-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Tax Forms

-

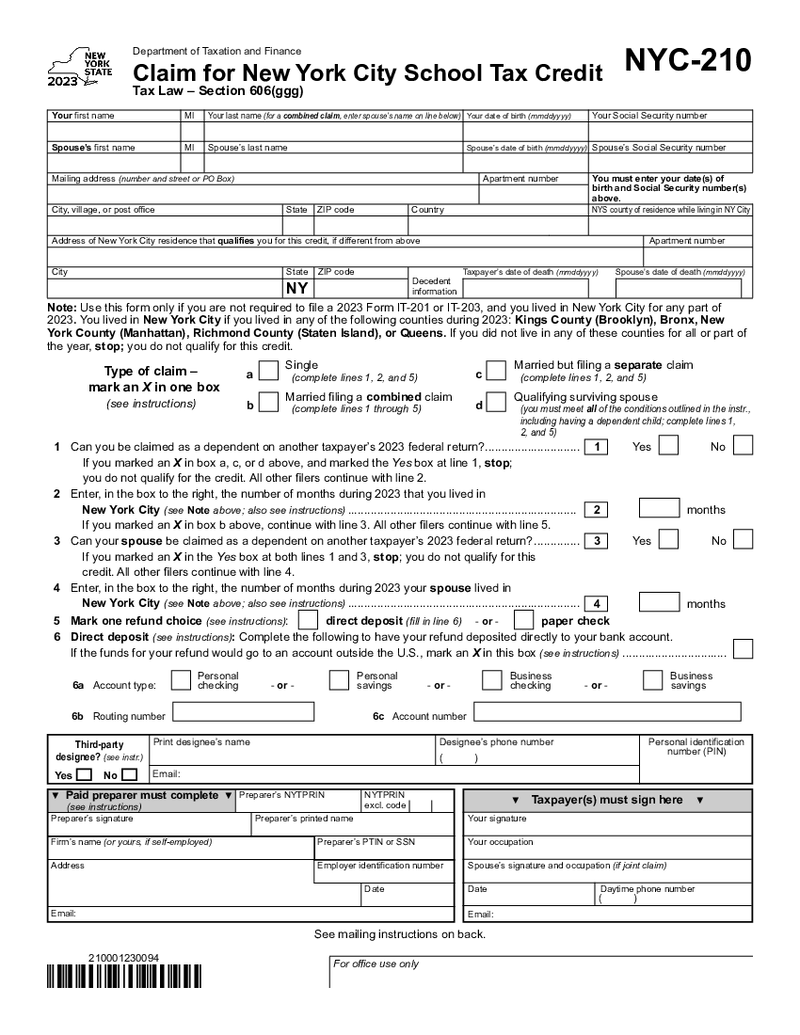

NYC 210 Form (2023)

What is NYC-210 Form 2023?

The NYC-210 form is known as Claim for New York City School Tax Credit. The form can be used to claim for the tax credit if you are a resident of New York City. The form was created by the New York City Department of Taxation an

NYC 210 Form (2023)

What is NYC-210 Form 2023?

The NYC-210 form is known as Claim for New York City School Tax Credit. The form can be used to claim for the tax credit if you are a resident of New York City. The form was created by the New York City Department of Taxation an

