-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms - page 16

-

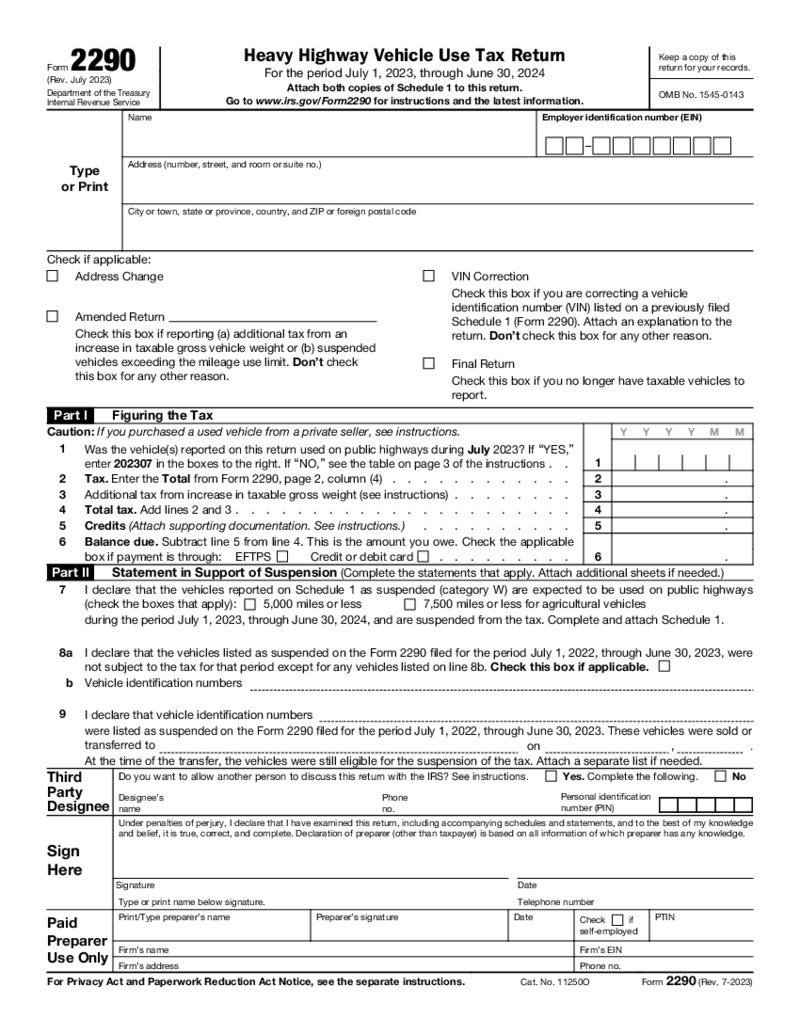

Form 2290

What Is a 2290 Form?

The fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. The form collects the information about all the vehicl

Form 2290

What Is a 2290 Form?

The fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. The form collects the information about all the vehicl

