-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

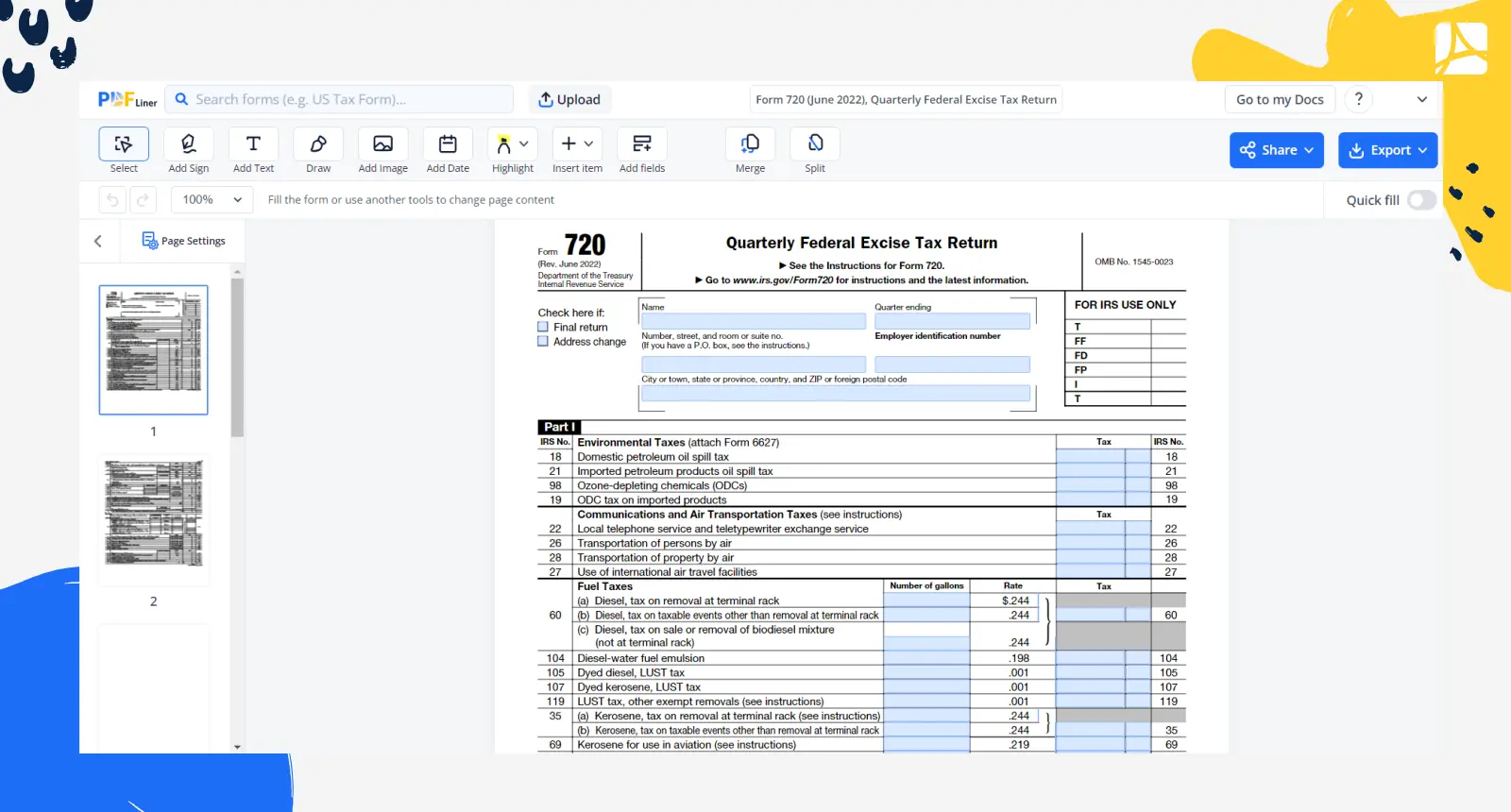

Form 720 (June 2022), Quarterly Federal Excise Tax Return

Get your Form 720 (June 2022), Quarterly Federal Excise Tax Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS Form 720?

Form 720, or the Quarterly Federal Excise Tax Return, is a document filed with the IRS by taxpayers who provide certain goods, services, and activities subject to excise taxes. IRS Form 720 for 2022 carries over the same purpose and is categorized into three parts. Part I covers environmental taxes, communication and air transportation taxes, fuel taxes, retail tax, and manufacturers' taxes.

Part II encompasses patient-centered outcomes research fee, indoor tanning services tax, and net investment income tax. Part III is for the taxpayer to calculate the balance due or overpayment.

How to Fill Out IRS 720 Form June 2022

Step 1: Identify Yourself

Fill out the top part of the form with your business name, address, and Employer Identification Number (EIN).

Step 2: Choose the Applicable Quarter and Year

Indicate the quarter and the year for which you are filing the form in the specified boxes.

Step 3: Fill Out Part I (If Applicable)

Part I includes a variety of excise taxes. If you owe any of these taxes, fill out the corresponding lines with the appropriate amounts. The form has clear instructions for each line.

Step 4: Complete Part II (If Applicable)

If you owe taxes that fall under Part II, fill out those lines. Again, the form provides instructions for each line.

Step 5: Calculate Total Taxes

Add the amounts from Part I and Part II to determine your total taxes for the quarter. Enter this amount in the "Total Tax" line.

Step 6: Report Installment Payments

If you made any installment payments of the environmental tax for gas guzzling vehicles during the quarter, enter the total amount on the corresponding line.

Step 7: Calculate the Balance Due or Overpayment

Complete Part III to calculate the balance due or overpayment. If the total taxes are more than your deposits, you owe the difference. If your deposits are more than the total taxes, you have overpaid.

Step 8: Sign and Date the Form

Once all the information is correctly filled in, sign and date the form. By signing, you are declaring that the information provided is accurate.

How to File Form 720

The process of filing IRS 720 Form is straightforward. The fillable 720 form can be downloaded from the official IRS website. After filling it out, you can submit it electronically through the IRS e-file system. Alternatively, you can mail the completed form to the IRS.

It's crucial to note that the IRS Form 720 should be filed quarterly. The due dates are as follows: April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter.

Where to send form 720

When you’re ready to file, you may wonder where to send Form 720. If you’re filing electronically, the form will be submitted directly to the IRS through the e-file system. If you opt to mail your 720 tax form, the IRS website provides an updated list of addresses, which depends on your location and whether you’re including a payment.

Why IRS form 720 June 2022 is important

The IRS uses the information from Form 720 to ensure that the correct amount of excise tax is collected. If you are required to file Form 720 and fail to do so, or inaccurately report your taxes, you could face penalties or interest. Therefore, it’s essential to familiarize yourself with IRS Form 720 for 2022 and ensure you’re meeting all tax obligations.

Form Versions

2022

Fillable Form 720 for March 2022

2021

Fillable Form 720 for 2021

2020

Fillable Form 720 for 2020

Fillable online Form 720 (June 2022), Quarterly Federal Excise Tax Return