-

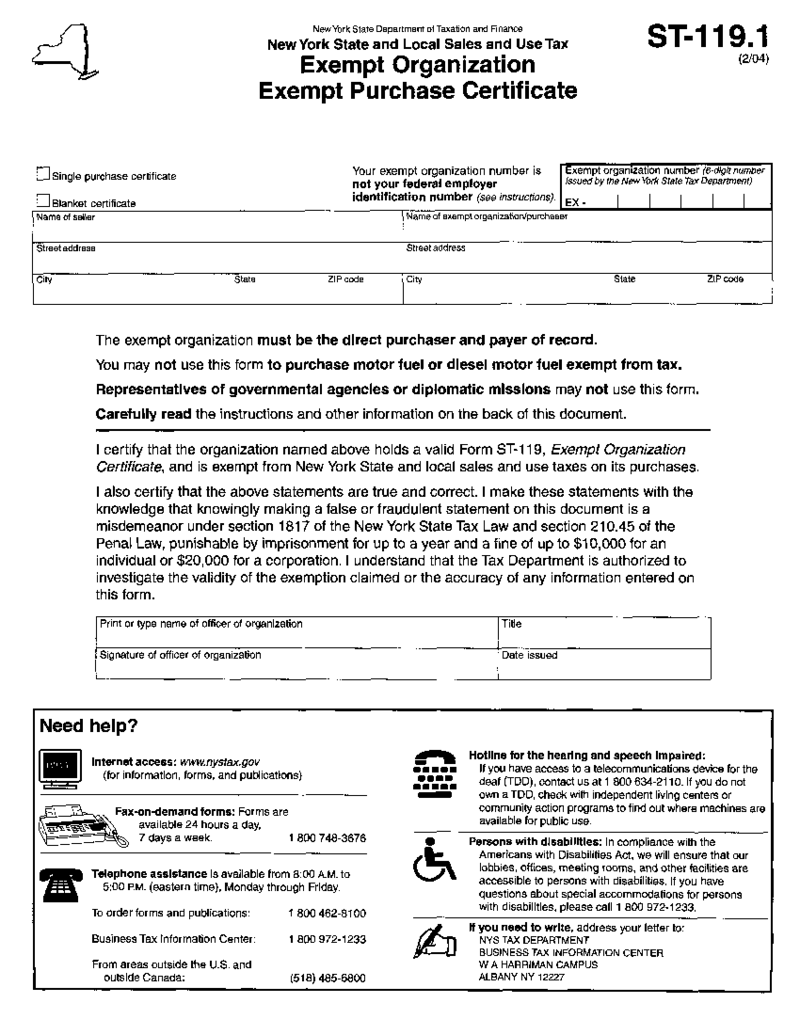

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

-

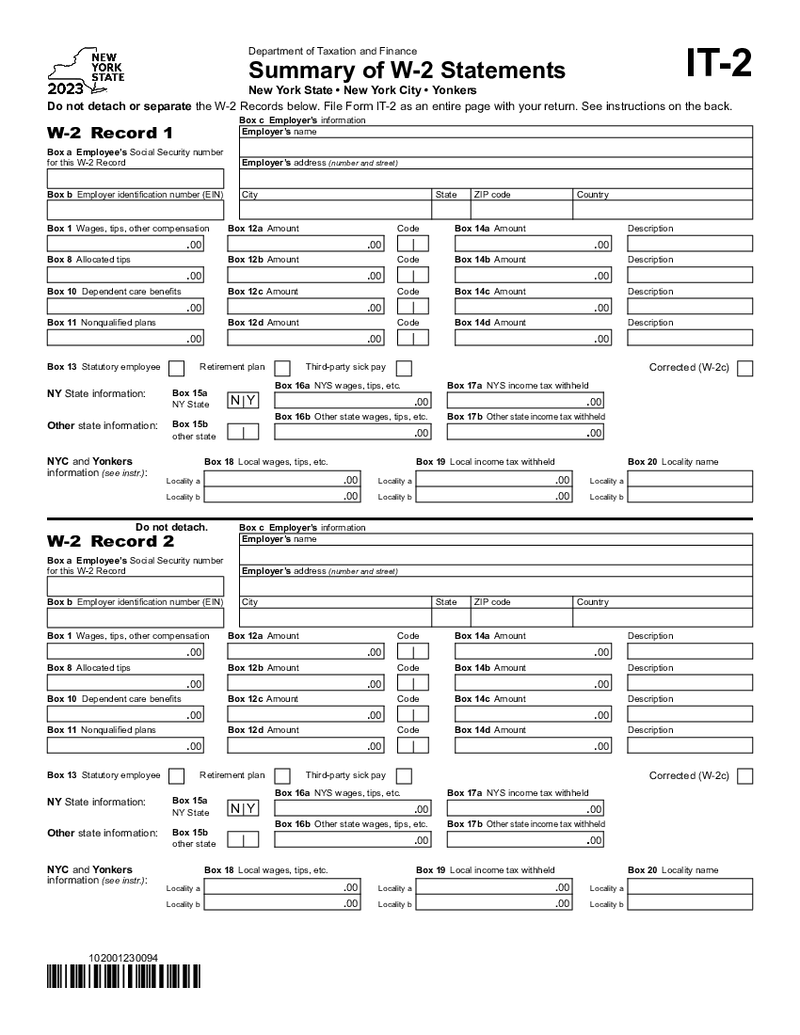

NY Form IT-2 - Summary of W-2 Statements

Understanding Form IT-2

The form IT 2 is tailored specifically for New York state residents or those who have earned income in New York, requiring them to report their earnings and tax withholdings. The clear-cut purpose of this form is to streamline the

NY Form IT-2 - Summary of W-2 Statements

Understanding Form IT-2

The form IT 2 is tailored specifically for New York state residents or those who have earned income in New York, requiring them to report their earnings and tax withholdings. The clear-cut purpose of this form is to streamline the

