-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms

-

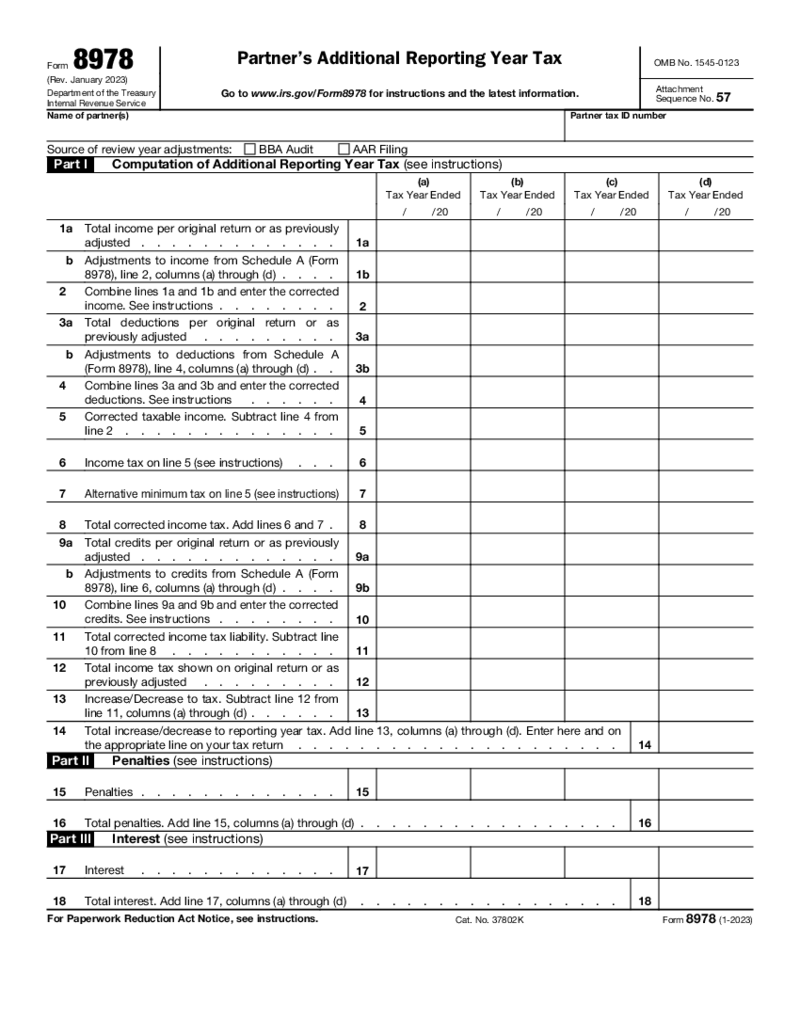

Form 8978

What Is Form 8978?

Form 8978 is a tax form used by foreign financial institutions (FFIs) to report information about their US account holders to the Internal Revenue Service (IRS). The form was introduced as part of the Foreign Account Tax Compliance Act

Form 8978

What Is Form 8978?

Form 8978 is a tax form used by foreign financial institutions (FFIs) to report information about their US account holders to the Internal Revenue Service (IRS). The form was introduced as part of the Foreign Account Tax Compliance Act

-

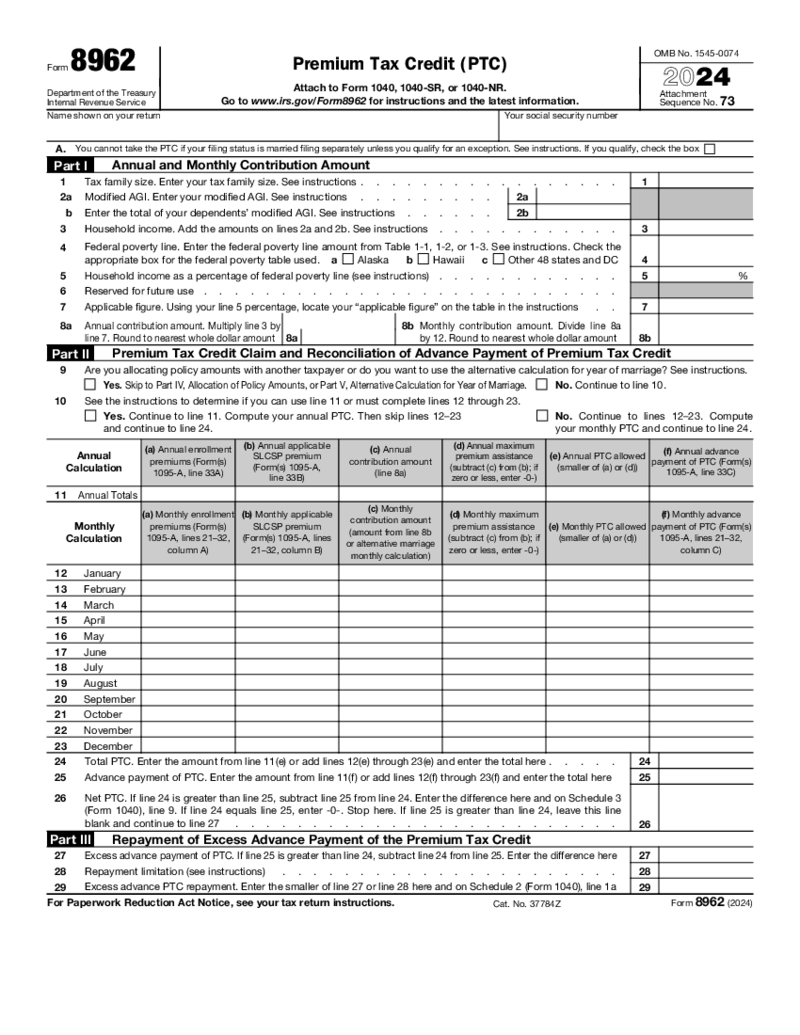

Form 8962

What is an 8962 Form (2024)

