-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

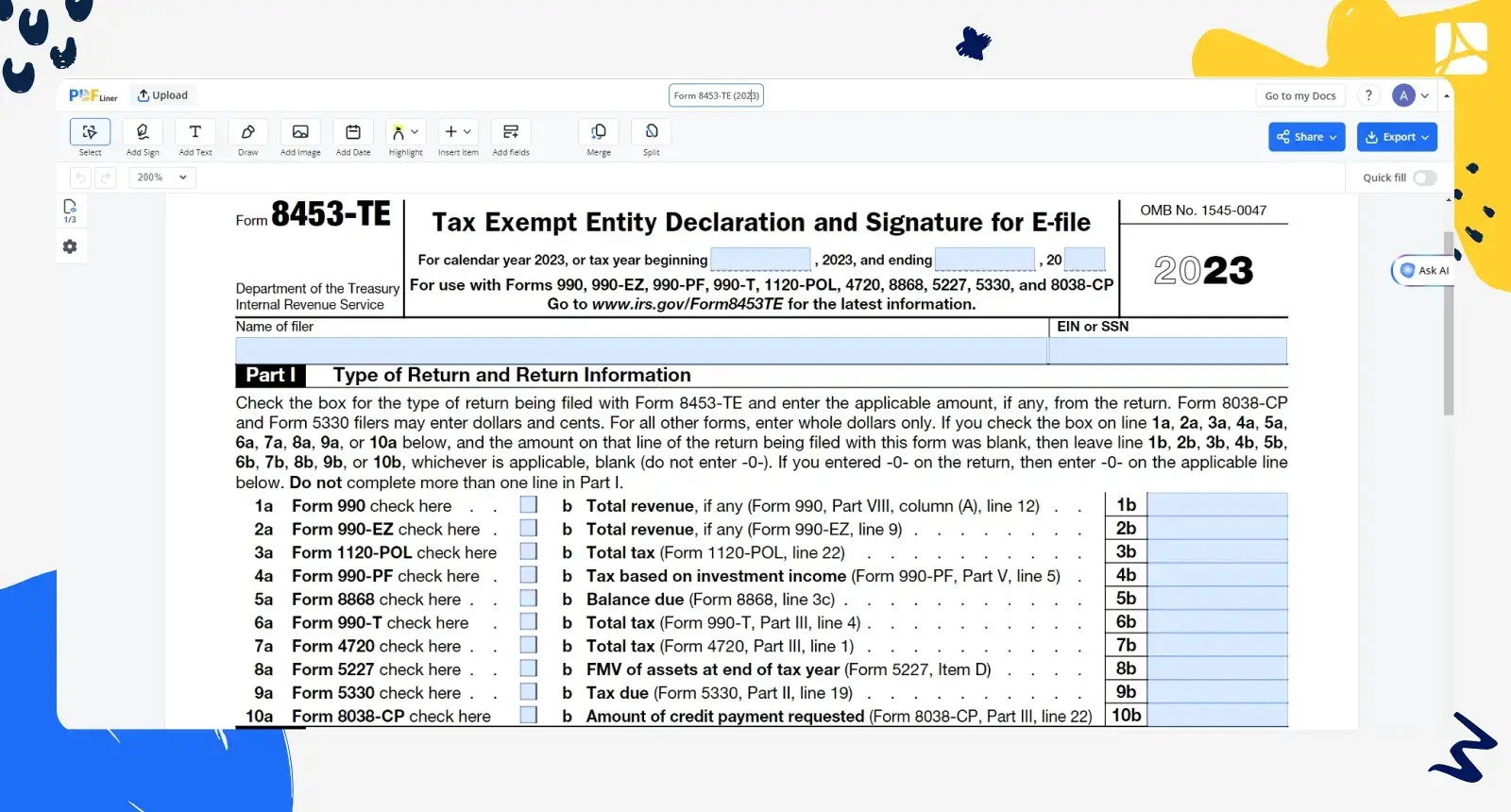

Form 8453-TE

Get your Form 8453-TE (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Complete Guide to Filling Out Form 8453-TE

In the realm of tax submissions, electronic filings have become increasingly common, offering convenience and efficiency. Particularly for tax-exempt organizations and certain other entities, submitting electronic documents necessitates the use of specific forms for authentication and documentation purposes. Form 8453-TE plays a crucial role in this process. Understanding how to correctly fill out this form is essential for ensuring a smooth and correct filing experience.

What is Form 8453-TE Used For?

Form 8453 TE acts as a key that unlocks the door to electronic filing for various tax forms related to non-profit and exempt organizations. Specifically designed for the electronic submission of forms such as 990, 990-EZ, and 990-PF among others, it authenticates the electronic form, authorizes electronic funds withdrawals for tax payments, and serves to submit any necessary paper documents or supporting materials that are required alongside the electronic filing. Essentially, it ensures that all submitted information is verified and allows for the secure transmission of documents and payments to the IRS.

The Importance of Correct Submission

Filing IRS Form 8453-TE accurately is paramount to avoid delays or issues in the processing of tax documents. Correct submission ensures that the IRS can efficiently process the tax return and, if applicable, issue any refunds or accept tax payments without hiccups. It also serves as a safeguard for your organization, ensuring that all documentation is in order and properly submitted, thereby minimizing the risk of audits or penalties.

How to Fill Out Form 8453-TE

Filling out Form 8453-TE requires attentiveness to detail and a clear understanding of the organization's filing necessities. Here are the step-by-step instructions for completing this form:

- Carefully read the instructions provided by the IRS to familiarize yourself with which parts of the form apply to your organization's filing.

- Enter the organization's name, Taxpayer Identification Number (TIN), and the tax year at the top of the form.

- Select the specific form(s) you are electronically filing from the list provided on Form 8453-TE. This could include forms 990, 990-EZ, 990-PF, among others.

- In Part II, if applicable, check the box to authorize electronic funds withdrawal and provide the necessary payment information including routing number, account number, and payment date.

- The officer or authorized person from the organization must then declare in Part II by checking the appropriate box and providing their name and title.

- If the return is being filed through an Electronic Return Originator (ERO), complete Part III by including the ERO's information and obtaining their signature.

- Finalize the form by making sure that all necessary declarations are signed and dated appropriately.

Form Versions

2021

Form 8453-TE (2021)

Fillable online Form 8453-TE (2023)