-

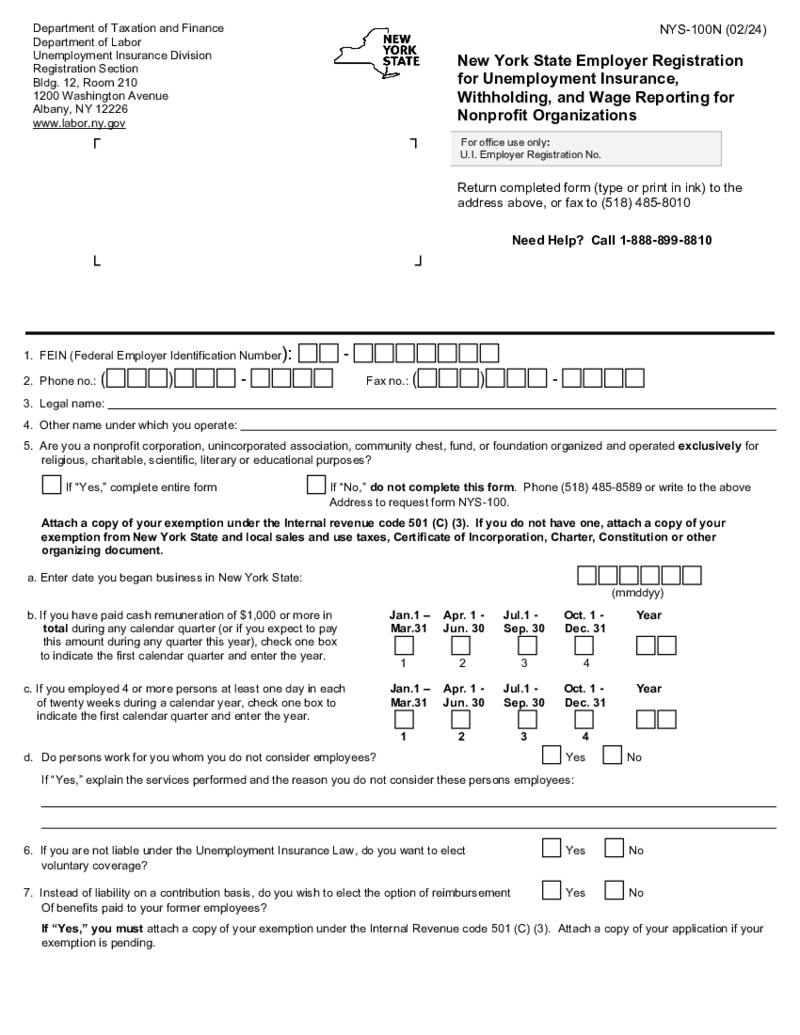

New York Form NYS-100N

What Is NYS 100N Form

The NYS 100N form, officially titled "New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations," is a mandatory document for nonprofit org

New York Form NYS-100N

What Is NYS 100N Form

The NYS 100N form, officially titled "New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations," is a mandatory document for nonprofit org

-

Form IT-1099-R

Overview: Tax Form It 1099 R

Form IT-1099-R is a tax document that reports distributions from retirement accounts, such as individual retirement accounts (IRAs) and pensions. This form is used to report distributions made during the tax year and is sent t

Form IT-1099-R

Overview: Tax Form It 1099 R

Form IT-1099-R is a tax document that reports distributions from retirement accounts, such as individual retirement accounts (IRAs) and pensions. This form is used to report distributions made during the tax year and is sent t

