-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Your last edited file here: Employee Time Sheet Template

Canada Tax Forms

-

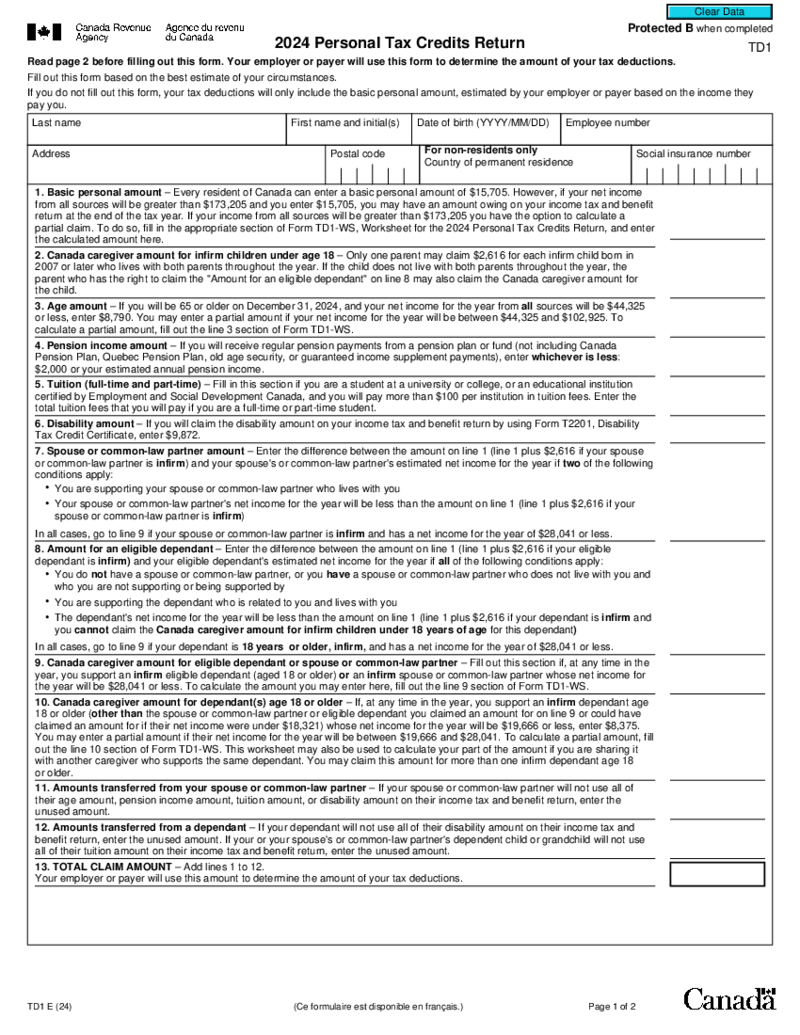

TD1 Form (2024) - Personal Tax Credits Return

Guide to the 2024 TD1 Form Personal Tax Credits Return

Every year, Canadian employees have the opportunity to adjust their tax withholdings to match their personal tax situations. The key to unlocking this potential is the TD1 form, officially known as th

TD1 Form (2024) - Personal Tax Credits Return

Guide to the 2024 TD1 Form Personal Tax Credits Return

Every year, Canadian employees have the opportunity to adjust their tax withholdings to match their personal tax situations. The key to unlocking this potential is the TD1 form, officially known as th