IRS 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. This form can be completed only if you need t

Form 8962

What is an 8962 Form (2024)

IRS 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. This form can be completed only if you need t

-

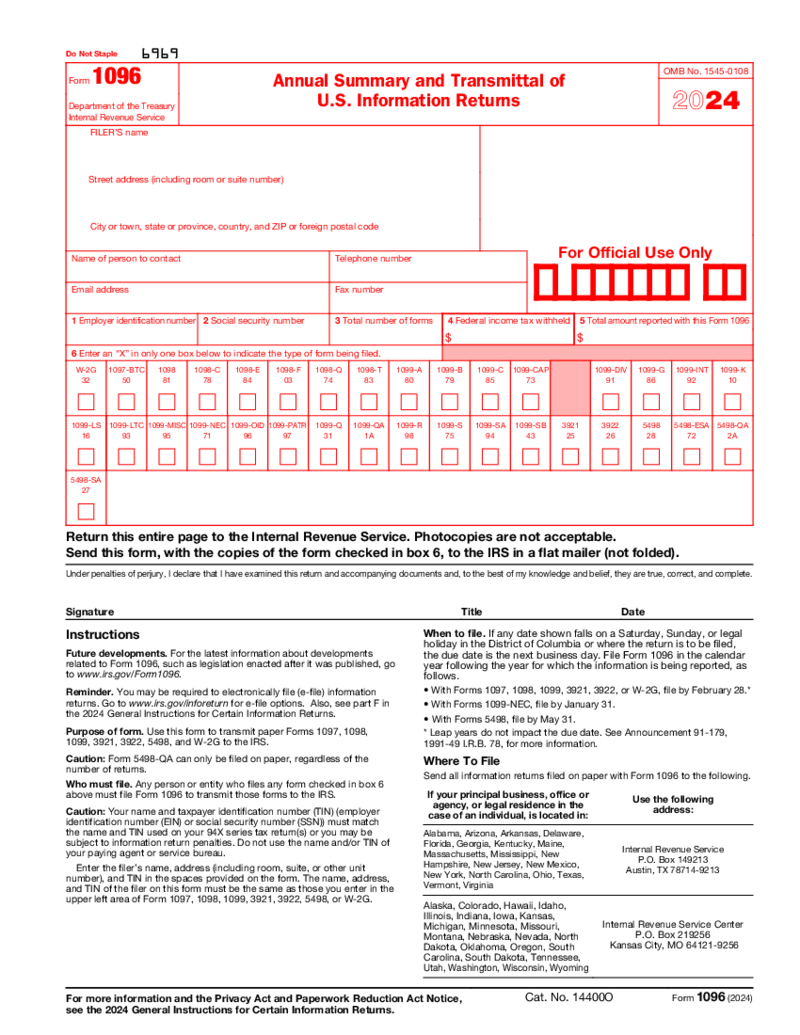

IRS 1096 Form

What is IRS 1096 2025?

Form 1096 is a file that provides results with all information documents you may already have submitted to recipients and Internal Revenue Service. If you provided information to recipients, no matter which docs you use, you must su

IRS 1096 Form

What is IRS 1096 2025?

Form 1096 is a file that provides results with all information documents you may already have submitted to recipients and Internal Revenue Service. If you provided information to recipients, no matter which docs you use, you must su

