-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Contract Templates

-

Nikah Nama PDF

What Is a Nikah Certificate Template PDF?

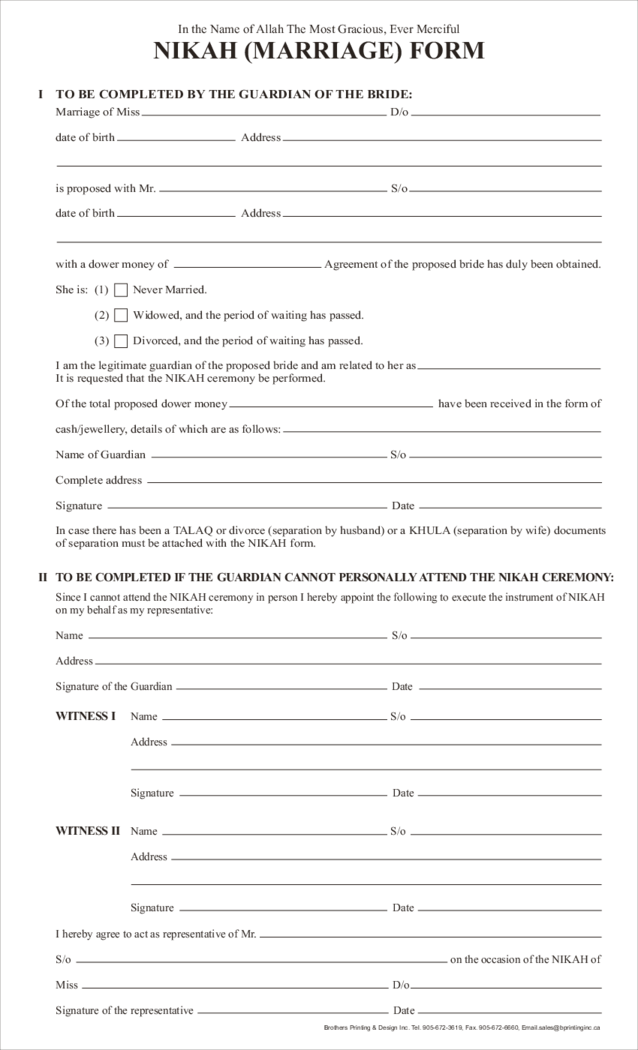

Let’s start with the definition of ‘nikah’. Simply put, it’s a religious ceremony that crowns the contract between the groom and the bride, who agree to be legally wed under Islamic law. Th

Nikah Nama PDF

What Is a Nikah Certificate Template PDF?

Let’s start with the definition of ‘nikah’. Simply put, it’s a religious ceremony that crowns the contract between the groom and the bride, who agree to be legally wed under Islamic law. Th

-

Virginia Motor Vehicle Bill of Sale

What is the Virginia Motor Vehicle Bill of Sale?

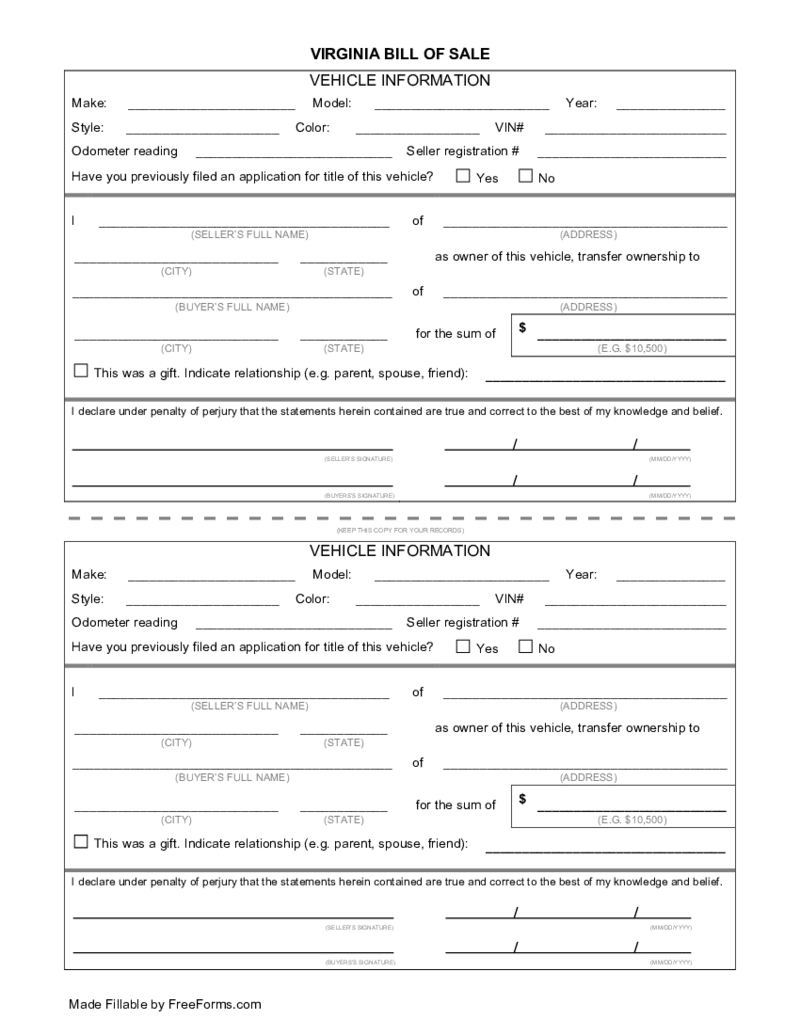

The auto bill of sale Virginia is the official document that binds the seller and buyer of the motor vehicle. It can be a truck, car, or motorcycle. The document is widely used in Virginia. Yet, if you are

Virginia Motor Vehicle Bill of Sale

What is the Virginia Motor Vehicle Bill of Sale?