-

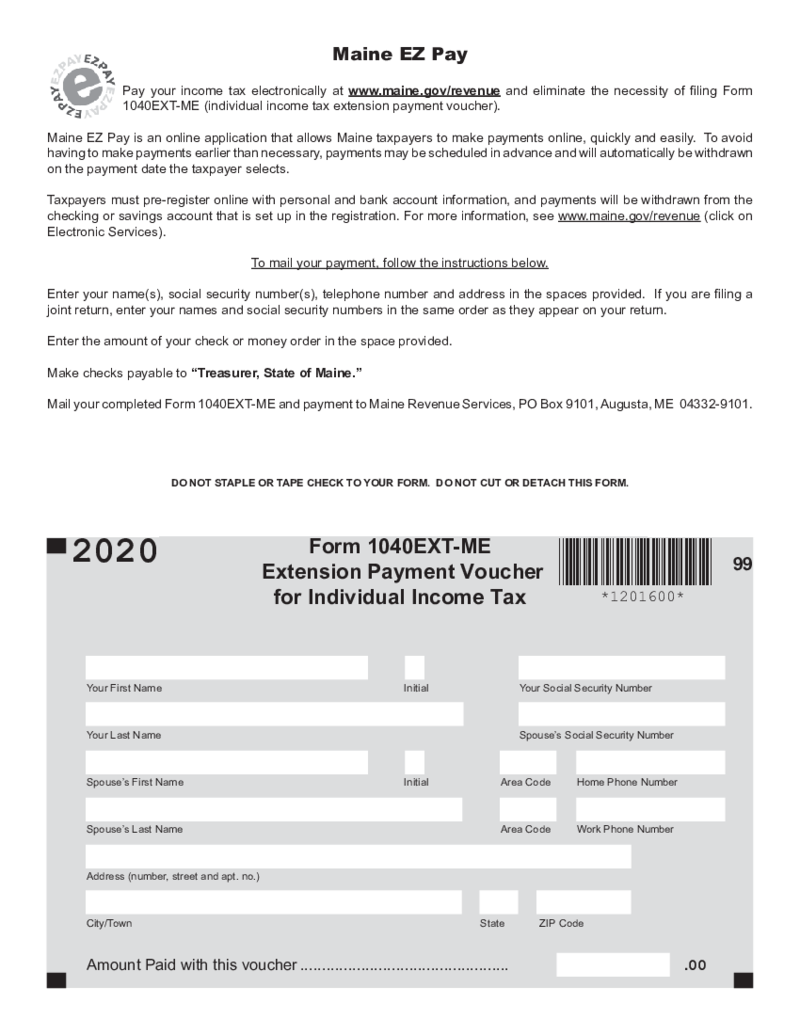

Maine EZ Pay

What is a Maine EZ Pay Form?

The fillable form Maine 1040EXT-ME is needed to make tax payments online. This form is specifically designed to simplify the process of making payments for various services and fees in the state of Maine. By utilizing this Mai

Maine EZ Pay

What is a Maine EZ Pay Form?

The fillable form Maine 1040EXT-ME is needed to make tax payments online. This form is specifically designed to simplify the process of making payments for various services and fees in the state of Maine. By utilizing this Mai

