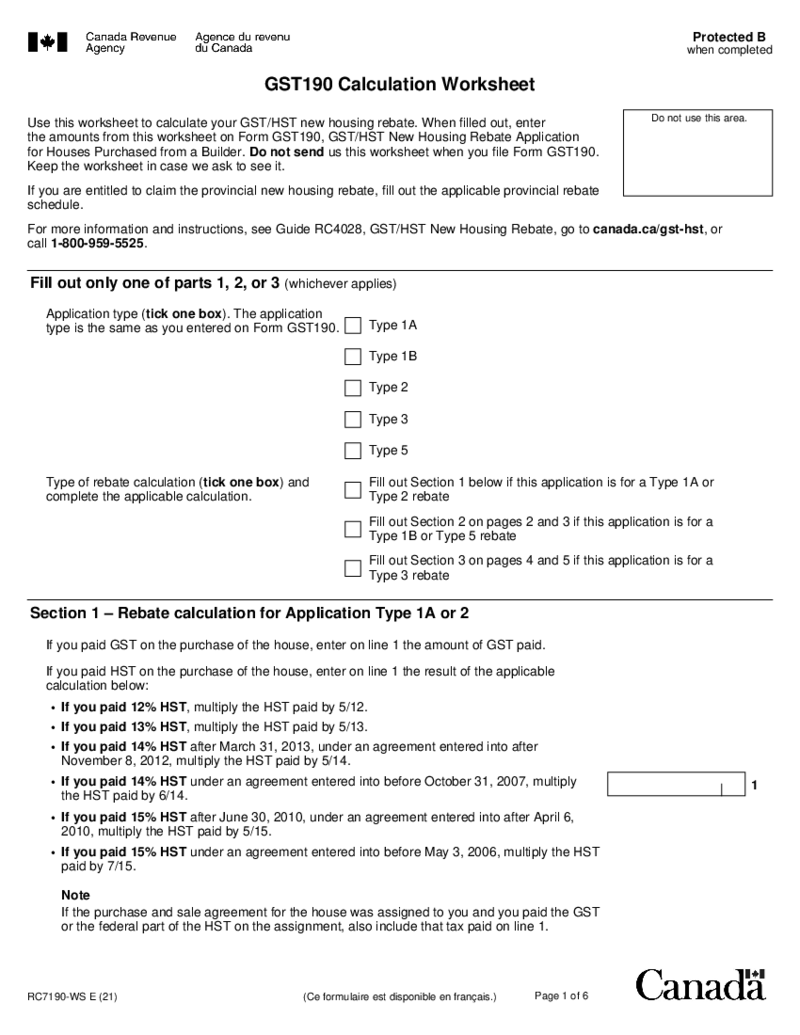

RC7190-WS GST190 Calculation Worksheet

What Is GST190 Calculation Worksheet Form?

The GST190 Calculation Worksheet allows eligible homebuyers to get back a portion of the GST or HST paid on the purchase or cost of a new or substantially-renovated home. The refund is based on a percentage of th

RC7190-WS GST190 Calculation Worksheet

What Is GST190 Calculation Worksheet Form?

The GST190 Calculation Worksheet allows eligible homebuyers to get back a portion of the GST or HST paid on the purchase or cost of a new or substantially-renovated home. The refund is based on a percentage of th

FAQ

-

How to fill federal tax form Canada?

Absolutely, the best way to fill out your templates is online. By doing it digitally, you won’t have to spend hours on the affair and deal with the oh-so-prone-to-getting-lost-and-damaged paper piles. As a matter of fact, going digital may be the only way to survive as a successful business these days.

-

How to fill out income tax return forms Canada?

Follow these tips if you want to complete your templates in the most effective way possible. First, be prepared. Prepare all the necessary documents you’ll rely upon when filling out your forms. Second, be precise. You don’t want to send tax forms with factual errors or typos and then start all over again or even face penalties. Third, monitor the deadlines. That’s a given. Fourth, seek professional help whenever necessary. Peace of mind should be your ultimate priority here.

-

Where to send tax forms Canada?

When you finish sorting out your forms, feel free to submit them to the Canada Revenue Agency, also referred to as CRA. Do it either online or by mail. Naturally, the former method is the best because it’s super fast, smooth, and flexible. If you’re outside the country, the only option is to send the ready forms by mail. Don’t forget to keep your CRA info updated and keep up with new technical tax information, for it will surely add up to your ultimate peace of mind throughout the tax season.