The auto bill of sale Virginia is the official document that binds the seller and buyer of the motor vehicle. It can be a truck, car, or motorcycle. The document is widely used in Virginia. Yet, if you are

-

2257 Model Release Form

What Is the 2257 Model Release Form?

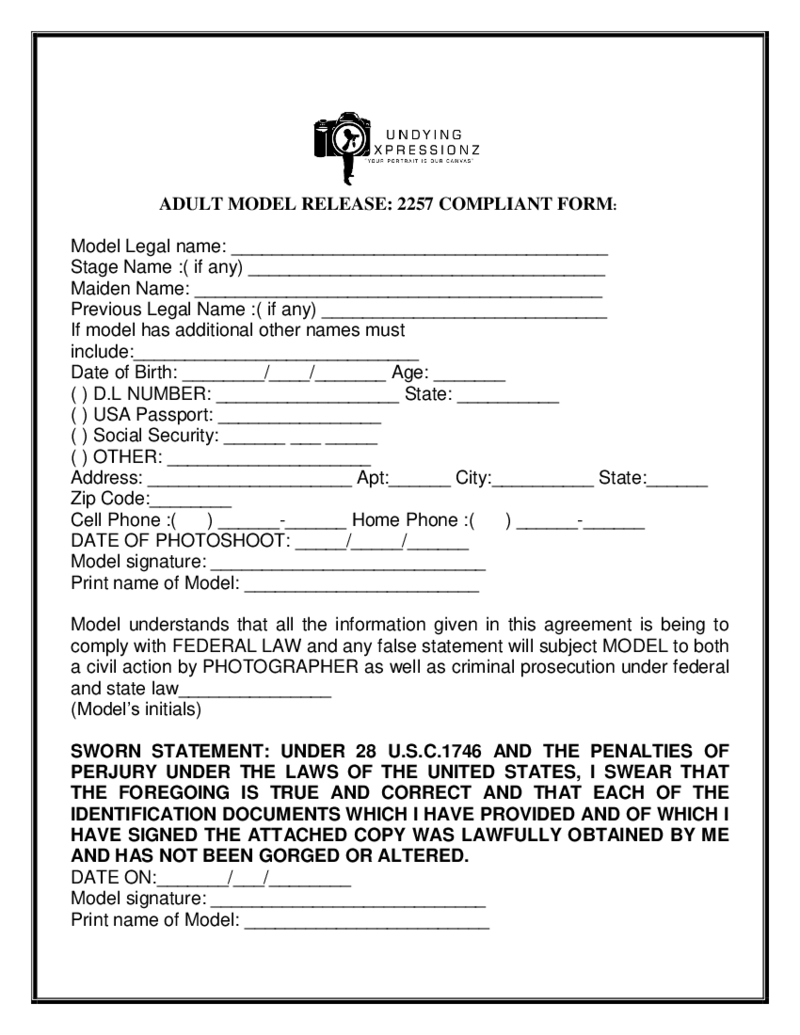

A model release form 2257 is a document that is used to establish that the person appearing in a photograph or video is over the age of 18 and has consented to the use of their image.

2257 Model Release Form

What Is the 2257 Model Release Form?

A model release form 2257 is a document that is used to establish that the person appearing in a photograph or video is over the age of 18 and has consented to the use of their image.