-

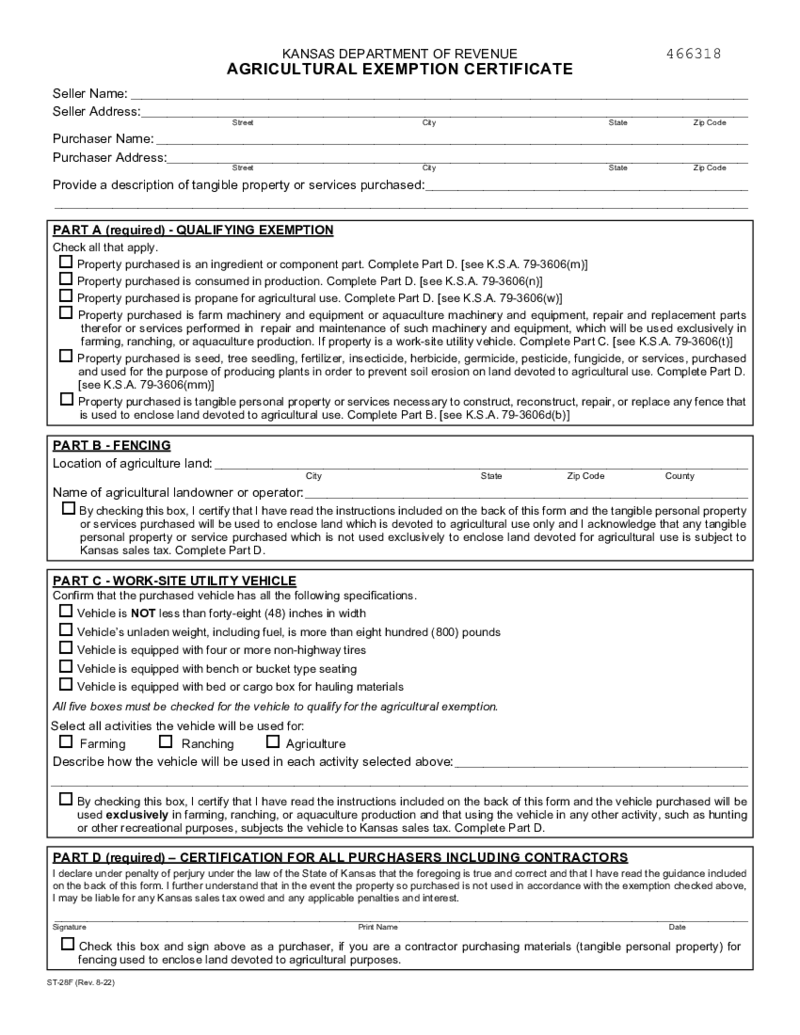

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

-

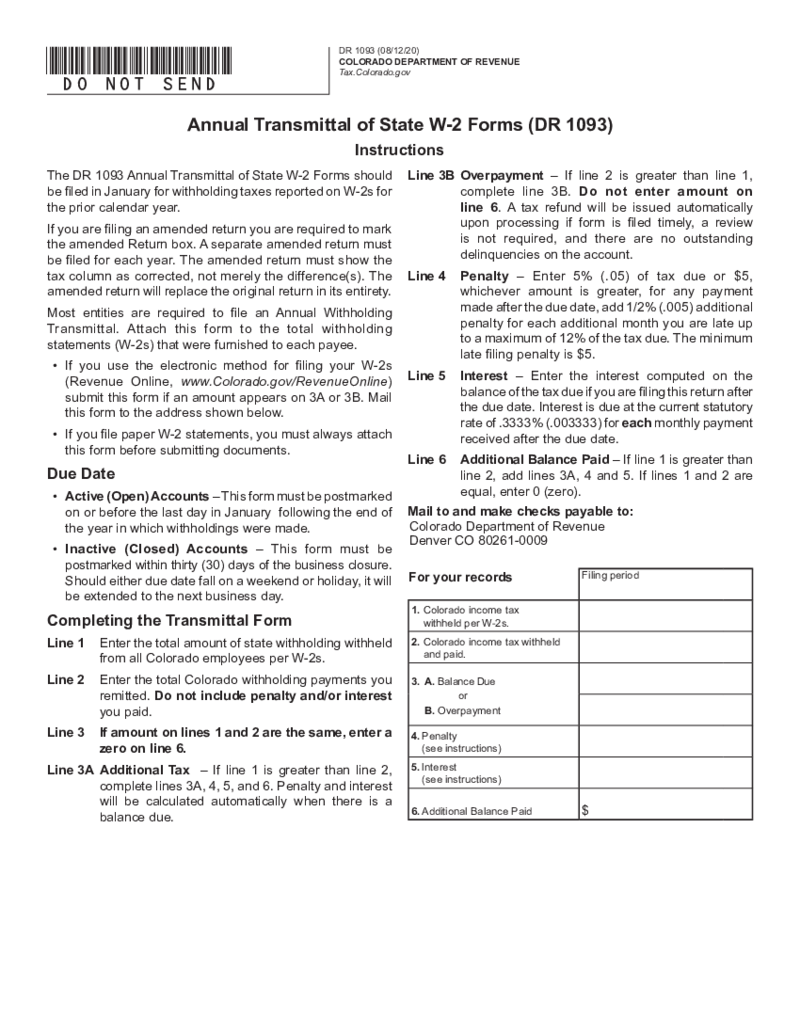

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