-

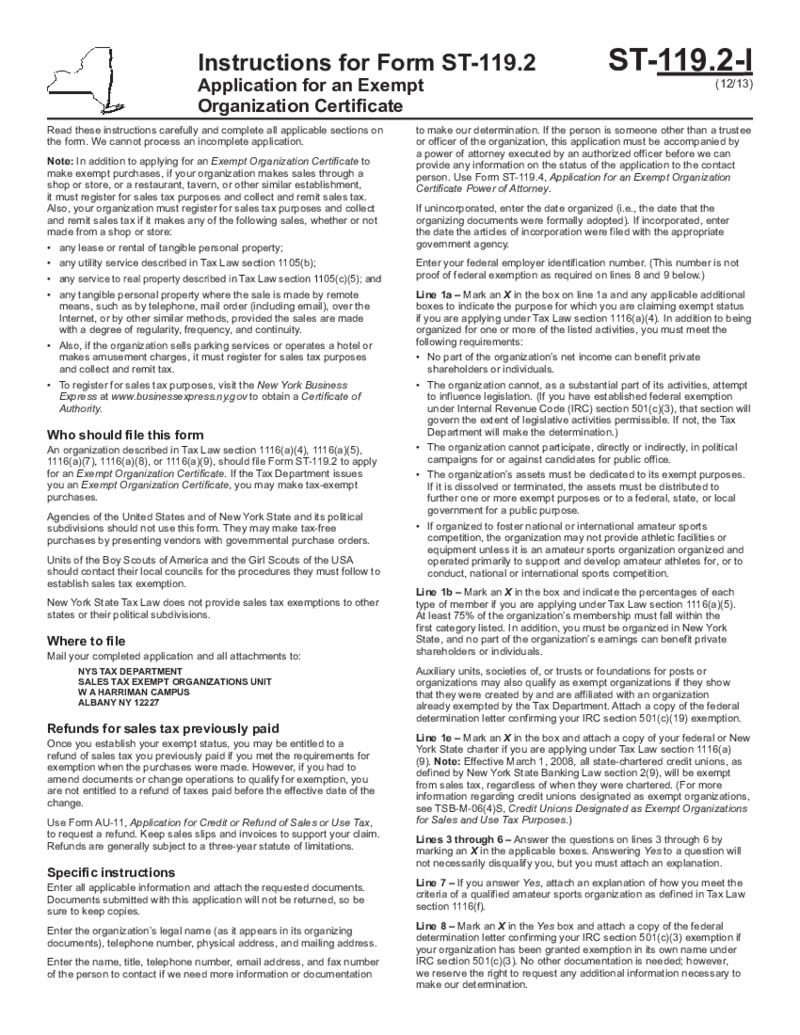

Form ST-119.2

Application for an Exempt Organization Certificate

To apply for an Exempt Organization Certificate using Form ST-119.2, you should first understand all sections and requirements. Incomplete applications cannot be processed.

Who Should File

Form ST-119.2

Application for an Exempt Organization Certificate

To apply for an Exempt Organization Certificate using Form ST-119.2, you should first understand all sections and requirements. Incomplete applications cannot be processed.

Who Should File

-

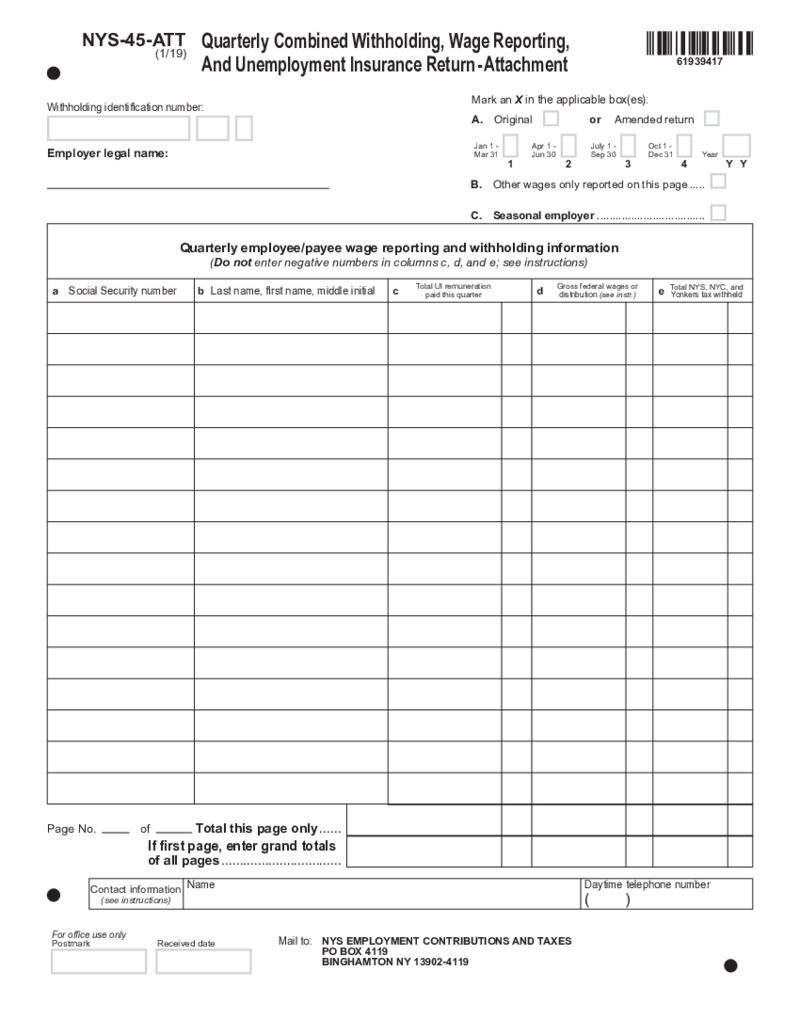

New York Form NYS-45-ATT

What Is A Form NYS-45-ATT

Form NYS-45-ATT, often called the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment, is a supplementary document associated with New York State's primary Form NYS-45

New York Form NYS-45-ATT

What Is A Form NYS-45-ATT

Form NYS-45-ATT, often called the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment, is a supplementary document associated with New York State's primary Form NYS-45