-

ADAC Second-hand Car Sales Agreement

ADAC Second-Hand Car Sales Agreement: What You Need to Know

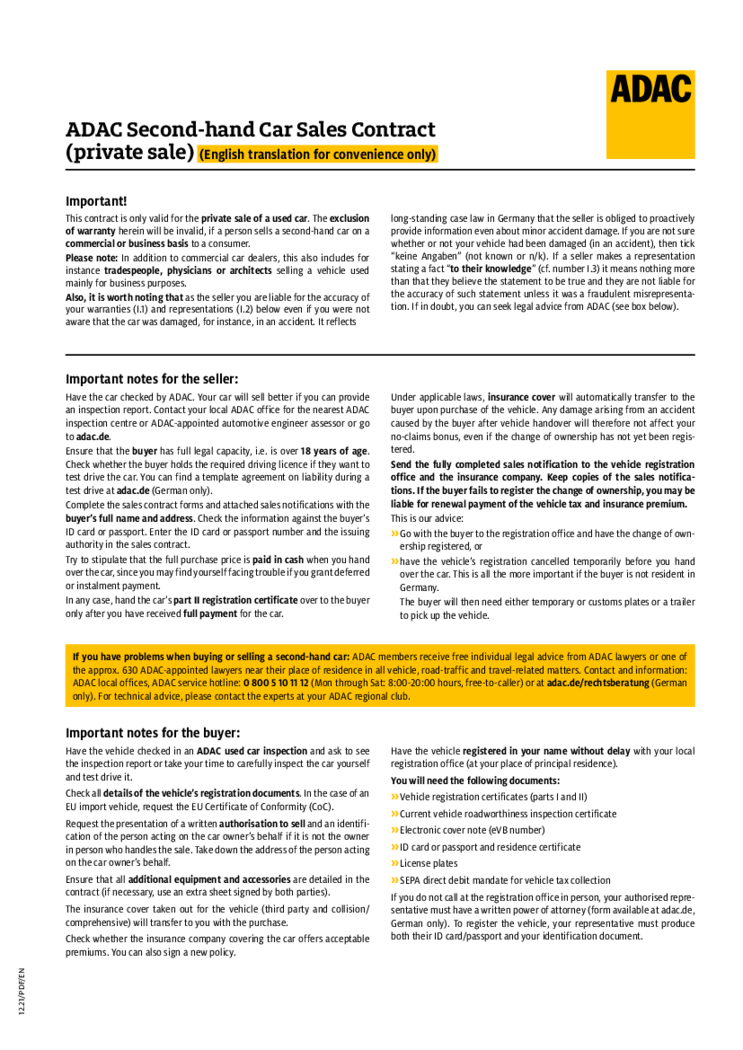

The ADAC second-hand car sales agreement is a crucial document that safeguards both the buyer and seller while purchasing a second-hand car. It's not just a formality; it's the backbone o

ADAC Second-hand Car Sales Agreement

ADAC Second-Hand Car Sales Agreement: What You Need to Know

The ADAC second-hand car sales agreement is a crucial document that safeguards both the buyer and seller while purchasing a second-hand car. It's not just a formality; it's the backbone o

-

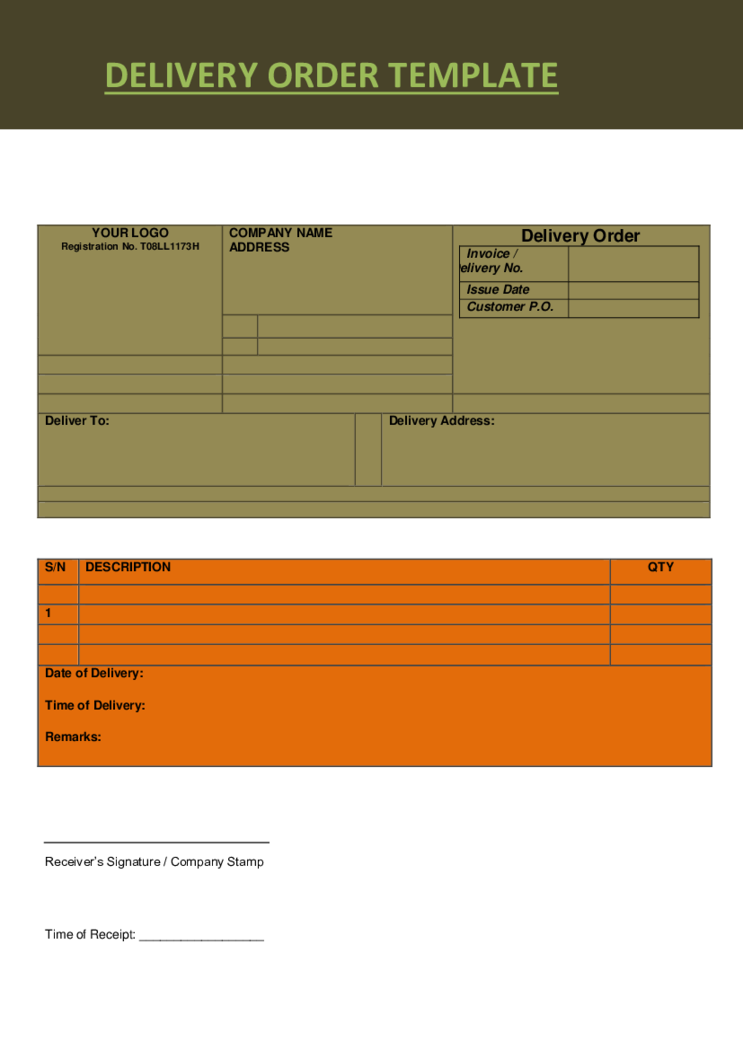

Delivery Order Template

What Is a Delivery Order Template Form?

Fillable Delivery Order Template is a form that is used by businesses that work with delivery. Download Delivery Order Template to ease the delivery process for you and your employees. The template is not the busine

Delivery Order Template

What Is a Delivery Order Template Form?

Fillable Delivery Order Template is a form that is used by businesses that work with delivery. Download Delivery Order Template to ease the delivery process for you and your employees. The template is not the busine