-

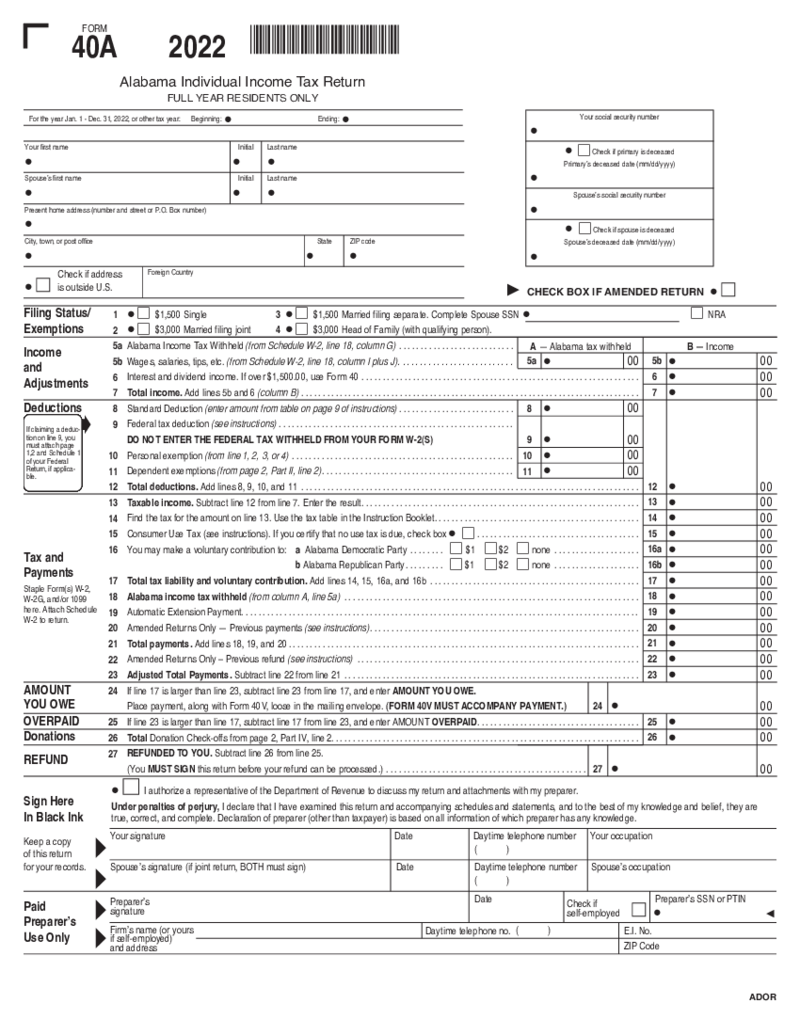

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

-

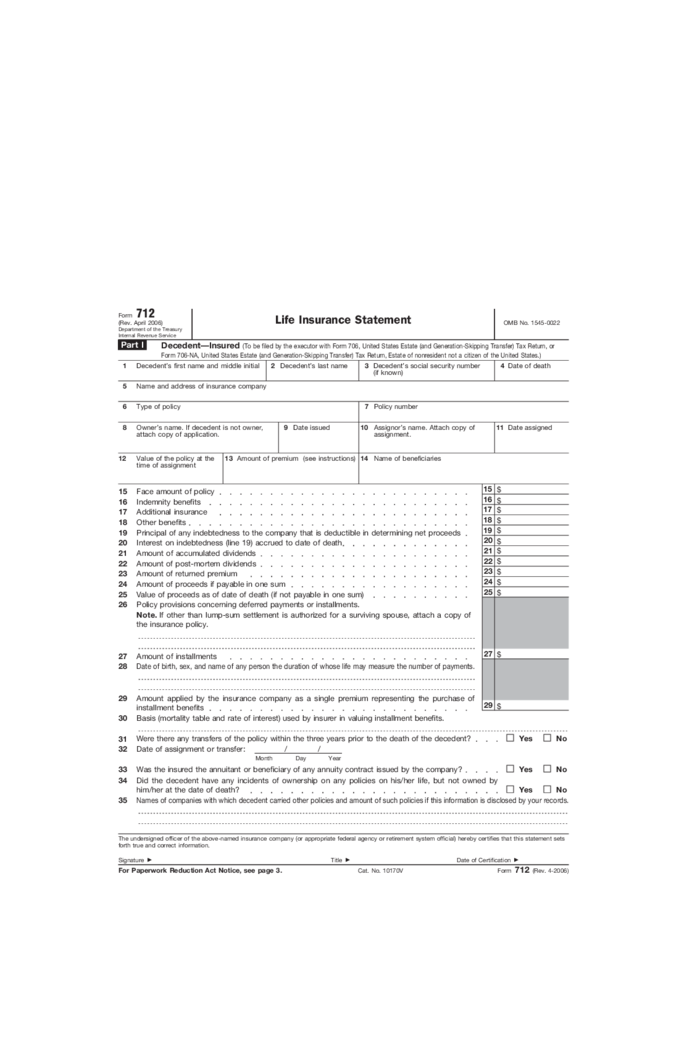

IRS Form 712

What Is an IRS Form 712?