-

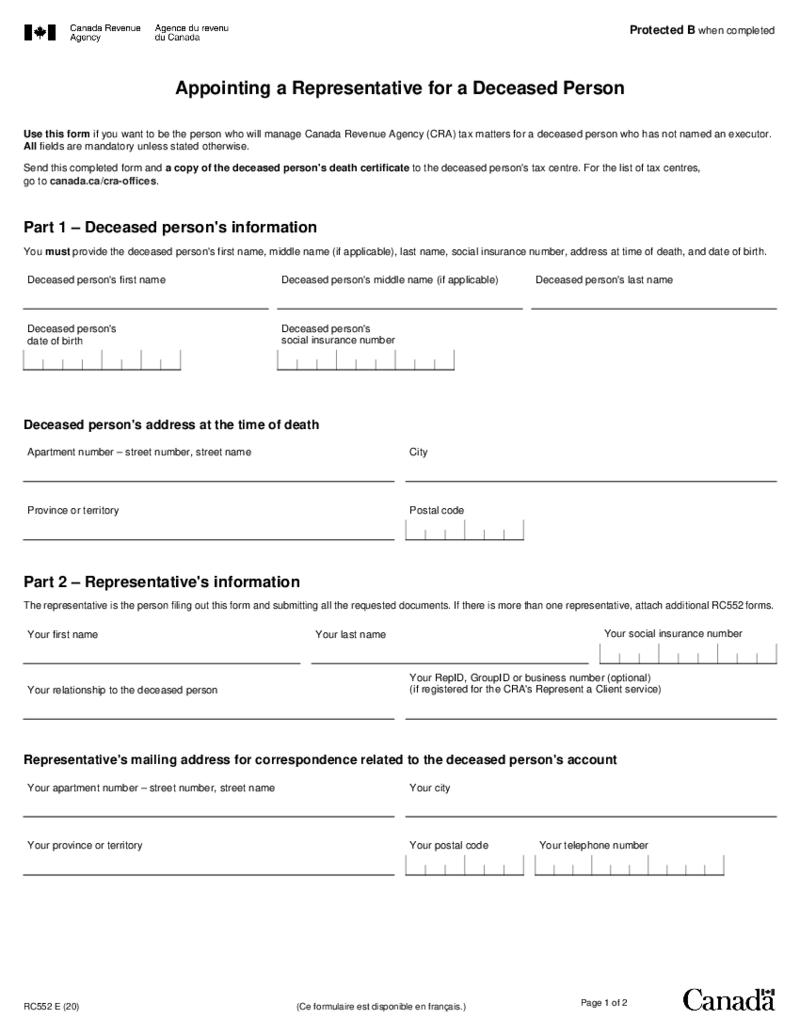

RC552 Appointing a Representative for a Deceased Person

What Is CRA Form RC552?

Also referred to as Appointing a Representative for a Deceased Person, the name of this form is pretty self-explanatory. It’s a document utilized by an individual who’s willing to handle Canada Revenue Agency tax

RC552 Appointing a Representative for a Deceased Person

What Is CRA Form RC552?

Also referred to as Appointing a Representative for a Deceased Person, the name of this form is pretty self-explanatory. It’s a document utilized by an individual who’s willing to handle Canada Revenue Agency tax

-

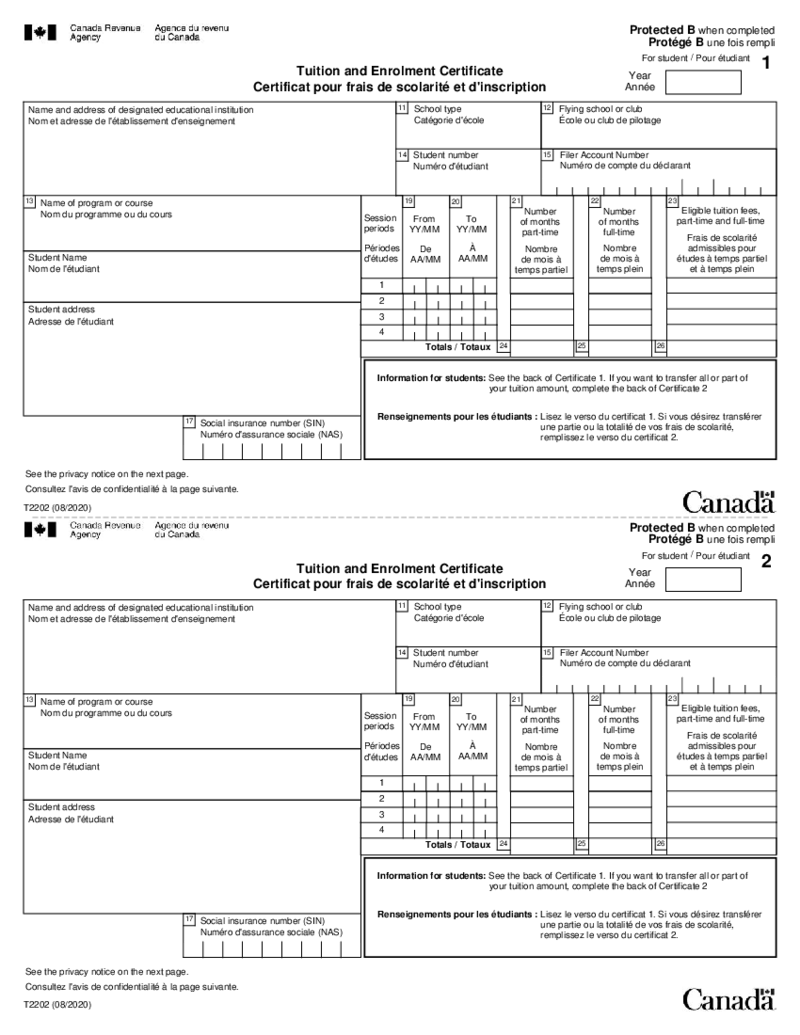

T2202 Tuition and Enrolment Certificate

Introduction to Form T2202

Form T2202, known as the Tuition and Enrolment Certificate, is an official document used in the Canadian tax system. This form is issued by educational institutions to students who have paid tuition for post-secondary level cour

T2202 Tuition and Enrolment Certificate

Introduction to Form T2202

Form T2202, known as the Tuition and Enrolment Certificate, is an official document used in the Canadian tax system. This form is issued by educational institutions to students who have paid tuition for post-secondary level cour