-

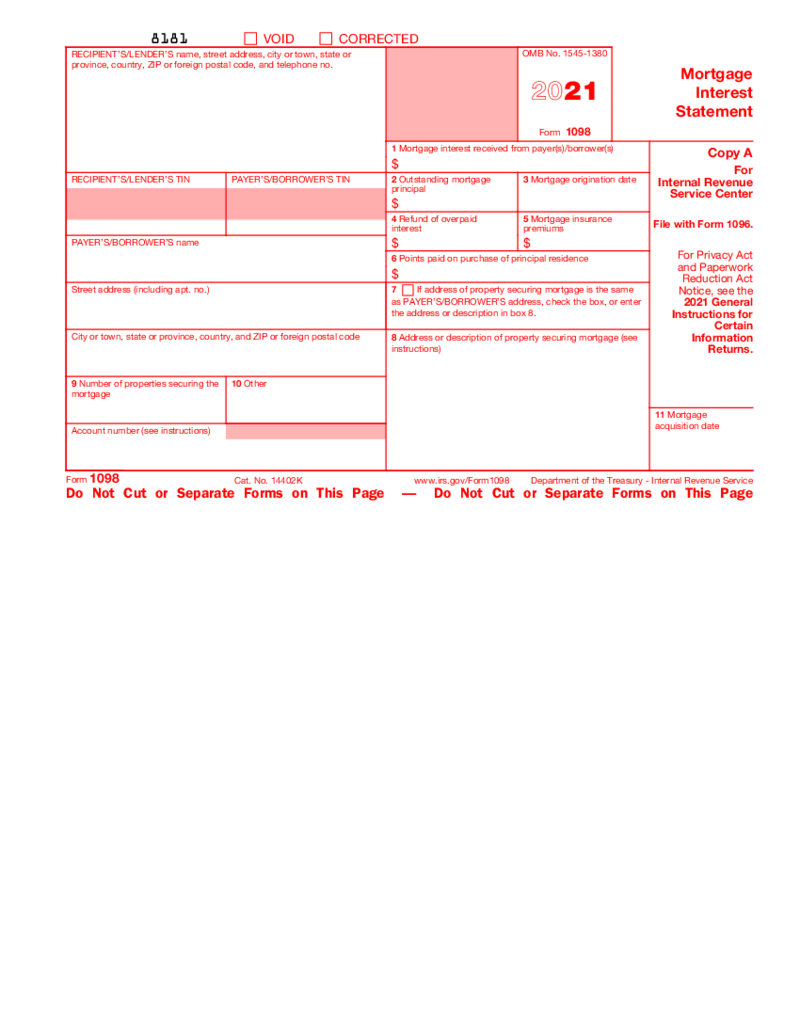

Form 1098 (2021)

1. What is a 1098 2021 Form?

The IRS Form 1098 for 2021 is the Mortgage Interest Statement tax form for 2021. If you are looking for a current version of Form 1098 you can also find it on PDFLiner.&nb

Form 1098 (2021)

1. What is a 1098 2021 Form?

The IRS Form 1098 for 2021 is the Mortgage Interest Statement tax form for 2021. If you are looking for a current version of Form 1098 you can also find it on PDFLiner.&nb

-

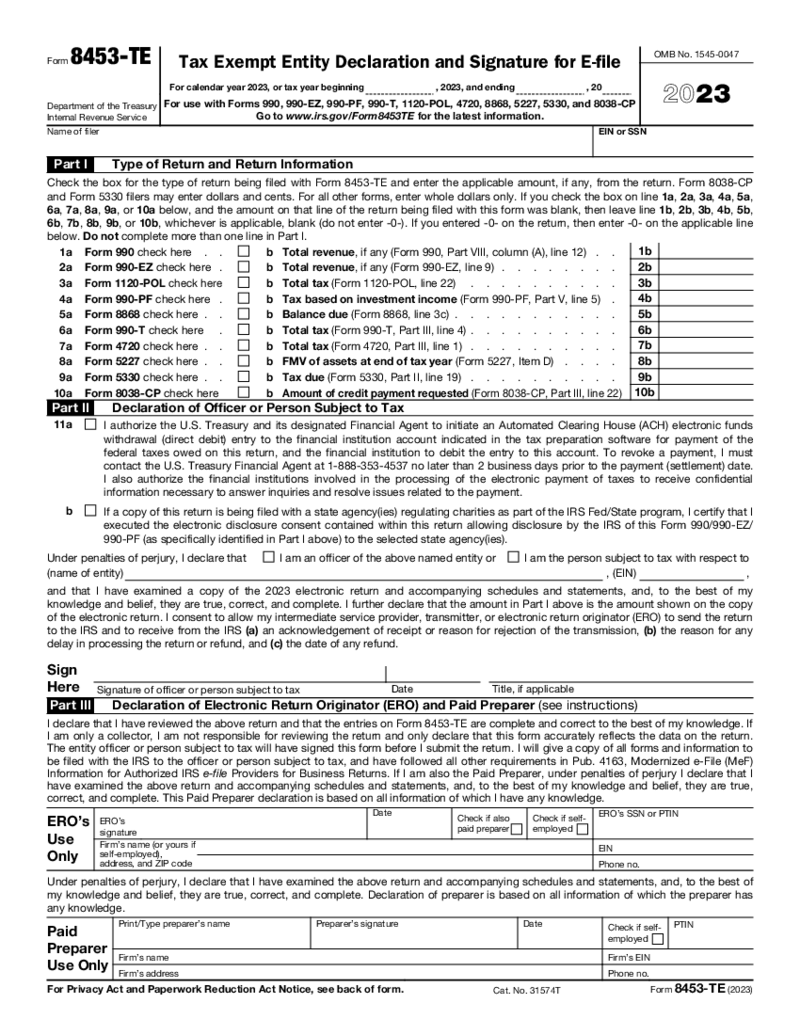

Form 8453-TE (2023)

Complete Guide to Filling Out Form 8453-TE

In the realm of tax submissions, electronic filings have become increasingly common, offering convenience and efficiency. Particularly for tax-exempt organizations and certain other entities, submitting electroni

Form 8453-TE (2023)

Complete Guide to Filling Out Form 8453-TE

In the realm of tax submissions, electronic filings have become increasingly common, offering convenience and efficiency. Particularly for tax-exempt organizations and certain other entities, submitting electroni