IRS Form 712 is a document used for the valuation of life insurance policies and gift tax returns. The form is also known as the Life Insurance Statement. The IRS Form 712 is used to report the value of the decedent's life ins

IRS Form 712

What Is an IRS Form 712?

IRS Form 712 is a document used for the valuation of life insurance policies and gift tax returns. The form is also known as the Life Insurance Statement. The IRS Form 712 is used to report the value of the decedent's life ins

-

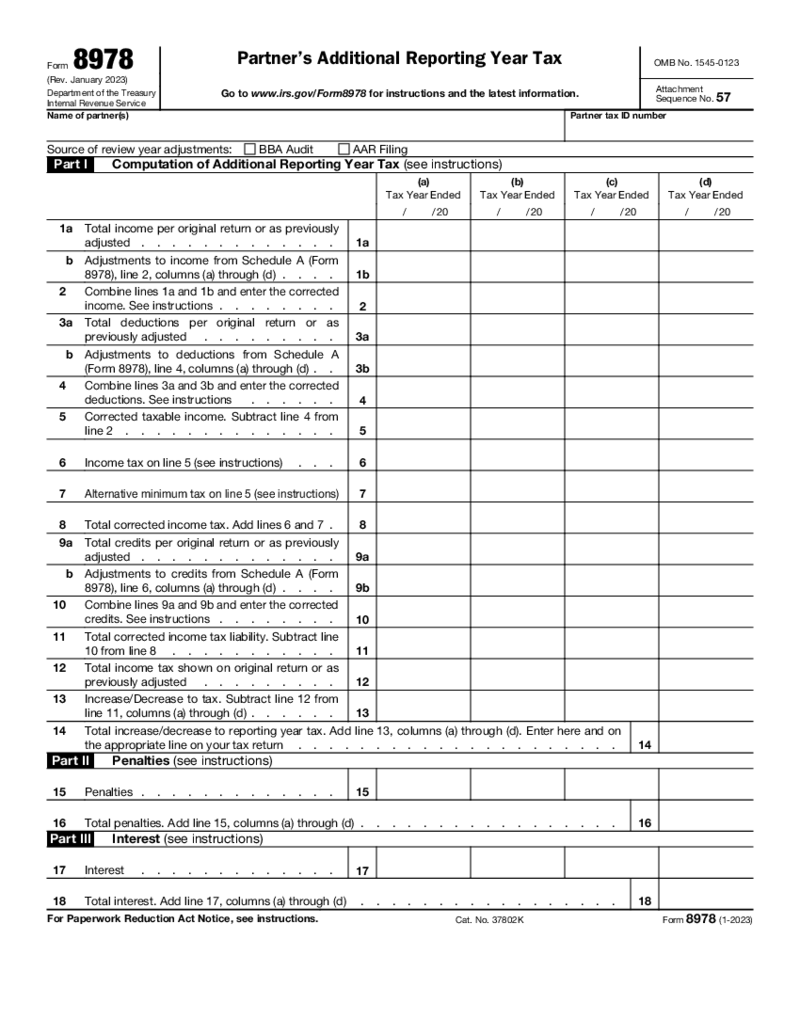

Form 8978

What Is Form 8978?

Form 8978 is a tax form used by foreign financial institutions (FFIs) to report information about their US account holders to the Internal Revenue Service (IRS). The form was introduced as part of the Foreign Account Tax Compliance Act

Form 8978

What Is Form 8978?