-

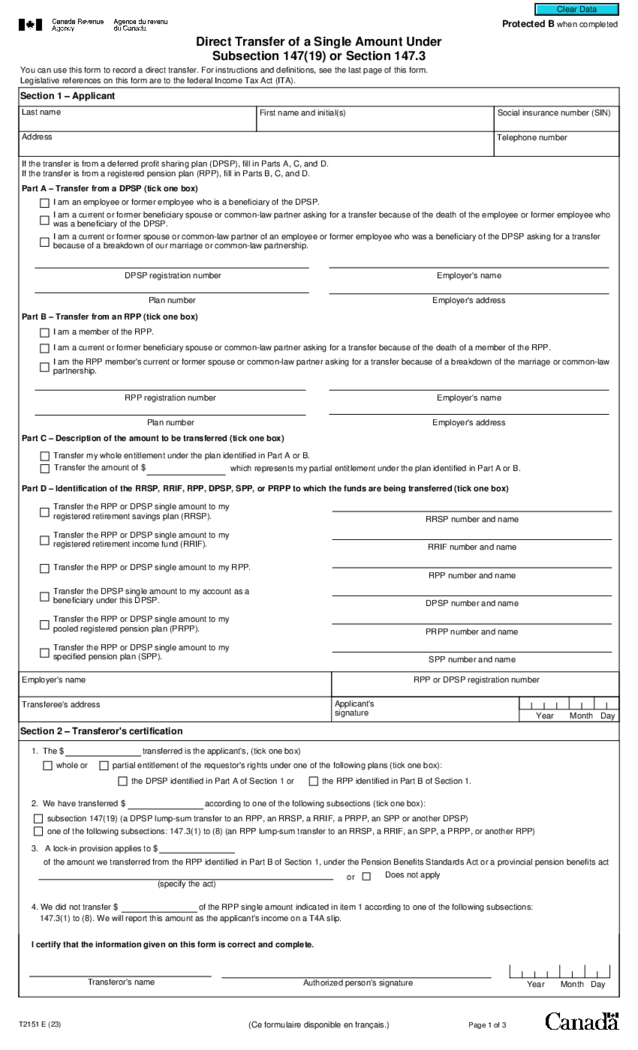

Form T2151

What Is a T2151 Form?

The T2151 transfer form of a single amount under the Subsection form is used to request the direct transfer of a single amount from one financial institution to another. This form is used when the amount to be transferred less than $

Form T2151

What Is a T2151 Form?

The T2151 transfer form of a single amount under the Subsection form is used to request the direct transfer of a single amount from one financial institution to another. This form is used when the amount to be transferred less than $

-

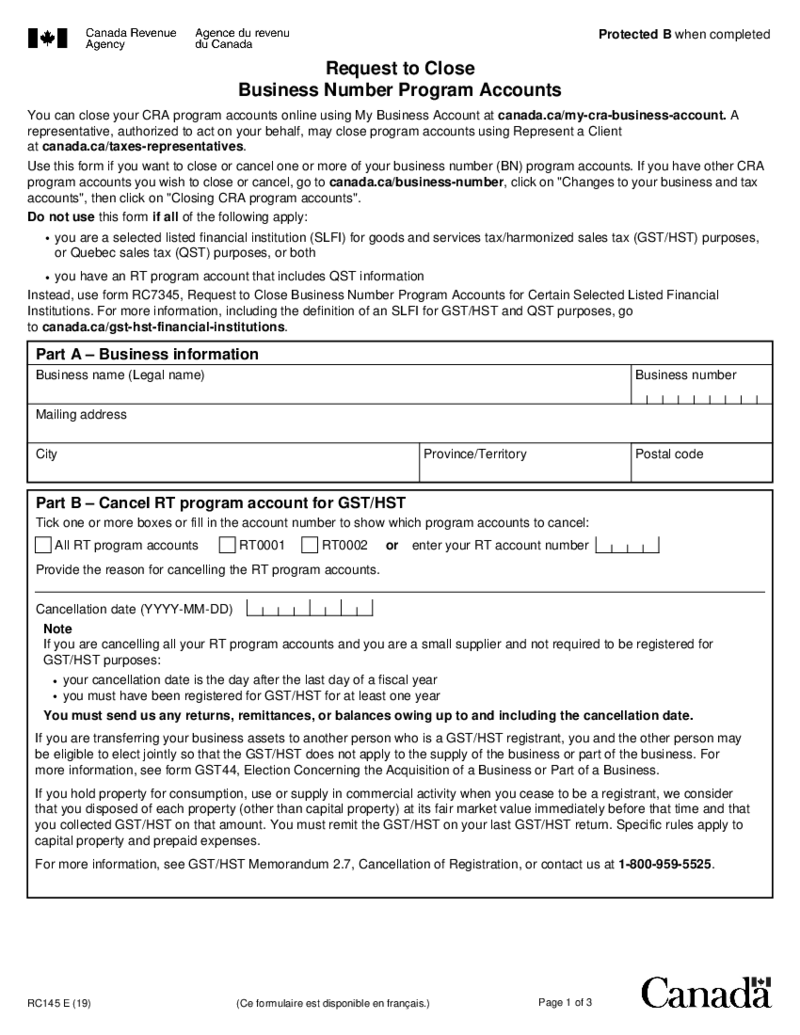

RC145 Request to Close Business Number Program Accounts

What Is RC145 Form?