-

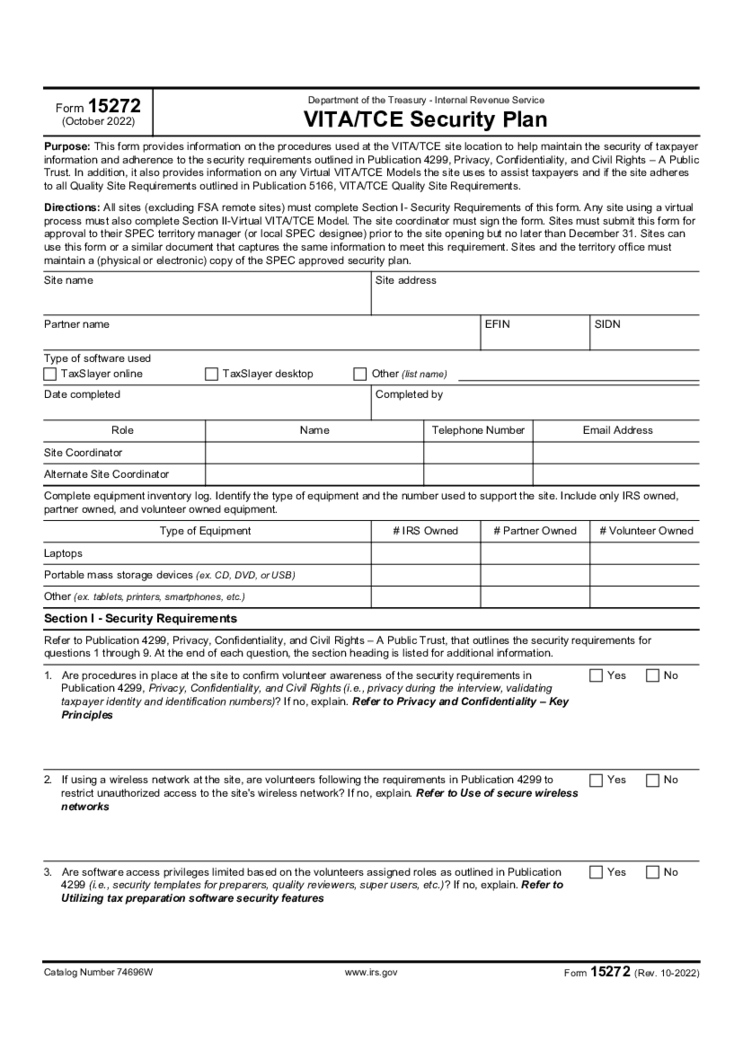

Form 15272

What Is 15272 Form?

Taxpayers making less than $54,000 yearly (regardless of their business), as well as the elderly, disabled, or those with limited English, may apply for free tax assistance within VITA (Volunteer Income Tax Assistance) and TCE (Tax Cou

Form 15272

What Is 15272 Form?

Taxpayers making less than $54,000 yearly (regardless of their business), as well as the elderly, disabled, or those with limited English, may apply for free tax assistance within VITA (Volunteer Income Tax Assistance) and TCE (Tax Cou

-

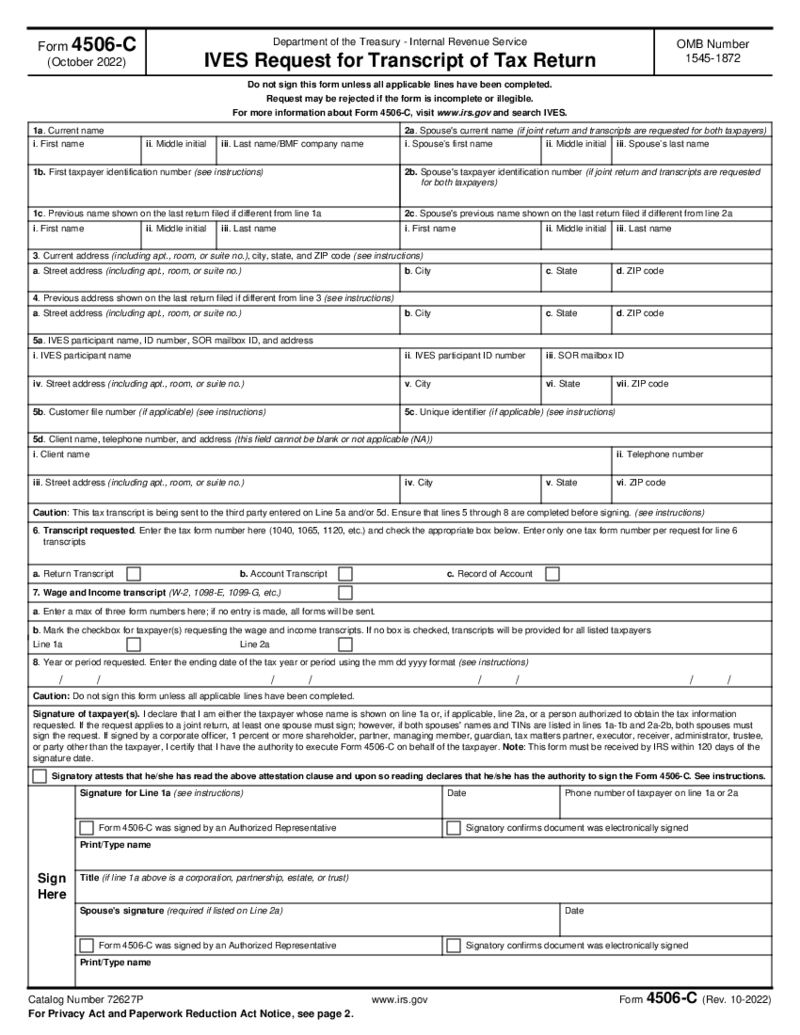

Form 4506-C (2022-2024)