-

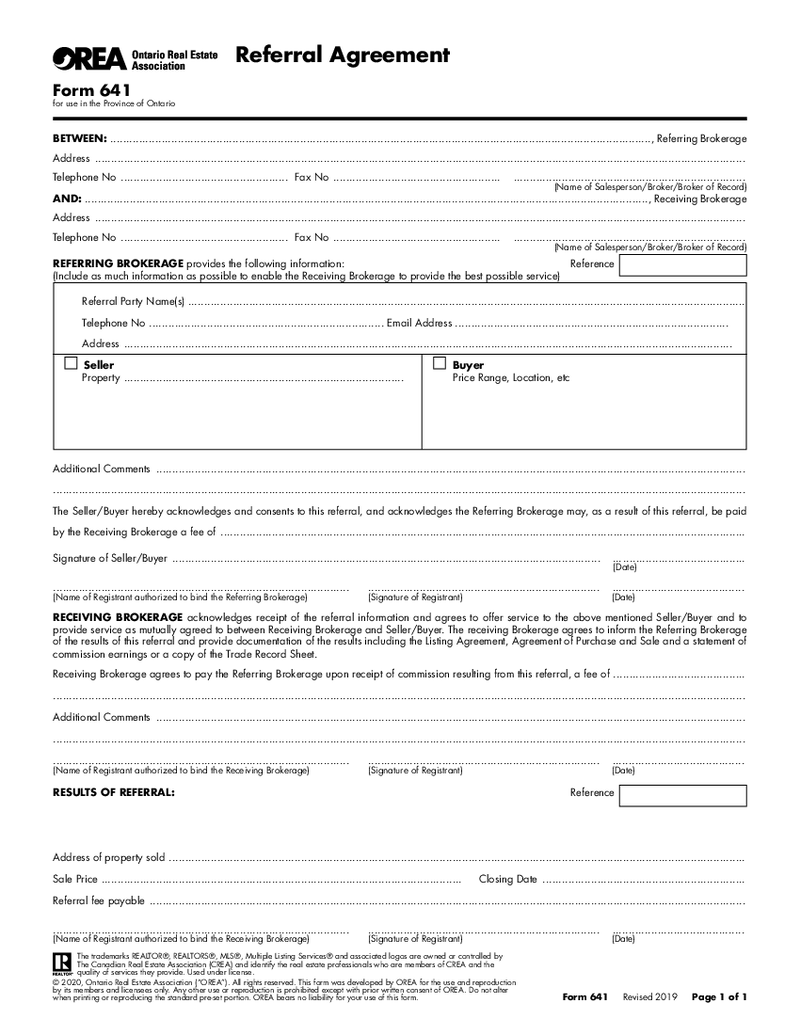

OREA Form 641, Referral Agreement

What Is OREA Form 641?

The OREA form 641 is also known as the Referral Agreement. It was created by the Ontario Real Estate Association and approved by the Canadian Real Estate Association. Yet, the document can be used in the Province of Ontario. You nee

OREA Form 641, Referral Agreement

What Is OREA Form 641?

The OREA form 641 is also known as the Referral Agreement. It was created by the Ontario Real Estate Association and approved by the Canadian Real Estate Association. Yet, the document can be used in the Province of Ontario. You nee

-

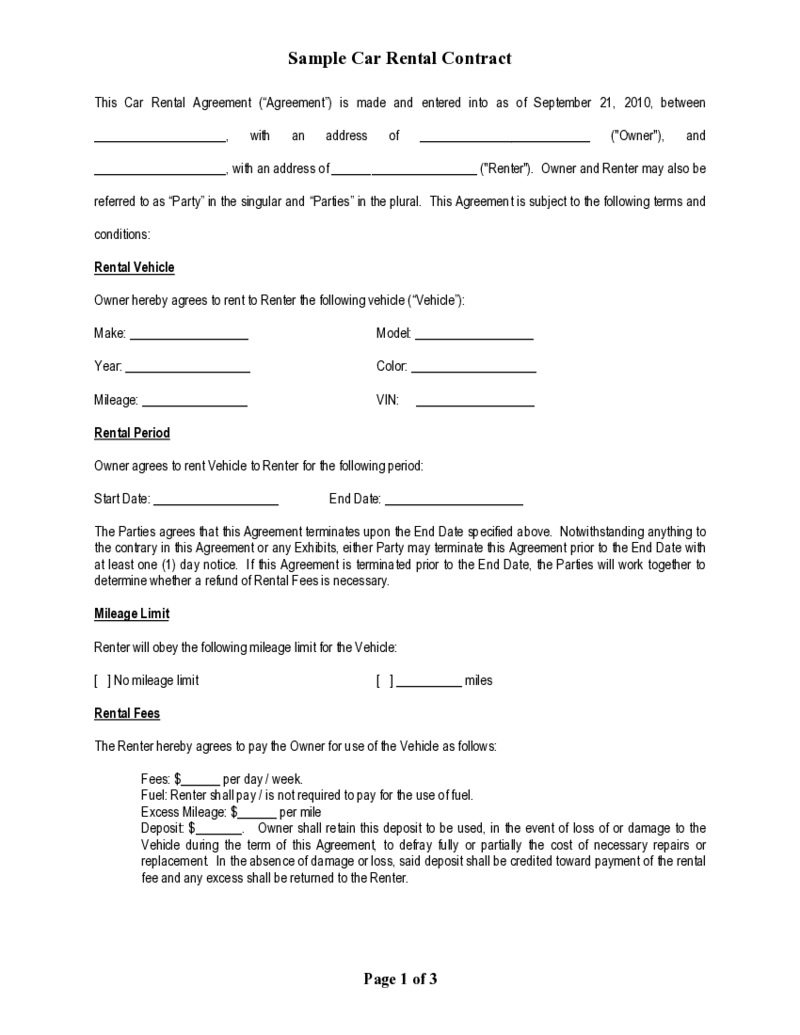

Car Rental Agreement Template

What Is a Car Rental Agreement Template?

