-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

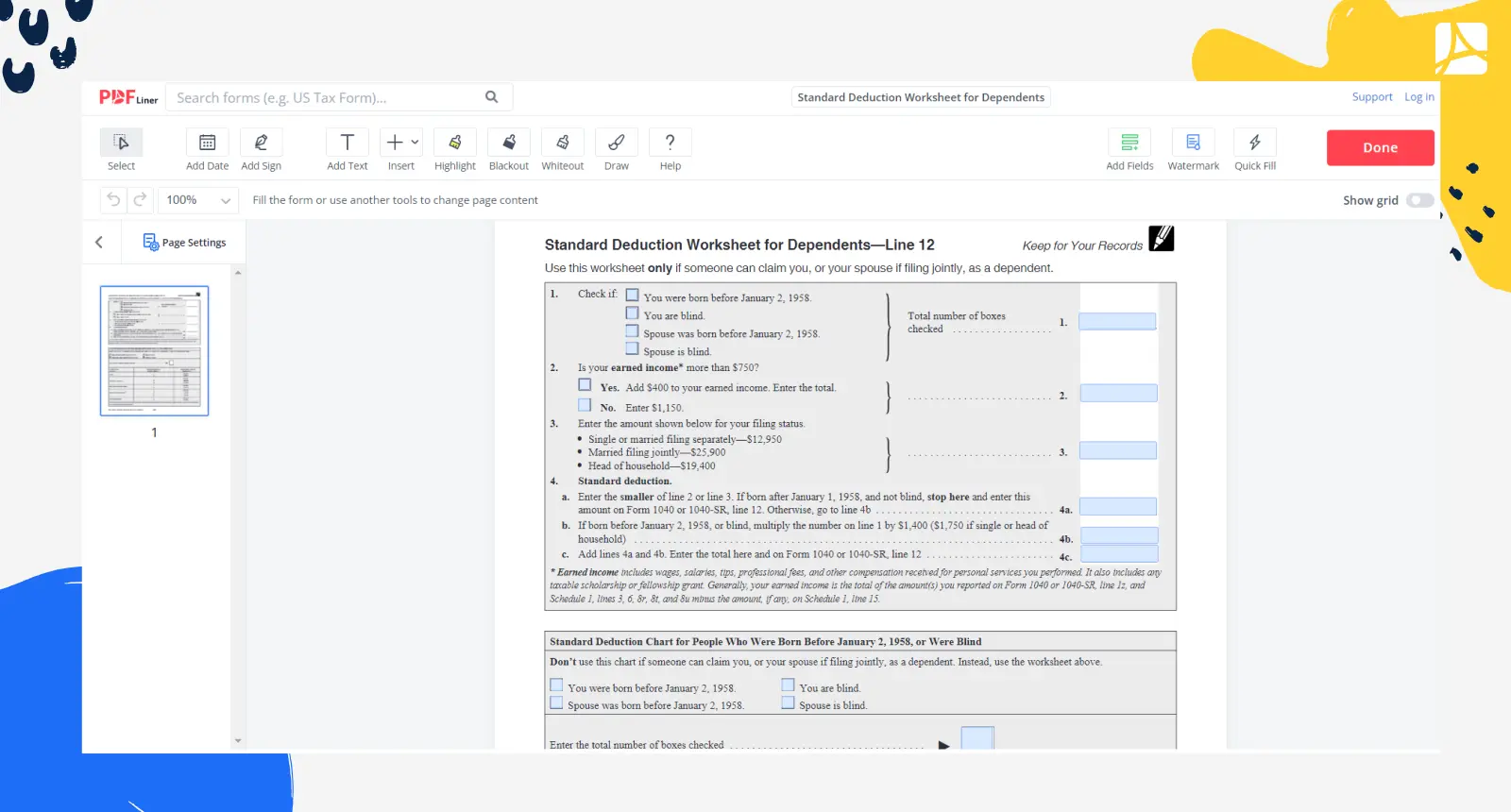

Standard Deduction Worksheet for Dependents (2023)

Get your Standard Deduction Worksheet for Dependents in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Standard Deduction Worksheet for Dependents

Standard deduction is an amount in US dollars deductible from your taxable earnings. Usually, this amount is influenced yearly by inflation, and is largely dependent on your marital or household status. There’s an online IRS tool you can use for the purpose of quickly calculating your own standard deduction.

The pre-designed template of this document is available free of charge in our ample catalog of fillable forms and can be modified to resonate with your current situation. You’re welcome to find it, grab it, complete it online, or download it for further offline use.

What do I need the worksheet for standard deduction 2023 for

The file is used for:

- supporting someone claiming you (or your spouse if filing jointly) as a dependent;

- crunching all the necessary numbers;

- maximum clarification and miscommunication prevention.

The IRS form 1040 Standard Deduction Worksheet for Dependents is not the only document template you can find on PDFLiner. Here, you’ll discover hundreds of other templates that cater to a multitude of niches, such as healthcare, finance, taxes, real estate, accounting, and many more.

How to Fill Out the Standard Deduction Worksheet for Dependents 2023

The document consists of one page only and shouldn’t be too hard for you to fill out. Here’s a quick step-by-step guide for sorting through the file under your own steam:

- Finalize your registration with PDFLiner.

- Find the form in our catalog.

- Open it and wait until it loads.

- Check the necessary boxes outlining your:

- birthdate;

- income details;

- your filing status;

- health-related issues.

This particular worksheet doesn’t need to be signed. However, you should know that e-signature is one of the tools offered here on PDFLiner. With the tool at your regular disposal, you’ll save heaps of your valuable time by adding legally binding, effortless, and secure digital signatures to your files in a jiffy. Our platform allows you to edit PDFs to suit your most intricate requirements with minimum effort and maximum efficiency.

If the Standard Deduction Worksheet for Dependants looks confusing and you need expert help to figure out the completion, don’t hesitate to call a reliable accountant or tax pro for assistance. This will speed up your administrative affairs, freeing up your time for the truly important stuff like spending time with your loved ones or coping with your direct responsibilities.

Organizations That Work With the IRS Standard Deduction Worksheet

- IRS.

Form Versions

2022

Standard Deduction Worksheet for Dependents 2022

Fillable online Standard Deduction Worksheet for Dependents