What is 4506-C Form PDF

IRS Form 4506 C, also known as the "IVES Request for Transcript of Tax Return", is handy for those who need to get a transcript of their tax records. This form can only be used by

Form 4506-C (2022-2024)

What is 4506-C Form PDF

IRS Form 4506 C, also known as the "IVES Request for Transcript of Tax Return", is handy for those who need to get a transcript of their tax records. This form can only be used by

-

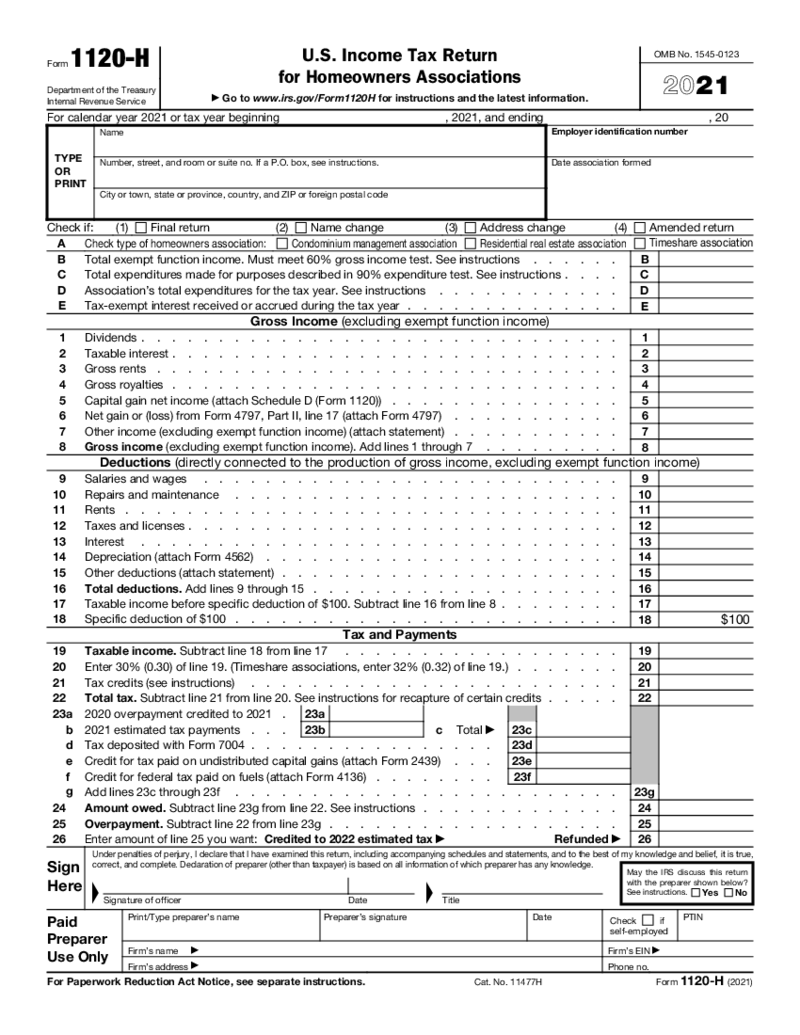

Form 1120-H (2021)

What Is IRS Form 1120 H 2021

IRS Form 1120 H 2021 is a specialized tax form for homeowners' associations, condominium management associations, and residential real estate management associations. This form allows these associations to benefit from cer

Form 1120-H (2021)

What Is IRS Form 1120 H 2021

IRS Form 1120 H 2021 is a specialized tax form for homeowners' associations, condominium management associations, and residential real estate management associations. This form allows these associations to benefit from cer