-

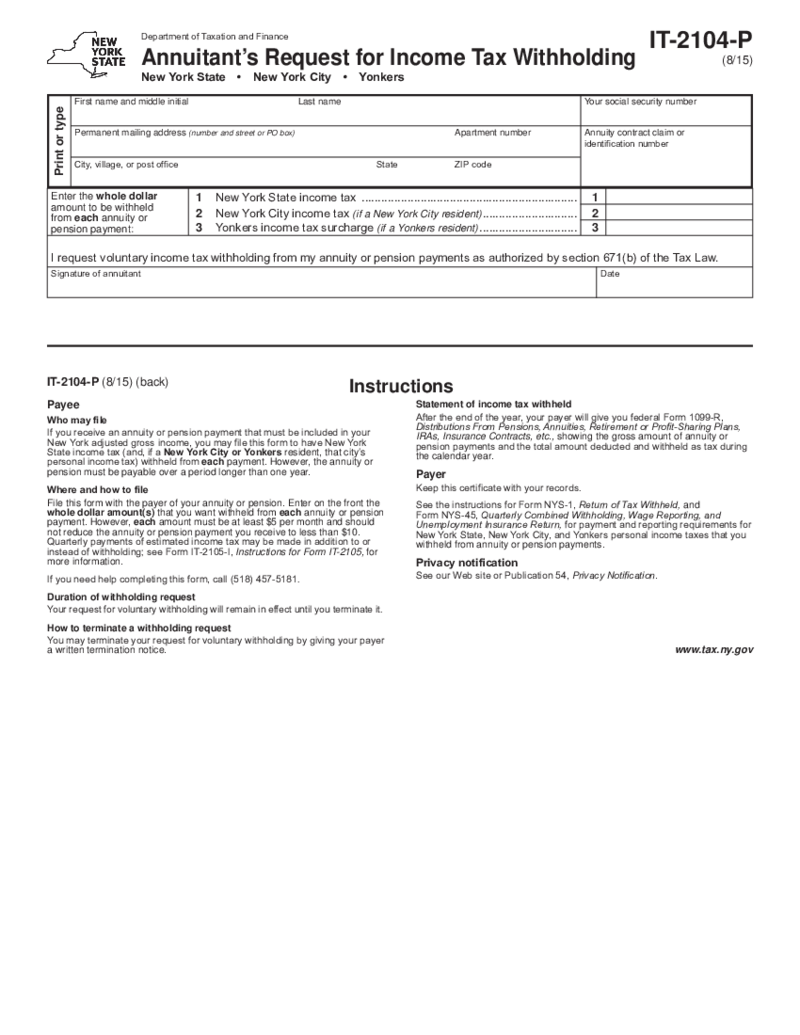

New York Form IT-2104-P

What Is the NY State Tax Form IT 2104 P?

The IT-2104 P form, also referred to as the Nonresident Employee's Withholding Recertification Form, is specific to New York State. This form is critical for nonresident individuals working in New York State wh

New York Form IT-2104-P

What Is the NY State Tax Form IT 2104 P?

The IT-2104 P form, also referred to as the Nonresident Employee's Withholding Recertification Form, is specific to New York State. This form is critical for nonresident individuals working in New York State wh

-

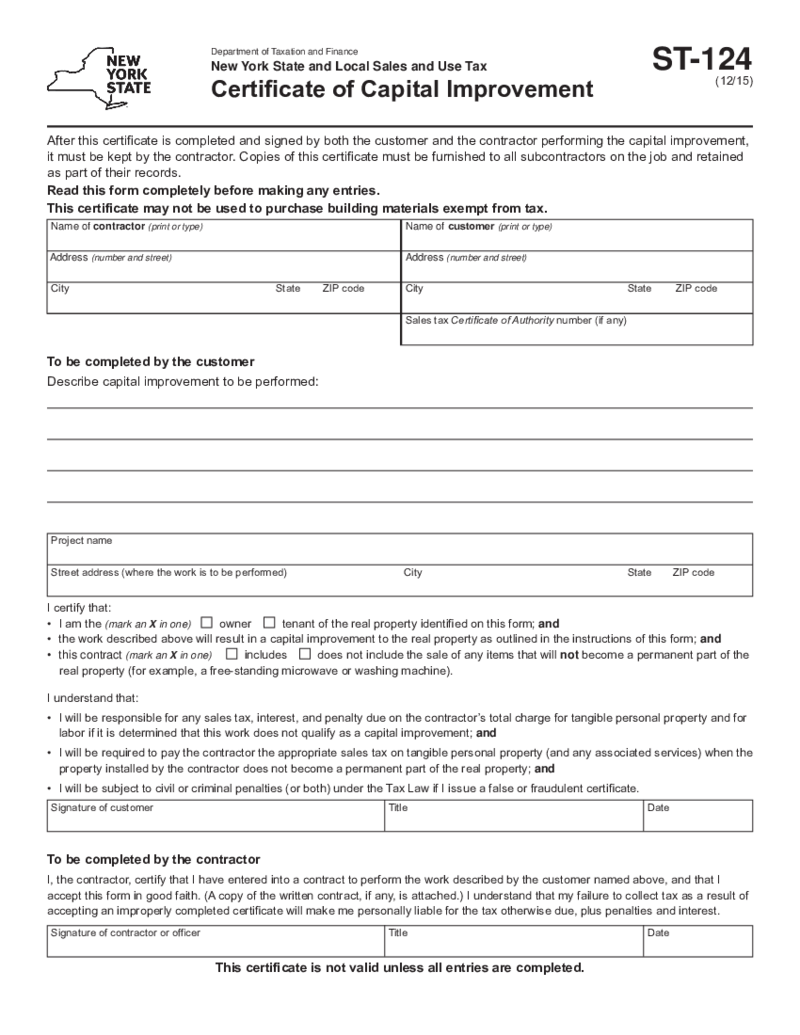

New York Form ST-124

Understanding NYS Form ST-124

The New York State ST 124 form, also known as the Certificate of Capital Improvement, is an essential document for taxpayers who have made substantial alterations to their properties. This New York form template serves a very