Form 8978 is a tax form used by foreign financial institutions (FFIs) to report information about their US account holders to the Internal Revenue Service (IRS). The form was introduced as part of the Foreign Account Tax Compliance Act

-

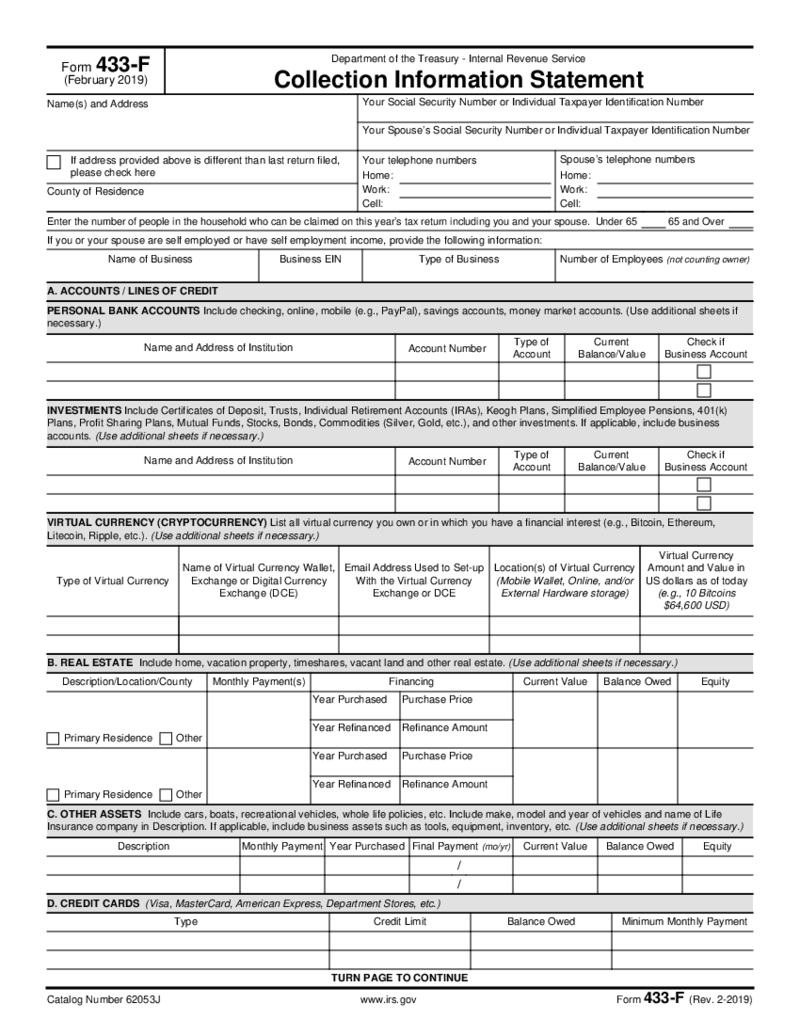

Form 433-F

What is Form 433-F?

The IRS Form 433 F Collection Information Statement is a two-page blank that allows you to tell the IRS in detail about your financial situation. To complete it, you will need information from your last tax return and Form 9465 to requ

Form 433-F

What is Form 433-F?

The IRS Form 433 F Collection Information Statement is a two-page blank that allows you to tell the IRS in detail about your financial situation. To complete it, you will need information from your last tax return and Form 9465 to requ