-

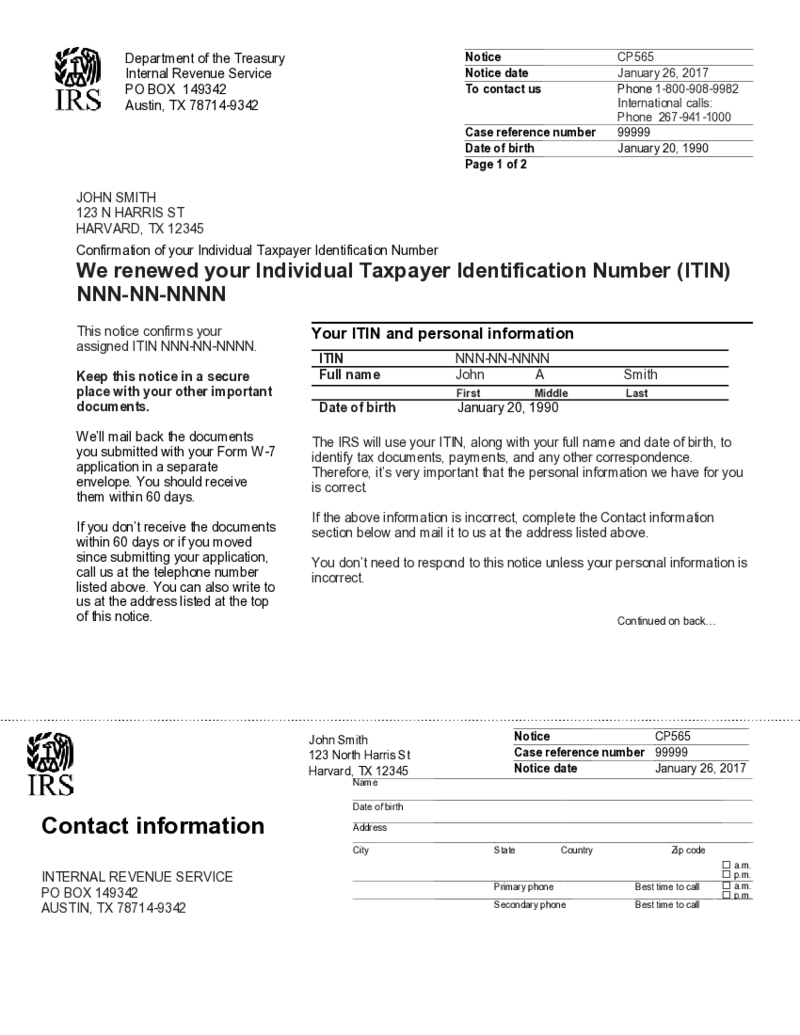

IRS CP565 Form

What Is Form CP565?

The CP565 form is an IRS notice that informs an individual they have been issued an Individual Taxpayer Identification Number (ITIN). An ITIN is a

IRS CP565 Form

What Is Form CP565?

The CP565 form is an IRS notice that informs an individual they have been issued an Individual Taxpayer Identification Number (ITIN). An ITIN is a

-

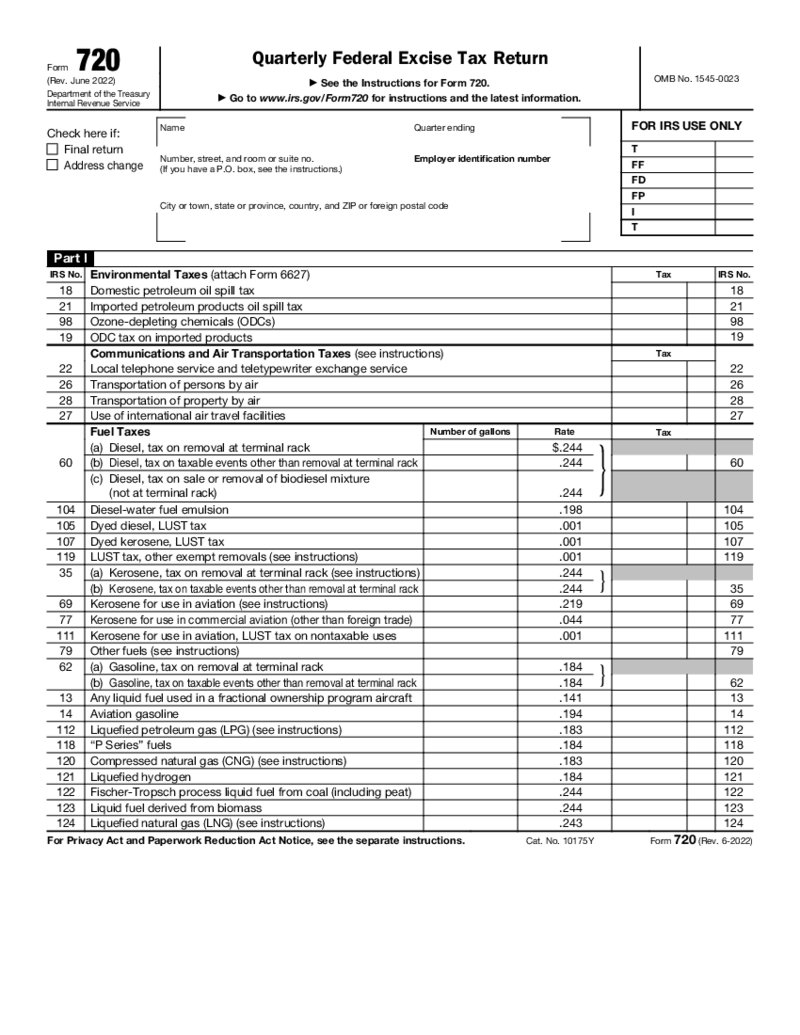

Form 720 (June 2022), Quarterly Federal Excise Tax Return

What is IRS Form 720?

Form 720, or the Quarterly Federal Excise Tax Return, is a document filed with the IRS by taxpayers who provide certain goods, services, and activities subject to excise taxes. IRS Form 720 for 2022 carries over the same purpose and

Form 720 (June 2022), Quarterly Federal Excise Tax Return

What is IRS Form 720?

