-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

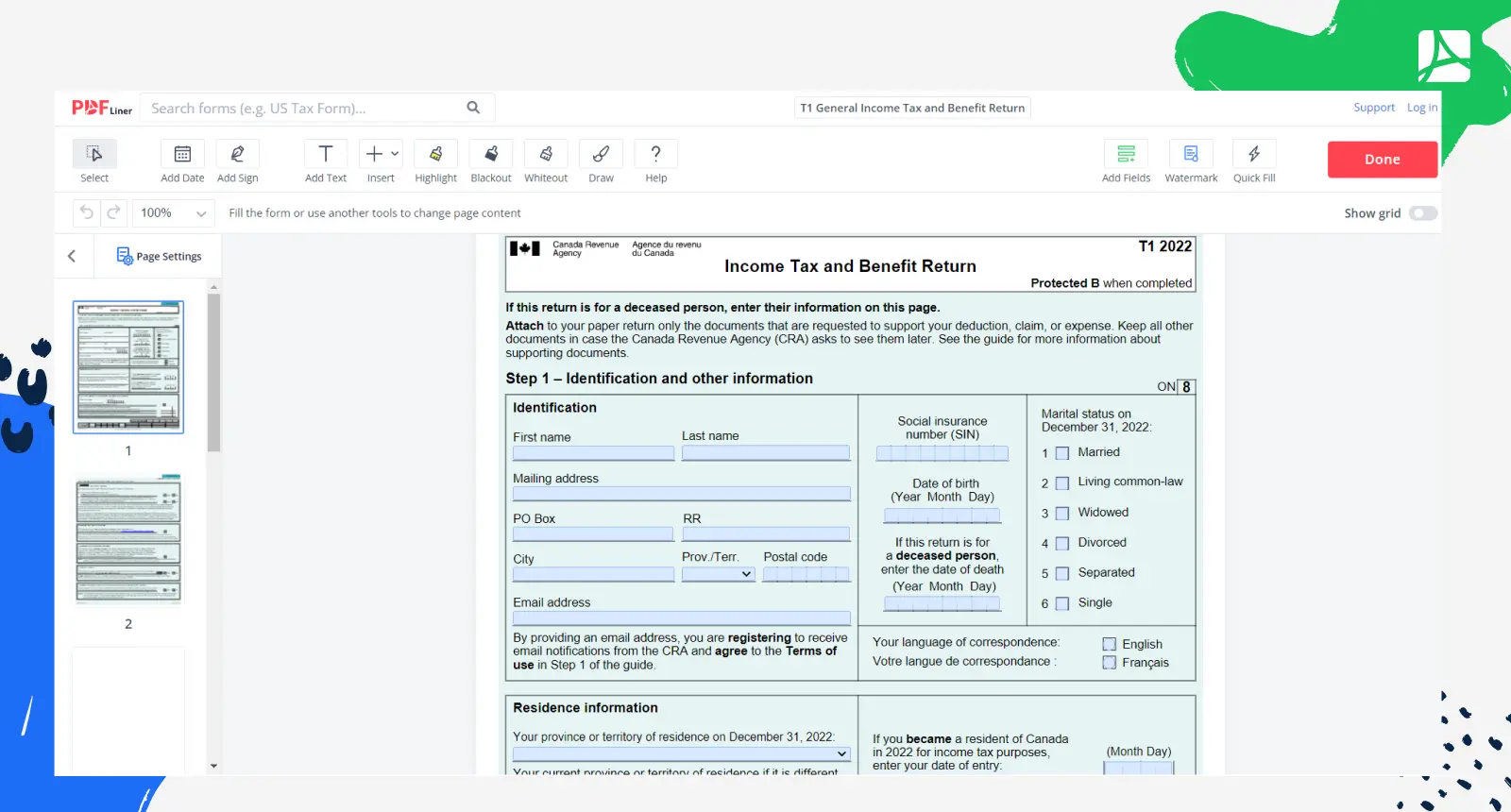

T1 General Income Tax and Benefit Return

Get your T1 General Income Tax and Benefit Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is a T1 General Income Tax Form?

