-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

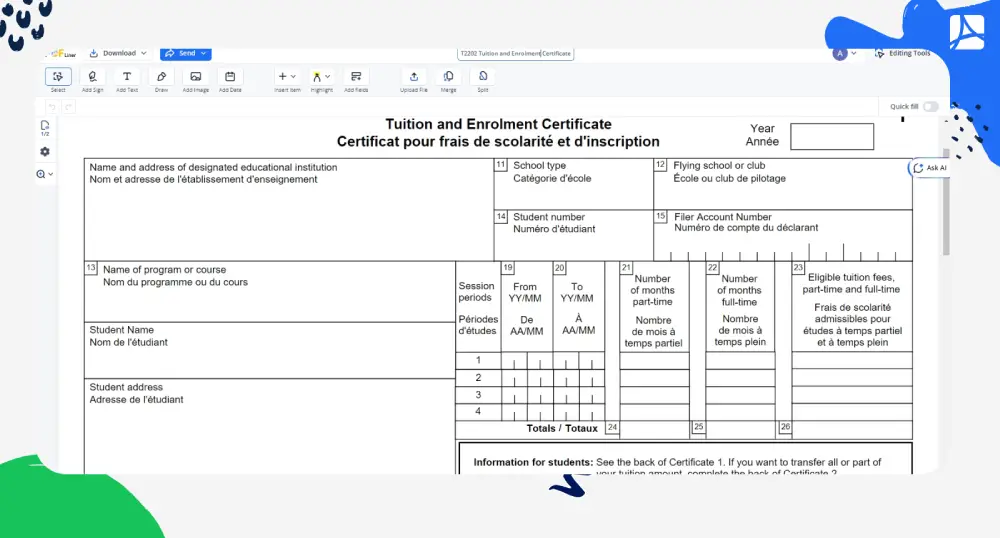

T2202 Tuition and Enrolment Certificate

Get your T2202 Tuition and Enrolment Certificate in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Introduction to Form T2202

Form T2202, known as the Tuition and Enrolment Certificate, is an official document used in the Canadian tax system. This form is issued by educational institutions to students who have paid tuition for post-secondary level courses. The certificate provides the necessary all-in-one information for tax claim credits. Form T2202 plays a pivotal role in the tax filing process as it enables students or parents to claim tuition, textbook, and education amounts.

Purpose of the T2202 form

The T2202 form makes it possible for the Canadian students to reduce their income tax. It includes relevant data such as the Social Insurance Number (SIN), the student's name, the institution's name, the period of enrolment and the total tuition fee paid in the tax year. This form is vital for individual tax return journeys and needs to be accurately filled to avoid any form of tax reporting errors.

The role of the Canada Revenue Agency form T2202

Form T2202 is distributed by the Canada Revenue Agency (CRA) for both domestic and international students who enrol in qualifying courses at post-secondary education levels. The CRA works to unify tuition and education-related claims all over Canada. Acting as the governing body, the CRA manages tax laws for the Canadian Government and also for most provinces and territories. They ensure a precise and timely delivery of tax benefits while making sure that all tax obligations are fulfilled.

How to Fill Out T2202 Form

Here's a detailed guide on filling out the T2202 tuition and enrolment certificate form template on PDFLiner:

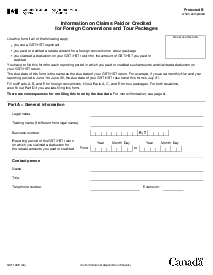

Begin by entering the student information section. Input the student's name and address in the designated fields. Add the student's Social Insurance Number (SIN) where indicated.

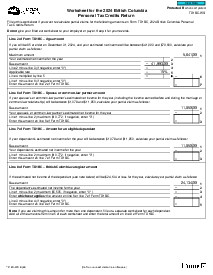

- Specify the year for which the tuition and enrolment certificate is being claimed at the top of the form.

- Enter the name and address of the designated educational institution where the student is enrolled.

- Indicate the type of school from the options provided, such as a university or a college. If applicable, specify if it's a flying school or club.

- Fill in the name of the program or course in which the student is enrolled.

- Input the student number assigned by the educational institution.

- Enter the Filer Account Number of the institution filing this form.

- For the session periods, input the start and end dates of the student’s academic sessions for the year in the format YY/MM.

- Specify the number of months the student attended part-time and full-time courses during the year.

- Enter the eligible tuition fees for both part-time and full-time studies.

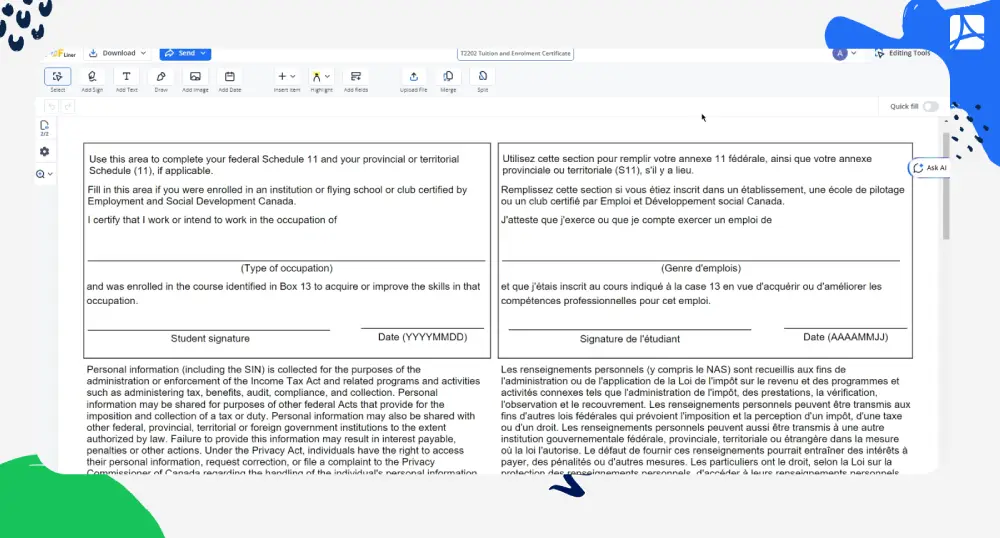

- If applicable, complete the section on transferring unused tuition amounts. Designate an individual, specifying their name and relationship to the student, and indicate the amount to be transferred, both federal and provincial or territorial, if applicable.

- Ensure all total fields for the amounts are correctly summed up and entered in the Totals section.

- Review the form to ensure all information is accurate and complete. Input any additional required information or corrections.

- Once all sections are filled, the student must sign and date the form, confirming the accuracy and completion of the information provided. Enter the date in the format YYYYMMDD.

After completing the form, the student or the filer can save the document on PDFLiner and proceed with any required submissions as per the educational institution or tax requirements. Be sure to review all entered information for accuracy to avoid any issues with tax claims or educational records.

Fillable online T2202 Tuition and Enrolment Certificate