A car rental agreement is a legally binding contract between a car owner and a renter that outlines the details and terms of the rental. In the majority of cases, the agreement features such information as the make

Car Rental Agreement Template

What Is a Car Rental Agreement Template?

A car rental agreement is a legally binding contract between a car owner and a renter that outlines the details and terms of the rental. In the majority of cases, the agreement features such information as the make

-

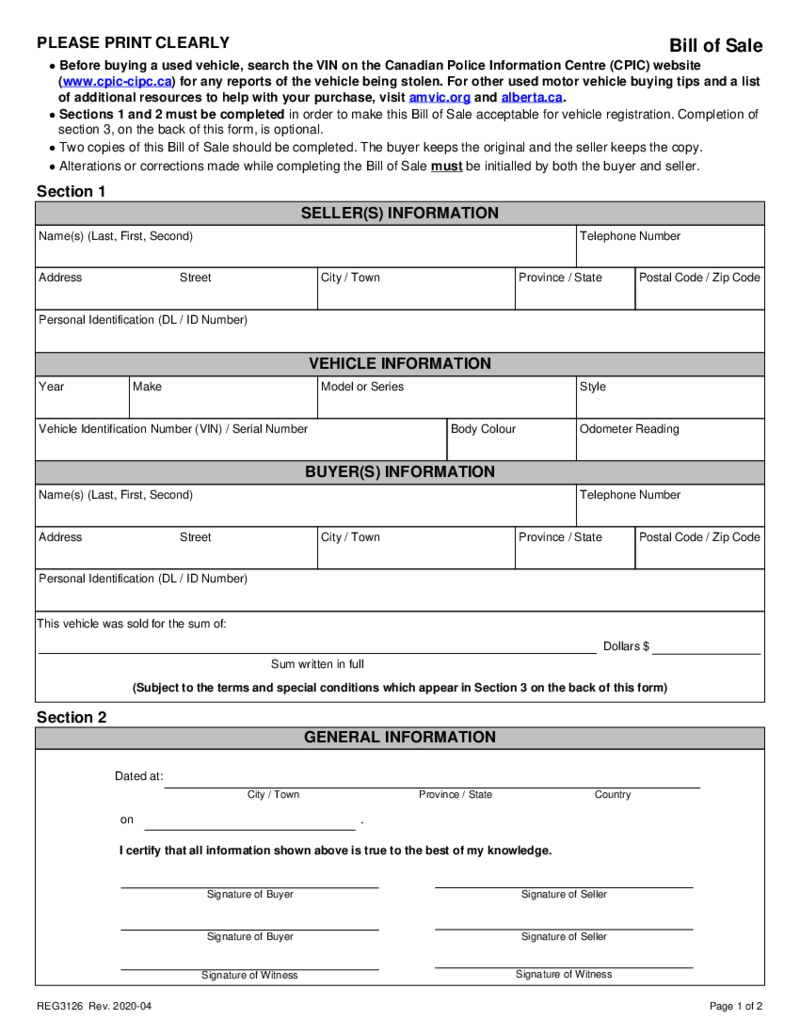

Alberta Motor Vehicle Bill of Sale

What Is the Alberta Motor Vehicle Bill of Sale?

Alberta Motor Vehicle Registry Bill of Sale is filled out when the vehicle is transferred from seller to buyer. It confirms that a buyer is the owner of the motor vehicle now. It can be used in court if ther

Alberta Motor Vehicle Bill of Sale

What Is the Alberta Motor Vehicle Bill of Sale?

Alberta Motor Vehicle Registry Bill of Sale is filled out when the vehicle is transferred from seller to buyer. It confirms that a buyer is the owner of the motor vehicle now. It can be used in court if ther

