-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

RC243-SCH-A Schedule A - Excess TFSA Amounts

Get your RC243-SCH-A Schedule A - Excess TFSA Amounts in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Form RC243 SCH A

The form RC243 SCH A is a Canadian tax form used by taxpayers who have contributed more than the allowable limit to their Tax-Free Savings Account (TFSA). It helps taxpayers calculate the tax being owed due to an excess TFSA amount.

TFSA is a type of savings account that allows Canadian residents aged 18 and above to save or invest money without having to pay taxes on the interest, income, and gains earned. The government sets an annual limit for the amount one can contribute to their TFSA. If you accidentally go over this limit, the RC243 SCH A form comes to your aid.

Importance of RC243 SCH A in tax filings

The proper execution of form RC243 SCH A is essential in your tax declarations. If you fail to declare the excess amounts or inaccurately report them in the form, you may face penalties or even tax implications. The CRA charges 1% per month on the highest excess TFSA amount in each month. This fine will continue to be charged until the full amount of the excess contribution is withdrawn.

How to Fill Out RC243-SCH-A Schedule A

To complete the RC243-SCH-A Schedule A - Excess TFSA Amounts Form on PDFLiner, follow these steps:

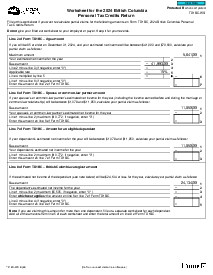

- Start by entering your TFSA contribution room at the beginning of the year in Column D for each month. This room can include your annual dollar limit, any unused room from the previous year, and any withdrawals made excluding qualifying transfers or specified distributions.

- Record all your contributions made during the month in Column A and any withdrawals in Column B. Ensure you exclude qualifying transfers, exempt contributions, and specified distributions from these entries.

- For each contribution, add the amount to the last reported total in Column C. This running total allows you to track contributions throughout the year.

- Calculate the Excess TFSA amount by subtracting the amount in Column D from Column C for each entry. If this calculation results in a negative number, record "0" in Column E.

- Maintain a cumulative total of any qualifying portions of withdrawals in Column F. These are parts of withdrawals that were necessary to reduce or eliminate a previously determined excess amount.

- Determine the qualifying portion of each withdrawal, which is the lesser of the excess TFSA amount (Column E minus Column F) or the withdrawal amount (Column B), and record this in Column G.

- Calculate your ongoing excess TFSA amounts by subtracting the values in Columns F and G from Column E for each entry and record these in Column H.

- At the end of each month, identify the highest value in Column H and enter this amount on the corresponding line in Section 2 of the form. This section requires you to enter the highest excess amount for each month and will help determine your total excess TFSA amount subject to taxation.

- Sum all the monthly highest excess TFSA amounts from Section 2 to compute your annual total, which should be reported on Line 1 of Section 1 – Part A of Form RC243, Tax-Free Savings Account (TFSA) Return.

Fillable online RC243-SCH-A Schedule A - Excess TFSA Amounts