-

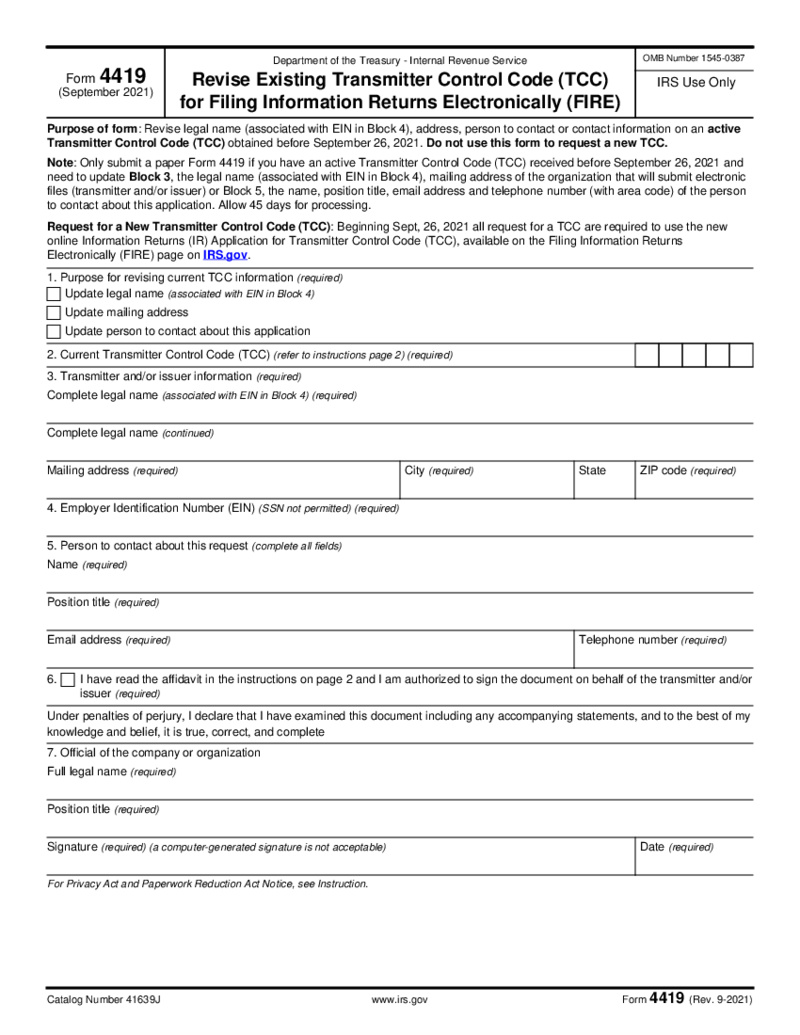

Form 4419

1. What is the 4419 form?

The fillable 4419 form is intended for the revision of the information on the current Transmitter Control Code. You can download the 4419 form to request the extra TCC for all the types of the form you may find in Box 8 in the do

Form 4419

1. What is the 4419 form?

The fillable 4419 form is intended for the revision of the information on the current Transmitter Control Code. You can download the 4419 form to request the extra TCC for all the types of the form you may find in Box 8 in the do