-

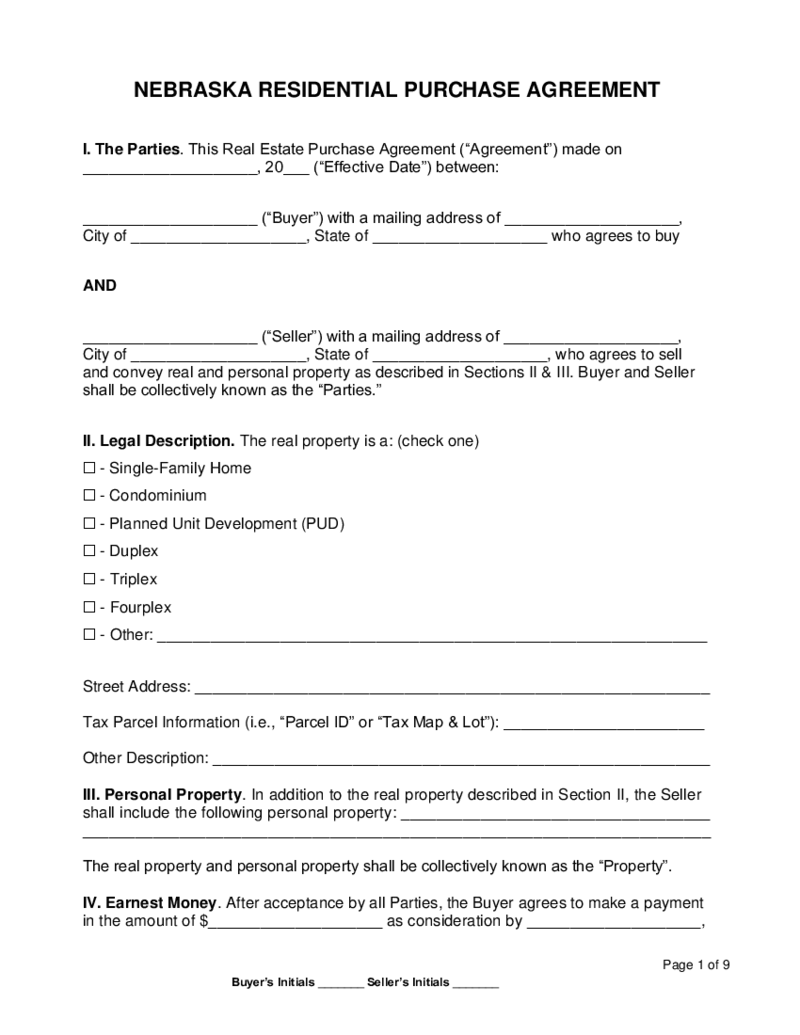

Nebraska Real Estate Contracts

What Is the Nebraska Real Estate Contract Form?

The Nebraska real estate purchase contract is a legal document used by buyers and sellers of residential property in Nebraska. The form outlines the terms and conditions of the sale, including the purchase p

Nebraska Real Estate Contracts

What Is the Nebraska Real Estate Contract Form?

The Nebraska real estate purchase contract is a legal document used by buyers and sellers of residential property in Nebraska. The form outlines the terms and conditions of the sale, including the purchase p

-

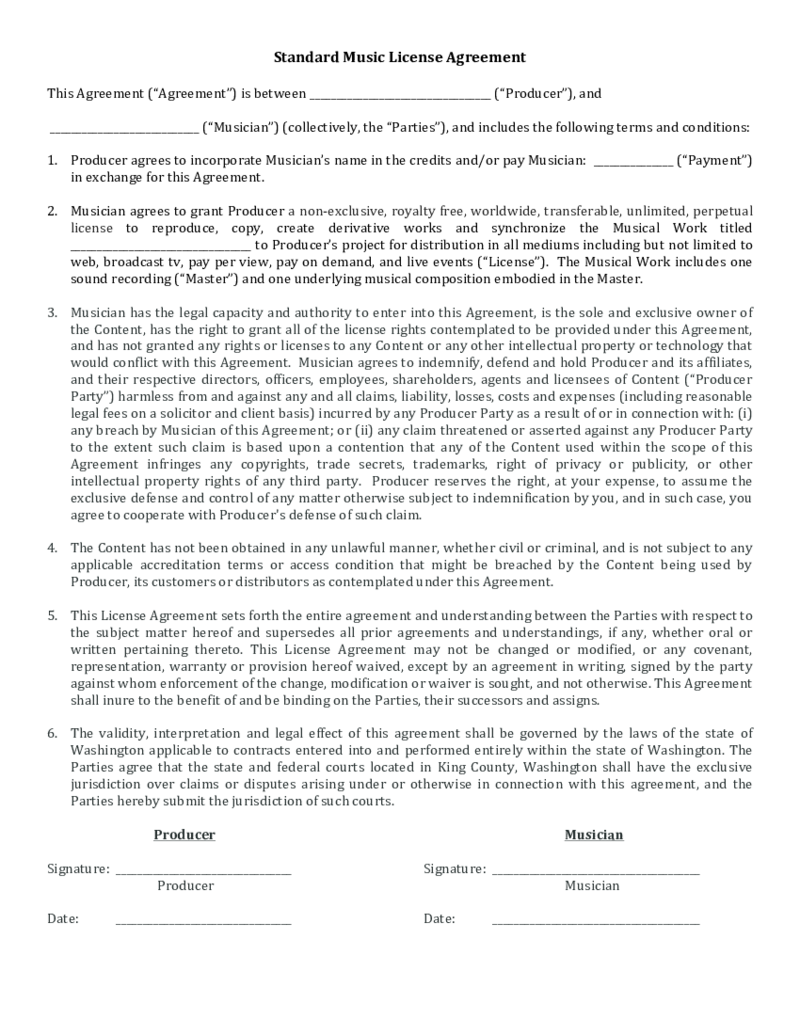

Music License Contract Template

What Is a Music Licensing Contract Template?

If you are in the music industry, chances are you will need to sign music licensing contract templates at some point. A music licensing contract is a legal agreement between a music artist and a company that wa

Music License Contract Template

What Is a Music Licensing Contract Template?

If you are in the music industry, chances are you will need to sign music licensing contract templates at some point. A music licensing contract is a legal agreement between a music artist and a company that wa