Also known as Request to Close Business Number, this blank is a document required for terminating one or several

RC145 Request to Close Business Number Program Accounts

What Is RC145 Form?

Also known as Request to Close Business Number, this blank is a document required for terminating one or several

-

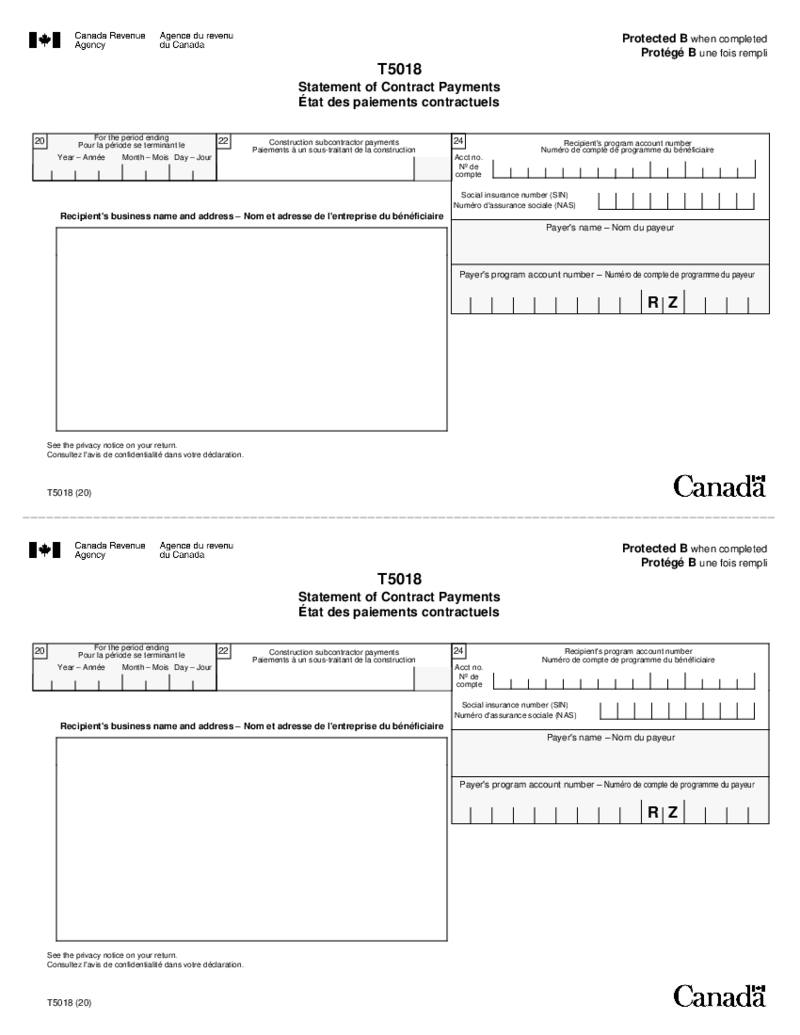

T5018 Statement of Contract Payments

What Is a T5018 Form?

Form T5018 is a report of contract payments used by businesses to report to the Canada Revenue Agency (CRA) on payments they have made to counterparties.

Who Needs to File T5018?

You can use T5018 to report paym

T5018 Statement of Contract Payments

What Is a T5018 Form?

Form T5018 is a report of contract payments used by businesses to report to the Canada Revenue Agency (CRA) on payments they have made to counterparties.

Who Needs to File T5018?

You can use T5018 to report paym

-

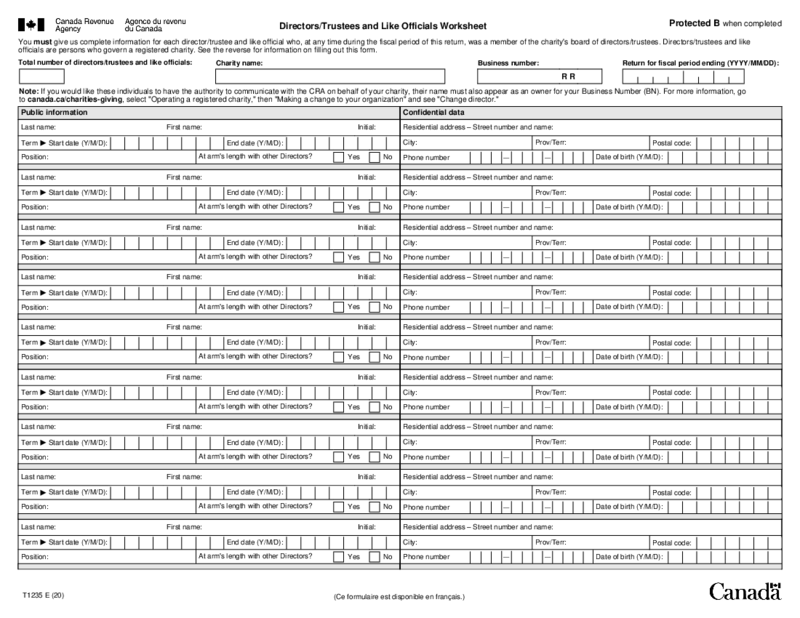

T1235 Directors Trustees and Like Officials Worksheet

What Is the T1235 Form?