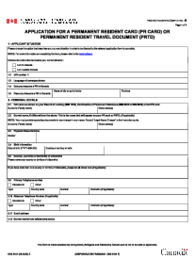

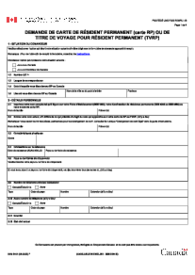

A T1 General income tax form is a document that is used to file an individual’s income tax return in Canada. The Canadian income tax forms T1 general is the most common form used by individuals and is available online through the Canada Revenue Agency (CRA) website. The T1 form is used to report an individual’s income from all sources, claim deductions and tax credits, and calculate the amount of tax owing.

The T1 form is divided into sections, each of which is used to report different types of income. The first section, labeled “Income,” is used to report an individual’s employment income, business income, and other sources of income such as interest and dividends.

The second section, labeled “Deductions,” is used to claim deductions for expenses such as child care expenses, charitable donations, and medical expenses. The third section, labeled “Credits,” is used to claim tax credits for things like tuition, child care, and medical expenses. The fourth and final section, labeled “Payments,” is used to calculate the amount of tax owing or refundable.

Individuals can file their T1 form online through the CRA website or through a paper copy. The CRA website offers a step-by-step guide to help individuals fill out their T1 form. Paper copies of the T1 form are also available at most post offices.

How to Fill Out T1 General Income Tax and Benefit Return?

If you're one of the millions of Canadians who file a T1 general income tax and benefit return form each year, you might be wondering how to fill it out. Here's a step-by-step guide to help you through the process.

1. Get started

The first step is to gather all the information you need to complete your return. This includes your T4 slips from your employer, any receipts for expenses you want to claim, and your Notice of Assessment from the previous year.

If you're missing any of this information, don't worry - you can still complete your return. The Canada Revenue Agency (CRA) will send you the missing information if you need it.

2. Choose your filing method

There are a few different ways to file your T1 return. You can do it yourself online, through the CRA's My Account service, or you can use software like TurboTax.

If you want someone else to do it for you, you can use a professional tax preparer.

3. Fill out your return

Once you've gathered all the information you need, it's time to start filling out your return. The CRA's website has a handy tool to help you fill out your return step-by-step.

4. Submit your return

Once you've finished filling out your return, you can submit it online, through the CRA's My Account service, or you can mail it in.

If you're mailing it in, make sure you include all the supporting documents, like your T4 slips and receipts.

5. Get your refund

If you're owed a refund, the CRA will send it to you within eight to 10 weeks. If you're not owed a refund, you don't need to do anything - the CRA will automatically apply any taxes you owe to your next return.

Get a Fillable T1 General Canada Income Tax and Benefit Return Online

The blank form is available in the PDFLiner form catalog. To start filling out the form, click the “Fill this form” button, or if you would like to know how to find it here letter, follow these steps:

- Log In to your PDFLiner account.

- Type the “T1 General Income Tax and Benefit Return ” in the Search for Documents tab.

- Click the "Fill Online" button next to the form.

That's how you find a printable T-1 General Income Tax and Benefit Return.

How to Edit a Fillable T1 General Canadian Income Tax and Benefit Return

With PDFLiner the editing process becomes quite simple, so you shouldn't have difficulties with the filling process.

To fill out the form complete the steps below:

- Click the "Fill this form" button to load the document.

- Choose the first field by clicking on it and begin to write the info.

- Switch between fields using your Alt or Left Click.

- Complete all requested info and sign document if needed.

- Once you're all set click the "Done" button.

That's it, the filling process is pretty simple. In the event when the file doesn't have fillable fields, check out the toolbar and add text, signature or date to your PDF. You can also add fields by using the “Add Fields” editor.

By settling on Pdfliner online PDF editing tool, you have the capacity to line up the editing that T-1 General Income Tax and Benefit Return instructs, manage fillable fields in your forms, share an access to it, e-sign in a blink of an eye, and stash all your PDF files on our cloud-based platform, so you will be able to access them even without your PC.

Form Versions

2020

Fillable T1 for 2020 tax year

Fillable online T1 General Income Tax and Benefit Return