-

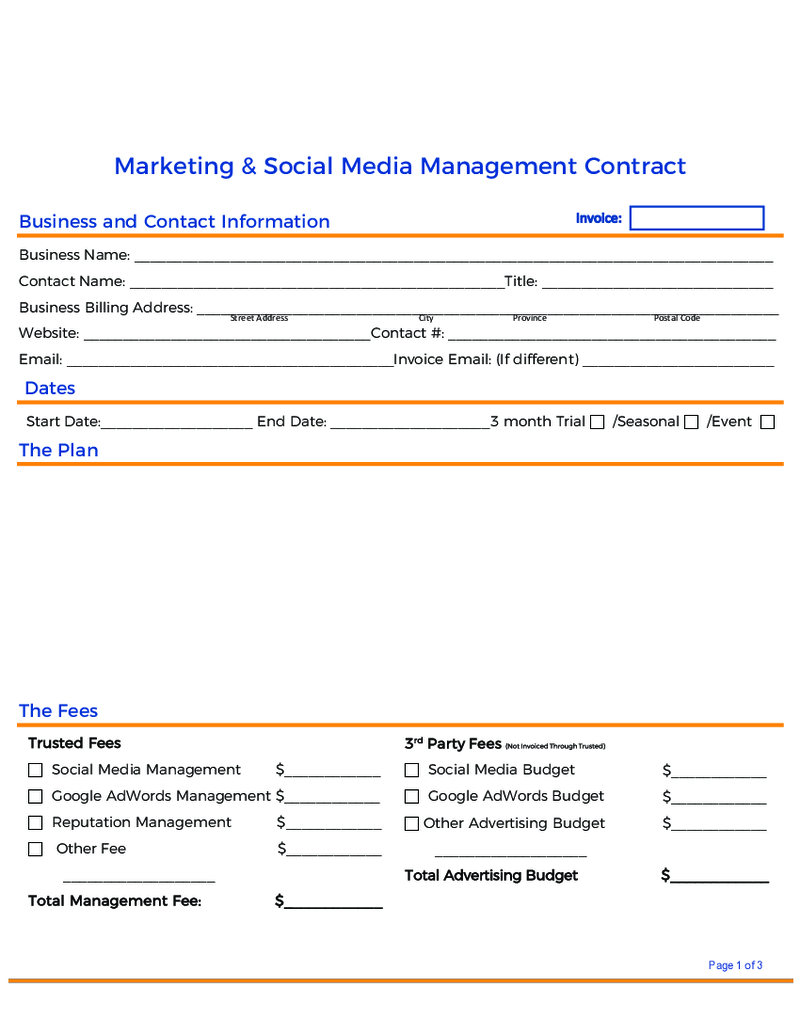

Social Media Management Contract

Understanding Social Media Management Contract

To run a successful business, hiring a competent social media manager is a crucial step in your digital marketing strategy. A well-drafted contract for media manager not only lays down the terms and condition

Social Media Management Contract

Understanding Social Media Management Contract

To run a successful business, hiring a competent social media manager is a crucial step in your digital marketing strategy. A well-drafted contract for media manager not only lays down the terms and condition

-

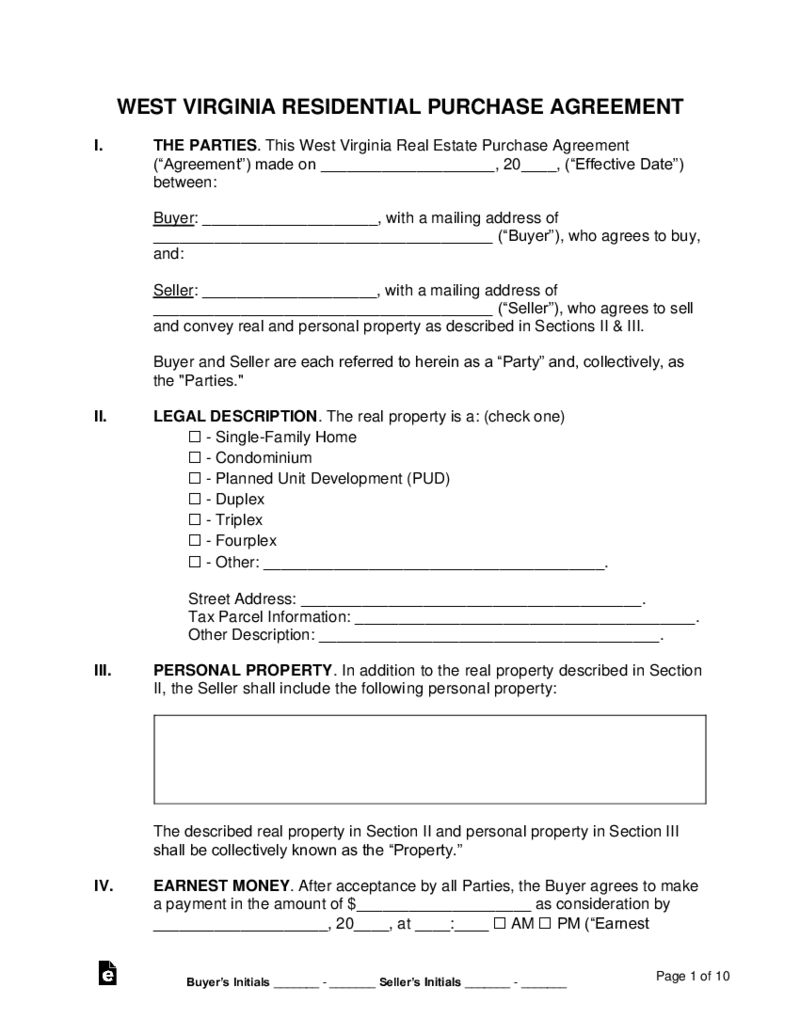

West Virginia Real Estate Contracts

Understanding the West Virginia Residential Real Estate Contract Form

The West Virginia Real Estate Contract form is a legally binding document that outlines the terms and conditions of a real estate transaction. It covers all aspects of the sale, includi

West Virginia Real Estate Contracts

Understanding the West Virginia Residential Real Estate Contract Form

The West Virginia Real Estate Contract form is a legally binding document that outlines the terms and conditions of a real estate transaction. It covers all aspects of the sale, includi

Search by State

What Are the Contracts Templates?