It’s a document utilized by Canadian charitable organizations, public foundations, or private foundations for the purpose of their directors’ identification. Canada Revenue Agency is where this file should be subm

T1235 Directors Trustees and Like Officials Worksheet

What Is the T1235 Form?

It’s a document utilized by Canadian charitable organizations, public foundations, or private foundations for the purpose of their directors’ identification. Canada Revenue Agency is where this file should be subm

-

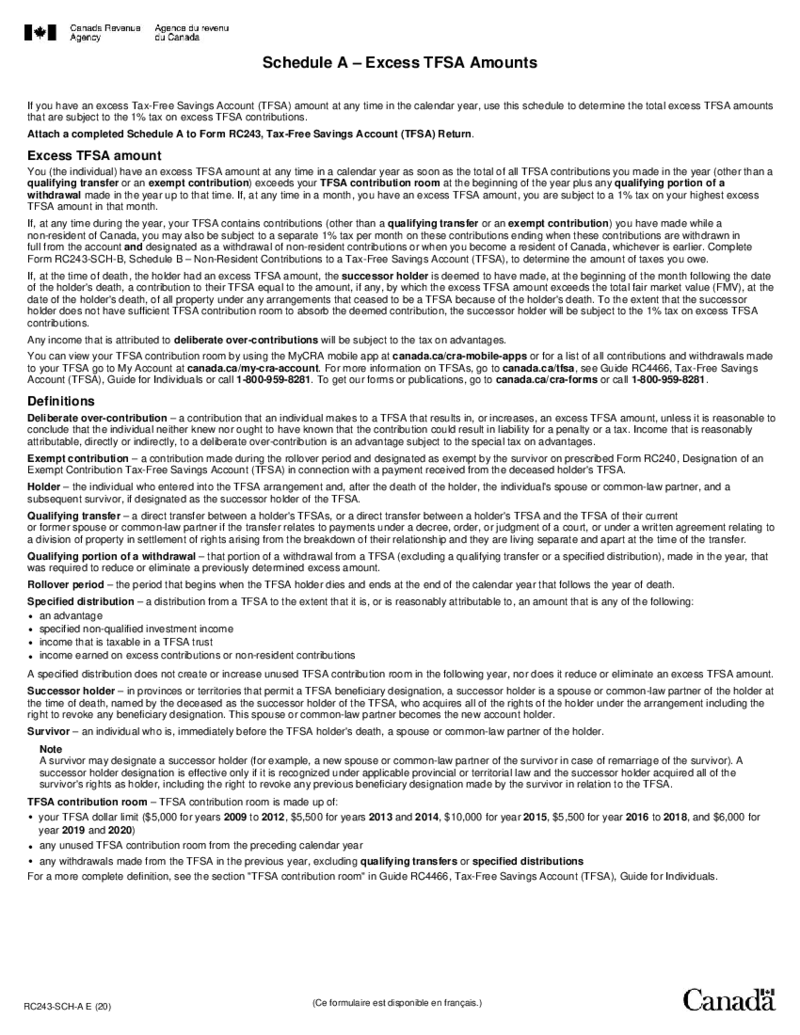

RC243-SCH-A Schedule A - Excess TFSA Amounts

Understanding the Form RC243 SCH A

The form RC243 SCH A is a Canadian tax form used by taxpayers who have contributed more than the allowable limit to their

RC243-SCH-A Schedule A - Excess TFSA Amounts

Understanding the Form RC243 SCH A

The form RC243 SCH A is a Canadian tax form used by taxpayers who have contributed more than the allowable limit to their

