-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

TD1-WS Worksheet for Personal Tax Credits Return 2024

Get your TD1-WS Worksheet for Personal Tax Credits Return 2024 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

TD1-WS Worksheet for Personal Tax Credits Return 2024

Gathering Necessary Documentation

Before you start filling out the worksheet, compile all necessary documents that can affect your tax credits, such as your previous year's notice of assessment, information on tuition fees, charitable donations, and details of any dependents.

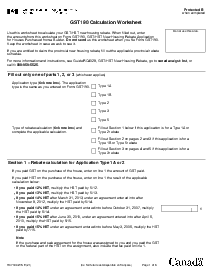

Calculating Federal Tax Credits

The first part of the TD1-WS worksheet is dedicated to federal non-refundable tax credits. You'll need to enter amounts for various credits, such as the basic personal amount, age amount, pension income amount, and education-related credits. Ensure to read the instructions carefully, as they will guide you in claiming only the credits that apply to your situation.

Determining Provincial or Territorial Tax Credits

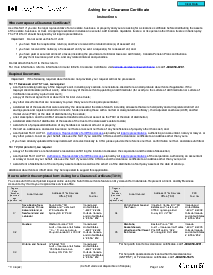

Next, you'll need to use the separate provincial or territorial tax credits sheet, also available from the CRA, to determine which credits you're eligible for at the provincial or territorial level. The availability and amount of these credits can vary significantly across regions.

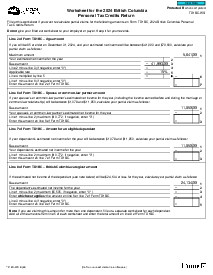

Estimating Total Income

One of the essential functions of the TD1-WS is to help you estimate your total income for the year. This includes employment income, self-employment income, investment income, and any other sources. Accurately estimating your income is crucial for determining the correct amount of tax to be deducted.

Factoring in Deductions and Adjustments

The worksheet allows for adjustments based on deductions that you expect to claim when you file your tax return, such as RRSP contributions or child care expenses. These can reduce your total estimated income, thereby affecting your tax deductions.

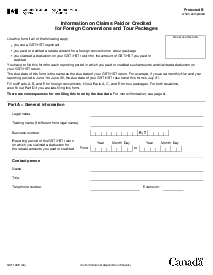

Calculating Final Tax Credits

Once you've gone through all the sections and calculated your credits and estimated income, the worksheet will guide you in determining the amount of tax credits you can claim. Transfer this amount to your TD1 form, which your employer will use to determine the correct amount of tax to withhold from your paychecks.

Conclusion

The TD1-WS worksheet is an invaluable resource for Canadians who want to ensure accurate tax withholdings throughout the year. By estimating your income and calculating your tax credits properly, you can avoid unpleasant surprises come tax time. Remember that personal tax situations can be complex, and consulting a tax professional is always a wise decision when in doubt. Remember to check with the CRA for the latest updates and changes to tax laws that could affect your TD1-WS calculations for the 2024 tax year.

Fillable online TD1-WS Worksheet for Personal Tax Credits Return 2024