-

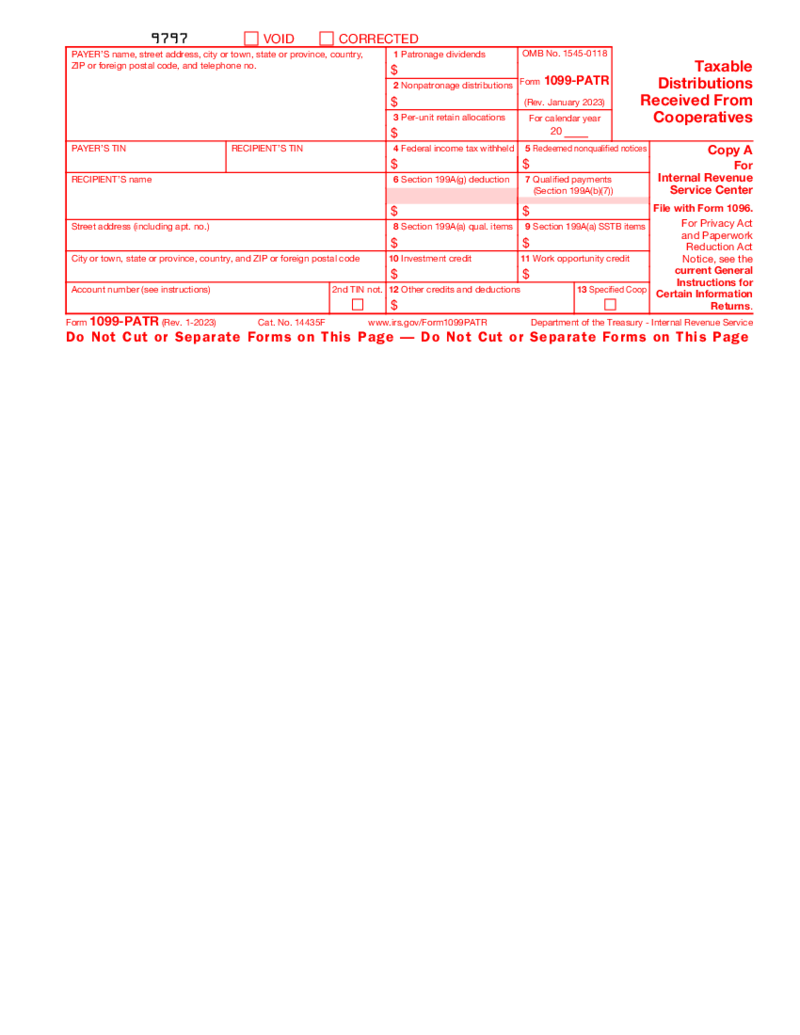

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

-

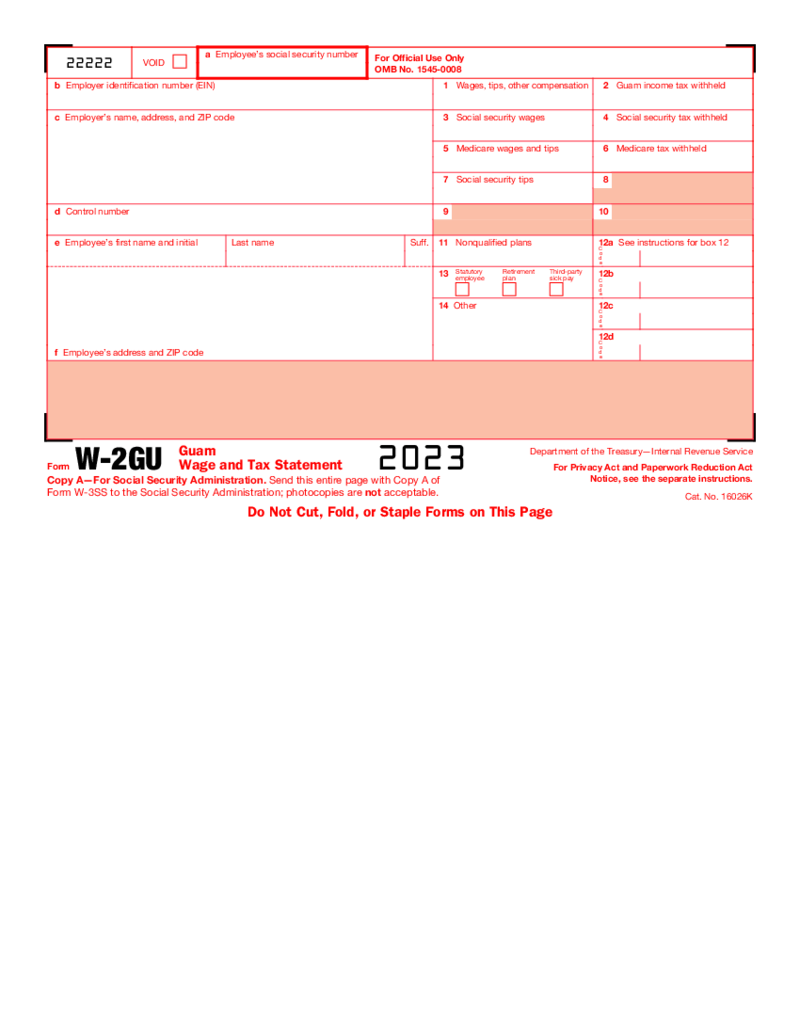

Form W-2GU

What is Form W-2GU?

The W 2GU template is also known as the Guam Wage and Tax Statement. Each employer has to send a report on the Guam wages to the IRS. If you pay the US income tax withholding wages you don’t have to use the form. You can use the

Form W-2GU

What is Form W-2GU?

The W 2GU template is also known as the Guam Wage and Tax Statement. Each employer has to send a report on the Guam wages to the IRS. If you pay the US income tax withholding wages you don’t have to use the form. You can use the

-

Form 1040 Tax and Earned Income Credit Tables

What Is An Earned Income Credit Table Form 1040

The Earned Income Credit (EIC) is a beneficial tax break designed to help low to moderate-income working individuals and families, particularly those with children. The credit reduces the ta

Form 1040 Tax and Earned Income Credit Tables

What Is An Earned Income Credit Table Form 1040

The Earned Income Credit (EIC) is a beneficial tax break designed to help low to moderate-income working individuals and families, particularly those with children. The credit reduces the ta

Search by State

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.