New York Form ST-124

Understanding NYS Form ST-124

The New York State ST 124 form, also known as the Certificate of Capital Improvement, is an essential document for taxpayers who have made substantial alterations to their properties. This New York form template serves a very

-

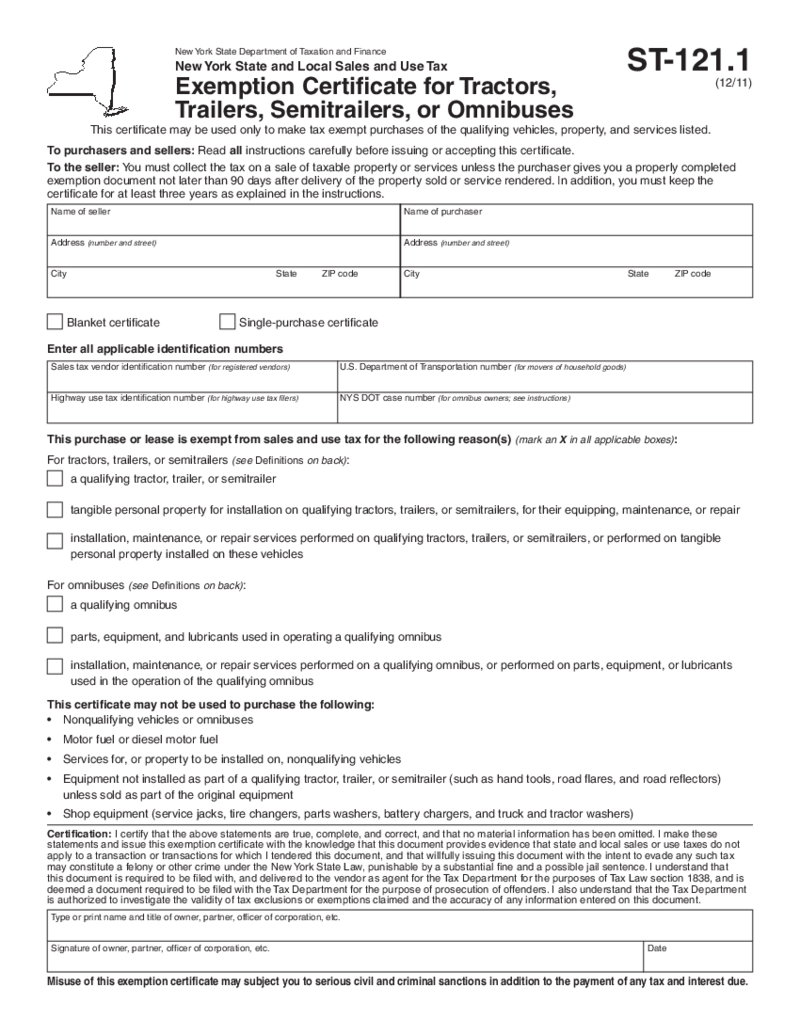

New York Form ST-121.1

What Is New York Form ST-121.1?

NY Form ST-121.1 is a sales and use tax return form used by businesses registered with the New York State Department of Taxation and Finance to report and pay sales tax collected on taxable sales made within the state. The

New York Form ST-121.1

What Is New York Form ST-121.1?

NY Form ST-121.1 is a sales and use tax return form used by businesses registered with the New York State Department of Taxation and Finance to report and pay sales tax collected on taxable sales made within the state. The