Form 720, or the Quarterly Federal Excise Tax Return, is a document filed with the IRS by taxpayers who provide certain goods, services, and activities subject to excise taxes. IRS Form 720 for 2022 carries over the same purpose and

-

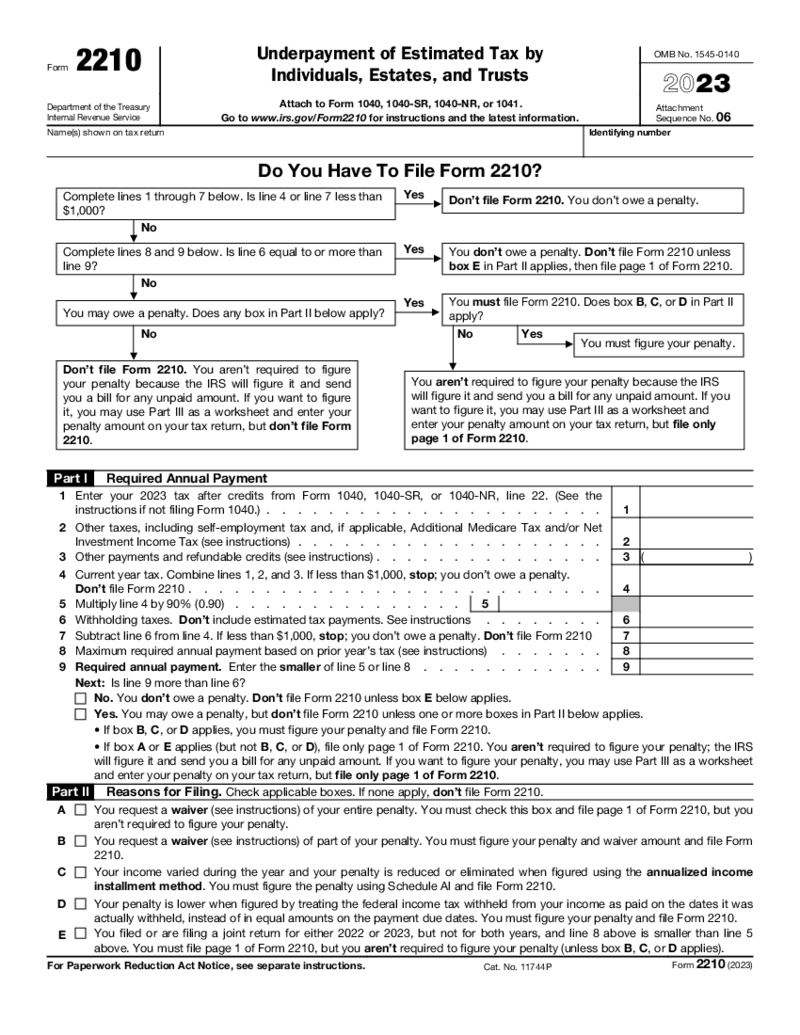

Form 2210

1. What is a 2210 Form?

The IRS Form 2210 (Underpayment of Estimated Tax by Individuals, Estates, and Trusts) is a federal tax form (not for business) that is used for checking out the presence of penalties for estimated tax underpayments. It also lets yo

Form 2210

1. What is a 2210 Form?

The IRS Form 2210 (Underpayment of Estimated Tax by Individuals, Estates, and Trusts) is a federal tax form (not for business) that is used for checking out the presence of penalties for estimated tax underpayments. It also lets yo