-

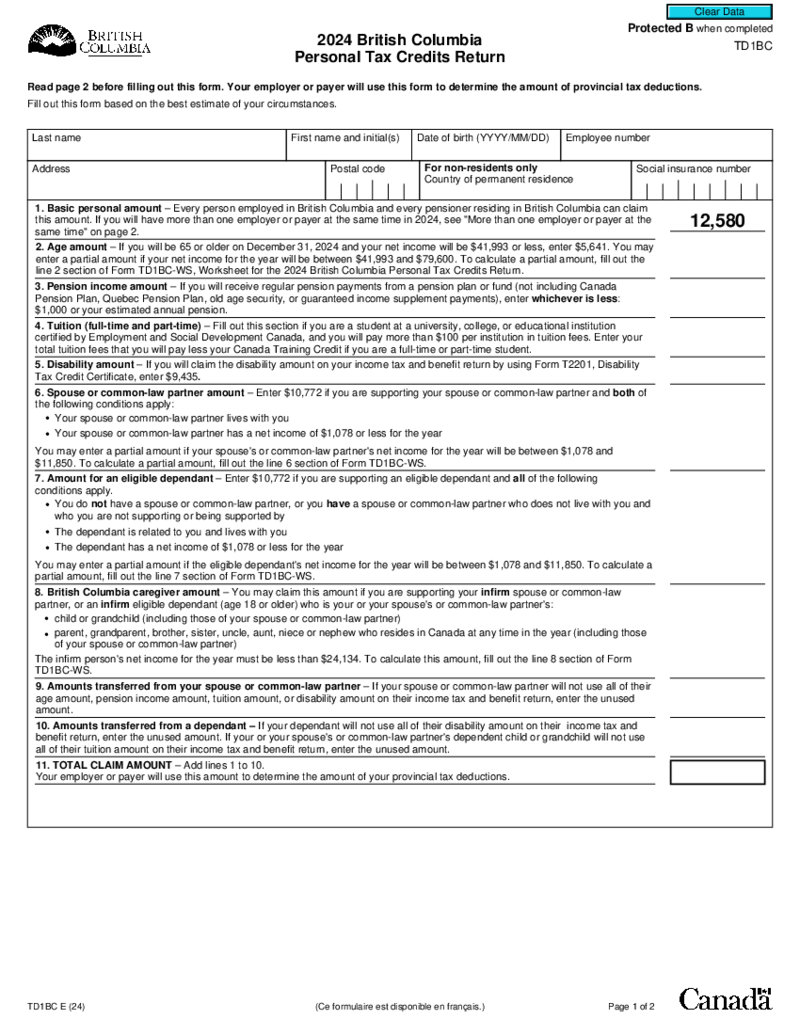

TD1BC Form (2024)

What Is the Fillable TD1BC 2025 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

TD1BC Form (2024)

What Is the Fillable TD1BC 2025 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

-

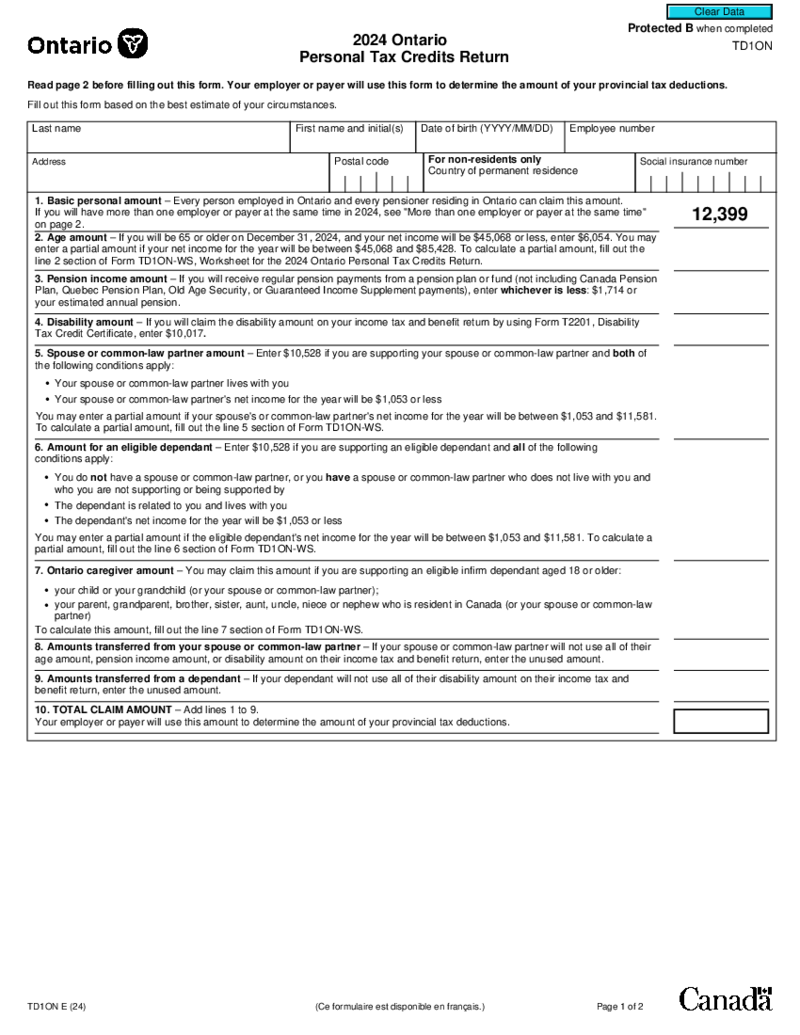

TD1ON 2024 - Ontario Personal Tax Credits Return

What Is the Ontario Personal Tax Credits Return Form 2025?

Ontario residents have the right to qualify for tax relief. For this purpose, the Canada Revenue Agency issues the TD1ON. With its help, every Canadian citizen who has official employment in Ontar

TD1ON 2024 - Ontario Personal Tax Credits Return

What Is the Ontario Personal Tax Credits Return Form 2025?