-

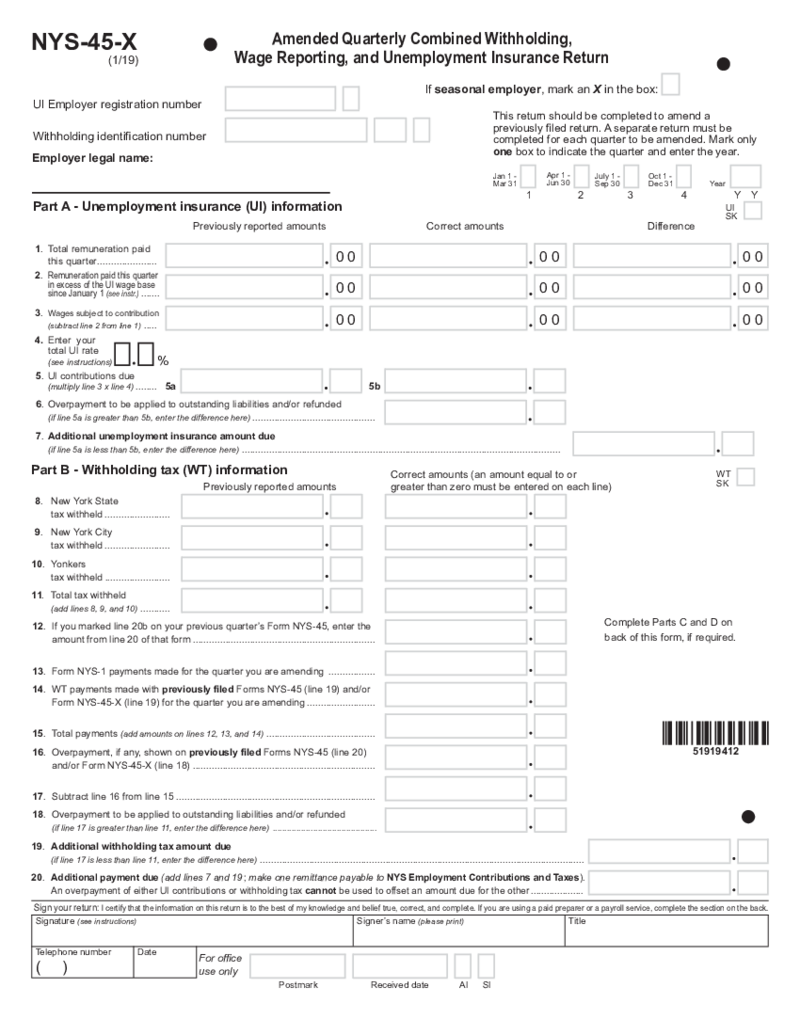

New York Form NYS-45-X

What Is New York Form NYS 45 X

New York Form NYS 45 X, also known as the Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves as a mechanism for employers in New York State to correct previousl

New York Form NYS-45-X

What Is New York Form NYS 45 X

New York Form NYS 45 X, also known as the Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves as a mechanism for employers in New York State to correct previousl

-

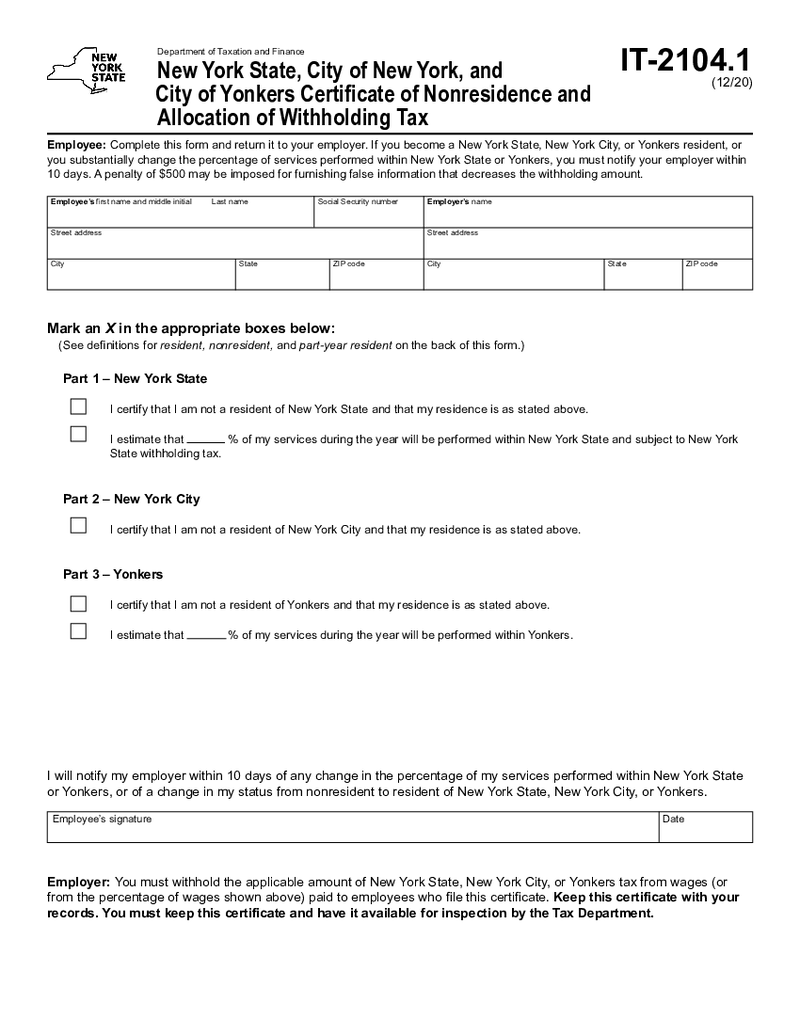

New York Form IT-2104.1

What Is Form IT 2104.1

New York form IT-2104.1 is essential for nonresidents and part-year residents who earn income in New York State but are not subject to typical state withholding rates. This form serves as a Nonresident and Part-Year

New York Form IT-2104.1

What Is Form IT 2104.1

New York form IT-2104.1 is essential for nonresidents and part-year residents who earn income in New York State but are not subject to typical state withholding rates. This form serves as a Nonresident and Part-Year

What are New York State Tax Forms?