-

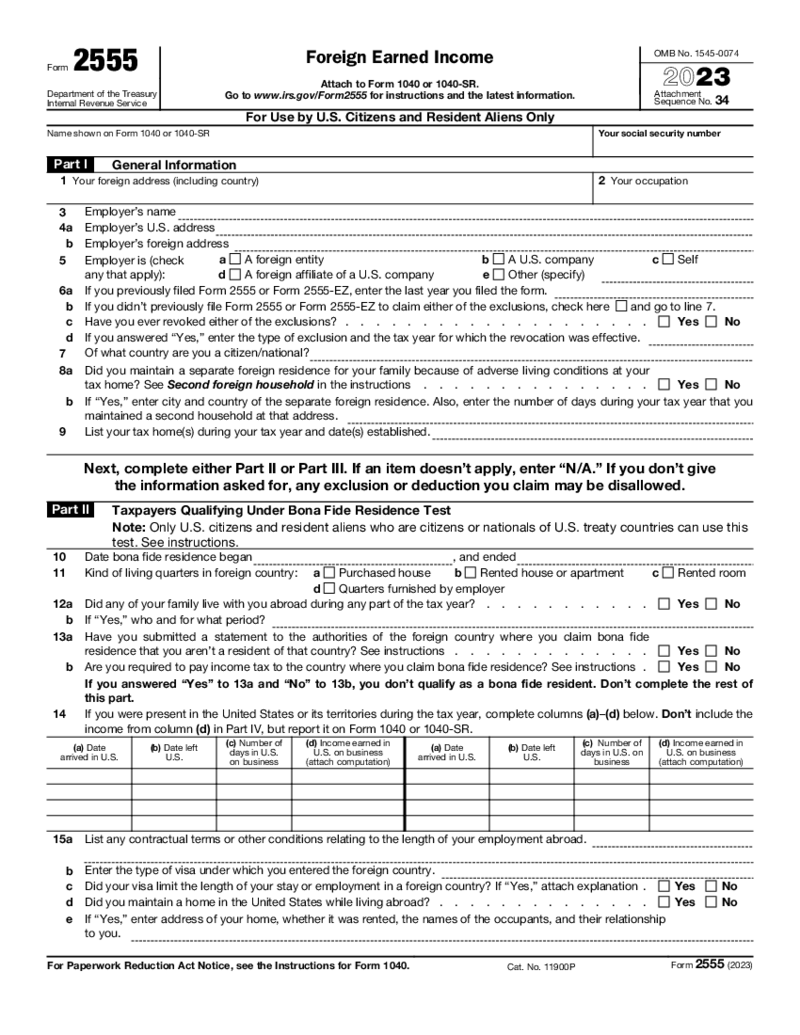

Form 2555 (2023)

What Is Form 2555 2023?

Form 2555 is a tax form used by United States taxpayers who qualify for the Foreign Earned Income Exclusion (FEIE). This exclusion allows eligible taxpayers to exclude a certain amount of their foreign income from their taxable inc

Form 2555 (2023)

What Is Form 2555 2023?

Form 2555 is a tax form used by United States taxpayers who qualify for the Foreign Earned Income Exclusion (FEIE). This exclusion allows eligible taxpayers to exclude a certain amount of their foreign income from their taxable inc

What Are Other Tax Forms?

In this category, you’ll find a selection of tax templates that aren’t united by any specific topic. They’re just miscellaneous tax forms that didn’t fit in any of the PDFLiner categories. Ready-made, free, fillable, and printable, these templates are up for grabs for all our service users on the right-here-and-right-now basis. We’re constantly adding new form templates and updating the existing ones to make our vast catalog live up to your most current expectations. Feel free to explore the outlines of the most frequently used files in this category, then pick the needed template and modify it online to suit your needs best.

Most Popular Other Tax Forms

Tax season is a challenging time for small businesses. Along with staying afloat operation-wise, you may find yourself struggling to collect, fill out, and file all the necessary docs to the IRS. So, instead of jiggling a multitude of useless tasks while trying to prepare all the necessary files offline, go digital and fill out the needed PDF files online. With a handy platform like PDFLiner, you are bound to succeed in filling out and submitting all the required forms perfectly on time.

Here’s a brief overview of the most widely used fillable tax forms within this category.

- Form 4506-C. Also known as IVES Request for Transcript of Tax Return, this form can be provided to you by the corresponding tax authorities upon your request. You don’t have to use this form every time the tax season is looming. What is more, this form is rarely used among the US taxpayers. To be more precise, the form is used when the lender needs permission from the borrower to obtain tax transcripts from the IRS. The form features two pages. The first page is fillable. While the second page contains instructions on the purpose of the form, as well as on how to fill it out. Read the instructions prior to getting data input started.

- Form 8962. Also referred to as Premium Tax Credit, the document is utilized by the taxpayers looking to pinpoint their premium tax credit amount with their federal tax return. In the majority of cases, the form is needed for covering the health insurance in your health plan. Because the file contains sensitive information about your earnings, ensure you submit it in the most secure way possible. Feeling confused by this doc or other tax forms 2022 - 2023? Turn to professional help and save heaps of your precious time.

- Form 8822-B. Also known as Change of Address or Responsible Party — Business, the form is utilized for the purpose of updating the information that was initially provided on the SS4 form when you applied for an EIN. The form is a two-pager, with the second page being non-fillable and containing useful instructions. Start by studying them and only then proceed by filling out the form itself.

- Form 15227. You’re probably aware that taxpayers should obtain Identity Protection PIN on a yearly basis for the purpose of secure tax filing. To apply for that IP PIN, you’re going to need to fill out and file this particular form. It should include your ID information, as well as date and signature. The form also comes with instructions, so don’t forget to read them carefully prior to getting the completion going.

- Form 4506. Also known as Request for Copy of Tax Return, the document is utilized for requesting a copy of your tax return or allowing a third party to obtain the tax return. Just like any other tax template, this form is available for you to customize here on PDFLiner. So, take action and let digital file management elevate your operation to the next level.

How to Get Tax Forms

You can find all the necessary tax forms on the IRS official website. But their website comes with no additional editing tools at all. As a fine alternative, you’re welcome to lay your fingertips on the necessary forms right here from this category of PDFLiner. Our extensive library of templates is always up for grabs. Just take a browse through it, find the necessary form, and get the fill-out process started. With our platform, you’ll say good-bye to printing and scanning. Digital file submission is a lot easier and faster than paper-based management. And it’s secure, too.

How to Fill Out Tax Forms

With our service at your regular disposal, you get the possibility to fill out any form by using our top-level drag-and-drop form builder and its outstanding editing functionality. When working on the template, determine its purpose, input essential details, apply suitable format, and double-check if everything is 100% correct. Upload your business logo, add fillable fields if necessary, send the file for e-signature fast and easily, and make the most of everything our platform has to offer. PDFLiner comes with a slight learning curve, but the effort you’ll invest in the affair is sure to pay off significantly.

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.