Ontario residents have the right to qualify for tax relief. For this purpose, the Canada Revenue Agency issues the TD1ON. With its help, every Canadian citizen who has official employment in Ontar

-

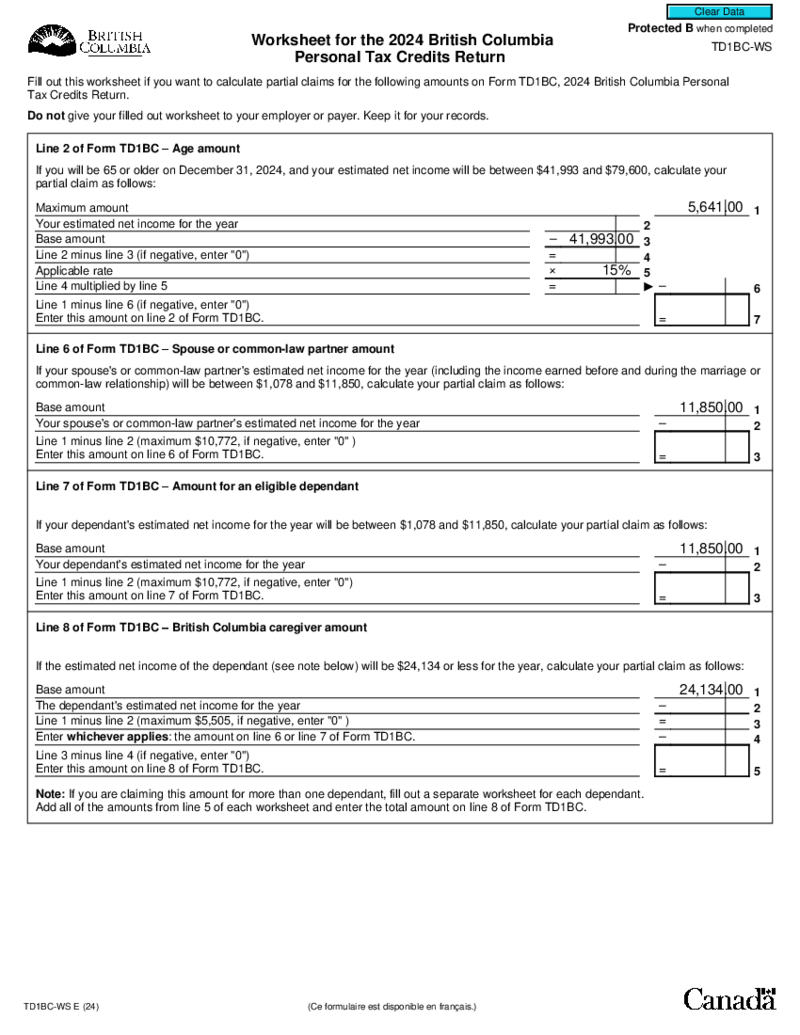

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

-

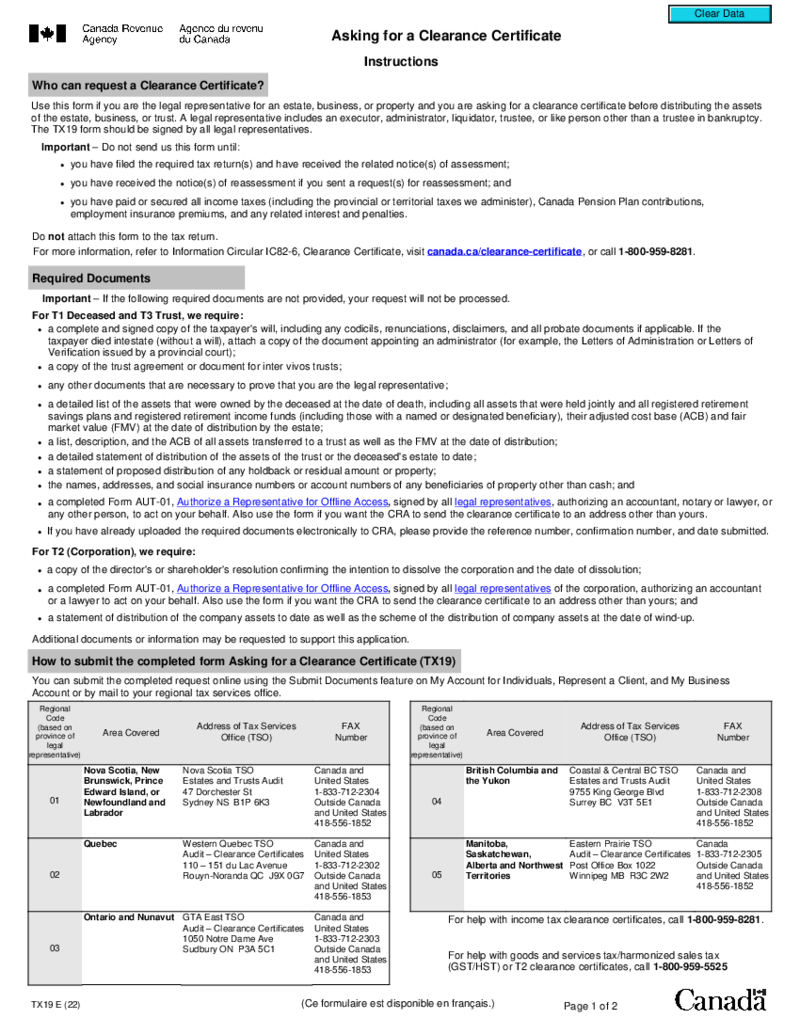

TX19 Asking for a Clearance Certificate

Understanding the TX19 Asking for a Clearance Certificate

The TX19 Asking for a Clearance Certificate is an official form used by individuals, trustees or legal representatives who are responsible for a deceased person's property. The purpose of the f

TX19 Asking for a Clearance Certificate

Understanding the TX19 Asking for a Clearance Certificate

The TX19 Asking for a Clearance Certificate is an official form used by individuals, trustees or legal representatives who are responsible for a deceased person's property. The purpose of the f

What Are Canada Tax Forms?