New York state tax forms are made for the ease of taxpayers and official authorities. These documents are widely used by residents and nonresidents that work in New York State. They all are dedicated to taxes and require detailed information about your income, whether you are an individual taxpayer or company representative. Pay attention to the fact that this is a state form we are talking about. You still need to file your annual tax reports to the IRS.

Don’t forget about the deadlines which are made for each form and are usually provided by the New York State Department of Taxation and Finance. You will find a wide range of New York state income tax forms on PDFLiner. They are placed in one section based on the location and topic.

Most Popular New York State Tax Forms

It is easy to get lost in New York tax forms. You will see different requirements for each form since they all are made for specific cases. The best approach is to learn which form you need directly from the Department of Taxation and Finance of the New York State. Yet, you can always check out all the New York state tax forms 2022 on PDFLiner, read brief descriptions under them, and pick the one you need. If you prefer to follow other user’s experiences read the list of the most popular forms here:

- Form IT-2. This is the form known as the Summary of W-2 Statements. This is not a unique document. Moreover, it is probably one of the most used New York state tax returns forms. It must be filed together with the NYS income tax return in case you receive the W-2 federal form Wage and Tax Statement. Every W-2 form you complete requires mention in the W-2 Record section of the document. Complete this document even if you did not get a W-2 federal form but received income from foreign countries.

- Form IT-201. It is known as the Resident Income Tax Return form. This document was created and released by the New York State Department of Taxation and Finance. The form is one of the most demanded New York income tax forms by taxpayers who live and work in the NYS. You have to complete it with the information you usually provide to the federal tax report. Write down your personal information, dependents, federal income, and adjustments. There are extra sections for the New York subtractions and additions. Be Specific with numbers.

- Form IT-203. If you are looking for a similar to the IT-201 form, but you are a non-resident or only part-resident of the state, this one's for you. It is called the Nonresident and Part-Year Resident Income Tax Return form. It was created by the Department of Taxation and Finance of NYS to ease the tax reports for nonresidents who work in New York State. The form is similar to IT-201 and you have to provide the same information, except for the address which will be not only your New York temporary residence but the home one.

- Form IT-214. This form is the Claim for Real Property Tax Credit. It is not one of the New York state tax exemption forms or extension documents. It is widely used by renters and homeowners. If you are a real estate agent you are probably familiar with this document already. You have to fill it with your personal information, eligibility, number of household members, gross income, and the tax for the real property.

- Form MTA-305. The form is known as the Employer’s Quarterly Metropolitan Commuter Transportation Mobility Tax Return. You need the number of employees, your condition code, and your personal information.

How Do I Get New York State Income Tax Forms?

It is easy to get lost in all New York state tax withholding forms and other types of tax documents you may find on the Department of Taxation and Finance of New York State website. This is the first place you may visit since it contains all the templates among others made for the NYS dwellers. The simpler way is to use PDFLiner. This editing service offers enough tools to fill the documents online in no time. You will have all forms gathered in one place, separated by location and sphere of interest. Here is what you need to do on PDFLiner:

- Find the form you need.

- Click the Fill Online button.

- Start the editor by opening the form and completing empty lines.

- If you need, sign it there and send it to the address indicated in the document.

FAQ:

-

Where can I get New York State and New York City tax return forms?

Where can I get New York State and New York City tax return forms?

You can get all the New York state tax extension forms, tax reports, and other types of forms at the Department of Taxation and Finance website. You have to make sure that the form is what you were looking for. Another option is to use PDFLiner. You will be able to quickly find the document there and edit it online. -

Where do you send tax forms for New York?

It depends on the form’s specifics. Usually, the NYS Department of Taxation and Finance asks to send them forms online or by email indicated in the document. If they need to receive the original made on paper you will see the address in the form within the instructions provided by the Department.

-

Where to download New York state tax forms for previous years?

You have to consult with the Department of Taxation and Finance before you send any tax forms from previous years. There is a support team that is able to answer your questions on the website. It is better to always keep a copy of the document on your device. PDFLiner may help you to save the forms wherever you want them.

-

Where to mail amended New York state tax forms?

Amended state tax forms must be filed electronically to the Department of Taxation and Finance. You will see the address inside the form. You have to follow deadlines and provide attachments the Department asks for.