Contracts templates are schemes or agreement plans that you can fill in with your information. They were created by professionals and can be used for contracts or amendments. Once you fill these templates with your personal information, they become unique. Each template for a contract must contain specific data on both parties who sign it. If you have the template, you don’t need to write down all the conditions in the agreement and the laws. You will find this information in the outline. All you need to do in most cases is include your personal information and sign it.

The most popular contract templates you might need are all related to the business and economy. You can find the contract template you need by searching for keywords. The most popular templates are:

- Car sales forms, including auto service, cleaning service, and car rent;

- Delivery orders, including international delivery service templates and due date agreements;

- Templates for specific work arrangements such as plumbing contract and catering, consulting, birthday party entertainments, wedding photography, and so on;

- Business-related templates, including tax forms, annual and quarterly reports of the company or trustees;

- Property-related templates, including agreements for rent and sales.

There are over 290 different contract templates on the website. The number keeps growing every week. Once you find the form you need there, fill it with your and the other party's information and sign.

What Should a Contract Template Contain?

A contract template has to meet specific requirements if you want to make it legal. You can legally bind two parties and more with this contract. It usually identifies the roles and obligations of each party. This is why it is so important to include specific clauses and terms in templates for contracts. You will need:

- Specification on terms and conditions of your agreement;

- Expectations of each party, including materials, timeframes, and payments if there are any;

- Details on the consequences of disagreements. Make sure that parties who sign the document are familiar with the outcome of the broken contract.

If you need to make your contracts template legally binding, you have to include the following information there:

- The offer itself. Make sure you include a piece of information about you and the other parties;

- Both parties must agree upon conditions in the contract;

- Money or any other services that are exchanged for the offer that was made;

- Both parties signing the basic contract template confirm that they are aware of the information that was written there.

You can find a wide range of options based on the type of contract you need. There are multiple versions of the same document for renting a car or lending money, for example. Yet, no matter whether you choose simple contracts templates or advanced, there must be a few similarities:

- Terms. If the contract has a strict deadline, you need to indicate it in the first paragraph, under the information about you and the other party. Don’t forget to include your full name, address, and phone number;

- Responsibilities of each party. There must be a detailed description of activities you perform and what you expect from others;

- Compensation that must be provided in specific cases, including when one party breaks the contract;

- Benefits and services that are offered by this contract.

Most Popular Online Contract Templates

There are hundreds of basic online contract templates on PDFLiner and even more on the Internet. You can easily get lost there. Some of them are alternative versions of the same document that can still work for you. Others contain the data you don’t need in the paper. Before you start filling one, you have to make sure that the agreement was made appropriately, includes the information you need, and has empty lines for you and another party.

PDFLiner offers templates for almost any occasion, from tax forms you have to send to the IRS every year to contracts for entertainment. They are all made in different styles and contain the information that is gathered for a specific case. You can’t use the birthday party contract for house rent. If you know which form you need, you don’t have to turn pages with forms. Just type the name of the form or specific indicators in the search panel above the forms.

The most popular forms on the PDFLiner are:

- “As Is” form for purchase and sale. This is the most popular form among realtors in Florida. It has been approved by the Florida Association of Realtors and Florida Bar. It is a simple form for buying/selling property that can save you time and effort. You will need to describe the property name and address, specify the extra items that come in the deal, and discuss the price. There will be a deadline mentioned which will save both parties from fraud.

- Car Rental Contract. This is a standard form that has to be filled out by the person who wants to rent a car. It requires information about the car owner and the renter. You have to specify the dates of the agreement and the time during which you want to rent it. Include the information about the vehicle as well.

- Consulting Agreement. This is a universal document for any consultations provided by third parties. There are two parties in the agreement: One is hiring, and the other is getting hired to provide consulting services. You need to specify information about both parties and the services that will be provided. Don’t forget to include the dates of these services. If you want to achieve some specific results, you need to write down your expectations too.

- Catering Contract. You need this form before some big events. If you want to hire a catering company or independent business owner, you have to sign the agreement in the first place. Include information about both parties and specify the services that are expected from the caterer. Write down the specific amount of money that will be paid for them.

- Cleaning Services. This is another contract for the work you receive or perform. There must be information about both parties, the address, and the exact date of services. If you hire a person for several visits, you need to specify this in the contract. Make sure that the payment is written down in the contract before both parties sign it. You can also pinpoint whether you want this contract to be prolonged or if it is a one-time agreement.

How to Create a Contract Template?

You can easily use any template that is already available on PDFLiner. Once you find the form you need, don’t worry. All you need to do is to enter PDFLiner and search for the form. Now, follow the next steps:

- You need to open one of the forms that you have found for your case. Just press the name, and you will be redirected there. Read detailed descriptions and brief recommendations if you need them.

- Press the big blue button “Fill Online this form,” and it will send you to the template.

- The form will appear in the editor where you can fill it with your information.

- You can put an e-signature using the Sign tool in PDFLiner. Once everything is in its place, you can press “Done.” You can print the form or just send it via email to another party.