-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

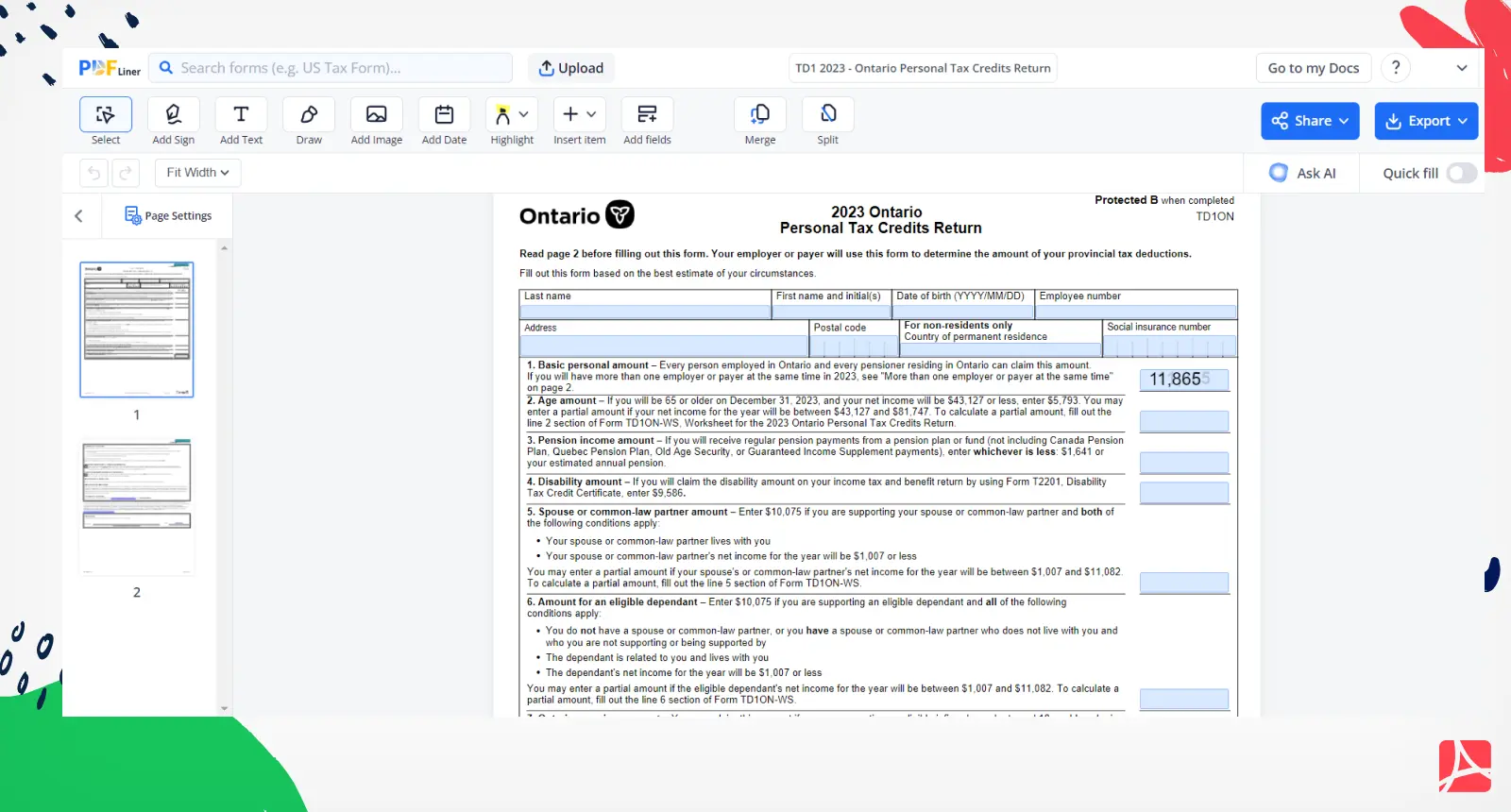

TD1ON Form 2024 - Ontario Personal Tax Credits Return

Get your TD1ON 2024 - Ontario Personal Tax Credits Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is the Ontario Personal Tax Credits Return Form 2026?

Ontario residents have the right to qualify for tax relief. For this purpose, the Canada Revenue Agency issues the TD1ON. With its help, every Canadian citizen who has official employment in Ontario can tell about their current financial situation, in particular dependents who are in their care and reduce the amount of tax due.

TD1ON tax form 2024 is a two-page document with fields for entering personal financial information. Please note that you may need other documents and forms (e.g., T2201) to complete it, depending on your current situation. Also, to make correct calculations, it is recommended to use the TD1-WS add-on.

What is the Ontario personal tax credits return form used for?

The 2023 Ontario personal tax credits return is a tool that can help you significantly reduce the amount of tax you have to pay. Factors such as supporting dependents under 18 or attending college/institute reduce the tax sum. Unlike deductions, credits do not reduce the amount taxed but the tax itself.

Using the form, you can describe all the circumstances that affect the amount. Without this document, every citizen of Canada can only qualify for the basic federal credit. If you don't submit the completed TD1ON basic personal amount 2023 is the only thing that will count, so deductions can be much higher than you expect.

How to Fill Out TD1ON Form 2024?

When calculating the number of credits, you should consider all the circumstances that may complicate your financial situation. Use the TD1ON Form 2024 to determine the tax on your income correctly. Depending on your personal situation, you may qualify for the following tax credits:

- Basic personal tax credit. As we wrote above, every Canadian can apply for this deduction. That is why it is called basic, and the below deductions can be added to it.

- Age credit. Taxpayers aged 65 and over who are still employed can apply for a tax reduction on this basis.

- Disability credit. If you have a documented disability or take care of someone with a disability, you can claim this credit.

- Spousal or common-law partner amount. If your partner is a Canadian citizen and is not a member of a prescribed class, you can ask for a tax reduction for them.

- Infirm dependent credit. If you have dependents over the age of 18 (relatives or spouses) in your care, claim the credit.

- Caregiver amount. This deduction is for those who cared for an infirm relative who lives with them in Canada during the tax year.

In total, the Ontario TD1On form lists more than ten items that highlight the main circumstances that affect the amount of tax. Keep in mind that you can only request tax credits for one source of income (if you have more than one).

How to submit Ontario personal tax credits return form?

Unlike many tax forms, TD1ON is not processed by the CRA (although this service issues the papers) but by your employer. Moreover, employers should provide their employees with blank forms to fill out. You can complete the form, sign it electronically, and send it to the recipient by email or using the generated link.

You can also print the form and fill it out by hand if you prefer. Physical paper can be given to the employer in person. Based on the collected TD1ONs, the HR/Payroll department determines the tax deductions. Keep in mind that CRA also releases a version of this form for the visually impaired (it is convenient for use by voice assistants). If you have vision problems, ask your supervisor to provide you with this option.

What is the difference between TD1 and TD1ON?

Both of these forms are used to obtain personal tax credits. In Canada, there are two versions of this document: the federal one, marked TD1, and the provincial one, such as TD1ON. A territorial version exists in all ten provinces of the country. The last two letters indicate exactly the specific province: ON is Ontario, AB is Alberta, and so on.

Both federal and local variations are part of the basic package of onboarding documents. So if you are a new employee or your financial situation has changed, you will need to complete both TD1 and TD1ON (for those who work in Ontario). Your employer should provide you with these two forms.

Form Versions

2023

TD1ON Form 2023

Fillable online TD1ON 2024 - Ontario Personal Tax Credits Return