Canada federal tax forms is a term understandable to everyone. They are income tax forms for Canada citizens and residents. If you’re in search of a specific template of this kind just now, we’ll be delighted to lend you a helping hand. PDFLiner presents a multitude of online tax forms Canada-based individuals are free to make the most of. In this particular post, you can also get an overview of the major Canada revenue income tax forms: their ultimate purpose and functions. Meanwhile, you can take a look through our extensive catalog to find any niche-specific fillable documents you need.

What Forms Do I Need for My Taxes in Canada?

At a glance, these templates don’t seem to differ from other similar document forms. They feature such similar components as people’s identities, dates, signatures… However, if you take a closer look at these templates, you’ll realize that the main distinction is that they are country-specific i.e., they are the government of Canada income tax forms. Now that you have this wonderful opportunity, you can easily digitize your tax issues and thus, ease your life tremendously.

Here’s a quick outline of the major Canada tax forms:

- T1: it’s a doc utilized for filing an individual tax return in the Great White North. In fact, this file is among the most widely used by the country’s citizens, aimed at reporting an individual income from all possible sources, as well as determining how much they actually owe. You can effortlessly find this fillable doc in this category.

- TD1: it’s a doc utilized for pinpointing the withholdable-from-payments tax. For instance, if you’re a pension payer in Canada, this form is most likely a must-complete for you. So, if this fillable blank is what you’re currently seeking, we’ll be delighted to present it to you in the most customizable form ever.

- TD1ON WS: this doc is for claiming specific personal tax credits for individuals and their partners. Bear in mind that this form is Ontario-oriented. It is not too challenging to deal with, but you can always turn to your accountant for help in case you’re not willing to spend your time managing its completion. Needless to say that this file is in our printable tax forms Canada category, too.

- T2151: this form is a must-do if moving your finances from one retirement savings account to another is your ultimate goal. This doc is also widely used in the Great White North, so you’re welcome to save it for further reference now that you’re here on PDFLiner.

- T3: this form is utilized in Canada for reporting earnings from an array of income types, such as interest, dividend, and capital gains. Feel free to find and fill out this form here within our PDF editing service. Make the most of our top-notch features for customizing any industry-specific form you need, easily add legally binding digital signatures to the templates you work on, and enjoy taking your productivity to newer heights.

- So, have you already tried filling out digital templates and polishing your files to perfection? Do go digital if you want to save loads of your treasured time, prevent multiple errors, and enjoy secure file storing possibilities. In this sense, PDFLiner is definitely right up your alley. Our fillable tax forms Canada catalog is your go-to productivity booster and administrative affair automation tool.

Where to Get Tax Return Forms Canada

Irrespective of the form you’re hunting for, this category is where your search can be resumed. Filled with a wide variety of fully adjustable templates, our gallery was created with quality and flexibility in mind. We’re updating it on a regular basis in order to adapt to all the changes that take place within the industries we present.

Here’s a quick guide on utilizing Canada tax forms via PDFLiner:

- Choose the required form out of the ones shared above.

- Find the Fill Online button and click it.

- When the editing functionality launches, get the completion going.

- Add e-signatures and print them out or send them away digitally.

With us, you will speed up your document-related processes and enjoy freeing up your time to focus on what matters most i.e., spending time with your loved ones and/or bringing the money in.

FAQ

-

How to fill federal tax form Canada?

Absolutely, the best way to fill out your templates is online. By doing it digitally, you won’t have to spend hours on the affair and deal with the oh-so-prone-to-getting-lost-and-damaged paper piles. As a matter of fact, going digital may be the only way to survive as a successful business these days.

-

How to fill out income tax return forms Canada?

Follow these tips if you want to complete your templates in the most effective way possible. First, be prepared. Prepare all the necessary documents you’ll rely upon when filling out your forms. Second, be precise. You don’t want to send tax forms with factual errors or typos and then start all over again or even face penalties. Third, monitor the deadlines. That’s a given. Fourth, seek professional help whenever necessary. Peace of mind should be your ultimate priority here.

-

Where to send tax forms Canada?

When you finish sorting out your forms, feel free to submit them to the Canada Revenue Agency, also referred to as CRA. Do it either online or by mail. Naturally, the former method is the best because it’s super fast, smooth, and flexible. If you’re outside the country, the only option is to send the ready forms by mail. Don’t forget to keep your CRA info updated and keep up with new technical tax information, for it will surely add up to your ultimate peace of mind throughout the tax season.